Good morning!

The GIFT Nifty was trading marginally lower near 25,280 early Friday. The futures contract based on the benchmark Nifty 50 remained completely flat at 25,281 as of 7:00 a.m., indicating a muted start for the Indian markets.

S&P 500 futures up 0.14%

Nasdaq futures up 0.15%

Euro Stoxx 50 futures up 0.79%

Markets On Home Turf

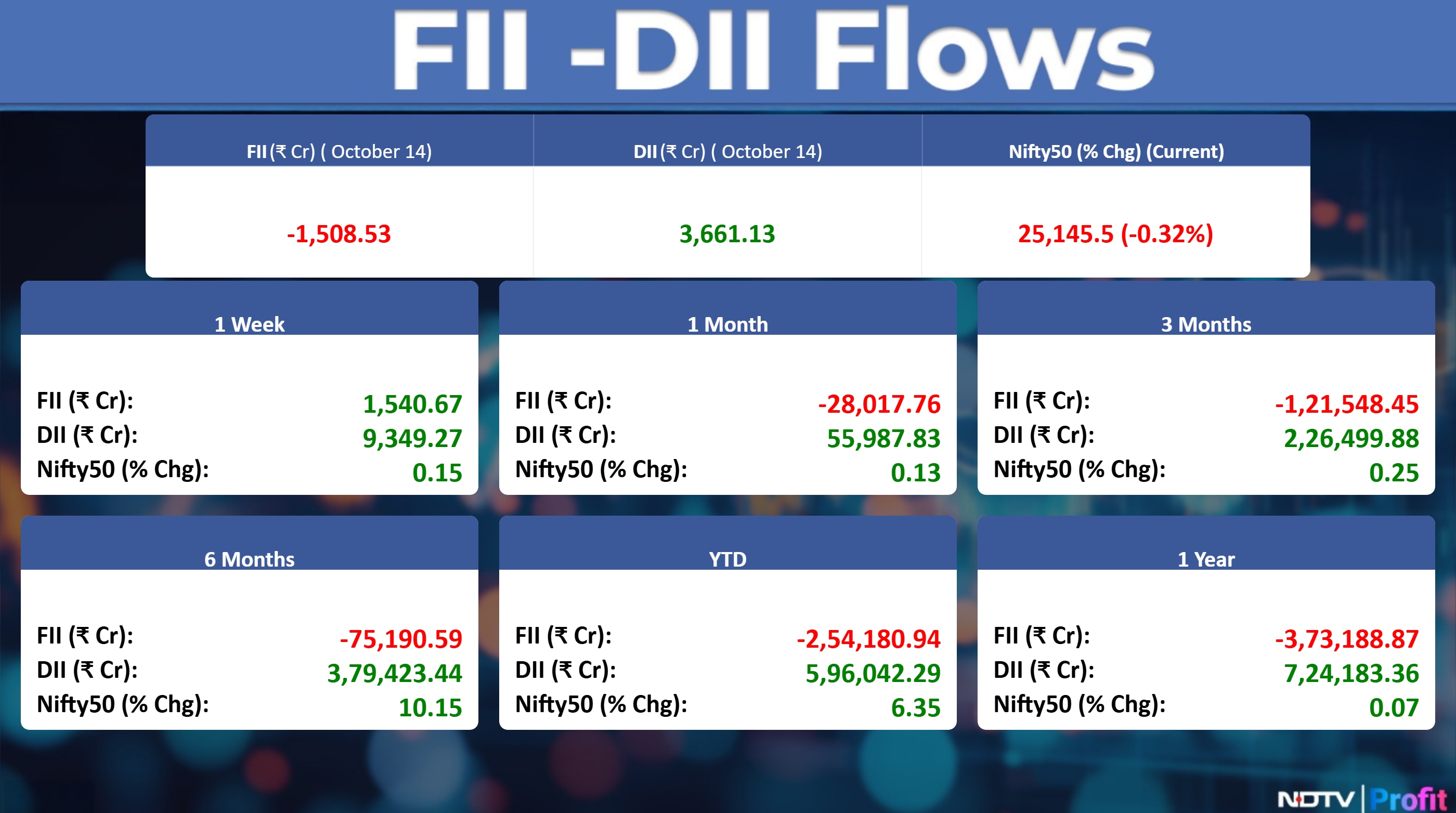

The Nifty ended in the red for the second consecutive session on Tuesday, after a volatile and choppy trade. At the close, the Sensex slipped 297.07 points, or 0.36%, to 82,029.98, while the Nifty fell 81.85 points, or 0.36%, to 25,145.50. Nifty fell as much as 0.66% during the day to 25,060.55, while the Sensex was also down 66% to 81,781.62.

