The fast-moving consumer goods giant ITC Ltd. has set the effective date of the demerger of its hotel business as Jan. 1, 2025.

ITC and ITC Hotels Ltd. have mutually acknowledged that all the conditions specified in the scheme of arrangement and have been fulfilled and satisfied, the former said in an exchange filing on Tuesday.

The cigarettes-to-staples company in October received approval from the Kolkata bench of the National Company Law Tribunal for the spinoff of its hotel business.

The FMCG giant announced its plans to demerge its hotel business in August 2023 into a separate entity. Under this demerger scheme, ITC will maintain 40% ownership of ITC Hotels, with ITC shareholders acquiring the remaining 60% in proportion to their stake in the parent entity.

Eligible shareholders will get one share of the ITC Hotels Ltd. for every 10 shares held in ITC Ltd. As per the scheme of arrangement, the new resulting company, ITC Hotels Ltd., will have an equity of 207.84 crore shares of Re 1 face value, that is, equity capital of Rs 207.84 crore.

The shareholders of ITC approved the demerger with a majority of 99.6%, after a tussle with the domestic proxy advisory firm, Institutional Investor Advisory Services. IiAS had advised shareholders of the firm to vote against the proposed demerger, stating that it only partially unlocks value.

ITC, however, said that the hotels business has matured over the years and is well poised to chart its own growth path as a separate entity in the fast-growing hospitality industry.

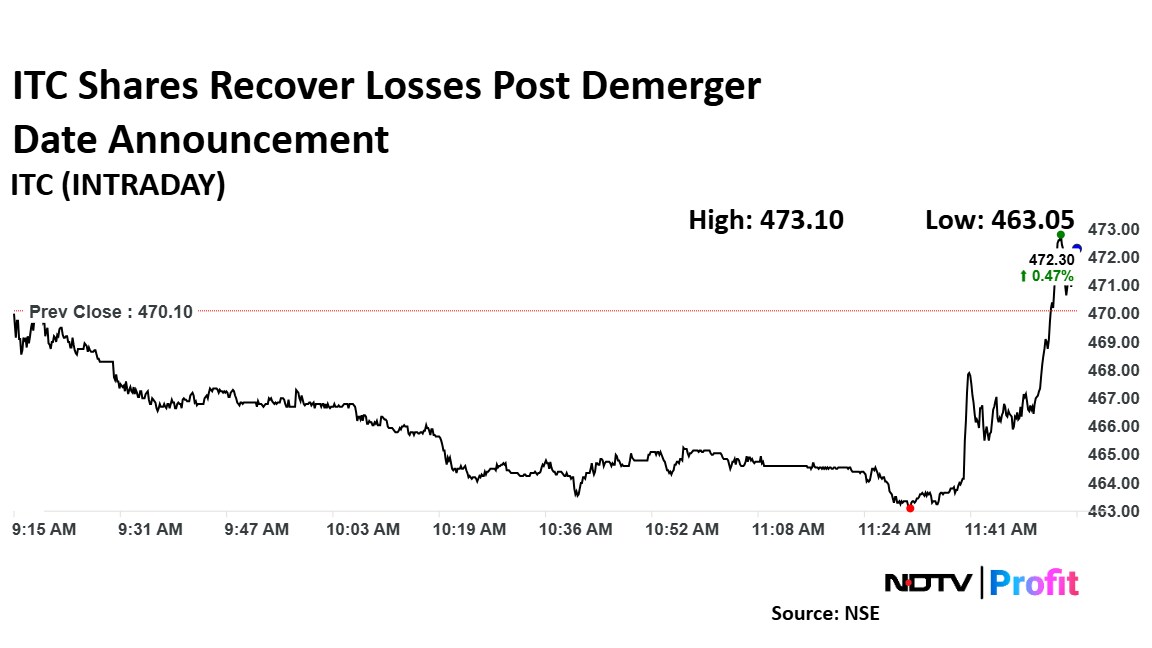

The ITC share price saw a sharp uptick at the back of the news and recovered to trade in the green.

ITC's stock fell as much as 1.5% during the day to Rs 463.05 apiece on the NSE. It recovered its losses and was trading 0.79% higher at Rs 473.8 apiece, compared to a 1.12% decline in the benchmark Nifty 50 as of 12:11 p.m.

It has risen 4.9% during the last 12 months and has advanced by 2.49% on a year-to-date basis. The relative strength index was at 47.

Of the 32 analysts tracking the company, 18 have a 'buy' rating on the stock, six suggest a 'hold' and eight have a 'sell', according to Bloomberg data. The average of 12-month analysts' price target implies a potential upside of 0.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.