Shares of Piramal Pharma Ltd. surged to a 52-week high on Monday after the company's profit doubled in the fourth quarter.

The pharmaceutical company's bottom line rose 102.19% year-on-year to Rs 101.3 crore in the quarter ended March 31, 2024, according to an exchange filing. Analysts tracked by Bloomberg had forecasted a profit of Rs 208.5 crore.

Revenue growth for Piramal Pharma in the quarter and fiscal ended March was driven by healthy growth in contract development and manufacturing, and India consumer Healthcare businesses. Operating profit was primarily driven by revenue growth, operating leverage, cost optimisation and operational excellence initiatives. Net debt-to-Ebitda ratio improved from 5.6 times at the start of fiscal 2024 to 2.9 times at the end of it.

“FY24 has been a strong year for the company with all-round improvement, mainly driven by our CDMO business that delivered a robust 19% YoY revenue growth. We saw significant increase in order inflows, especially for on-patent commercial manufacturing, amid a difficult biotech funding environment," said Nandini Piramal, chairperson of Piramal Pharma.

Piramal Pharma Q4 FY24 Results Highlights (Consolidated, YoY)

Revenue up 17.96% to Rs 2,552.4 crore. (Bloomberg estimate: Rs 2,481.7 crore).

Ebitda up 51.08% to Rs 530.7 crore. (Bloomberg estimate: Rs 469.4 crore).

Margin at 20.79% versus 16.23% (Bloomberg estimate: 18.9%).

Net profit rises 102.19% to Rs 101.3 crore. (Bloomberg estimate: Rs 208.5 crore).

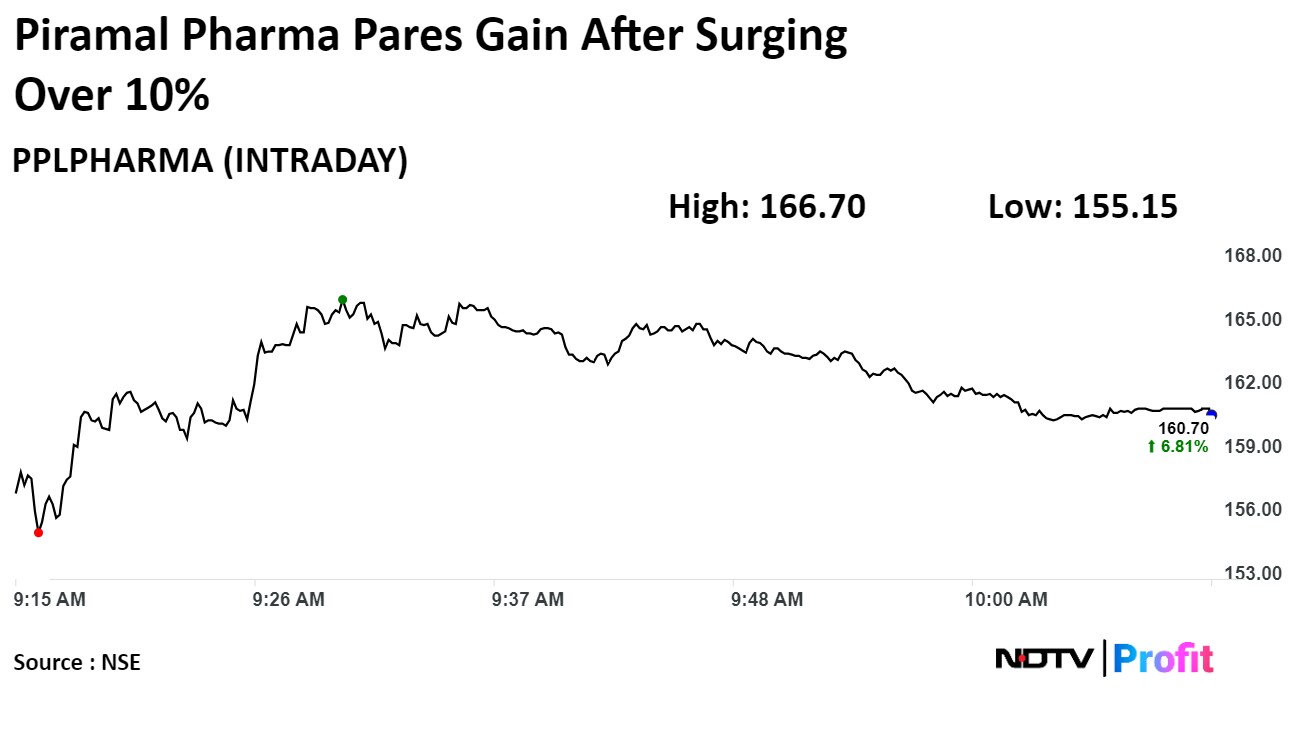

Shares of Piramal Pharma rose as much as 10.8% before paring gains to trade 7.01% higher at 10:08 a.m., compared to a 0.94% decline in the benchmark Nifty 50.

The stock has risen 122% in the last 12 months and 14.6% year-to-date. Total traded volume so far in the day stood at 19 times its 30-day average. The relative strength index was at 68.

All seven analysts tracking the company have a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analysts' price targets implies a potential upside of 3.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.