Wall Street's hopes that Donald Trump's trade war is cooling drove stocks to one of their best weeks so far in 2025, with the S&P 500 rising for a fifth straight session despite a weak reading on consumer sentiment.

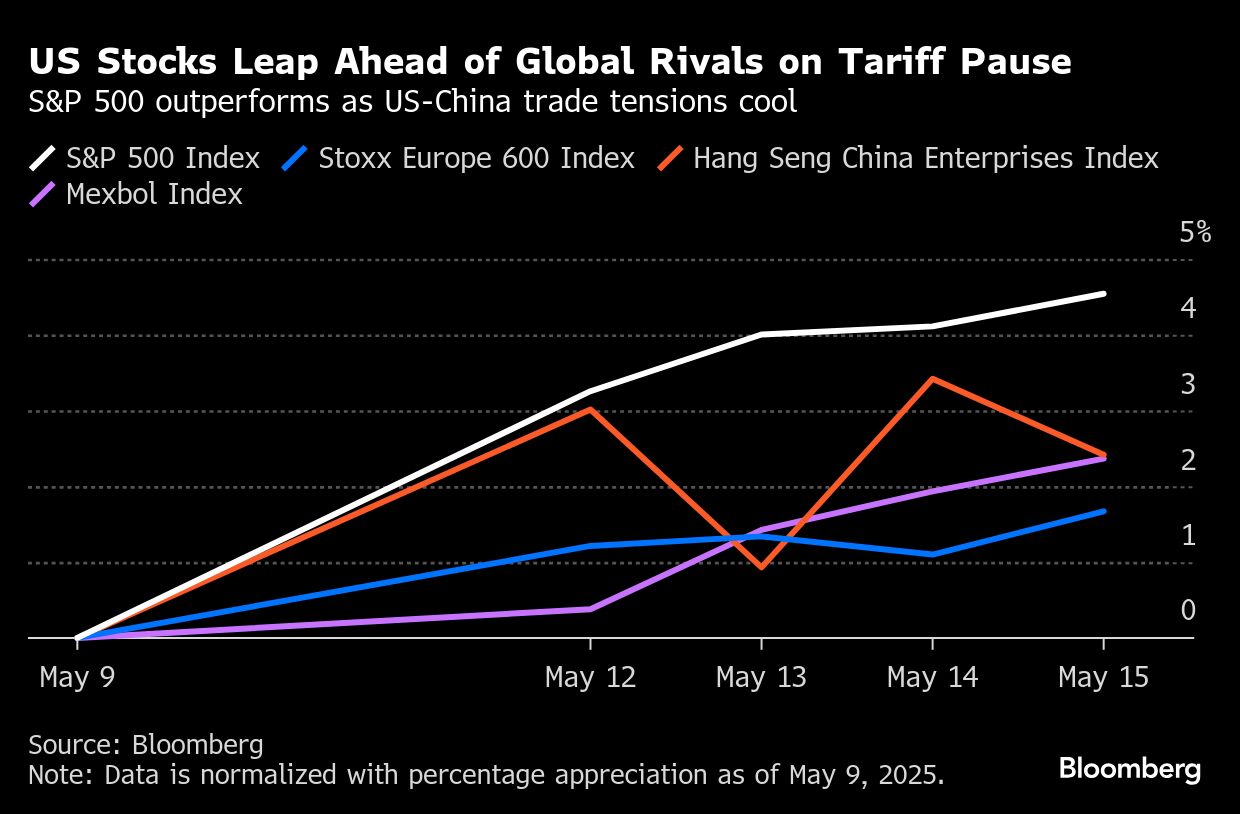

After wiping out this year's losses, equities kept gaining after a US-China trade truce and speculation of more deals with America's top commercial partners. That's bolstered the risk-on tone that has some market pros positioning for the equity benchmark to eclipse its February record in coming months, rising from the brink of a bear market just weeks ago. The S&P 500 rose 0.2% Friday and was up 4.8% this week.

Wall Street focused on consumer sentiment.

