The great Wall Street rebound resumed in earnest as stocks staged a late-day comeback even as fears grow that the US economy will buckle under the weight of Donald Trump's trade war.

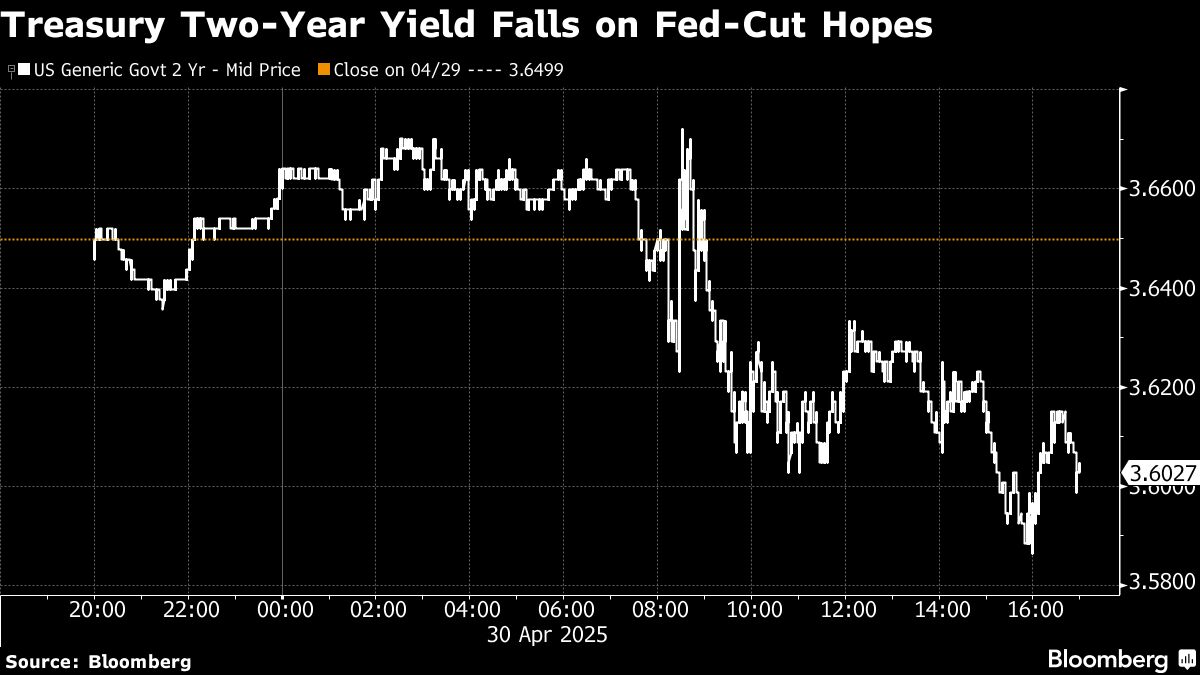

A month of historic volatility ended on that same note, with the S&P 500 wiping out a 2% slide for the first time since 2022. Hopes that trade talks will prove constructive firmed up sentiment, after a report that the US has been proactively reaching out to China through various channels. At the same time, a cohort of investors is betting the Federal Reserve will administer its policy medicine to forestall a recession.

Stocks jolted by economic data.

“Weak data could hasten Fed cuts,” said Fawad Razaqzada at City Index and Forex.com. “The Fed is now more likely to step in sooner with its rate cuts to support an ailing economy, while the weakness in data could also encourage Trump to ease off on tariffs and make deals, quicker.”

Wild swings lashed US assets throughout the month as Trump's fast-evolving tariff war put the S&P 500 on the brink of a bear market, with a plunge of almost 20% from its February record through April 8. The gauge erased about half of that slide, but still saw its third straight month of declines - the longest losing streak since 2023.

Following a few chaotic days in early April that underscored fears foreign investors were beating a retreat from American assets, Treasuries rebounded and notched their their fourth straight month of gains. The dollar saw its worst monthly slide since 2022.

