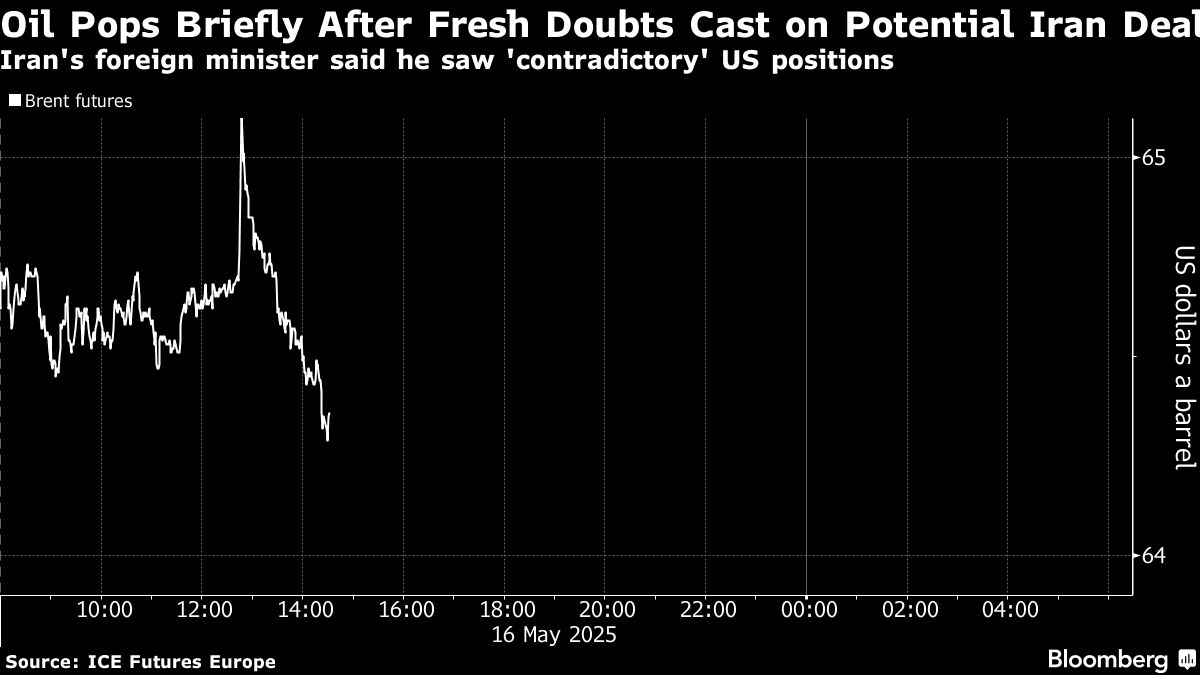

Oil fell after a short-lived spike as Tehran cast fresh doubts about the status of US-Iran nuclear talks.

Brent traded below $65 a barrel after jumping by as much as 1.1% after Iran's foreign minister, Abbas Araghchi, said that he saw “many opposing and contradictory positions” from US negotiators. West Texas Intermediate was near $61. Prices had plummeted earlier this week after President Donald Trump suggested the sides were closer to an agreement.

A deal — should it be agreed — could raise the prospect of limited extra supplies from Iran if sanctions are eased, but they would arrive into a market already gearing up for a surplus. The International Energy Agency on Thursday reiterated that it expects an increase in new output, and the return of shuttered production by OPEC+, to exceed slowing demand growth this year and next, creating a global glut.

“We wouldn't overstate the impact on Iranian supply here — a deal might add 200,000 to 300,000 barrels a day to Iranian exports, which isn't enormous,” said Robert Rennie, head of commodity and carbon research at Westpac Banking Corp. in Sydney. “We maintain the view that Brent should remain in a $60 to $65 holding pattern in the weeks ahead.”

Oil is set to eke out a second weekly gain, after jumping on the prospect of increased demand following a détente in the trade conflict between the US and China, the biggest crude consumers. Prices are still down more than 10% this year thanks to the twin hit of trade uncertainties and faster-than-expected output increases by the Organization of the Petroleum Exporting Countries and its allies.

Parts of the futures curve remains in contango, a bearish pricing pattern that's characterized by nearer-term contracts trading at a discount to longer-dated ones. The spread between the nearest two December contracts for Brent was at the most negative in more than a week.

Prices:

Brent for July settlement fell 0.3% to $64.31 a barrel at 7:54 a.m. in London.

Prices briefly traded as much as 1.1% higher.

WTI for June delivery slid 0.4% to $61.35 a barrel.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.