Ami Organics Ltd. stock surged to over 8% on Friday after investors in the company pared stake worth Rs 473.69 crore in multiple bulk trades.

The pharmaceutical company signed a non-binding memorandum of understanding with a global manufacturer to produce electrolytes for battery cells in Gujarat, as per an exchange filing on Thursday.

The company will also sign an MoU with the Gujarat government for an investment of up to Rs 300 crore, for a manufacturing facility for the electrolytes business, the filing said.

Bulk Deal Details

Girishkumar Limbabhai Chovatia sold 19.7 lakh shares (5.34%) at Rs 1,030.12 apiece.

Kiranben Girishbhai Chovatia sold 18.4 lakh shares (4.98%) at Rs 1,030 apiece.

Dhwani Girishkumar Chovatia sold 7.89 lakh shares (2.14%) at Rs 1,030 per share.

Morgan Stanley Asia Singapore Pte bought 8.07 lakh shares (2.18%) at Rs 1,030 apiece.

BOFA Securities Europe Sa bought 5.25 lakh shares (1.42%) at Rs 1,030 apiece.

ICICI Prudential Mutual Fund bought 5 lakh shares (1.35%) at Rs 1,030 apiece.

Malabar India Fund bought 4.85 lakh shares (1.31%) at Rs 1,030 apiece.

Value Quest Investment Advisors bought 6.89 lakh shares (1.86%) at Rs 1,030 apiece.

Goldman Sachs Investments Mauritius bought 2.42 lakh shares (0.65%) at Rs 1,030 apiece.

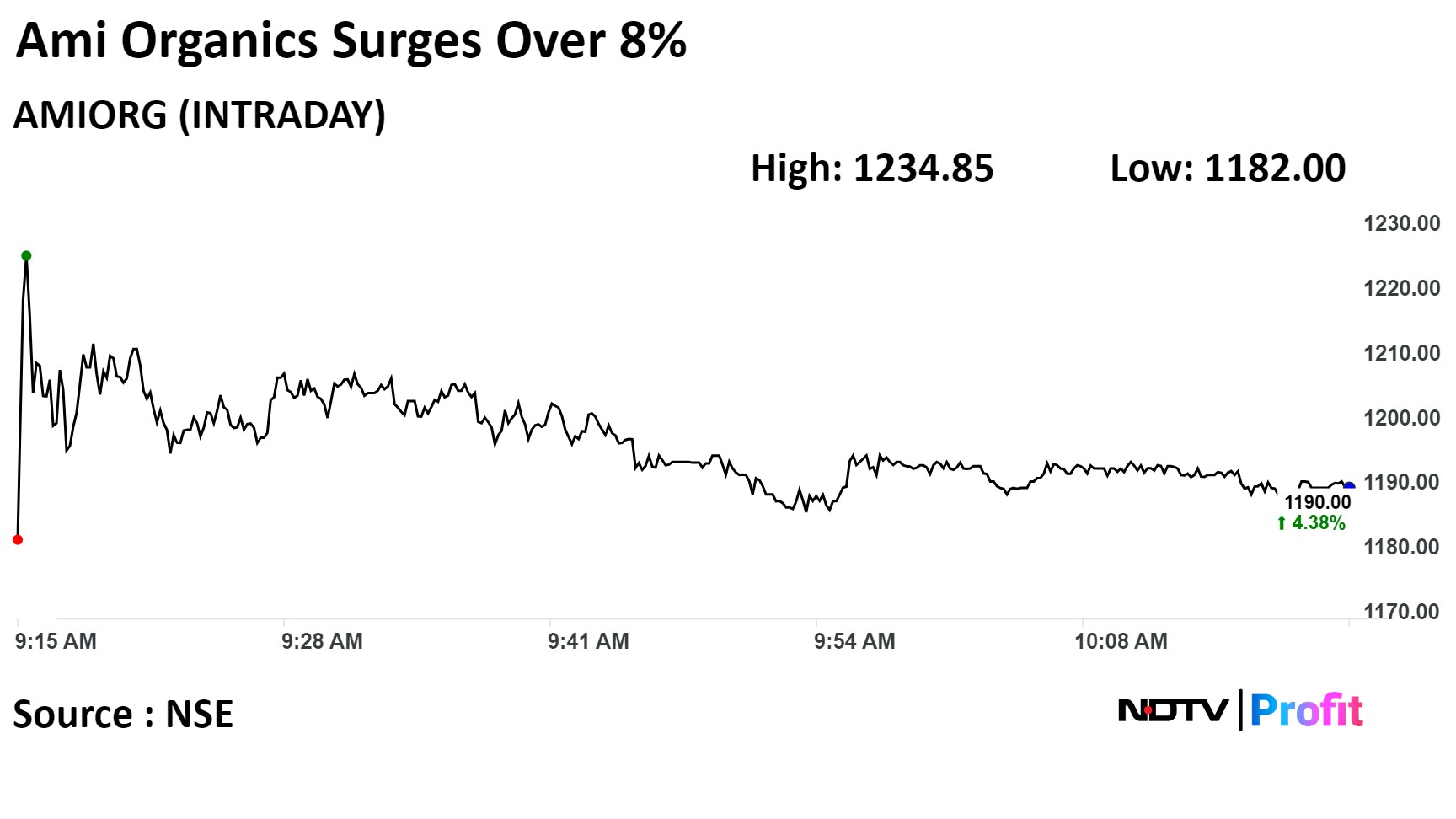

Shares of Ami Organics Ltd. rose as much as 8.31%, the highest since Oct. 23, before paring gains to trade 4.68% higher at 10:13 a.m. This compares to a 0.44% advance in the NSE Nifty 50.

The stock also posted its biggest percentage gain on Friday since May 15. It has risen 23.53% year-to-date. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 60.93.

Of the eight analysts tracking the company, seven maintain a 'buy' rating, and one suggests 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 14.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.