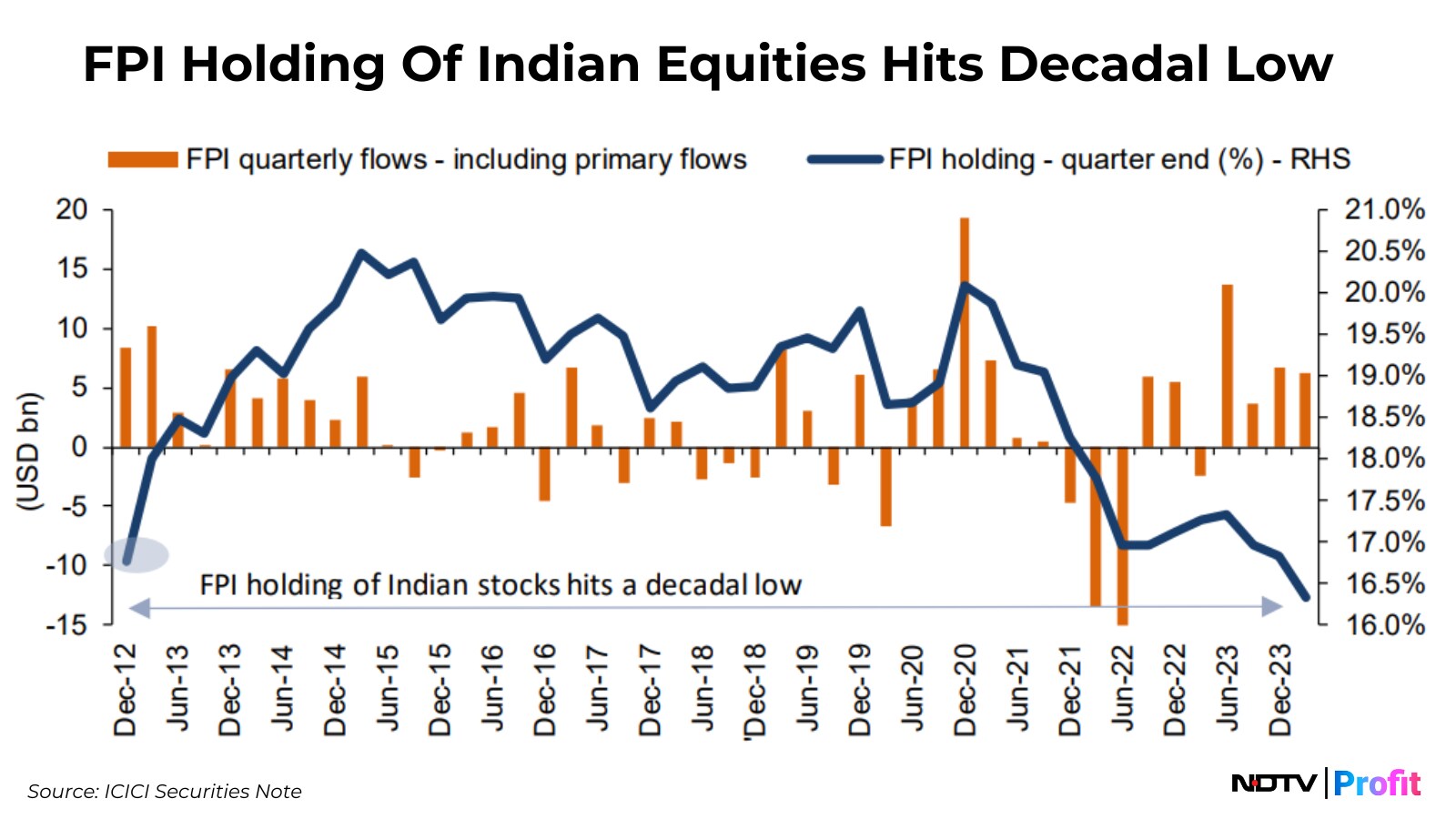

Foreign portfolio investors' aggregate holding in Indian stocks fell to a decadal low by the end of January 2024, according to ICICI Securities.

The aggregate holdings of FPIs stood at Rs 62 lakh crore at the end of January 2024, against the total aggregate market capitalisation of Indian equities of Rs 380 lakh crore. This implies that FPI holdings in Indian stocks fell to a decadal-low of 16.3% by the end of January 2024, ICICI Securities said in a note.

The lowest holding of FPIs in recent times is driven by incremental selling in CY24TD, that is around $3.5 billion, and significant outperformance of small caps, where FPIs have lower allocation along with their overall portfolio orientation, the note said.

As of December 2022, FPIs held 78% of their portfolio within large caps while their holdings in mid/small-caps were at 14%/8%, based on shareholding data of top-1,000 stocks by marketcap, ICICI Securities noted.

However, over CY23, FPI buying in mid/small-caps has been much higher than in large-caps, thereby resulting in their holdings of mid/small-caps rising to 17%/9%, it said.

