Shares of Aditya Birla Real Estate Ltd. fell nearly 5% on Tuesday following the release of its third-quarter earnings for FY25. The company's revenue, Ebitda, and net income all showed significant declines.

For the third quarter, Aditya Birla Real Estate reported a 10.6% drop in revenue, which stood at Rs 957 crore, compared to Rs 1,070 crore in the same quarter last year.

The company's Ebitda plunged 93.5%, falling to Rs 12.8 crore from Rs 197 crore a year ago. As a result, Ebitda margins also plummeted to 1.3% from 18.4% in Q3 FY24.

The company reported net loss of Rs 42.4 crore, a sharp contrast to the Rs 79.9 crore profit posted in the same quarter last year.

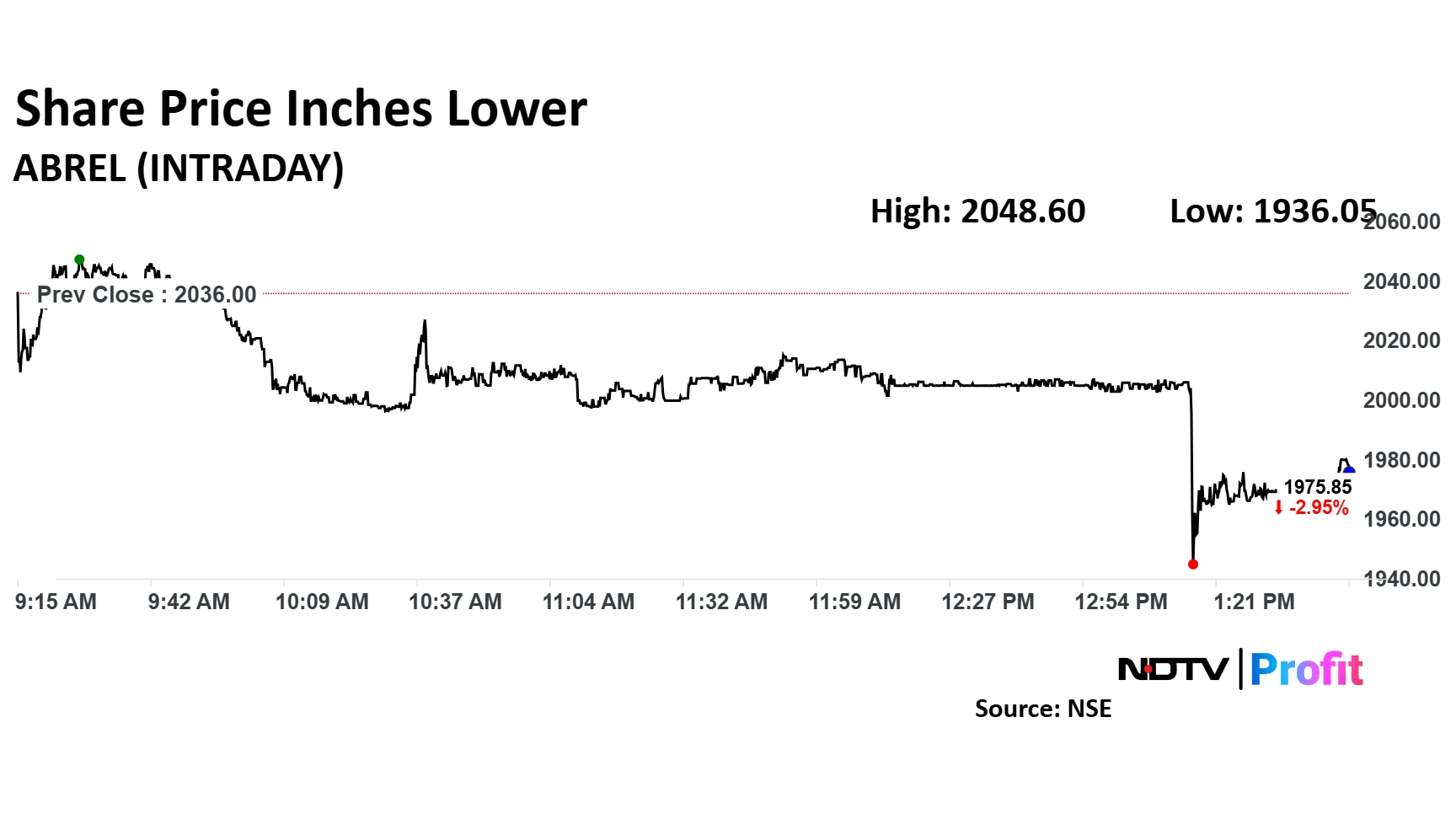

The weak earnings report has likely weighed heavily on investor sentiment, leading to a sharp decline in the stock price.

Aditya Birla Real Estate, a part of the Aditya Birla Group, ventured into the real estate sector in 2016. The company has successfully completed two commercial projects and launched five residential developments, establishing a strong presence in key cities like the Mumbai Metropolitan Area (MMR), the National Capital Region (NCR), and Bengaluru.

The scrip fell as much as 4.91% to Rs 1,936.05 apiece. It pared losses to trade 3.33% lower at Rs 1,968.15 apiece, as of 1:35 p.m. This compares to a 0.36% decline in the NSE Nifty 50 Index.

It has risen 43.32% in the last 12 months. The total traded volume for 30 days average stood at 0.7. The relative strength index was at 29.23.

Four analysts maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 62.5%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.