Adani Ports and Special Economic Zone Ltd. is Citi Research's top pick as it expects strong growth in volume, revenue and Ebitda including good cash flows.

The market share of the company and its industry dominance are set to increase in the port and logistics industry in India as it continues to execute well and grow its dominance in these sectors, according to Citi Research.

"With the final Supreme Court judgement on the short-seller case a few days ago, the controversy is behind us," Citi said in its Jan. 7 note. "This, combined with good cash flows and improving leverage, should drive stock price performance."

Citi Research has a 'buy' rating on the stock while raising the target price to Rs 1,368 from Rs 1,213, implying an upside of 18.8%.

Investment Strategy

Adani Ports is the largest port operator in India and has achieved significant locational including first-mover and scale advantages in the business with 25%+ market share, the note said.

It now has ports across both the east and west coast of India and is diversified across commodities and customers. "We believe that valuations are attractive, especially given good quality underlying business and dominant position in port industry in India," Citi Research said.

Key Risks

The risks that could cause Adani Ports shares to trade below Citi's target price include:

further increases in consolidated debt, higher loans, and advances;

increase in related-party transactions;

slowdown in economic growth;

higher-than-expected capex; and

project delays.

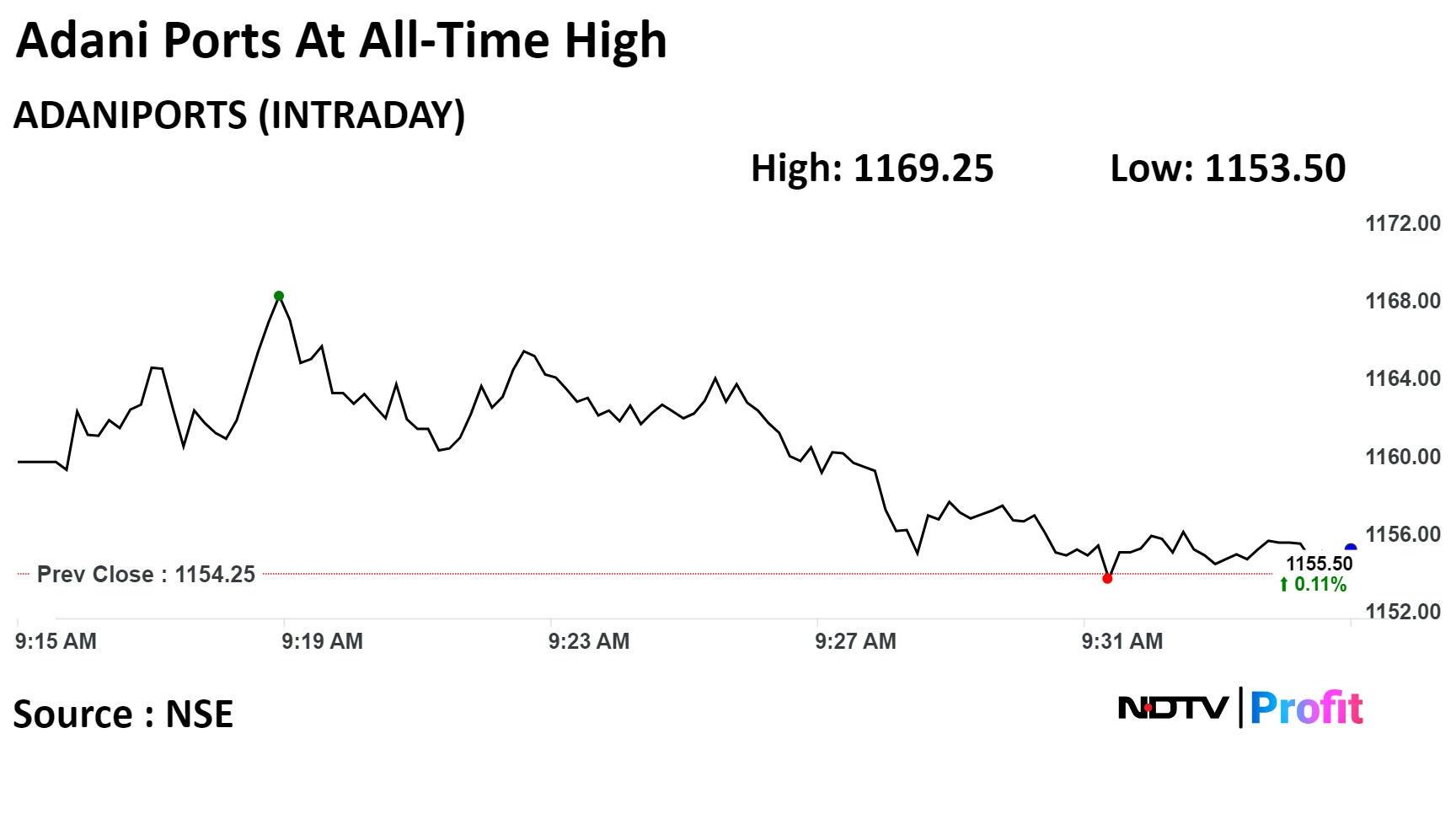

Shares of Adani Ports was trading 0.29% higher at Rs 1,157.65 apiece, compared to a 0.03% advance in the benchmark Nifty 50 as of 9:33 a.m. The stock rose as much as 1.30% during the day to Rs 1,169.25 to hit a life high.

The stock has risen over 41.76% in the past 12 months. The RSI of the stock is at 80, indicating that stock may be overbought.

Nineteen out of the 21 analysts tracking the company have a 'buy' rating on the stock and two recommend a 'hold', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 7.9%.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.