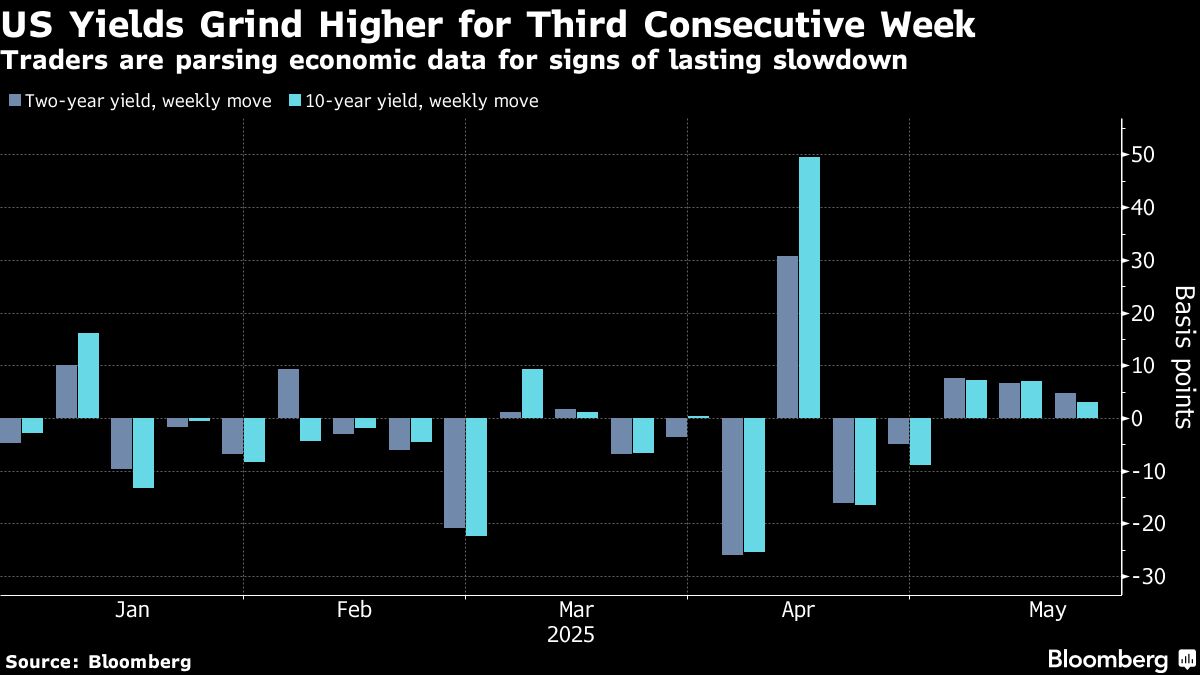

Action in the bond market was muted, though Treasuries headed for a third straight weekly drop — the longest losing streak this year. The dollar rose despite data showing sentiment among options traders is the most negative in five years.

Banks across Wall Street are watering down calls for recession as the White House appears to be softening its approach to trade negotiations. President Donald Trump said he would set tariff rates for US trading partners “over the next two to three weeks,” asserting there are “150 countries that want to make a deal.”

Earlier Friday, investors didn't get any encouragement from a report showing US consumer sentiment unexpectedly fell and inflation expectations climbed to multi-decade highs. Nevertheless, given the recent de-escalation of trade tensions with China, Capital Economics' Alexandra Brown expects a marked rebound in sentiment next month.

“It appears that households were more alarmed by the tit-for-tat escalation in tariffs with China than they were soothed by the reciprocal tariff pause for other countries or the drop back in energy prices,” she said. “Given the latest deal with China to reverse most of those prohibitively high tariffs, however, sentiment should soon rebound.”

The Nasdaq 100 wavered. The Dow Jones Industrial Average added 0.1%. The yield on 10-year Treasuries was little changed at 4.43%. The Bloomberg Dollar Spot Index rose 0.3%.

In the past week, renewed optimism around the American economy has propelled US stocks ahead of benchmarks in Europe, China and Mexico. Fund managers added $20 billion to US stock funds in the past week, the first inflow to the region in more than a month, according to EPFR Global data cited by Bank of America Corp.

