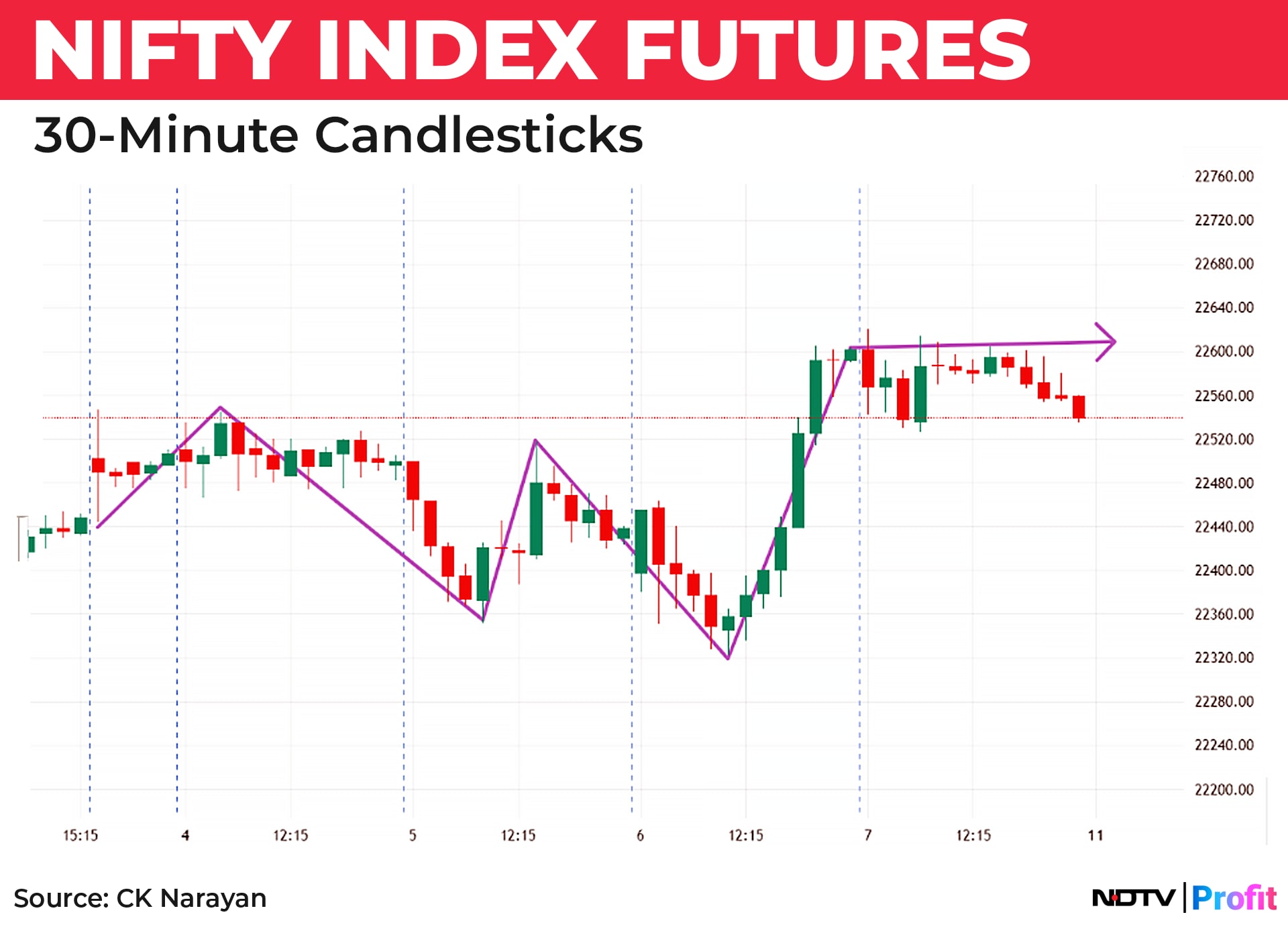

Last week, we had written, "… high probability of a continuation ahead… supportive evidences by way of momentum, sentiment favoured sectors (Metals and possible revival in small and midcap segment) should enable us to hit new highs at 23200." Quite in line with this, the Nifty did make a new high on March 4, suffered a small pullback for the next two sessions, until it shot up powerfully to finish at new all-time highs. That it was a slightly laboured affair is visible from the intraday pathway chart shown in in Chart 1.

On the Daily chart this resulted in the formation of a doji candle for the weekly chart. This now demands that there should be follow-through price action in the coming week for the sequence of new highs to be punched out afresh. Macro elements (this time from the U.S. Fed) continued to contribute for local index gains. It is now a small toss-up whether the market shall find sufficient news triggers in the week ahead to keep ticking.

