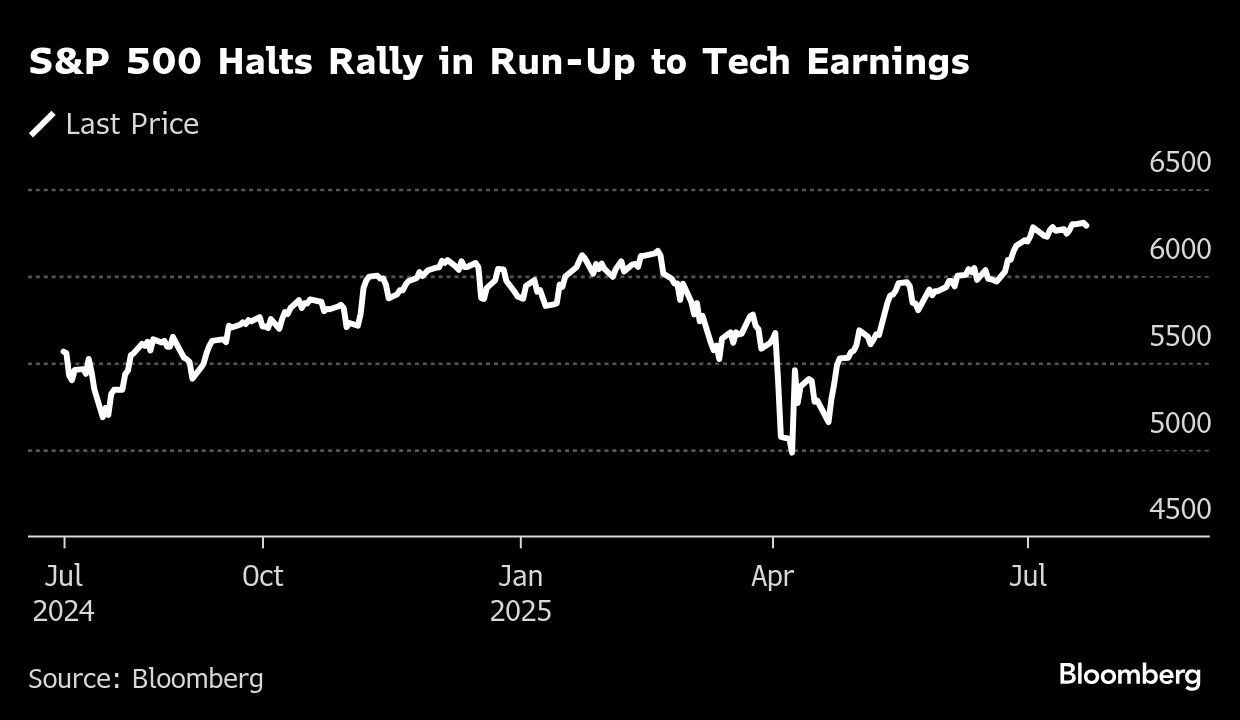

A slide in several big techs dragged down stocks ahead of the start of a high-stakes earnings season, while Microsoft Corp. accused Chinese hackers of exploiting vulnerabilities in its SharePoint software that have led to breaches worldwide. Bond yields and the dollar fell.

The S&P 500 dropped from a record. A gauge of the “Magnificent Seven” megacaps got hit in the run-up to results from Tesla Inc. and Alphabet Inc. Chipmakers sank after NXP Semiconductors NV's underwhelming outlook. Nvidia Corp. slid 2%. D.R. Horton Inc. led a rally in homebuilders on a profit beat. Kohl's Corp. soared as much as 105% before paring the gain to around 35%.

Benchmark 10-year yields dropped for a fifth consecutive session. The greenback halted a rally, but was still poised for its best month in 2025.

“Investors digest what has been a monster run,” said Bespoke Investment Group strategists. “You can't fault investors for taking a step back to catch their breath as earnings season picks up and we approach the Aug. 1 tariff deadlines.”

Treasury Secretary Scott Bessent said he will meet his Chinese counterparts in Stockholm next week for their third round of trade talks aimed at extending a tariff truce and widening the discussions. He predicted a “rash” of trade deals between now and the Aug. 1 deadline.

Bessent also offered support for Jerome Powell amid regular attacks from Trump administration officials, saying he sees no reason for the Federal Reserve chair to step down.

“There's nothing that tells me that he should step down right now,” Bessent said of the US central bank chief, speaking on Fox Business Tuesday. “His term ends in May. If he wants to see that through, I think he should. If he wants to leave early, I think he should.”

