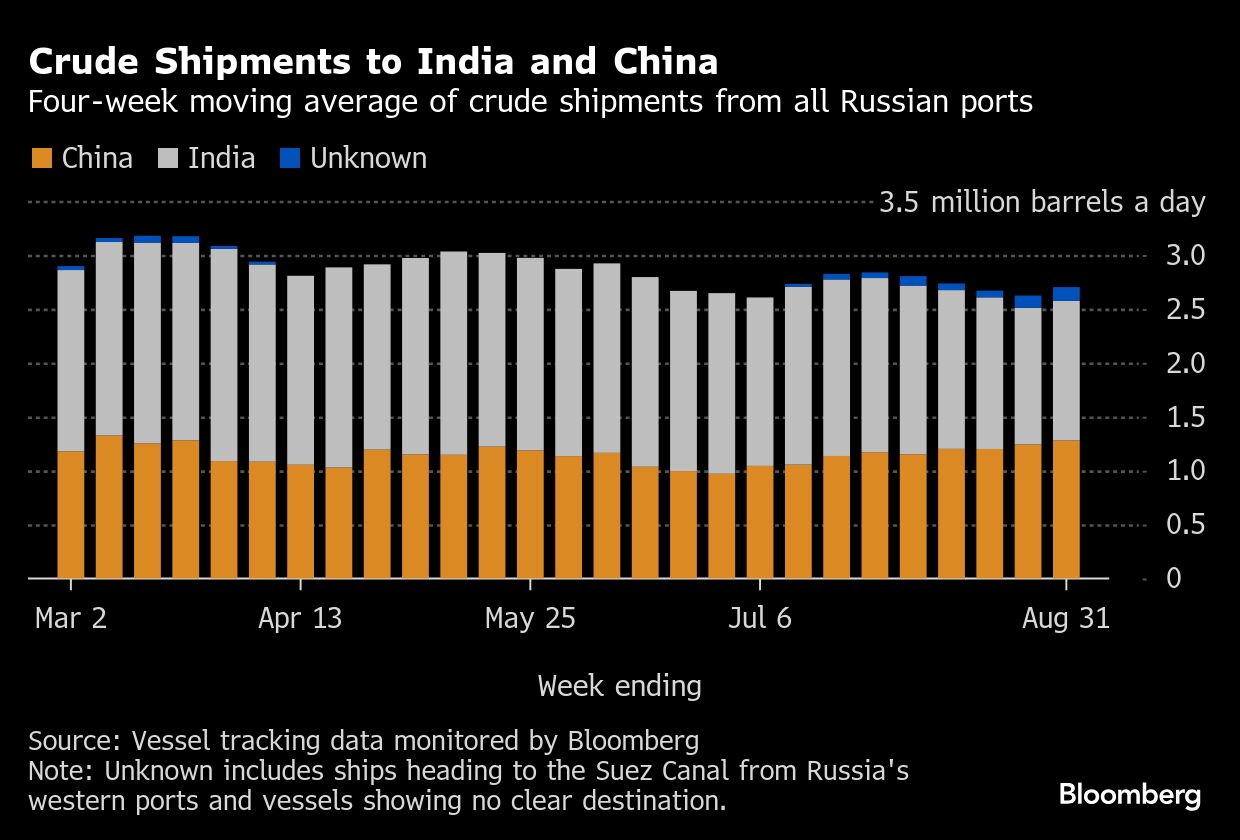

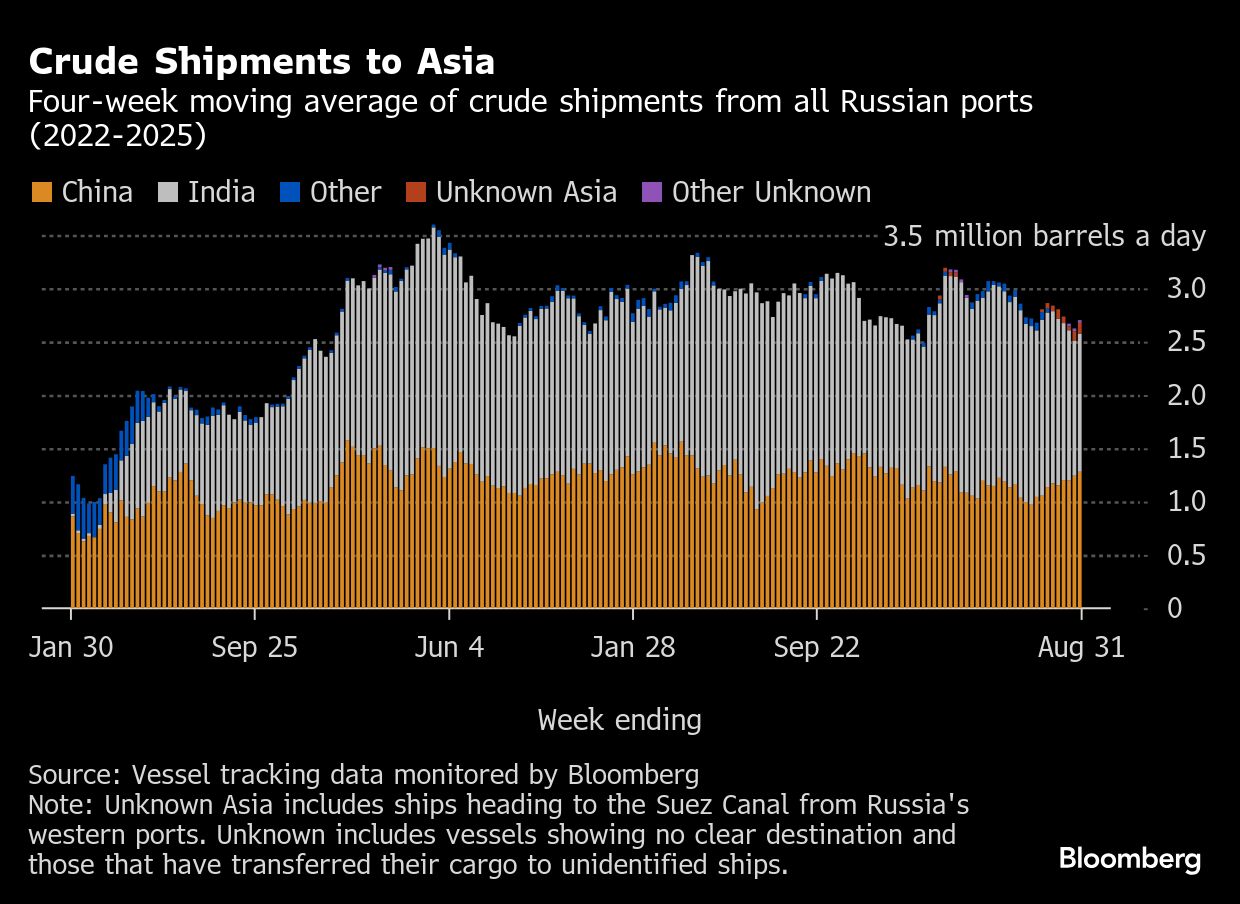

Russia's crude shipments rebounded, with China picking up the slack after US President Donald Trump's punitive tariffs on India choked exports to the south Asian nation.

Trump's doubling of US import tariffs on goods from India to 50%, imposed as punishment for its persistent buying of Russian oil, appears to be hitting the flow of Moscow's crude to the nation despite the defiance of the government in New Delhi.

The amount of crude on tankers heading to India stuck below 1.3 million barrels a day in the four-weeks to Aug. 31, down by about one-third from the recent peak seen in March. Even if all the cargoes on ships yet to show a destination ends up in India, flows would still be down by about 550,000 barrels a day, or 28%, from the March peak.

Meanwhile, the amount of crude heading to China has moved in the opposite direction, reaching a five-month high of 1.28 million barrels a day.