"Equity markets saw broad-based profit booking amid a lack of fresh domestic triggers, as weak cues from Asian and European peers dampened investor sentiment," said Ponmudi.

Asian Market Update

Asian stocks rebounded after three days of losses, as optimism over a potential Federal Reserve interest-rate cut lifted sentiment and outweighed renewed US-China trade tensions, reports Bloomberg.

Hang Seng futures jumped 0.12%

Japan's Nikkei jumped 0.74%

Australia's S&P/ASX 200 was 0.77%

Wall Street Wrap

The S&P 500 fell 0.16% to close at 6,644.69

Nasdaq fell 0.76% to end at 22,521.70

The Dow Jones Industrial Average surged 202.88 points, or 0.44%, to finish at 46,270.46

Commodity Check

Oil prices steadied after falling to a five-month low Tuesday on expectations for a supply glut and escalating US-China trade tensions.

Brent traded near $62 a barrel after sliding 1.5% in the previous session, while West Texas Intermediate was below $59.

Gold, meanwhile, edged higher toward a record yet again, boosted by an escalation in US-China frictions and bets the Federal Reserve will cut interest rates twice more this year, according to Bloomberg.

Bullion rose toward the peak of $4,179.70 reached on Tuesday. Spot silver, on the other hand, advanced after a volatile day on Tuesday that saw prices surge to an all-time high above $53.54 an ounce, before tumbling sharply amid signs a historic squeeze is starting to ease.

Key Events To Watch

Government will release trade data for September.

Industry group SIAM to release car sales data for September.

Earnings In Focus

Axis Bank, HDB Financial Services, HDFC Asset Management Company, HDFC Life Insurance Company Angel One, Tata Communications, Oberoi Realty, Delta Corp, Heritage Foods, Huhtamaki India, Indian Railway Finance Corporation, KEI Industries, Kewal Kiran Clothing, L&T Finance, Mangalore Refinery and Petrochemicals, Nuvoco Vistas Corporation, Rossari Biotech.

Earnings Post Market Hours

Tech Mahindra Q2 Highlights (Consolidated, QoQ)

Revenue up 4.8% to Rs 13,995 crore versus Rs 13,351 crore (Estimate: Rs 13,777.50 crore)

Net Profit up 5% to Rs 1,194.50 crore versus Rs 1,140.60 crore (Estimate: Rs 1,285 crore)

Ebit up 15% to Rs 1,699.30 crore versus Rs 1,477.10 crore (Estimate: Rs 1,609 crore)

Margin at 12.1% versus 11.1% (Estimate: 11.67%)

Announces dividend of Rs 15 per share

ICICI Lombard General Insurance Co Q2 Highlights (Consolidated, YoY)

Total income up 12.5% to Rs 6,583 crore versus Rs 5,851 crore

Gross Premiums written up 1.58% at Rs 7058 crore versus Rs 6948 crore.

Net Premium Earned up 12.45% at Rs 5651 crore versus Rs 5025 crore.

Net Profit up 18.1% to Rs 820 crore versus Rs 694 crore

Cyient DLM Q2 Highlights (Consolidated, YoY)

Revenue down 20.2% to Rs 310.60 crore versus Rs 389.40 crore

Net Profit at Rs 32 crore versus Rs 15 crore

Ebitda down 1% to Rs 31.20 crore versus Rs 31.60 crore

Margin at 10.0% versus 8.1%

Thyrocare Technologies Q2 Highlights (Consolidated, YoY)

Revenue up 22.1% to Rs 216.53 crore versus Rs 177.36 crore

Net Profit up 81% to Rs 47.81 crore versus Rs 26.42 crore

Ebitda up 48% to Rs 71.35 crore versus Rs 48.29 crore

Margin at 33% versus 27.2%

Persistent Systems Q2 Highlights (Consolidated, QoQ)

Revenue up 7.4% to Rs 3,580.70 crore versus Rs 3,333.50 crore

Net Profit up 11% to Rs 471.40 crore versus Rs 424.90 crore

Ebit up 13% to Rs 583.00 crore versus Rs 517.70 crore

Margin at 16.3% versus 15.5%

Business Update

Kolte Patil:

Sales down 13% at Rs 670 crore (YoY)

Collections up 8% at Rs 596 crore (YoY)

Stocks In News

Keystone Realtors: Promoters to sell up to 45.8 lakh shares or 3.63% stake of the company via offer for sale on Oct. 15-16. The floor price set for the deal is Rs 550 per share, a 10% discount to current market price.

Navneet Education: The company sets up manufacturing unit to manufacture plastic moulding items in Gujarat.

