Russia's oil shipments are yet to show clear signs of being hit by US President Donald Trump's threat to “substantially” hike tariffs on imports from India, the biggest buyer of Moscow's seaborne crude.

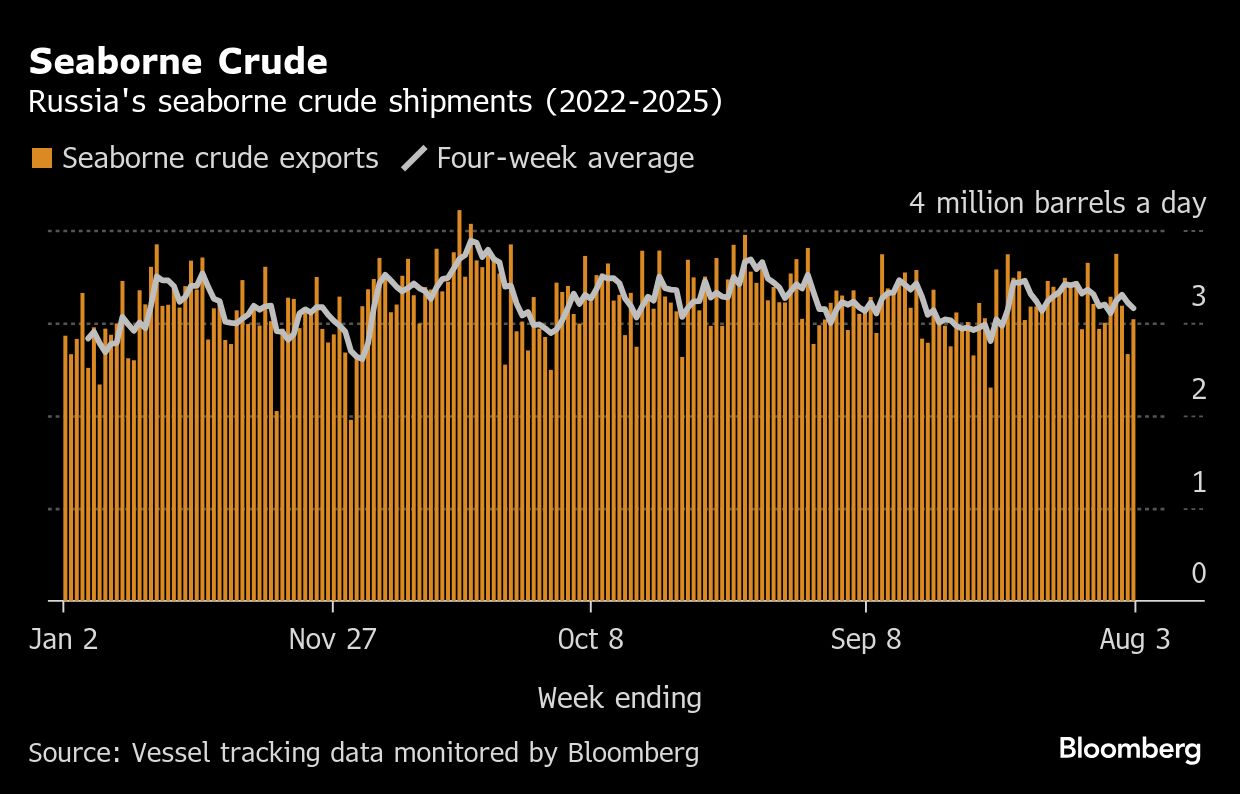

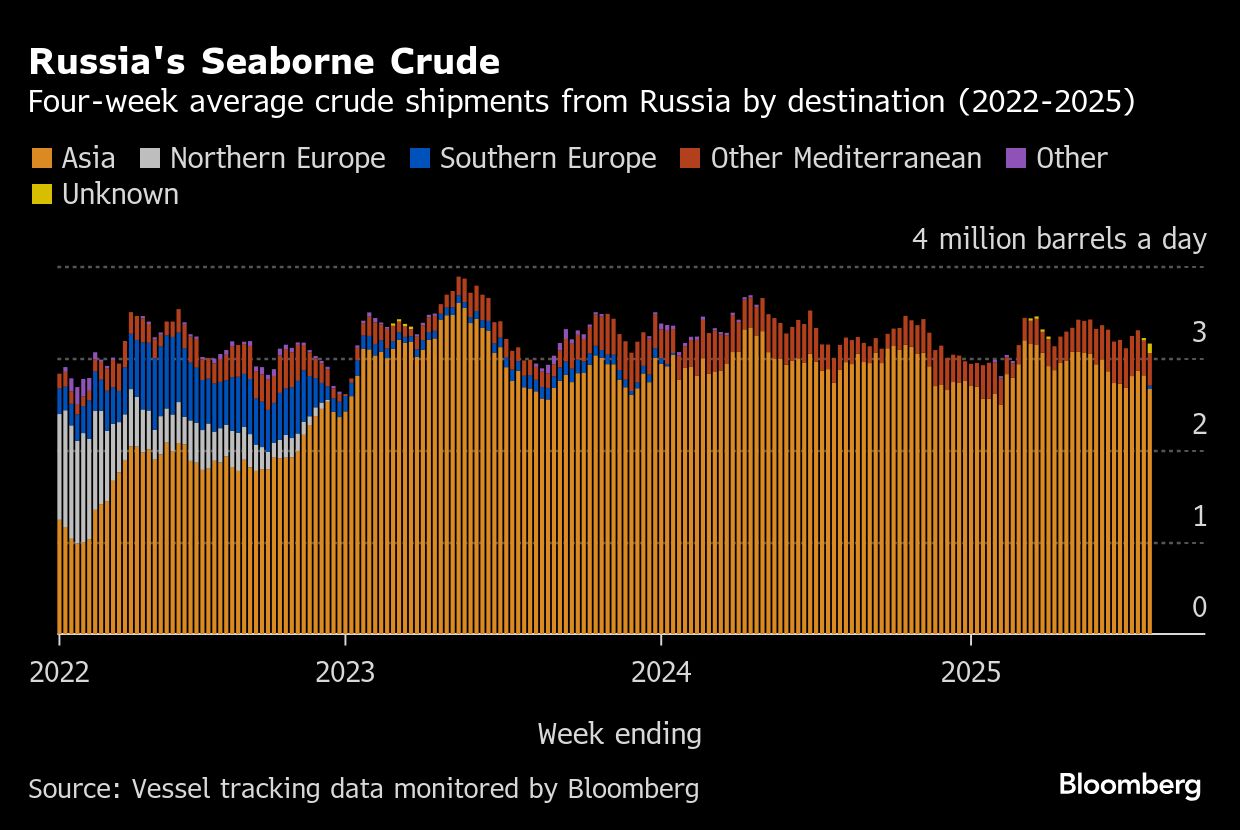

Four-week average crude shipments edged lower for a second week in the latest data, while seven-day flows rebounded. Seaborne cargoes averaged 3.15 million barrels a day in the four weeks to Aug. 3, down by about 2% from the period to July 27, tanker-tracking data compiled by Bloomberg show.

President Trump has threatened India with undisclosed additional tariffs on top of an already announced 25% rate. The extra levy will come into effect if New Delhi continues to take oil from Russia, Trump said ahead of an Aug. 8 deadline that he set for Moscow to agree a truce with Ukraine.

The US leader first proposed secondary tariffs on buyers of Russian oil in mid-July, subsequently shortening the deadline for their implementation and on Monday focusing specifically on purchases by India.

The country's refiners have bought about 1.7 million barrels a day of Russian crude so far this year. Before Moscow's 2022 invasion of Ukraine, they imported virtually none. Much of the refined product made from that crude is then exported back to buyers in Europe, earning Indian processors healthy profits — and indirectly helping to fund Russia's war in Ukraine.

With OPEC+ oil producers agreeing another big output hike for September and global oil markets forecast to be over-supplied in the second half of the year, the White House could be calculating that there may be no better time to try to curtail Russia's oil shipments.

The tracking of crude shipments from Russia's western ports is becoming more difficult with an increase in spoofed position signals in the Baltic, the Black Sea and around Murmansk. Bloomberg uses a combination of signals from ships' automated information systems, port agent reports and satellite imagery to track oil flows.