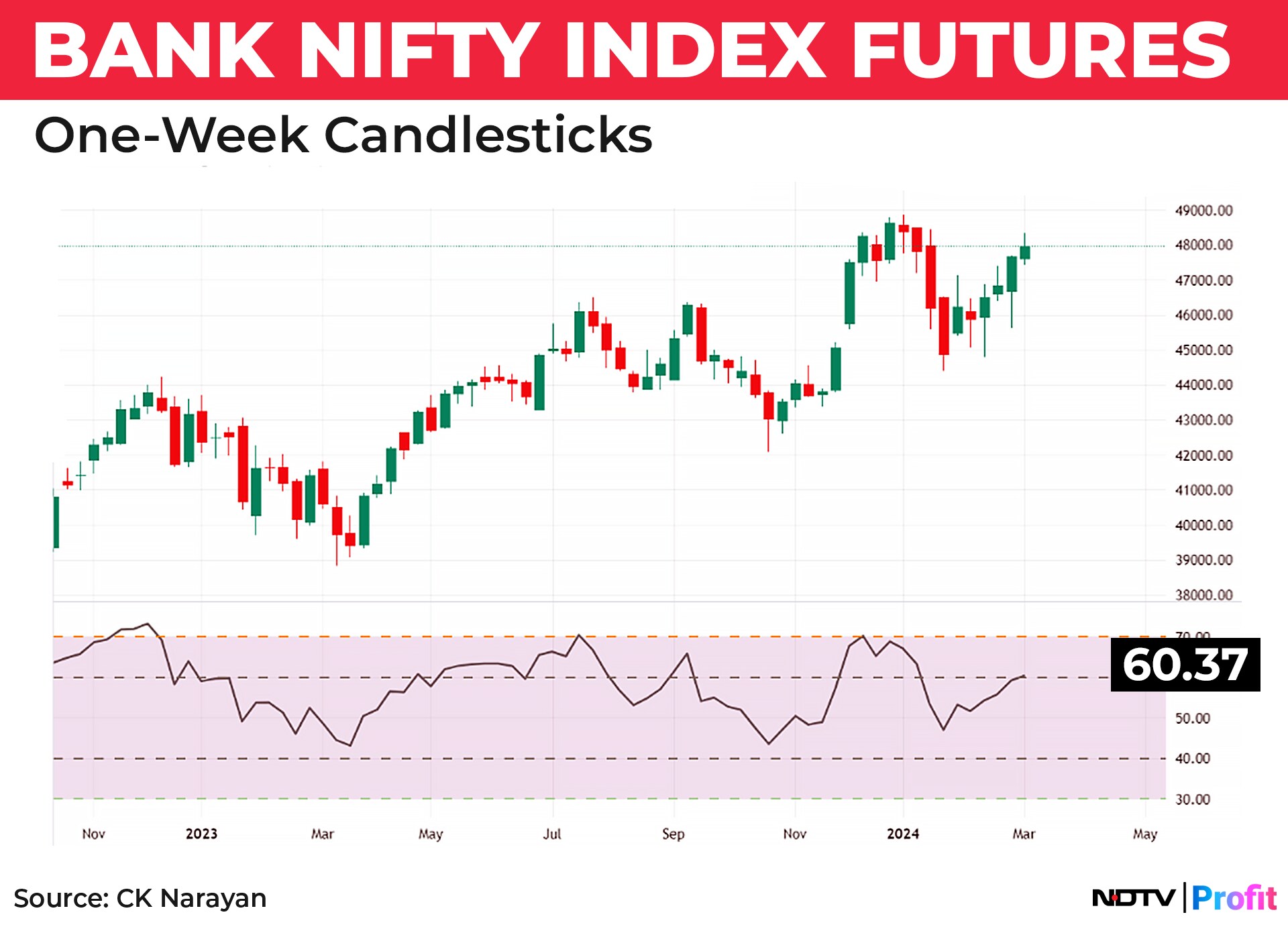

But, batting for the bulls during the week was the banking pack and a combination of value buying and short covering managed to send the Bank Nifty higher to fill up a previous yawning gap and finished the week near the resistance. More than private sector banks (couple of which managed to do their bit) it was the strong performance by the PSU banking leaders that managed the show for the banking sector. The PSU banking sector rose 7.3% for the week and it has clocked 28% gain over a month. In terms of sentiment influence the PSU banks now command a greater mind share than the private banks. Lack of rallies in HDFC Bank yet is seemingly holding up the surge in private banks. It was however encouraging to find the other poor performers from the sector (Kotak Bank) making some amends during the week. If, in the week, HDFC Bank where to find its mojo again we may continue to see the banking sector leading the charge upward. Chart 2 shows weekly chart of the Bank Nifty where we can note that with a minimal effort the Bank Nifty can challenge former highs and push to all time new highs. Momentum indicator is poised to stage a breakout into an acceleration mode based on current evidence I estimate the target for Bank Nifty in the immediate future to be 50600.