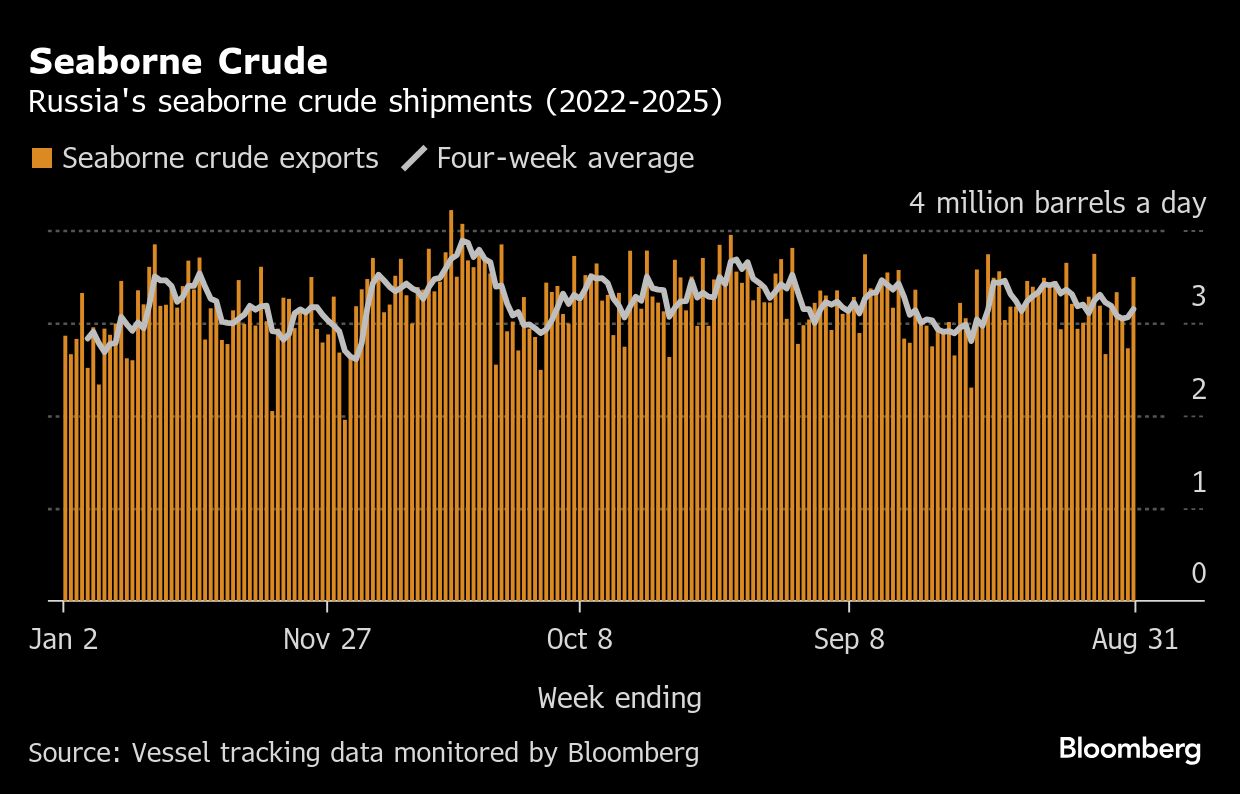

Overall weekly crude shipments from Russian ports jumped by 770,000 barrels a day to a seven-week high of 3.49 million barrels, rebounding from an unusually low level during the previous seven days. The surge pulled up four-week average crude volumes, with seaborne cargoes averaging 3.15 million barrels a day in the period to Aug. 31, tanker-tracking data compiled by Bloomberg show.