Crude Shipments

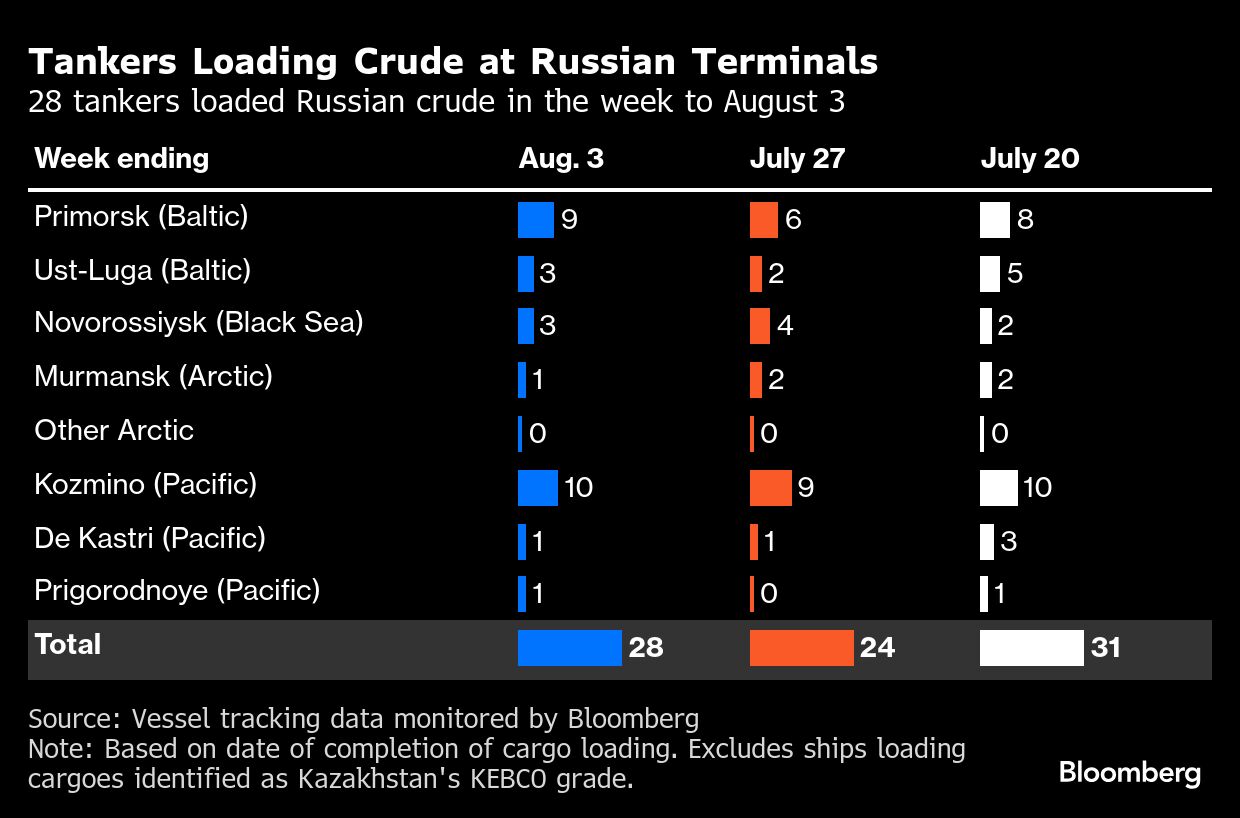

A total of 28 tankers loaded 20.97 million barrels of Russian crude in the week to Aug. 3, vessel-tracking data and port-agent reports show. The volume was up from 18.63 million barrels on 24 ships the previous week.

Crude flows in the period to Aug. 3 stood at about 3.15 million barrels a day on a four-week average basis, down by 70,000 barrels a day from the period to July 27. The four-week average smooths out big swings in weekly numbers, giving a clearer picture of underlying trends in crude flows. Using more volatile weekly figures, shipments rose by about 330,000 barrels to 3 million barrels a day, recovering some of the previous week's loss.

The gain in weekly flows was driven by a sharp rebound in volumes of Urals crude from the Baltic and a small uptick in shipments from the Pacific. Those increases were partly offset by lower flows from the Black Sea and the Arctic.

There was one shipment of Kazakhstan's KEBCO crude during the week from Novorossiysk and one from Ust-Luga.

Export Value

The gross value of Moscow's exports rose by about $190 million, or 18%, to $1.33 billion in the week to Aug. 3. The increase in flows was accompanied by higher average prices for Russia's crudes.

