In just 10 minutes, Indians can now order wedding suits to tomatoes to sugar-free ice cream. Thanks to the rise of quick commerce, direct-to-consumer brands who were struggling to reach the 'largesse', have a new lease of life. But before they could settle into the renewed growth mode, an impending urban slowdown could play spoilsport.

"While the urban slowdown will inevitably temper growth, existing D2C brands that adapt to the new environment can still achieve sustainable expansion," says Shivaraj Jayakumar, practice leader-consumer and internet at consulting firm Praxis Global Alliance. "Growth rates may temper from the 20–25% seen historically, but strategic shifts such as diversifying geographies, adjusting product lines, and enhancing operational efficiency can lead to steady, resilient progress."

New-age brands — be it healthier snacking options, smarter clothing brands — have caught the imagination of young Indians. Experts believe that even with lower growth rates, these new brands with nimble strategies can quickly pivot to newer business models to thrive, if not survive.

"The urban slowdown may temper the pace of new D2C launches, but it won't stop innovation," says Anirudh Damani, managing partner at Artha Venture Fund. "Economic slowdowns often lead to a surge in entrepreneurship as individuals identify gaps and opportunities in the market."

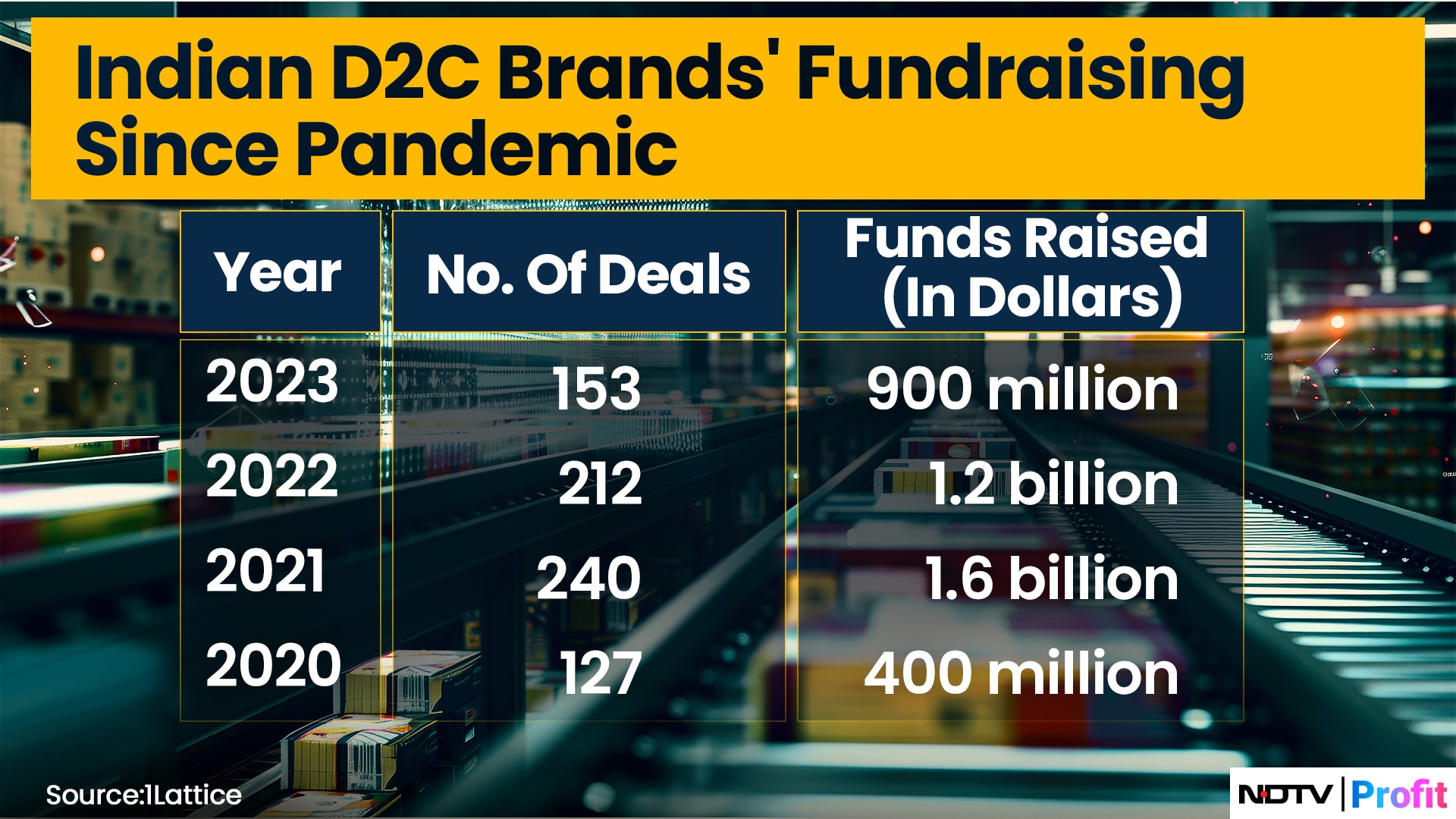

In the last few years, many D2C brands across categories have mushroomed in — all vying for customer eyeballs. Over 600 new brands have zoomed into the Indian market since 2016 into Indian shopping carts if not shelves, as per 1Lattice. Even after the funding winter set in, the sector was able to raise over $900 million in 2023 — showing the interest of VCs to fund new-age brands.

"On an average, only seven or eight out of 10 D2C brands will survive. And those who will, shall continue to grow — even with a slower growth rate," says Amar Choudhary, chief executive officer of intelligence and insights at 1Lattice.

