Institutional Investor Advisory Services, a domestic proxy advisory firm, has advised shareholders of ITC Ltd. to vote against the proposed demerger of the conglomerate's hotels business on the grounds that it only partially unlocks value.

"The proposed structure, while designed to improve ITC's ratios, provides neither a complete value unlocking for shareholders nor does it materially reduce any capital support responsibilities for the hotel business from ITC," IiAS said as a reason for its recommendation.

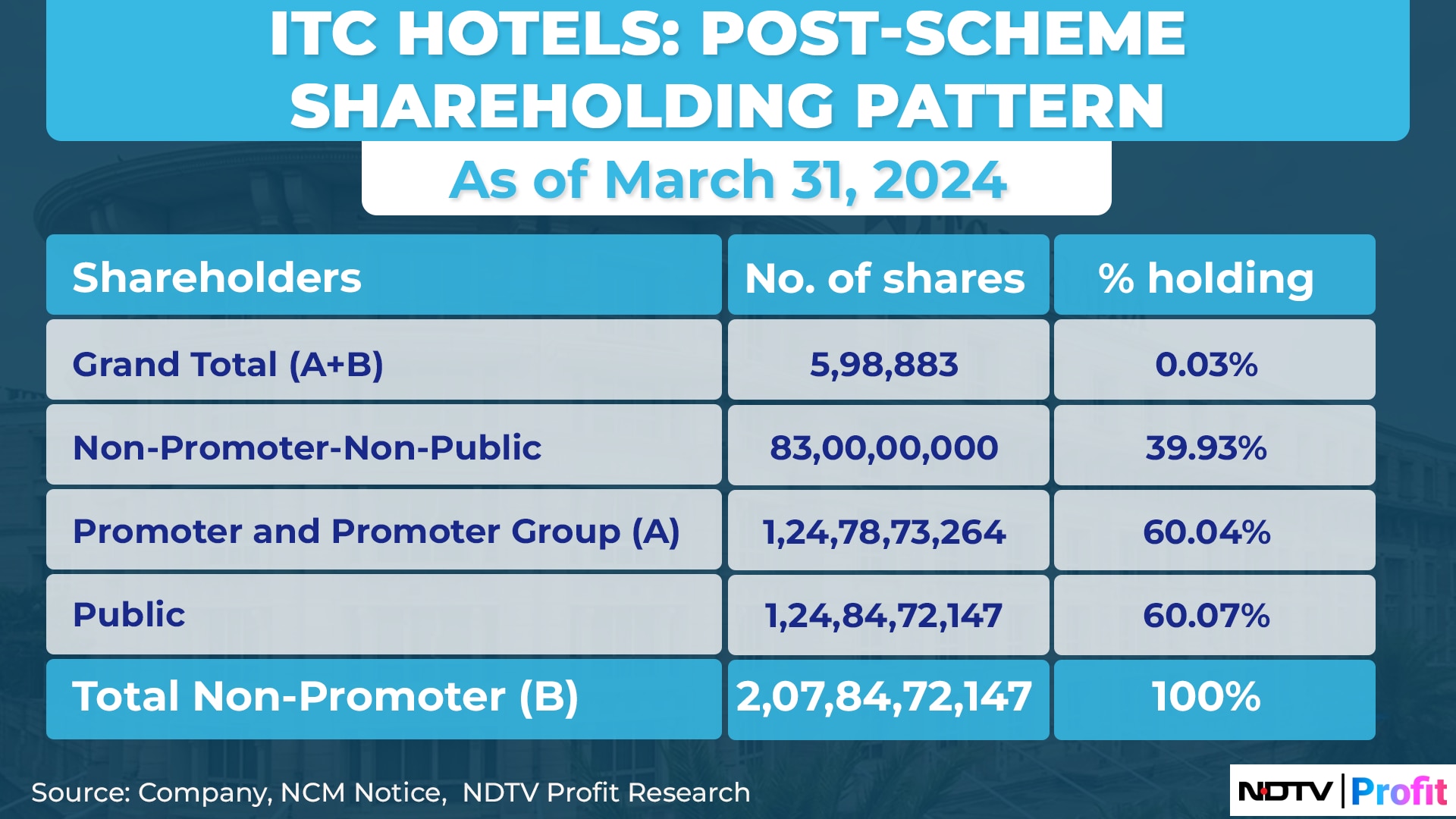

Last year, on August 14, the board of ITC approved the demerger of its hotels business into a separate entity. Under this demerger scheme, ITC will maintain 40% ownership of ITC Hotels, with ITC shareholders acquiring the remaining 60% in proportion to their stake in the parent entity. Shareholders of ITC will receive one share in the demerged hotels business for every 10 shares held in the parent company. The demerger process is expected to be completed this year, after which ITC Hotels will be listed.

The board has not clearly articulated its plan for the 40% holding in the hotels business—whether it proposes to eventually sell the equity to a strategic buyer or continue to hold it, according to IiAS. Additionally, with the separation of the hotels business, the rationale behind ITC holding onto the 13.7% equity stake in EIH Ltd. and the 7.6% equity in HLV Ltd. is also unclear, the proxy firm said. Hospitality chain EIH Ltd. is the flagship of the Oberoi Group, while HLV Ltd. runs hotels in India under the Leela brand.

The Kolkata-based conglomerate responded to IiAS by stating that they saw the hotel chain as a valuable asset that could attract potential investors. In light of that, the management clarified that retaining a 40% stake in ITC Hotels would provide ITC not only stability but flexibility and headroom for any future dilution in the event of an equity fund raise by the hotels business.

The management further noted that if ITC does not have a stake in the demerged hotels business, then the entity will not be able to utilise the 'ITC' brand name and associated brand equity and goodwill for its hotel operations. This may be detrimental to sustained value creation for its shareholders.

IiAS also pointed out that the hotel division's relatively small revenue, which makes up only 3.5% of the company's total revenues, may limit the potential for synergy between ITC's hotel business and its other businesses—agriculture and FMCG.