Urals from the Baltic rose by about $1.80 a barrel to average $60.40 a barrel during the week, while the same grade loading in the Black Sea was up by $2 to $60.61 a barrel. The price of key Pacific grade ESPO also rose by $1.80 to average $69.93 a barrel. Delivered prices in India were up by $1.80 at $68.10 a barrel, all according to numbers from Argus Media.

On a four-week average basis, the export price of Russia's Urals from both the Baltic and the Black Sea was up by $0.80 a barrel, averaging about $58.60 a barrel, while Pacific ESPO was up by about $0.70 a barrel to $69.18 a barrel.

Using this measure, the value of exports was little changed from the period to July 27, averaging about $1.36 billion a week.

Flows By Destination

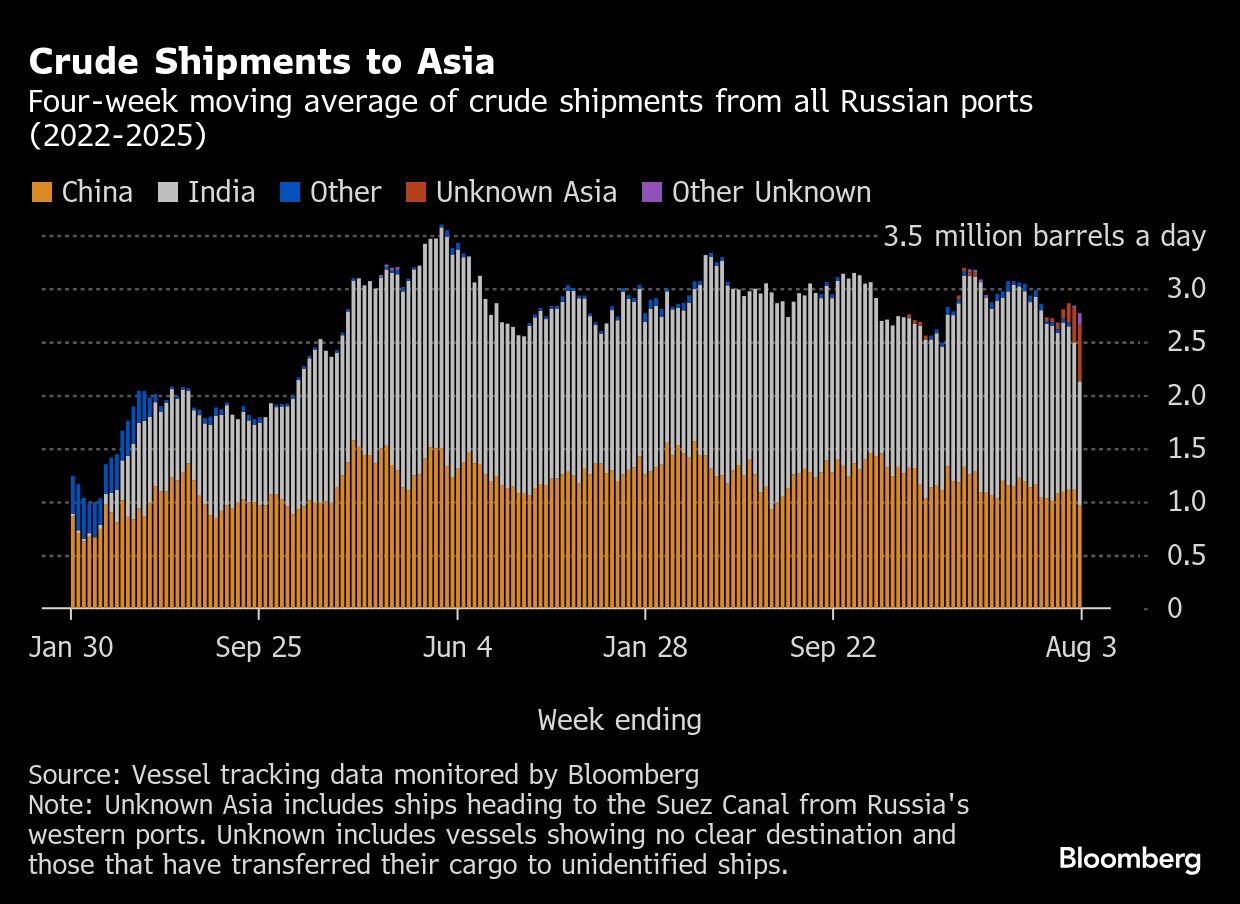

Observed shipments to Russia's Asian customers, including those showing no final destination, fell to 2.77 million barrels a day in the 28 days to Aug. 3.

