Emerging Asian currencies look set to extend their underperformance versus global peers as the prospect of interest-rate cuts further erodes their appeal, according to fund managers and strategists.

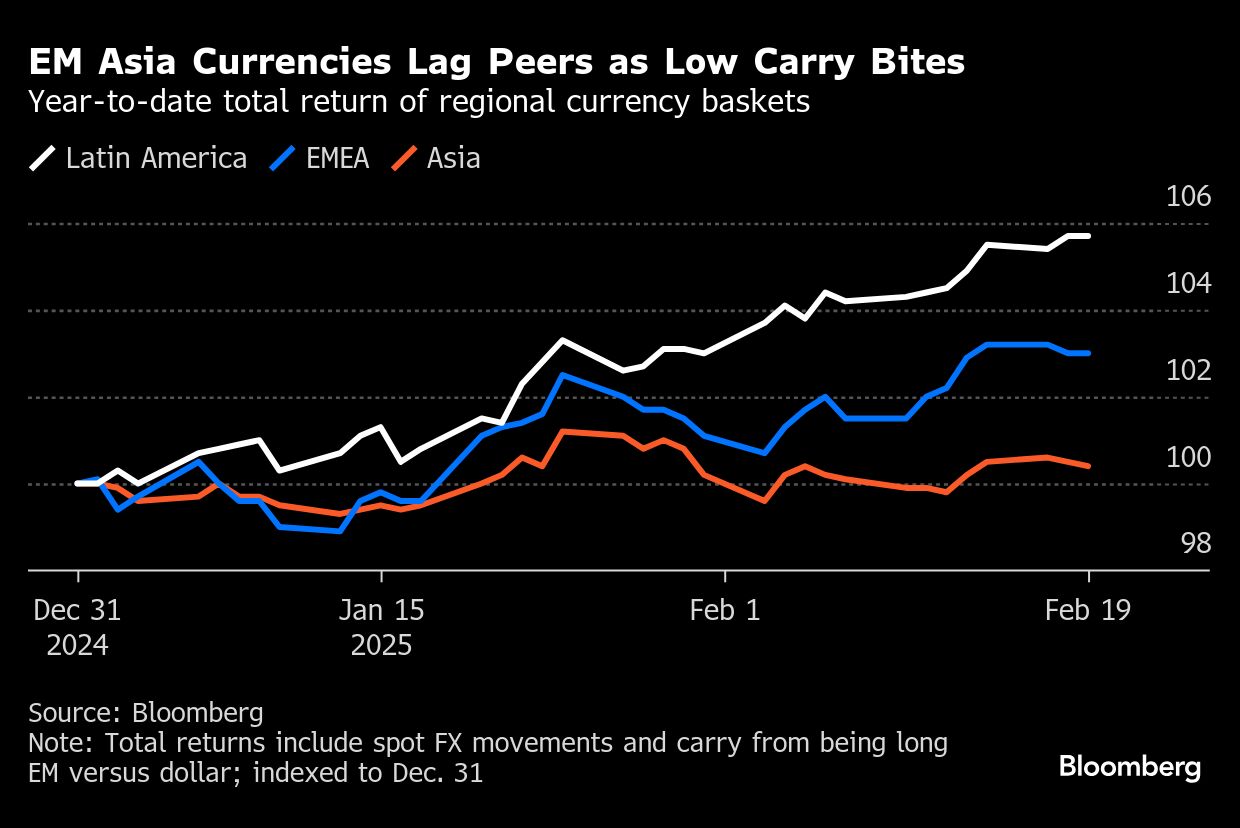

Traders holding emerging Asian currencies earned a total return of just 0.4% this year through Wednesday, compared to the 5.7% return they would have got from buying a basket of Latin American currencies, according to data compiled by Bloomberg. A key reason: lower interest rates in Asia, which have dented the returns traders can earn by holding currencies — known as the carry.

The impact of low carry is likely to worsen for Asian currencies, as central banks mull further interest rate cuts. Strategists also think rising trade tensions between China and the US will weigh heavily on a region that is increasingly exposed to the world's second-largest economy.

“There's more downside in these currencies, particularly those that are more acutely exposed to Chinese demand,” said Matthew Ryan, head of market strategy at Ebury Partners Ltd.

Forward prices underscore just how much traders can earn by shifting from Asian currencies to those elsewhere. The average three-month currency forward implied yield on a basket of Asian currencies was around 4.15% on Feb. 19, versus almost 9% in Latin America and 5.78% in Europe, the Middle East and Africa.

EMEA currencies have also beaten emerging Asia in total return terms, generating a return of around 3.1% so far this year, according to Bloomberg-compiled data.

Central Bank Divergence

Central banks in China, India, Indonesia, the Philippines, South Korea and Thailand have already starting easing, and more cuts are on the table. Swap markets are pricing in cuts from India, South Korea and Thailand over the next six months.

That is a stark contrast to the stance being adopted by Latin American central banks, which are waging a familiar battle against inflation. Brazil has increased rates and said there are more hikes to come. Uruguay most recently hiked in February. Money managers are betting Chile could follow.

So far this year, carry from Latin America currencies has beaten emerging Asia by almost 0.6 percentage points, according to data compiled by Bloomberg. If Asia's central banks continue to cut rates while those in Latin America hike or pause, those carry returns would be amplified for the remainder of the year.

“Investors would prefer to be exposed to currencies with higher carry,” said Marcelo Assalin, head of emerging markets debt at William Blair International.

The prospect of further US tariffs is another negative for Asian currencies, although few emerging markets will be spared from the impact of rising trade tensions. Most Asian economies are exposed to reciprocal levies, according to Nomura Holdings Ltd. More targeted tariffs against China could also weigh broadly on Asian currencies, given the influence of yuan movements on wider sentiment.

The 90-day correlation between the Bloomberg Asia Dollar Index and the onshore yuan is around 0.9, signaling both have been moving practically in lockstep.

Policymakers in Asia are likely to allow some currency depreciation to soften the blow of higher US tariffs, said Assalin, since weaker currencies will make exports more attractive to foreign buyers.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.