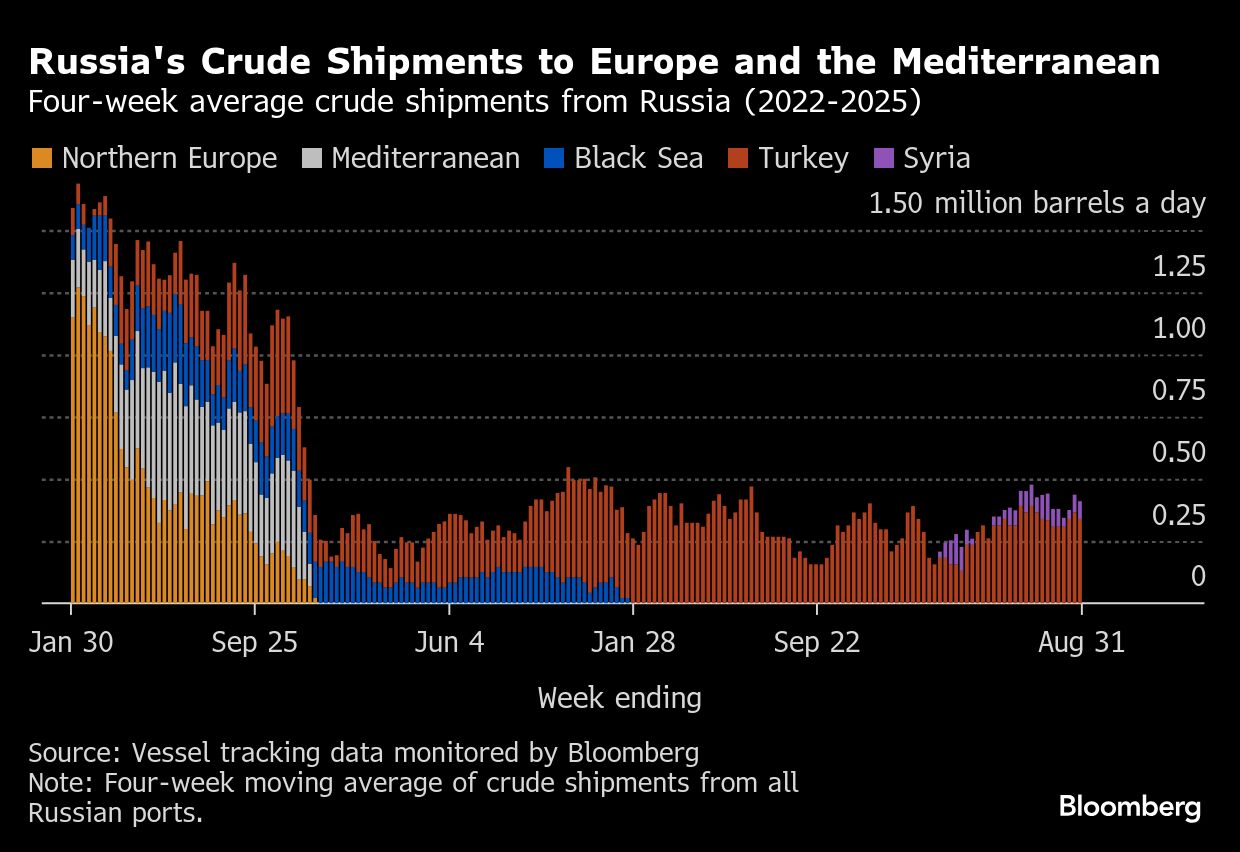

Shipments resumed from the Sakhalin 2 project off Russia's east coast after a four-week absence, likely caused by maintenance work. In the west, flows to the Baltic port of Ust-Luga, disrupted by drone-attack damage to a pumping station, were partly restored, with additional volumes diverted to Primorsk.

The latest uptick in Moscow's seaborne crude flows comes as Ukraine continues to hit Russian refineries with drones and missiles, potentially making more crude available for export.

Ukraine attacked at least eight Russian refineries last month, forcing more than 13% of the country's active capacity offline. The disruptions has added pressure to crude-processing rates already crimped by longer-than-normal maintenance following a wave of drone attacks in the winter. Work can take longer than expected due to sanctions-linked delays in delivering key equipment, Energy Minister Sergei Tsivilev said in July.

A separate attack on the Unecha pumping station, on the Druzhba pipeline system close to Russia's border with Belarus, halted crude deliveries to Hungary and Slovakia and hampered flows to the port of Ust-Luga on the Baltic coast. The Baltic Pipeline System 2, which carries Russian and Kazakh crude to the port, begins at Unecha.

The port is expected to operate at about half its normal capacity this month, with crude diverted to Primorsk and Novorossiysk on the Black Sea. Those diversions have already begun, with Primorsk handling a record-equaling 11 tankers last week.

Crude Shipments

A total of 32 tankers loaded 24.45 million barrels of Russian crude in the week to Aug. 31, vessel-tracking data and port-agent reports show. The volume was up from 19.07 million barrels on 25 ships the previous week

Crude flows in the period to Aug. 31 stood at about 3.15 million barrels a day on a four-week average basis, up by 90,000 barrels a day from the period to Aug. 24. The four-week average smooths out big swings in weekly numbers, giving a clearer picture of underlying trends in crude flows. Using more volatile weekly figures, shipments jumped by about 770,000 barrels to a seven-week high of 3.49 million barrels a day. The increase in weekly flows was driven by more cargoes being loaded at almost all of Russia's ports.

In addition, there was one shipment of Kazakhstan's KEBCO crude during the week from Novorossiysk.