Pitfalls Of Fast Growth

The fund raising in the D2C sector hit its zenith in 2021 as it raised as much as $1.6 billion across fashion, FMCG, beauty and even electronics sectors. Funding winter however has tempered the mood for many such emerging brands which had its job cut out during bad times. The number of acquisitions have also gone up in the sector.

"Recent years have seen a turbulent scenario for D2C brands driven by high customer-acquisition costs, operational complexities, saturated markets across several categories with limited differentiation across brands," says Jayakumar.

The first of the D2C brands to list on the stock exchanges is also seeing turbulent times — showcasing the pitfalls of aggressive growth strategies. Honasa Consumer, the parent of Mamaearth, has been facing multiple troubles like channel overstocking.

Mamaearth's stock shed over 30% of its value in the last one year — and has come dangerously close to losing its unicorn status as its market cap hovers around Rs 8,500 crore. Its market cap was at Rs 10,424 crore on the day of its debut. FirstCry, too, shed over 11% of its value since its debut on the bourses this year.

More importantly, the profitability pivot, which has become the post-pandemic VC keyword, is also tough to come by for D2C brands. Heavy marketing spends, rising competition for ads on digital platforms make it tough for D2C brands to gain and more importantly, retain customers.

Now, with an urban slowdown, growth could be slower — pushing the signpost of profitability further into the horizon.

The Q Of Profitability

While q-comm has made it easy for the niche brands to hit their target market, it also comes at a price. "The promise of delivery within 10 mins drives impulse purchases, benefitting brands across categories. However, quick commerce as a channel is quite expensive for new-age brands with brands giving upwards of 25% margins to quick commerce platforms in addition to considerable spends on marketing," says Jayakumar.