ITC has argued that the hotels business has matured and that it will be able to raise capital—both debt and equity—on its own. ITC Hotels will have a strong balance sheet with a net worth of Rs 9,600 crore and zero debt, and this would also enable it to raise additional funds from the capital markets should such a need arise, according to the company.

But IiAS said, "While this may be reflected in the strength of its recent performance of the business, the hotels business inherently carries high operating leverage and revenue volatility and may, over the years, need capital support from ITC Limited as its promoter". The proxy firm cited the case of Indian Hotels Company Ltd., one of ITC's competitors, which has raised equity totaling Rs 3,980 crore in the past five years.

Other proxy firms, InGovern Research and Stakeholders Empowerment Services have recommended voting in favour and has not raised any concerns.

InGovern, however, cautioned minority shareholders to exercise caution regarding the royalty fee ITC Hotels must pay to ITC for utilizing the brand name, along with the possibility of future capital inflow from the parent company.

The hotel demerger plan failed to cheer investors when it was initially announced, as the conglomerate didn't opt for a full split.

Still, analysts are gung-ho about the demerger because the capital guzzler hotel business has been a drag on ITC's books, accounting for over 20% of the company's capex and less than 5% of its EBIT over the last decade.

All of ITC's 36 lakh shareholders can vote on the resolution. Voting through electronic mode, which started on May 22, will close on June 5. The proposed resolution is special, necessitating more than 75% of the votes in favour.

ITC has no promoter holdings. British American Tobacco Plc. is the largest shareholder in ITC Ltd. with a 25.49% holding, followed by Life Insurance Corporation of India (15.2%) and Specified Undertaking of the Unit Trust of India (7.81%).

According to a demerger document sent to shareholders, BAT has voted in favour of the demerger. BAT will directly own 15.32% of ITC Hotels as a foreign direct investment, making it the largest public shareholder after ITC's promoter holding of 39.93%. However, the demerged hotel business won't have any board representation from BAT Plc.

The cigarette-to-hotels major will convene a meeting of ordinary shareholders on June 6 to approve the proposed hotels demerger.

Watch the interview below:

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.