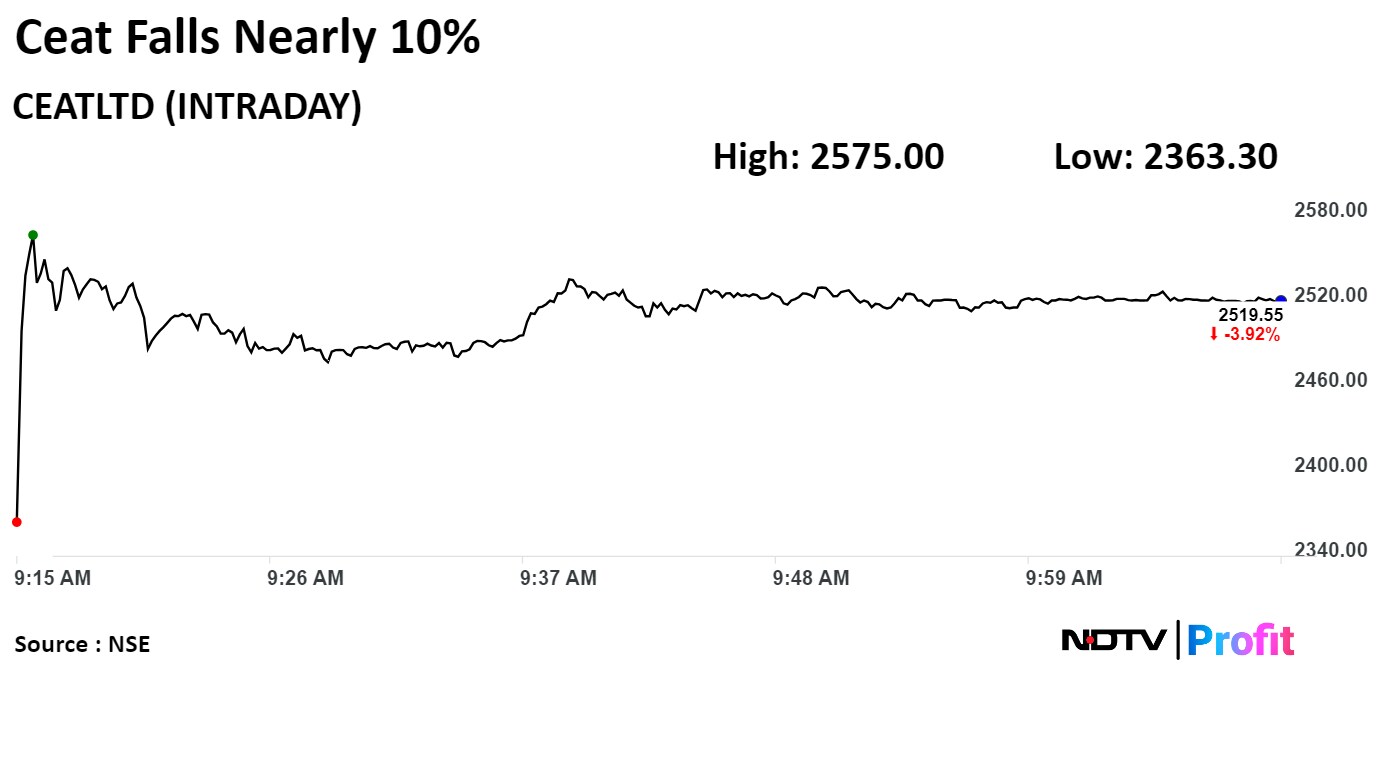

Shares of Ceat Ltd. plunged nearly 10% on Friday to the lowest in over four months after its consolidated net profit fell 23% in the fourth quarter of financial year 2024, missing analysts' estimates.

The tyremaker posted a profit of Rs 102.3 crore in the quarter ended March 31, according to an exchange filing.

"There are two items in the exceptional cost list in quarter four numbers. Approximately Rs 8 crore is on account of the volatility separation scheme we launched in our factories," Chief Financial Officer Kumar Subbiah said in an interview to NDTV Profit. "Balance is provisions we made towards extending producers' responsibility. We're calling it an exception as it pertains to the year 2023."

"There's momentum in the market, and we are seeing lots of opportunities in the international markets as well. We lost some volumes in the OEM business. We are expecting a growth momentum in the coming quarters," Subbiah said.

Ceat Q4 FY24 Earnings Highlights (Consolidated, YoY)

Revenue up 4.07% at Rs 2,992 crore vs Rs 2,875 crore (Bloomberg estimate: Rs 3,055 crore).

Ebitda up 6.44% at Rs 392 crore vs Rs 368 crore (Bloomberg estimate: Rs 454 crore).

Margin expands 29 basis points to 13.08% vs 12.79% (Bloomberg estimate: 14.9%).

Net profit down 23% at Rs 102.3 crore vs Rs 132.4 crore (Bloomberg estimate: Rs 169 crore).

Board recommends a final dividend of Rs 30 per share.

On the NSE, the stock dropped as much as 9.88% during the day to Rs 2,363.30 apiece, the lowest Dec. 21, 2023. It was trading 3.86% lower at Rs 2,521.05 per share, compared to a 0.50% advance in the benchmark Nifty 50 at 10:03 a.m.

The share price has risen 53.82% in the last 12 months and 3.74% on a year-to-date basis. The total traded volume so far in the day stood at 18 times its 30-day average. The relative strength index was at 43.1.

Fifteen out of 23 analysts tracking the company have a 'buy' rating on the stock, three recommend 'hold' and five suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside 11.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.