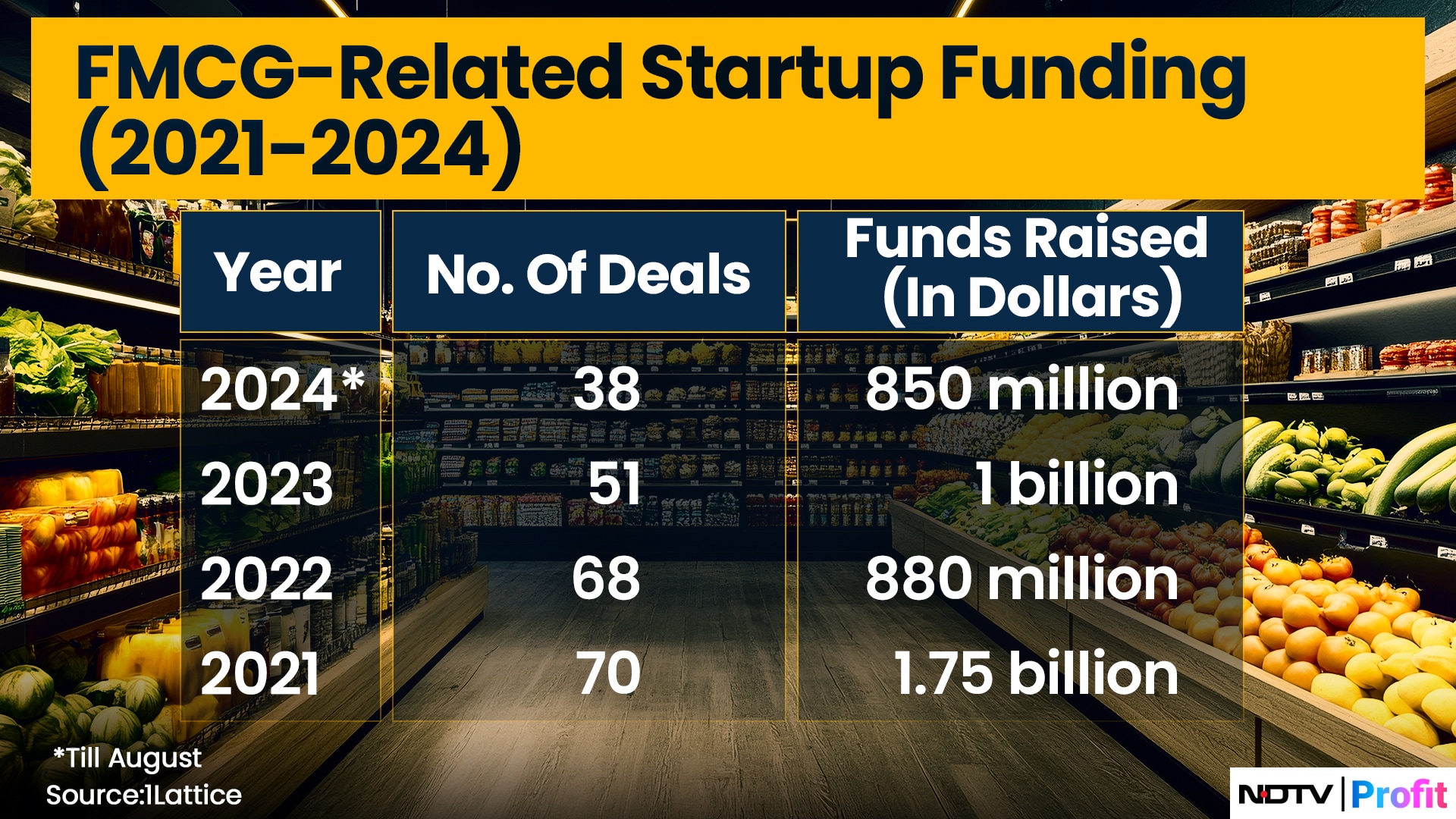

Lightning-fast deliveries are a game changer for D2C brands. "Quick commerce is driving faster sales, particularly in the grocery and FMCG sectors. However, high commission costs are impacting profitability, pushing brands to strengthen direct-to-consumer channels and customer-engagement strategies," says Choudhary.

A few experts, however, believe that precise consumer insights that q-com gives is priceless, especially D2C brands that engage with AI and predictive analytics. The precision, experts say, allows D2C brands to optimise their supply chains, reduce wastage, and enhance customer satisfaction.

Quick commerce enables real-time insights into product performance, allowing brands to test stock keeping units efficiently and adapt their offerings to meet market demands.

"Platforms like Zepto and Swiggy Instamart localise inventory to cater to specific neighbourhoods. For instance, the inventory at a dark store in Lower Parel will differ from one in Mahim or Bandra, reflecting hyperlocal demand," says Damani.

The Value In Premium

Holding on to the pulse of consumers constantly can also help D2C brands adapt to the changing realities of market dynamics and its impact quicker. Offline delivery, which is slower, drags the whole process of change in an organisation. Empowered by quick commerce, brands can now re-evaluate pack sizes, price points and even deep preferences to innovate.

Moreover, D2C brands with their niche appeal can also cater to the growing affluent Indians who are a growing tribe — and less impacted by the tribulations of inflation and more such. The high margins in premium products can offset the costs of qcomm and other channel expenses.

"Affluent Indians, projected to reach 100 million by 2027, are less price-sensitive and more inclined to pay a premium for quality and exclusivity. New brands should leverage this demographic by offering aspirational products that align with evolving consumer preferences, focusing on areas like sustainability, clean ingredients, and unique designs. This approach ensures profitability and provides a stable revenue base, even during periods of economic uncertainty," says Damani.

Jayakumar, too, agrees, but believes that they must also include a few non-premium products as well. "Brands should focus on launching products that cater to value-for-money needs, such as smaller SKUs or multi-use items, while maintaining core offerings for premium customers," he adds.

Weathering the slowdown is also a factor of the category of this vast universe of D2C brands. "Essential categories like grocery and personal care are likely to remain steady, even amid economic uncertainties. Brands focusing on value-driven mid-range products are better positioned to weather this slowdown," says Choudhary.

The time has now come for D2C brands to face their biggest challenge since funding winter — to hold on to fast growth in a market that's growing much slower than expected.

Katya Naidu is a senior business journalist who writes about equity markets, startups, energy, infrastructure, real estate and healthcare.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.