The figures include about 540,000 barrels a day on ships from Western ports showing their destination as Port Said or the Suez Canal, or those from Pacific ports with no clear delivery point, and a further 100,000 barrels a day on tankers yet to signal a destination.

It's too early to say whether President Trump's threatened additional tariffs on imports from India has affected the country's purchases of Russian crude. The apparent drop-off in shipments to India could well be reversed once the destinations of those vessels in the Unknown Asia and Other Unknown categories become clear.

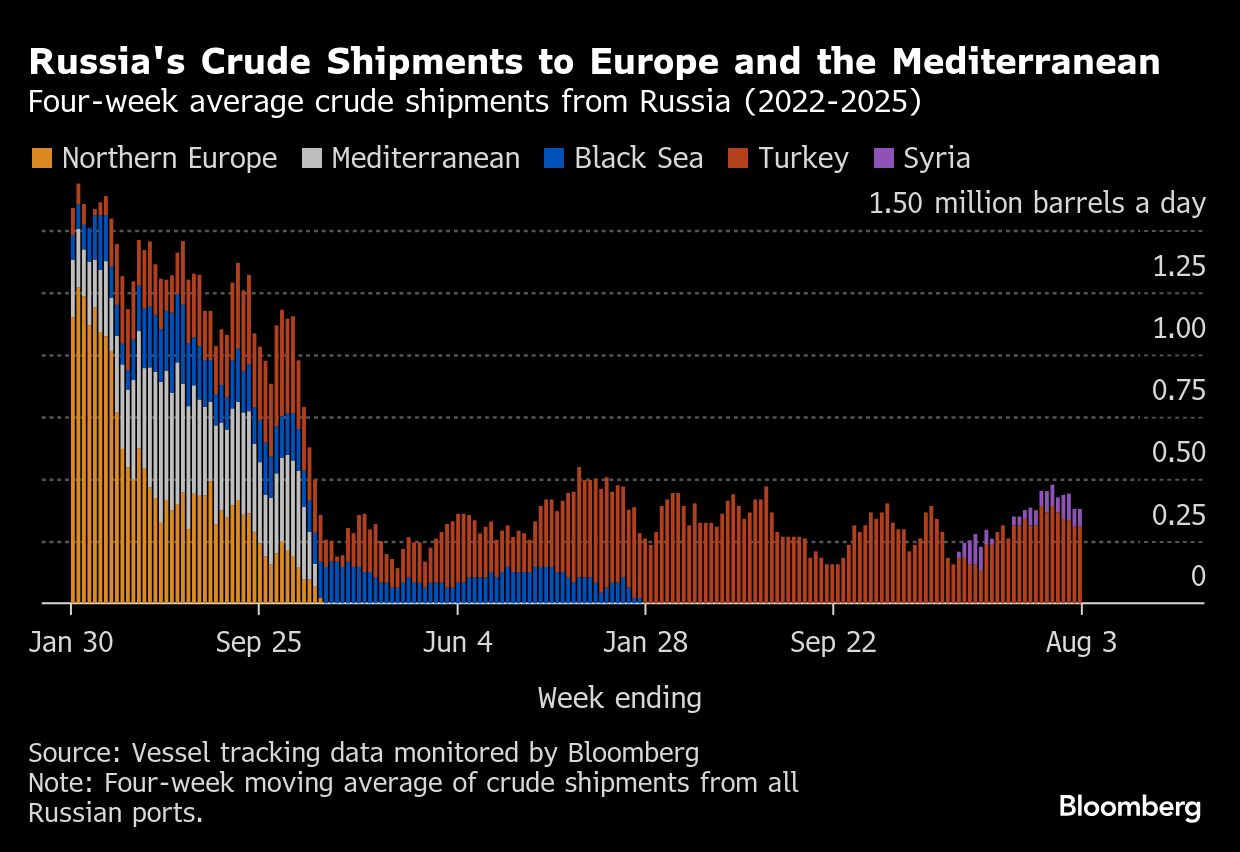

Flows to Turkey in the four weeks to Aug. 3 were unchanged from the period to July 27 at about 310,000 barrels a day, the lowest since May. Shipments to Syria averaged about 70,000 barrels a day.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.