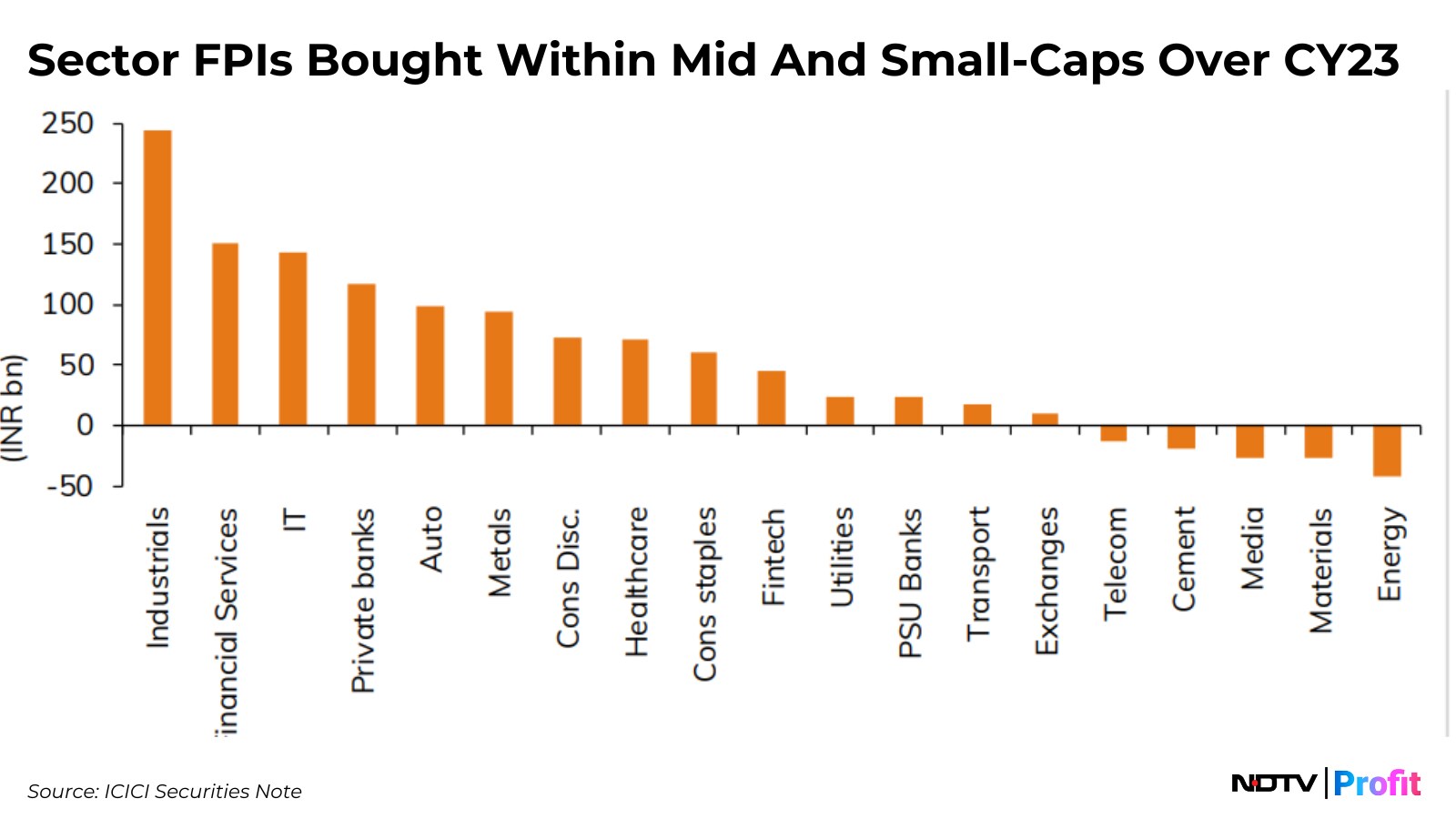

Sectoral Flows In Mid And Small Caps Based On Shareholding Data

Sectorally, FPI's major implicit inflows within mid and small caps have been in financials (Rs 29,100 crore), industrials (Rs 24,400 crore), information & technology (Rs 14,400 crore), auto (Rs 9,900 crore), while FPI's major implicit outflows were in energy (Rs 4,300 crore), materials (Rs 2,700 crore, media (Rs 2,700 crore), ICICI Securities said.

Active mutual funds portfolios continue to see buying across sectors during CY24 so far led by private banks, energy, industrials, healthcare, etc.; selling was observed in utilities, telecom, media, IT, etc. during January 2024.

The SIP inflows continue to rise structurally, in spite of extreme volatility, and have reached north of $2 billion per month.

Inflows into active ‘market cap' based mutual funds scheme continue led by mid-cap scheme (Rs 2,600 crore), multi-cap scheme (Rs 1,800 crore), small-cap scheme (Rs 1,700 crore) during Jan'24.

The markets have experienced an outflow of Rs 24,616 crore so far this year till Feb. 27. The foreign portfolio investors offloaded $3,096 million or Rs 25,744 crore worth of stocks in January, the highest in a year, NSDL data showed.

Major outflows were observed in financials, discretionary consumption, FMCG sectors, etc. while inflows have been observed in IT, energy, power, telecom sectors, the note added.

Outlook For Equity Flows

From a macro perspective, an environment of relatively resilient growth in India's GDP and corporate earnings coupled with rising probability of moderation in interest rates going ahead is positive for institutional flows towards India

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.