Shares of Ajanta Pharma Ltd. surged over 13% to a record high on Friday after its fourth-quarter profit surged, beating analysts' estimates, aided by robust sales across domestic and international markets. The drugmaker's net profit rose 66% year-on-year to Rs 203 crore in the quarter ended March 2024, according to an exchange filing. That compares with the Rs 187 crore consensus estimate of analysts polled by Bloomberg.

Revenue from operations rose to Rs 1,054 crore in the fourth quarter of FY24, compared to Rs 882 crore in the previous year. The company board has also approved the distribution of Rs 351 crore to shareholders in the form of a buyback.

Ajanta Pharma - (Consolidated, YoY)

Revenue up 19.53% at Rs 1,054.08 crore. (Bloomberg estimate: Rs 1,034 crore).

Ebitda up 86.32% at Rs 278 crore. (Bloomberg estimate: Rs 250 crore).

Margin up 946 bps at 26.4%. (Bloomberg estimate: 24.1%).

Net profit up 65.82% at Rs 203 crore. (Bloomberg estimate: Rs 187 crore).

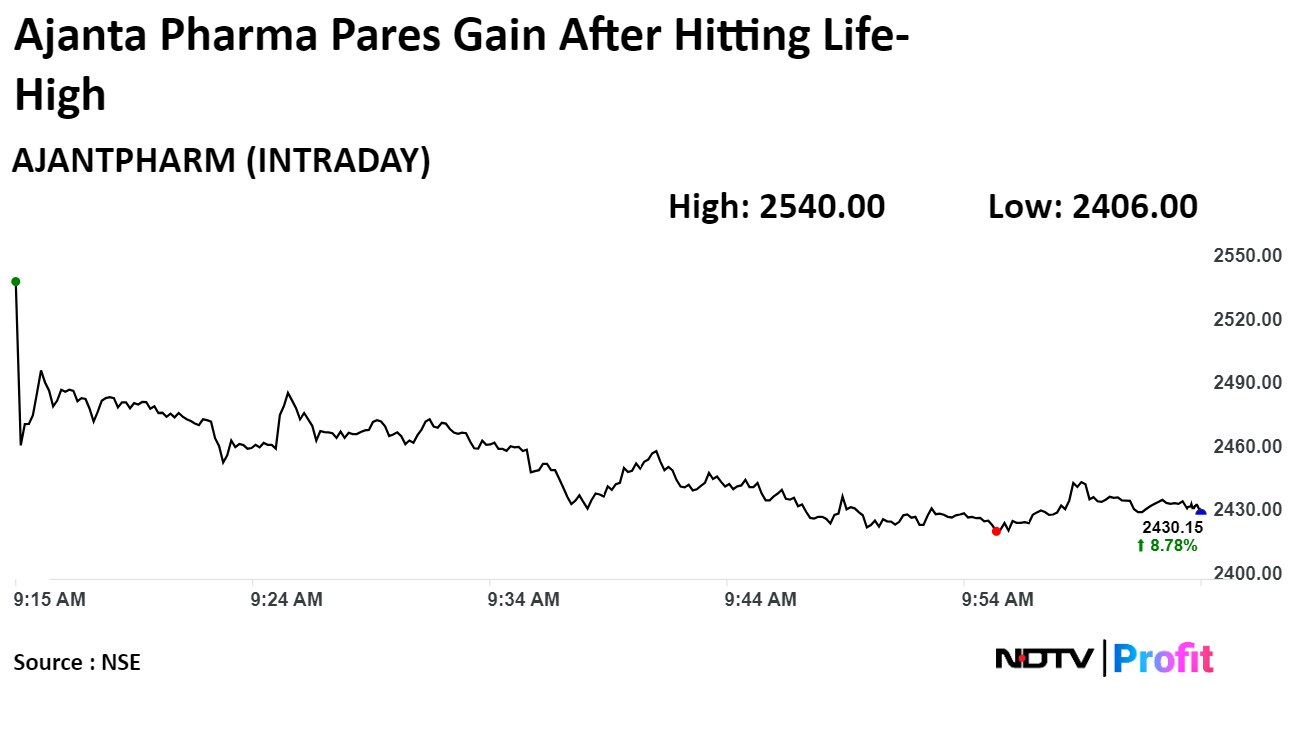

Shares of the company rose as much as 13.7% during the day to a life high of Rs 2,540 apiece on the NSE. It was trading 8.59% higher at Rs 2,426 apiece, compared to a 0.56% advance in the benchmark Nifty 50 at 9:57 a.m.

The stock has risen 88.9% in the last 12 months and is up 11.25% year-to-date. The total traded volume so far today was 97 times its 30-day average. The relative strength index was at 78.

Twelve out of the 15 analysts tracking the company have a 'buy' rating on the stock, one recommends a 'hold' and two suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 3.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.