The Bank of Japan left its benchmark rate unchanged while pushing back the timing for when it expects to reach its inflation target amid intensified uncertainties due to the global trade war.

Governor Kazuo Ueda's board voted unanimously to maintain the central bank's policy rate at 0.5% at the end of the two-day gathering, according to a statement, as expected by all 54 economists surveyed by Bloomberg.

The BOJ said it expects inflation to be consistent with its 2% goal around the second half of its outlook period, which was extended by a year to include fiscal 2027. The bank halved its economic growth projection to 0.5% for this fiscal year in a sign of heightened caution following the US levies and counter measures by others.

While emphasizing “extremely high” uncertainties ahead, the BOJ retained its commitment to raising borrowing costs if its economic outlook is realized, indicating policymakers will press ahead on lifting rates once the fog has cleared.

“The BOJ can still say it's on track to hit its price goal with price forecasts around 2%, but they are taking many downside risks from trade policy into account and I think they will have to be cautious about interest rate hikes,” said Harumi Taguchi, principal economist at S&P Global Market Intelligence.

The yen slid 0.5% to 143.76 against the dollar following the announcement, after touching the strongest level in seven months of 139.89 last week as market participants continued to pile into safe-haven assets. Benchmark 10-year yields fell while stocks held gains.

Ueda is facing the strongest economic headwinds of his tenure leading the bank after a relatively smooth path toward phasing out its massive monetary stimulus program over the past two years. Donald Trump's tariff campaign prompted the International Monetary Fund and World Trade Organization to cut forecasts for global growth and commerce, respectively, highlighting the risks for trade-reliant countries such as Japan.

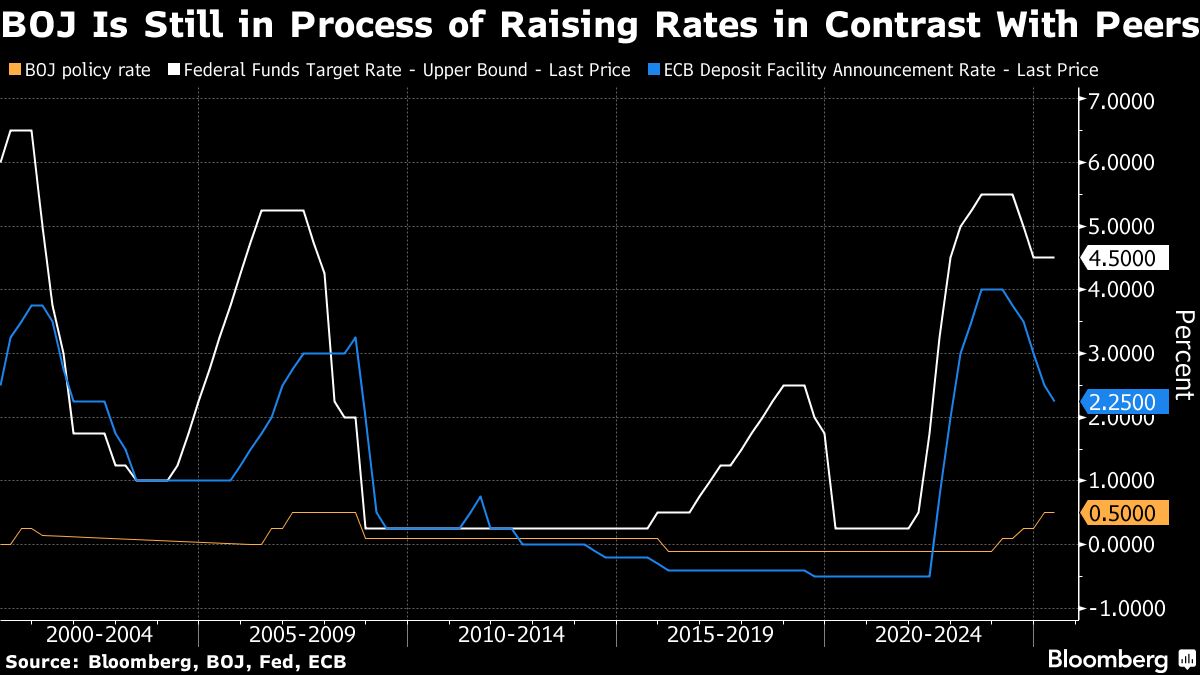

Concerns over the potential tariff impact have reignited speculation over rate cuts in the US and Europe as the economic outlook dimmed. Ueda has recently said he'll be mindful of deeper uncertainties stemming from the tariffs, suggesting he's in no rush to hike rates for now.

