- Shares of Adani Power split 1:5, dividing Rs 10 shares into five Rs 2 shares

- The split does not change market capitalisation but lowers price per share

- New shares credited up to two days post-ex-date will be visible from Sept. 24

Adani Power Ltd. shares traded ex-stock split on Monday. Each fully paid-up equity share, having a face value of Rs 10, has been divided into five equity shares, each with a value of Rs 2.

The board last month approved the plan for a 1:5 subdivision of shares, Adani Power's first-ever corporate action.

A stock split is a corporate action where a company divides its existing shares into multiple new shares, increasing the total number of outstanding shares but decreasing the price per share.

Although it does not alter the overall market capitalisation of the stock, it can make the shares more accessible to a wider range of investors by lowering the price per share. This helps improve the stock's liquidity and attract new small investors.

The record date determines shareholder eligibility to qualify for the corporate action. Under India's T+1 settlement cycle, shares must be purchased a day before the record date to make it to the shareholders' list.

The ex-date, which typically coincides with the record date, marks when the share price adjusts to reflect the share subdivision.

It may take up to two working days from the ex-date/record date for the new subdivided shares to be credited to an investor's demat account, and they will not be visible during this time.

The P&L may show an artificial decrease in profits or an increase in losses until the new shares are credited, but it will be automatically adjusted once they are credited.

Hence, the Adani Power portfolio will show accurate data from Wednesday, Sept. 24.

Adani Power Share Price

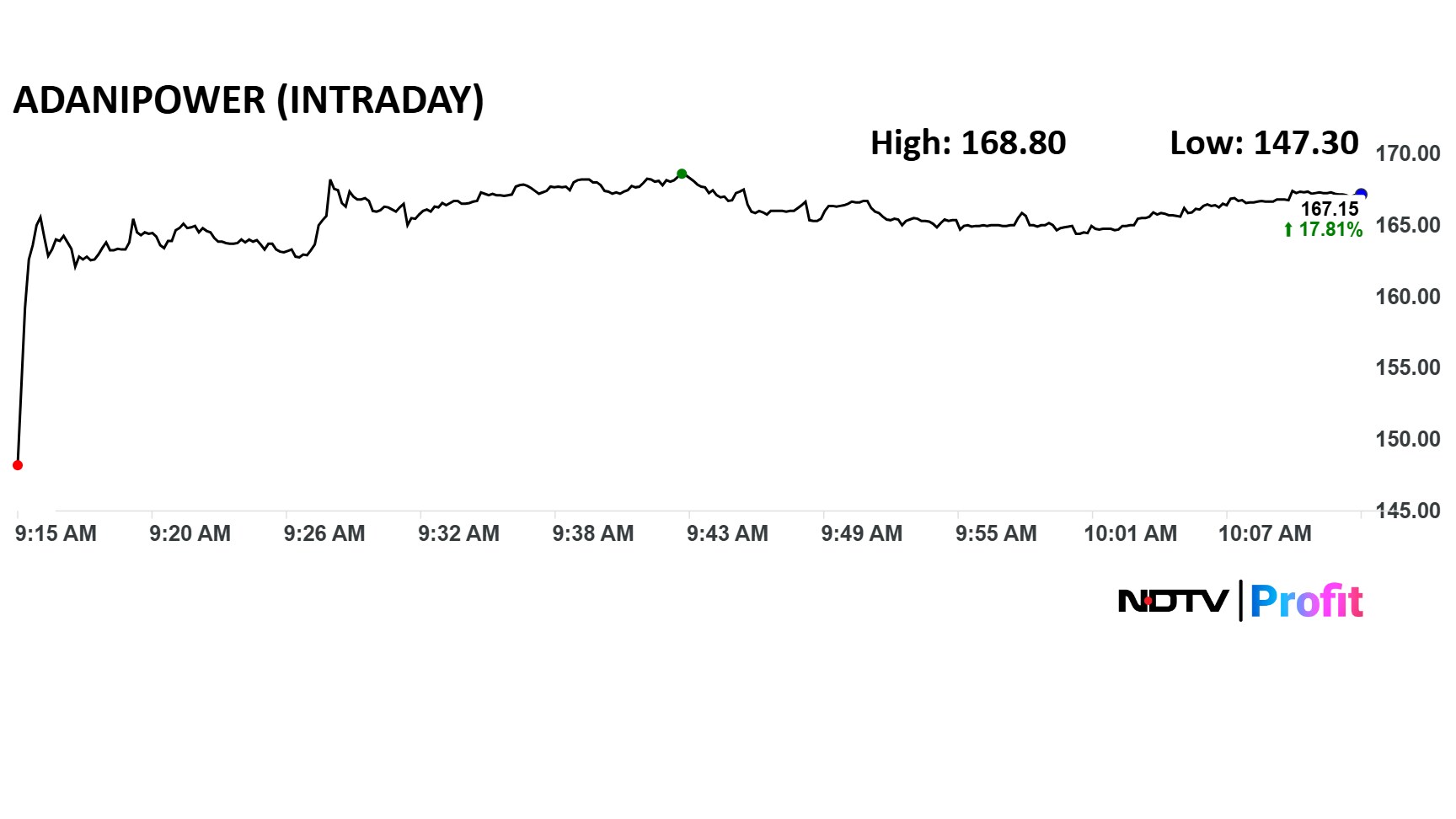

Adani Power's share price opened at Rs 148.20 on Monday. It closed at Rs 709.40 on Friday. This reflects the adjustment due to the 1:5 stock split.

The total traded turnover stood at Rs 1,110 crore on the NSE, with over 6.7 crore shares changing hands.

Adani Power has 385.69 crore fully paid-up equity shares. Promoters owned 74.96% stake, as per the latest shareholding data on the BSE. Nearly 18 lakh retail investors own a combined 4.8% equity, and foreign portfolio investors have a 12.46% stake.

Catch all the live stock market action here for real-time updates, stock movements, and broader trends throughout the day.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.