Powell underscored Tuesday the need for the banking system's capital framework to work together effectively, and for banks to be well-capitalized and to manage their risks well. He added that competition is also crucial for the industry.

“We expect market volatility to pick up in the lead-up to the August tariff deadline, with threats to Federal Reserve independence and geopolitical uncertainty lingering in the background,” said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management

Meantime, big tech's strength will be on full display over the next few weeks as they begin unveiling their quarterly earnings. Two of this year's laggards among the Magnificent Seven — Tesla and Alphabet — are on deck Wednesday.

The lion's share of S&P 500 earnings growth continues to come from beneficiaries of advancements in artificial intelligence.

The Magnificent Seven companies are expected to post a combined 14% rise in second-quarter profits, while earnings for the rest of the US equity benchmark are predicted to be relatively flat, according to Bloomberg Intelligence data.

“We expect solid earnings growth from big tech coupled with significant spending on artificial intelligence infrastructure by the hyperscalers,” said Richard Saperstein at Treasury Partners. “This AI spending and investment is set to support future earnings growth.”

Saperstein said most of the Magnificent Seven should continue leading the market due to impressive earnings growth, copious levels of cash flow and continued demand for their businesses.

“The AI tailwinds are in the early innings, and are set to benefit the biggest players in tech the most,” he added.

What Bloomberg Strategists say...

“An ugly start to US equity trading is far from across the board. The frothier tech and growth stocks are leading declines, but value stocks and defensive sectors are up on the day still. Coupled with the decline in bond yields, this looks like the market paring a little risk, perhaps ahead of Tesla and Alphabet earnings on Wednesday.” - Sebastian Boyd, Macro Strategist, Markets Live.

Corporate Highlights:

OpenAI and Oracle Corp. announced they will develop 4.5 gigawatts of additional US data center capacity in an expanded partnership, furthering a massive plan to power artificial intelligence workloads.

Lockheed Martin Corp. reported second-quarter earnings that fell short of analyst estimates and lowered its outlook for the year after the world's largest defense contractor racked up $1.6 billion in charges on a classified program and its Sikorsky helicopter unit.

Northrop Grumman Corp. raised its earnings guidance for the full year after getting a boost from its Sentinel ballistic missile and B-21 bomber programs.

RTX Corp. lowered its full-year profit outlook as the company digests the impact of tariffs that have roiled the aerospace industry, even as strong demand boosts sales above Wall Street's expectations.

General Motors Co. earned $2.53 per share on an adjusted basis, above the Bloomberg consensus forecast of $2.33 but short of the $3.06 it made a year ago. GM's profits also suffered from higher warranty costs and a buildup in inventory of electric vehicles.

Coca-Cola Co. posted second-quarter sales growth that beat Wall Street expectations as consumers continue to pay higher prices for the company's soft drinks.

Philip Morris International Inc. lifted its full-year profit guidance, as sales of its Zyn nicotine pouches and IQOS heated tobacco sticks continued to accelerate.

Oscar Health Inc. slashed its guidance and reported preliminary results below Wall Street estimates, the latest health insurer to be rocked by trouble in Affordable Care Act marketplaces.

Sarepta Therapeutics Inc. announced that the company plans to temporarily pause all shipments of its gene therapy to treat Duchenne muscular dystrophy, Elevidys, in a reversal of its prior stance.

Some of the main moves in markets:

Stocks

The S&P 500 fell 0.1% as of 11:30 a.m. New York time

The Nasdaq 100 fell 0.6%

The Dow Jones Industrial Average was little changed

The Stoxx Europe 600 fell 0.5%

The MSCI World Index was little changed

Bloomberg Magnificent 7 Total Return Index fell 0.7%

The Russell 2000 Index rose 0.4%

Currencies

The Bloomberg Dollar Spot Index fell 0.3%

The euro rose 0.4% to $1.1736

The British pound rose 0.1% to $1.3508

The Japanese yen rose 0.7% to 146.41 per dollar

Cryptocurrencies

Bitcoin rose 1.8% to $119,109.86

Ether fell 1.3% to $3,710.83

Bonds

The yield on 10-year Treasuries declined five basis points to 4.33%

Germany's 10-year yield declined two basis points to 2.59%

Britain's 10-year yield declined three basis points to 4.57%

Commodities

West Texas Intermediate crude fell 1.6% to $66.12 a barrel

Spot gold rose 0.8% to $3,425.31 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.