Infosys Ltd. said on Thursday that there is no tax demand against the company, and a petition challenging a notice from GST authorities is pending in the Karnataka High Court.

The IT major issued a clarification to the stock exchanges on media reports regarding a show-cause notice issued by the Directorate General of GST Intelligence for Rs 415 crore over alleged ineligible input tax credits (ITC) refunds.

Sharing the sequence of events, Infosys said the DGGI had, in May, sought information on the GST refunds claimed by the company, which were later provided along with meeting officials on the matter.

Then, DGGI issued a pre-show cause on July 30 for which the company had sought additional information and relevant documents and sought time to file a suitable response.

The authorities did not provide the additional time requested and instead issued a show cause notice on Aug. 12 for Rs 414.88 crore, excluding interest and penalties.

As per the notice, the services provided by the company's overseas branches are not export of services and hence the refund claimed by the Company is allegedly erroneous.

Infosys assessed the merits of the show-cause notice and also sought advice from external tax consultants and legal counsel. On Sept. 19, the company filed a writ petition in the Karnataka High Court challenging the legitimacy of the show cause notice.

"The company would like to reiterate that it has always been fully compliant with all the central and state laws and regulations with respect to GST refunds. There is no material impact of this article on the company," the exchange filing said.

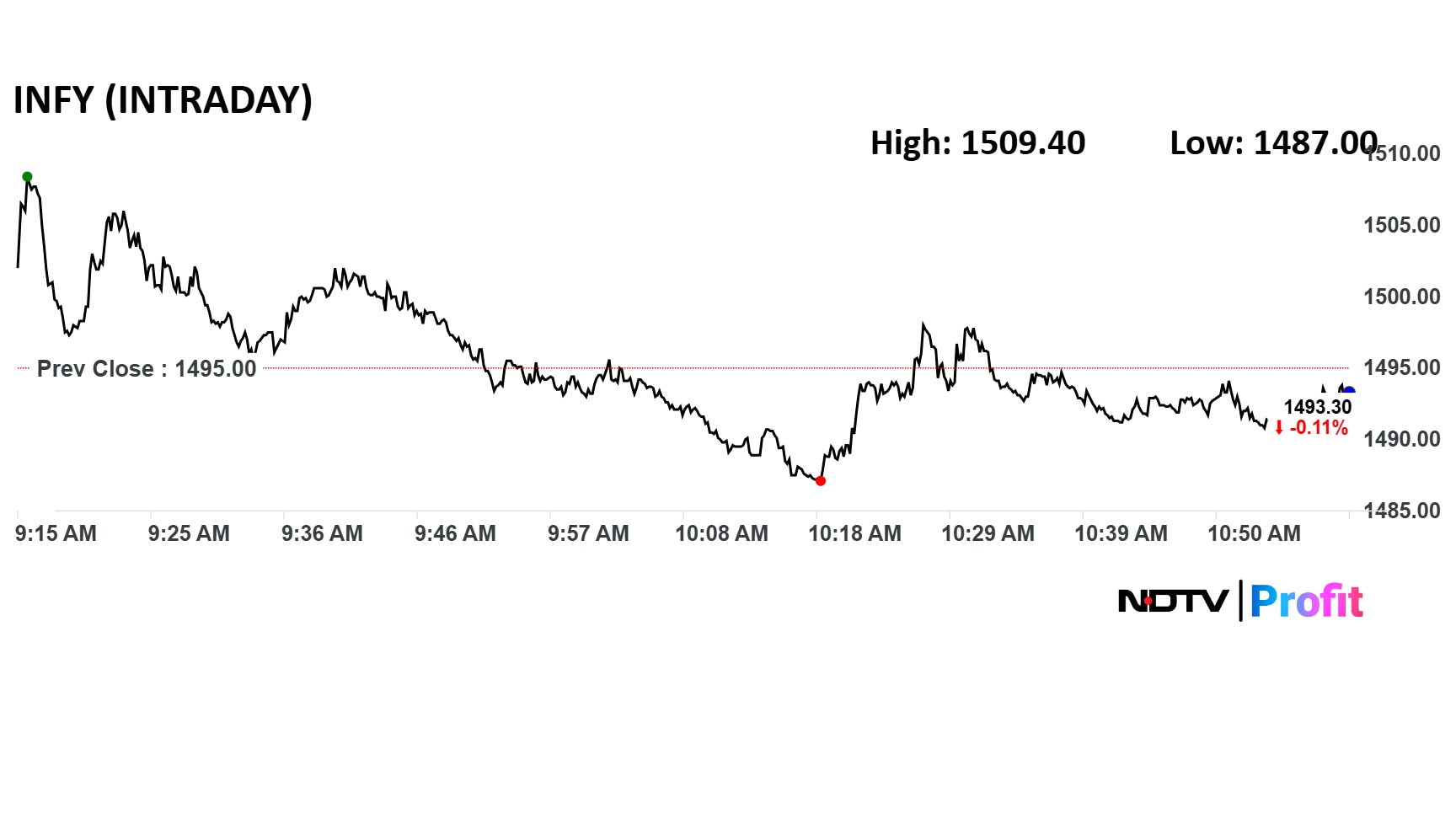

Infosys' share price was trading 0.1% lower at 11:00 a.m.

Infosys' share price was trading 0.1% lower at 11:00 a.m. The benchmark Nifty 50 was up 0.3%. The total traded turnover was Rs 207 crore on the NSE. The relative strength index was at 55.

The stock has fallen 23% in the last 12 months and 20% on a year-to-date basis.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.