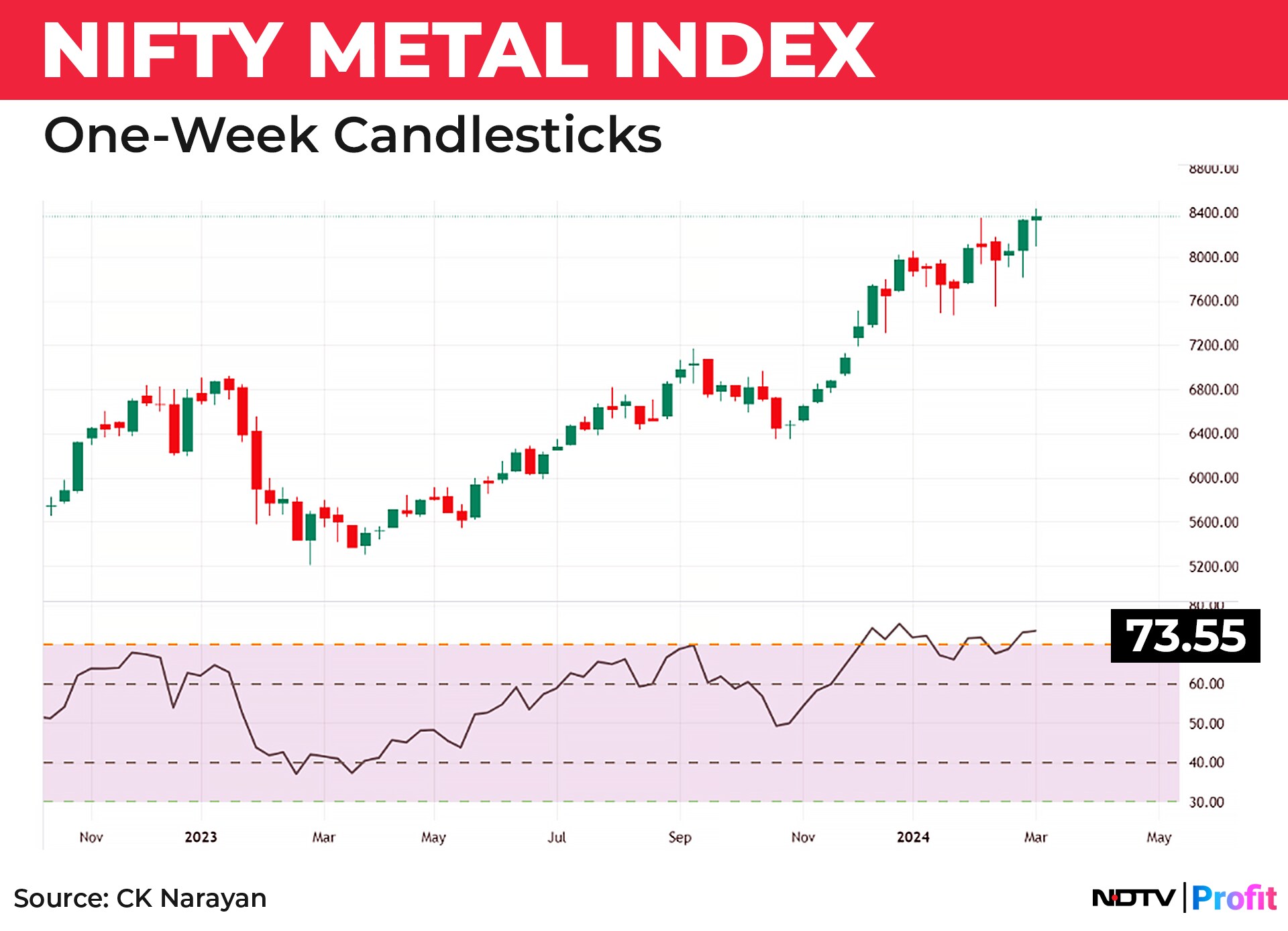

In the last week mention was made about a possibility of revival was made in Metal sector. As we find that the Metal sector rose by 6.3% see Chart 3. There is a good surge in RSI levels visible on the charts presaging the possibility of further thrust in the component stocks in the coming week.