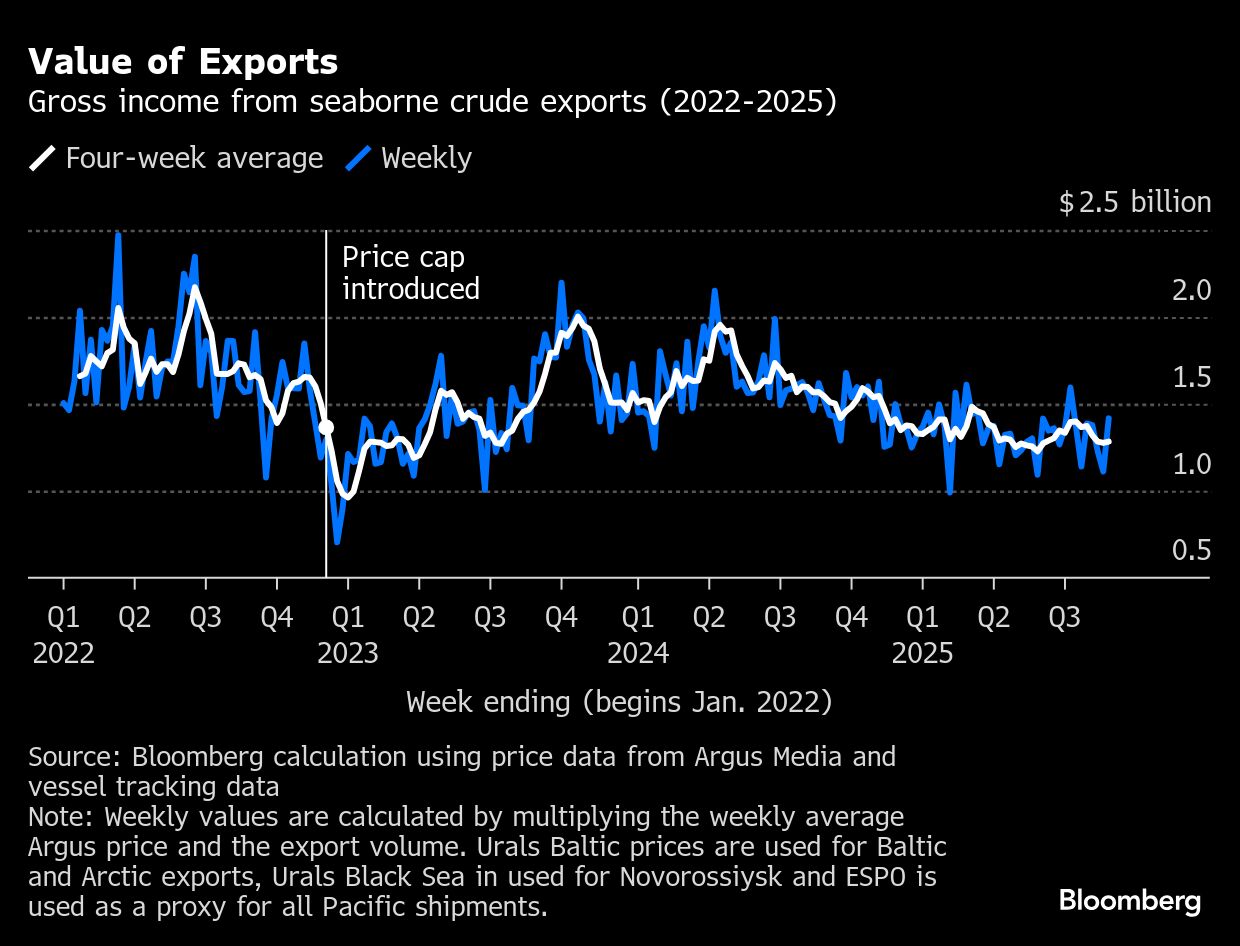

Export Value

The gross value of Moscow's exports rose by about $310 million, or 28%, to $1.42 billion in the week to Aug. 31 from $1.11 billion the previous week. The increase in flows was partly offset by slightly lower average prices for Russia's Urals crude.

Urals cargoes from the Baltic fell by about $0.50 a barrel to average $54.36 a barrel, while shipments from the Black Sea fell by the same amount to $54.91 a barrel during the week. Both set new lows for the period since mid-June.

The price of key Pacific grade ESPO moved in the opposite direction for a second week, rising by $0.60 to average $64.17 a barrel. Delivered prices in India slipped by $0.30 a barrel to $64.43 a barrel, all according to numbers from Argus Media.

