Tata Motors Ltd.'s growth may moderate in the next couple of years, even as its planned deleveraging and demerger remain on track.

The maker of the Nexon and Punch SUVs expects the first half of the financial year ending March 31, 2025, to be weaker for its passenger as well as commercial vehicle businesses, while the luxury business under Jaguar Land Rover may just remain resilient, the company said in its post earnings call.

While earnings in January–March 2024 were largely in line, the growth outlook is cautiously optimistic. According to analysts,

In JLR, marketing expenses could rise amid a declining order book.

In the commercial-vehicle business, the near-term volumes could be weak, partly due to elections.

Elections, heatwaves, high channel inventory, and a strong base in cars could result in modest near-term demand.

Consolidated net profit of the Nexon maker rose 219% over the previous year to Rs 17,529 crore in the three months ended March 31, 2024, on the back of revenue that rose 13.3% year-on-year to Rs 1.2 lakh crore, according to an exchange filing on Friday.

Analysts polled by Bloomberg had estimated the top line at Rs 1.21 lakh crore and the bottom line at Rs 6,966.98 crore.

Tata Motors Q4 Results: Key Highlights (YoY)

Revenue up 13.3% to Rs 1.2 lakh crore (Bloomberg estimate: Rs 1.21 lakh crore)

Ebitda up 32.8% to Rs 16,995 crore (Bloomberg estimate: Rs 17,406.73 crore)

Ebitda margin at 14.2% versus 12.1% (Bloomberg estimate: 14.4%)

Net profit up 218.9% to Rs 17,529 crore (Bloomberg estimate: Rs 6,966.98 crore)

Note: One basis point is one-hundredth of a percentage point.

Here's a look at what brokerages had to say on Tata Motors' Q4 results.

Elara Capital

Rating: Accumulate | Target Price: Rs 1,100 | Potential Upside: 11%

In-line results; near-term outlook muted

Margin expands 190bp YoY; JLR EBIT margin up 40bp QoQ at 9.1%

Weak CV with slow Q1 and PV outlook; JLR FY25 EBIT guidance flat YoY

Factor in 2% JLR volume CAGR over FY26, with EBIT 9.3%

Flat India CV Volumes with monitoring margins

Nuvama

Rating: Reduce | Target Price: Rs 940 | Potential Downside: 10%

Q4 miss due to lower CV, PV numbers; JLR/CV business to moderate

JLR order book, high base should lead to single-digit growth in FY25E

Muted showing in India CV is likely due to loss of share to railways

Building in moderate revenue/Ebitda CAGR of 8%/13% over FY24–26E

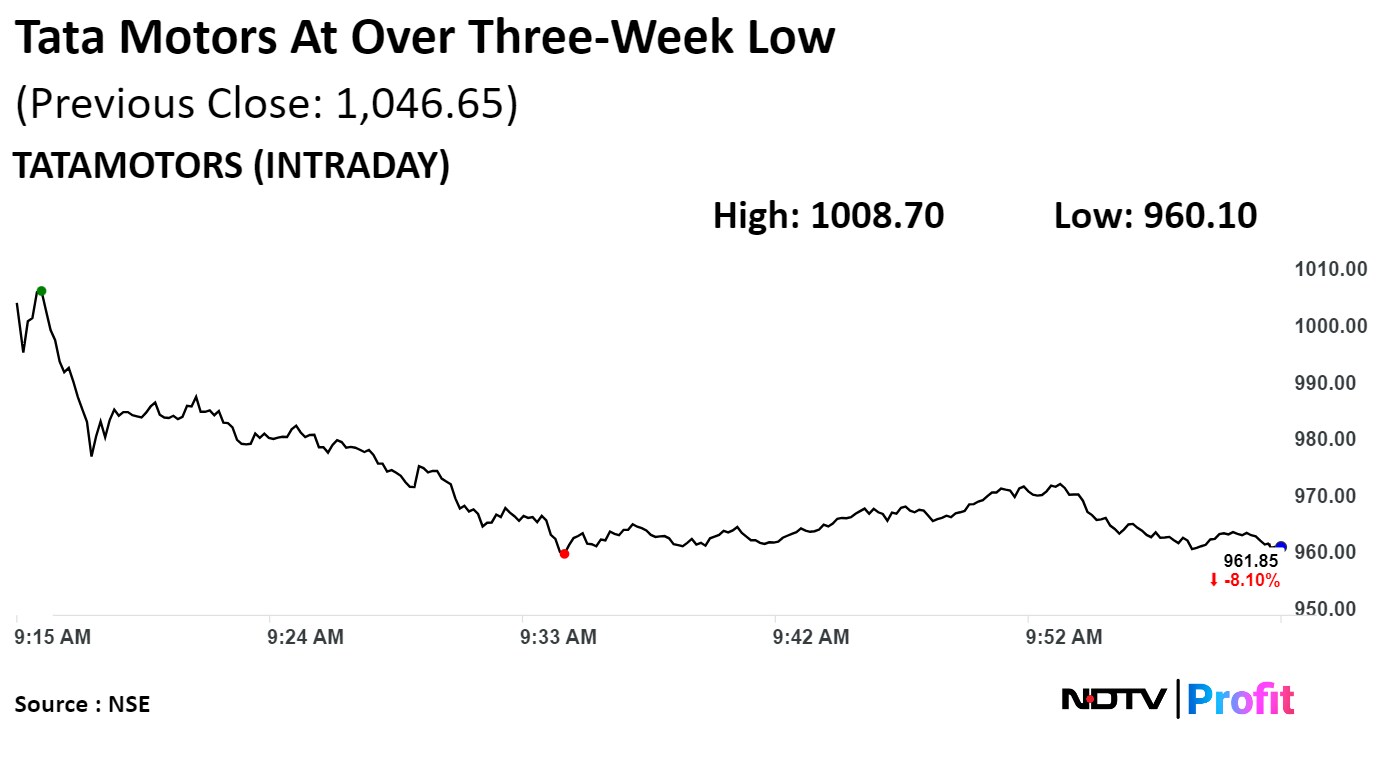

Shares of Tata Motors declined as much as 8.27% to Rs 960.10 apiece, the lowest level since April 19. It was trading 7.89% lower at Rs 963.65 apiece as of 09:56 a.m. This compares to a 0.87% decline in the NSE Nifty 50 Index.

The stock has risen 83.10% in last 12 months. Total traded volume so far in the day stood at 12 times its 30-day average. The relative strength index was at 43.71.

Out of 34 analysts tracking the company, 21 maintain a 'buy' rating, six recommend a 'hold,' and seven suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 10.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.