The shift came after a period in which Wall Street money managers grew skeptical about the US equity market and started to pull away from growth stocks and rotate into defensive names, due to escalating concerns from trade wars to economic growth and geopolitical tensions. The latest quarterly filings shows hedge funds boosted positions in healthcare stocks while reducing exposure in the technology sector.

The S&P 500 index declined 4.6% in the first three months on 2025, posting its worst quarter compared with the rest of the world since the global financial crisis. Bloomberg has so far analyzed 13F filings by 736 hedge funds. Their combined holdings amounted to $530.04 billion, compared with $553.02 billion held by the same funds three months earlier.

Warren Buffett's Berkshire Hathaway Inc. made no major purchases during the market slump that preceded Trump's trade war, instead whittling or selling off holdings in financial stocks during the first quarter.

In the last year of his tenure as Berkshire's chief executive officer, Buffett exited his position in Citigroup Inc., according to a regulatory filing Thursday. The firm also shrank its pile of Capital One Financial Corp. shares, as well as its longtime stake in Bank of America Corp.

Michael Burry's Scion Asset Management liquidated almost its entire listed equity portfolio in the first quarter, while taking on fresh bearish wagers on Nvidia Corp. and China-related stocks before US President Donald Trump launched a trade war and roiled global markets.

The hedge fund manager, famous for his 2008 bet against the US housing market, bought put options — that profit from price declines — on the chipmaker, according to 13F regulatory filings released on Thursday. The puts on Nvidia and other companies “may serve to hedge long positions which are not eligible to be reported” in the 13F, according to a note on the filing.

Corporate Highlights

Boeing Co. has reached a preliminary framework with the Justice Department that would allow the company to avoid prosecution over two fatal 737 Max crashes, Reuters reported, citing people familiar with the matter.

Applied Materials Inc. gave a lackluster forecast for the current period, highlighting the potential cost of the US trade dispute with China.

Charter Communications Inc. has agreed to combine with closely held Cox Communications in a cash-and-stock deal that would unite two of the biggest US cable providers.

Take-Two Interactive Software Inc. reported quarterly sales that beat analysts' estimates, benefiting from the strength of its latest basketball game and the continued success of Grand Theft Auto Online, but the full-year forecast for revenue came up short.

Novo Nordisk A/S is replacing Chief Executive Officer Lars Fruergaard Jorgensen as the drugmaker wrestles with increased competition for its Wegovy obesity shots that transformed the weight-loss industry and made the Danish company the star of corporate Europe.

OpenAI is rolling out a new artificial intelligence agent for ChatGPT users that's designed to help streamline software development as the company pushes into a crowded market of startups and large tech firms offering AI tools for coders.

Billionaire Michael Novogratz said Galaxy Digital Holdings Ltd. is talking with the US Securities and Exchange Commission about tokenizing its own stock as well as other equities using its digital-asset platform.

Some of the main moves in markets:

Stocks

The S&P 500 rose 0.2% as of 11:36 a.m. New York time

The Nasdaq 100 was little changed

The Dow Jones Industrial Average rose 0.1%

The Stoxx Europe 600 rose 0.4%

The MSCI World Index rose 0.2%

Bloomberg Magnificent 7 Total Return Index was little changed

The Russell 2000 Index rose 0.3%

Currencies

The Bloomberg Dollar Spot Index rose 0.3%

The euro fell 0.4% to $1.1147

The British pound fell 0.3% to $1.3262

The Japanese yen fell 0.2% to 145.97 per dollar

Cryptocurrencies

Bitcoin rose 0.6% to $104,101

Ether rose 2.2% to $2,593.73

Bonds

The yield on 10-year Treasuries was little changed at 4.43%

Germany's 10-year yield declined three basis points to 2.59%

Britain's 10-year yield declined one basis point to 4.65%

Commodities

West Texas Intermediate crude rose 1.1% to $62.31 a barrel

Spot gold fell 1.8% to $3,180.96 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.