Star Cement: The company approved raising funds worth up to Rs 1,500 crore via private placement or preferential issue.

Sonata Software: The company is in an agreement with Adesso to deliver AI-powered Modernisation & Measurable Value for Enterprises Worldwide.

Dalmia Bharat: The company denies reports of acquiring cement factory for Rs 500 crore.

Carraro India: The company received Rs 17.5 crore order from TI Clean Mobility.

Share India Securities: The company approved the Issuance of NCDs worth Rs 50 crore on a private placement basis.

Cholamandalam Investment: The company allots 55,000 secured non-convertible securities worth Rs 1,000 crore.

Jeena Sikho: The company launches Pet–Yakrit– Pleeha Shuddhi Kit for promoting detoxification & overall wellness.

Kirloskar Ferrous: Company's operations at Karnataka plant suspended temporarily for 40 Days for maintenance & repairs activities.

Afcons Infra: Allots NCDs worth Rs 50 crore on a private placement basis.

Mishra Dhatu Nigam: The company secured an order worth Rs 306 crore. With this, the open order position of MIDHANI as on date is around Rs. 2,212 crore.

Ola Electric Mobility: The company to launch product in Energy Space on Oct. 17 via premiere on its official social Media Handles. Also to launch first non-vehicle product this Diwali.

LG Electronics India: Unveils 'LG Essential Series', a new line of Home Appliances made for India.

Avenue Supermarts: The company opens new store in Andhra Pradesh, The total number of stores as on date stands at 433.

Ambuja Cements: Shareholders meeting to be held virtually on Nov. 20 to vote on scheme of arrangement with Sanghi Industries as ordered by NCLT.

HCL Tech: The company partnered With GSMA To Accelerate Telecom Innovation.

GR Infra: I-T department carries out a search operation at Office Premises, Residence of Promoters & CFO. The search was conducted on Oct. 9 and concluded on Oct. 14.

DCM Shriram: The company commissions Epichlorohydrin Plant of 35,000 TPA at Chemical complex in Gujarat. The balance capacity of 17,000 TPA to be commissioned shortly.

Ugro Capital: The board is to meet on Oct. 17 to consider raising funds via NCDs.

Crompton Greaves Consumer Electricals: The company launched star param JB Downlighter (5w, 7w, 9w); Product Categorized Under B2C Lighting for Domestic Market.

TCC Concept: The company acquired 95.2% stake of Pepperfry on Fully Diluted Basis for Rs 659 crore. Approves issuance of 1.2 crore shares to sellers at Rs 557.94 per share.

Borosil Renewables: The Government mandates registration for renewable energy component imports.

Patel Engineering: The company reaches in-principal settlement of $5 million with Plaintiffs continental casualty company and Western Surety Company; Settlement to resolve claims related to Asi Constructors Inc.

Insolation Energy: Incorporates 2 arms as SPVs to set up solar power plants.

Dhani Services: NCLT Nod for scheme of arrangement between Yaari Digital, Co & 17 group entities.

Lemon Tree: The company signs pact for 54-Room Hotel in Gujarat.

IPO Offering

Canara HSBC Life Insurance: The company operates in life insurance space. Promoted by Canara Bank and HSBC Insurance (Asia-Pacific) Holdings. The public issue was subscribed to 2.29x on day 3. The bids were led by QIBs (7.5 times), NIIs (0.33 times) retail investors (0.42 times), Employee (2.06 times)

Midwest: The company is engaged in the business of exploration, mining, of natural stones. The IPO opens for the subscription tomorrow. The total issue size of the IPO is Rs 451 crore. The IPO is a combination fresh issue of Rs 250 crore and offer for sale Rs 201 crore.

Bulk Deals

Awfis Space Solutions: HSBC MF bought 9.18 lakh shares (1.28%) at Rs 585 apiece, while QRG Investments and Holdings sold 24.07 lakh shares (3.36%) at Rs 585 apiece.

Trading Tweaks

Demerger: SKF India: SKF India completed demerger of its industrial business into a new company, SKF India (Industrial), Shareholders to receive one new share of the industrial entity for each share they hold in the SKF India.

Dividend: Infosys.

F&O Cues

Nifty October futures are down by 0.49% to 25,185 at a premium of 40 points.

Nifty October futures open interest up by 3.05%.

Nifty Options Oct. 20 Expiry: Maximum Call open interest at 26,000 and Maximum Put open interest at 24,000.

Securities in ban period: RBLBANK, SAMMAANCAP

Currency/Bond Market

The rupee depreciated 9 paise to 88.77 against the US dollar in early trade on Tuesday, weighed down by the broad strength of the American currency in the overseas market.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.