On a four-week average basis, the export price of Russia's Urals from the Baltic was down by $1.50 a barrel, while Black Sea cargoes were down by $1.40 a barrel, averaging $55.42 a barrel and $55.87 a barrel respectively, while Pacific ESPO was down by about $0.70 a barrel to $63.16 a barrel.

Using this measure, the value of exports was up by about $10 million from the period to Aug. 24, averaging about $1.28 billion a week.

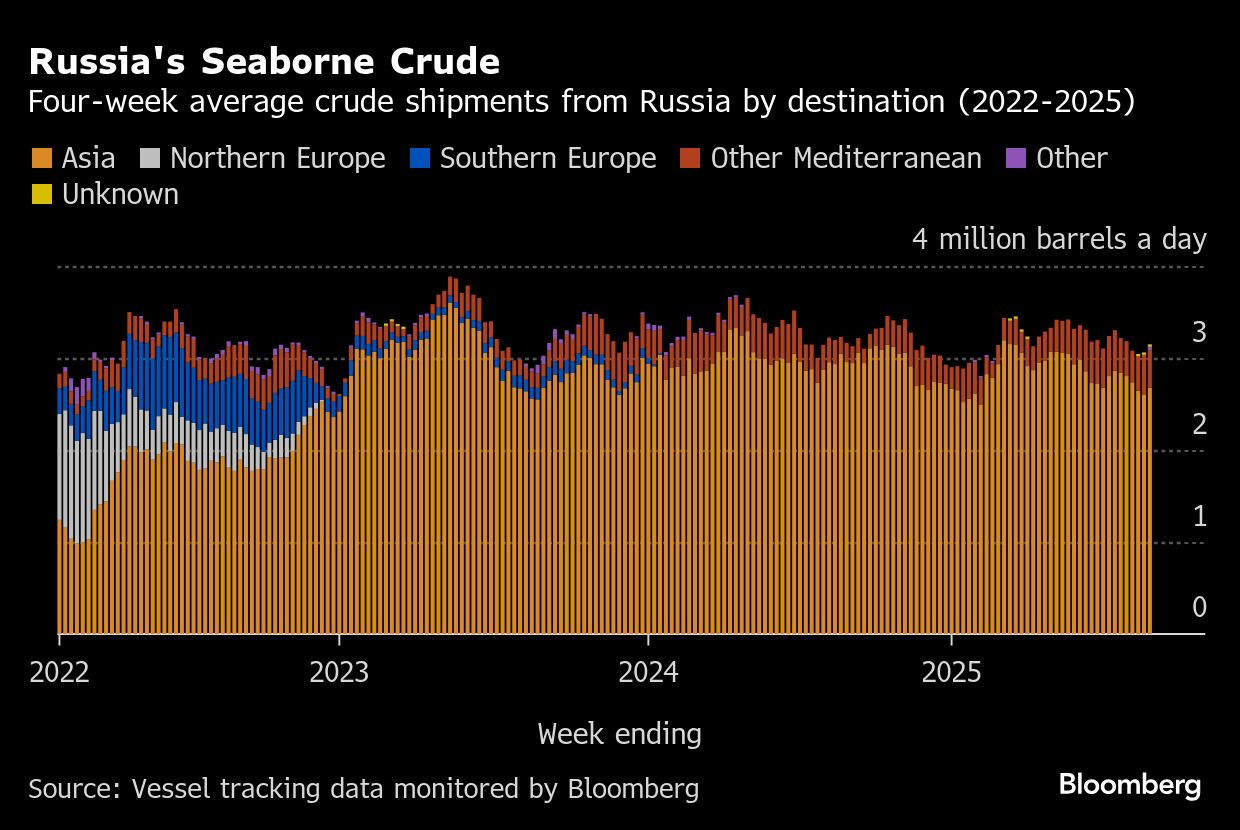

Flows By Destination

Observed shipments to Russia's Asian customers, including those showing no final destination, rose to 2.7 million barrels a day in the 28 days to Aug. 31, up from 2.62 million barrels a day in the period to Aug. 24.

The figures include about 100,000 barrels a day on ships from Western ports showing their destination as Port Said or the Suez Canal, or those from Pacific ports with no clear delivery point, and a further 30,000 barrels a day on tankers yet to signal a destination.

Flows to Turkey in the four weeks to Aug. 31 slipped to about 340,000 barrels a day, down from the highest in almost two months. Shipments to Syria were unchanged, averaging about 70,000 barrels a day.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.