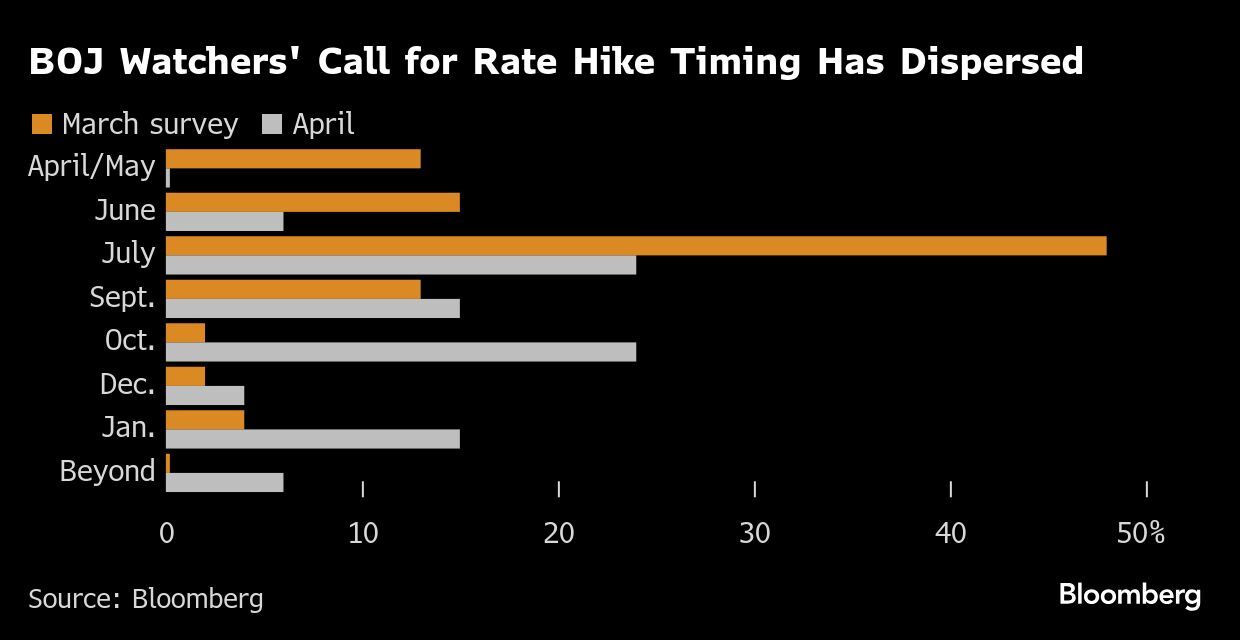

With little expectation for a rate hike at this meeting, the quarterly economic report was a focus for BOJ watchers. In its first forecasts for the fiscal year starting April 2027, the central bank projected core inflation at 1.9%, with the rate that excludes both fresh food and energy forecast at 2%. Those estimates — around the 2% target — give the bank reason to further roll back its accommodative monetary settings when conditions allow.

What Bloomberg Economics Says...“The details show the BOJ is poised for another rate hike. For the new inflation forecast for the fiscal year ending March 2028, the BOJ is keeping it around 2% - signaling policymakers aren't overly concerned that tariffs will derail Japan's price momentum.”— Taro Kimura, economist.

The bank had said for the past year that price trends were consistent with reaching the target in the second half of its three-year outlook period through March 2027.

Japan's consumer prices have been rising at the fastest pace among Group of Seven countries. Core inflation, which excludes fresh food, has been at or above the BOJ's target for about three years, and recent data suggest it's reaccelerating. With borrowing costs the second lowest among major economies, Ueda is still eyeing rate hikes even as market speculation over the potential for Fed rate cuts continues.

On Thursday, the BOJ noted that risks to inflation are skewed to the downside this year and next, a stark shift from three months ago when it only cited upside risks. Data released this week showed that factory output and retail sales dropped more than expected in March, highlighting weakness before the tariffs took effect.

Citigroup and Morgan Stanley MUFG Securities are among those estimating that data due May 16 will show Japan's economy contracted in the first quarter. A subindex of the Au Jibun Bank's purchasing managers' index published Thursday showed that business confidence slipped to the lowest level since June 2020.

Ryosei Akazawa, Japan's chief trade negotiator, is in Washington this week. He'll meet with Treasury Secretary Scott Bessent and others for a second-round of discussions later Thursday.

US tariffs are likely to have a profound impact on Japan's manufacturing base, especially if an across-the-board 10% duty reverts to the 24% rate that Trump initially announced before giving a three-month grace period through early July.

The universal tariffs were in addition to a 25% levy on US imports of steel and aluminum that started in March and a similar tax on autos that kicked in April. While Trump took a step to ease the impact of auto levies on industry this week, the 25% tax remains in place.

Ueda will elaborate on the thinking behind today's decision at a press briefing starting at 3:30 p.m.

“Amid high uncertainty surrounding trade-related issues, I will be paying attention to how Governor Ueda will explain the relationship between prices and trade policies at his press conference today,” Taguchi said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.