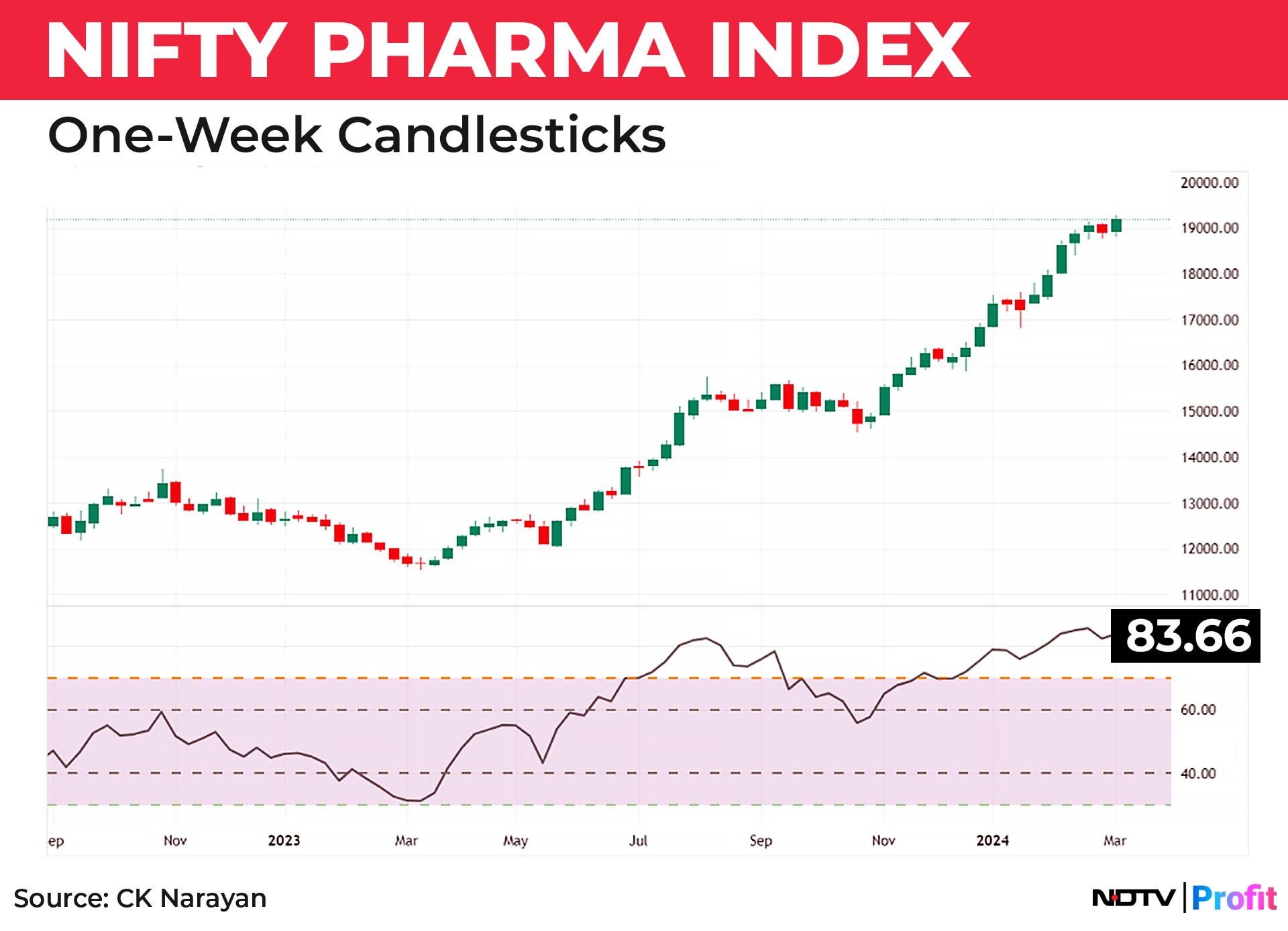

Also picking up good trend strength was the Nifty Pharma index where good momentum has been in force for quite a while. Therefore, this thrust to new highs in the pharma index is to be taken as a continuation bullish signal.

Using relative strength analysis finding Torrent Pharma, Sun Pharma to be leading the rest of the pack. One could look for long positions in these and other leader names.

One of the notable features of last week trading was the sharp decline in India Vix suggesting the return of confidence amongst the bulls. The VIX dived nearly 20% during the week as Put sellers returned with aggression in both Nifty and Bank Nifty. In earlier weeks we had seen a bigger dominance of call writers that managed to keep the lid on rising attempts. With the possibility of the VIX may remain ranged for a while ahead there should not be much of an impediment for the market to continue higher. The largest concentration of option positions is seen at 22,500 / 48,000, both of which are quite near the present price levels. The PCR betrays a bullish bias ahead for the week.

The next turn date for March is placed around the 19 to 21 window and so long as last Friday low 46,600 and 22,180 is not violated one should continue to play the long side. These two levels are the nearest stoploss for active traders.

Summing up, sentiment continues to be upbeat and technical evidence is pointing to more gains ahead. Both micro and macro appears to be pretty much played out and therefore stock specific order flows may dictate trend in the coming week. Further gains in banks, Metals and pharma are expected hence focus can be there for long trades. Any intraday week declines maybe of profit taking nature, barring any unexpected news flow. The approach of buy intra week dips should be continued.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.