The macro picture remained at the forefront as traders waded through corporate results. In late hours, Microsoft Corp. and Meta Platforms Inc. reported better-than-expected sales, suggesting demand hasn't been rattled by tariffs. EBay Inc. issued a bullish forecast for the quarter, while Qualcomm Inc.'s revenue prediction was tepid.

To Louis Navellier, what happens next very much depends on the tariff developments.

“If we get a series of announcements soon of trade agreements reached, optimism will rise, and the Fed will likely cut soon,” said the chief investment officer at Navellier & Associates. “If things drag out for weeks and months, the damage to supply chains and inevitable near-term inflation could cause shouts of stagflation and be very bearish for stocks.”

Equities dropped earlier Wednesday after a report showed the US economy contracted at the start of the year for the first time since 2022 on a monumental pre-tariffs import surge. The market started bouncing after separate data highlighted a jump in consumer spending, while a key inflation gauge decelerated.

At the very least, says Bret Kenwell at eToro, this could tone down the worry that the Fed can't lower rates should the labor market begin to weaken, even though officials will likely need to see further proof that inflation is cooling.

To Krishna Guha at Evercore, Wednesday's data give investors and the Fed a better read on the state of the economy heading into the tariff shock. But the relative magnitude of these effects may not become clear until some time in the third quarter, he said.

“This presents the Fed with a dilemma as to whether it should wait to July/September or consider cutting in June anyway because the risk of delay is too high, even though it may not have as much clarity on the outlook as it would like,” Guha noted.

In the swaps market, traders increased their wagers on four quarter-point reductions by the end of the year, with the first fully priced in for July.

Despite the contraction, the underlying details of the gross domestic product data suggest some key drivers remained on a good footing at the start of the year.

However, looking further out, forecasters contend that the higher tariffs will cause a supply shock, challenging businesses and leading to a pullback in demand. Retaliatory levies would also discourage exports, setting up a tough backdrop for the rest of the year and making the odds of a recession essentially a coin flip.

“This was all first quarter,” said Neil Dutta at Renaissance Macro Research. “Now, uncertainty is an enemy of growth and it is also the enemy of Fed cuts.”

Corporate Highlights

Nvidia Corp. Chief Executive Officer Jensen Huang said he'd like the Trump administration to change regulations for exporting artificial intelligence technology from the US to the rest of the world so American businesses can better capitalize on the opportunities in the future.

Caterpillar Inc. expects slightly lower sales this year if Trump administration tariffs remain in place and the economy dips into a recession in the second half.

Ford Motor Co. won't increase the price of its vehicles until it sees how competing carmakers respond to higher costs imposed by Trump's tariffs.

Retail investors flocked to Robinhood Markets Inc. as Trump's trade war roiled markets, boosting the company's revenue and earnings, even as growth in cryptocurrency revenue slowed.

Humana Inc. spent less money on medical care than Wall Street expected in the quarter, easing investor concerns about how rising medical costs are making business more difficult for US health insurers.

Norwegian Cruise Line Holdings Ltd. broke with its cruise peers by warning that cruise demand, which has long defied worrying travel trends, is beginning to weaken.

Some of the main moves in markets:

Stocks

The S&P 500 rose 0.1% as of 4 p.m. New York time

The Nasdaq 100 rose 0.1%

The Dow Jones Industrial Average rose 0.3%

The MSCI World Index rose 0.2%

Bloomberg Magnificent 7 Total Return Index fell 1.1%

The Russell 2000 Index fell 0.6%

Currencies

The Bloomberg Dollar Spot Index rose 0.1%

The euro fell 0.5% to $1.1329

The British pound fell 0.6% to $1.3329

The Japanese yen fell 0.5% to 143.02 per dollar

Cryptocurrencies

Bitcoin fell 0.6% to $94,279.21

Ether fell 0.8% to $1,795.63

Bonds

The yield on 10-year Treasuries declined two basis points to 4.15%

Germany's 10-year yield declined five basis points to 2.44%

Britain's 10-year yield declined four basis points to 4.44%

Commodities

West Texas Intermediate crude fell 3.6% to $58.22 a barrel

Spot gold fell 0.8% to $3,292.31 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.