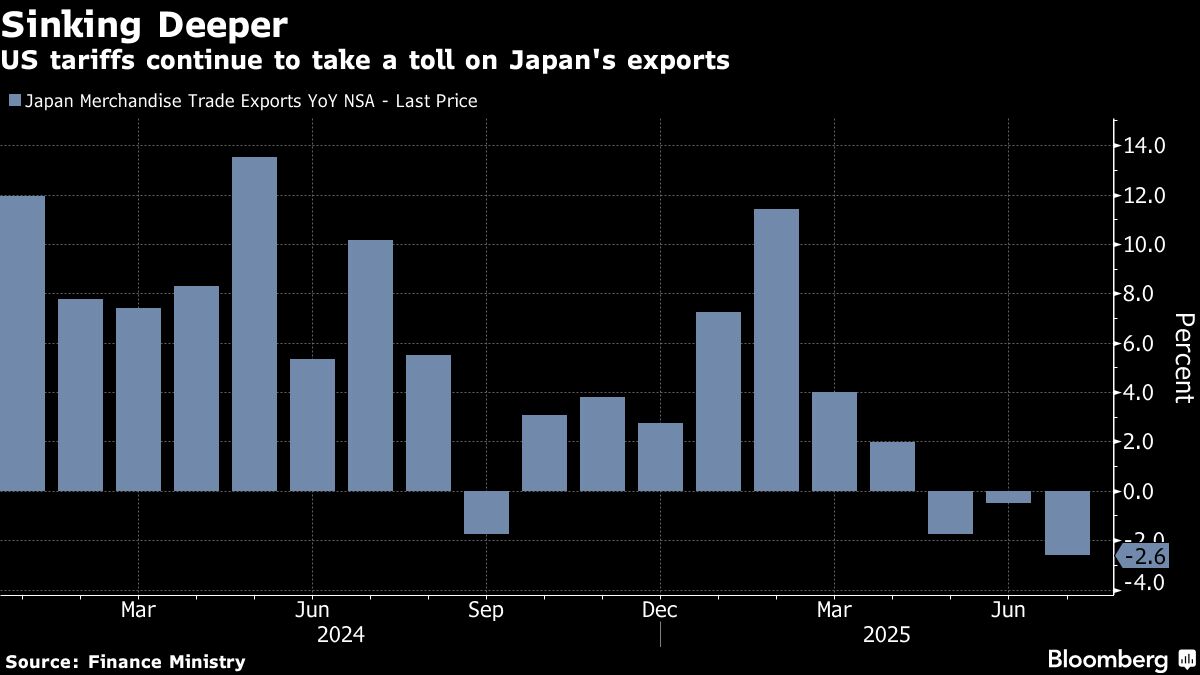

Japan's exports sustained their steepest drop in more than four years as US tariffs continued to weigh on global commerce, clouding the outlook for economic growth at a time when personal spending remains unsteady.

Exports fell 2.6% in value in July from a year earlier, sliding more than the median forecast of a 2.1% decline, the Ministry of Finance reported Wednesday. The downturn, led by cars, auto parts and steel, was the biggest since February 2021.

Export volumes rose by 1.2%, suggesting exporters are continuing to absorb US tariff costs by cutting selling prices to preserve market share. Imports decreased 7.5% as inbound shipments of crude oil, coal and liquefied natural gas all shrank by double digits, but the trade balance still flipped to a deficit of ¥117.5 billion.

The latest slide in exports may strengthen concerns over whether Japan's economy can continue to expand as US President Donald Trump's tariffs weigh on global trade. While the economy has so far managed to eke out growth in the last five quarters despite weakness in domestic consumption, further drops in exports could drag the economy into reverse.

Continued falls in exports may also encourage Bank of Japan Governor Kazuo Ueda to adopt a cautious stance. The ability of the economy to show resilience in the face of the US duties is a factor in the calculus for the BOJ as it considers the best timing for its next interest rate hike. The BOJ is expected to stand pat when it next sets policy on Sept. 19.

“Car shipments to the US have started to decline in volume, suggesting that the impact of tariffs is finally starting to show,” said Taro Saito, head of economic research at NLI Research Institute. “In the US, prices of Japanese exports began rising around June or July, so we're now seeing the effects of Japanese goods gradually losing their price competitiveness.”

The report showed that exports to the US dropped by 10.1% last month from a year earlier, with the value of shipments of vehicles and auto parts plunging 28.4% and 17.4%, respectively. In terms of volume, exports of vehicles to the US fell by 3.2%, a clear indication that carmakers are absorbing a portion of the tariffs to support sales.

In April the US imposed a 25% tariff on imports of Japanese cars and auto parts and a 10% duty on most other goods. A levy on imports of steel was doubled to 50% in early June.

Automobiles and parts account for around a third of Japan's exports to the US, and earlier this month Toyota Motor Corp. warned of a ¥1.4 trillion ($9.5 billion) hit to its bottom line from the US levies.

The levies on cars and broad-based goods will be assessed at 15% under a trade deal reached in late July, although it may take some time for that deal to be implemented. Written documentation on the trade deals agreed to with Japan and South Korea are “weeks away,” US Commerce Secretary Howard Lutnick said Tuesday in an interview with CNBC.

“The timing for implementing lower auto tariffs was never clearly set,” said Saito at NLI Research Institute. “If they're reduced some time in September, which is the general consensus, that would come as a relief, but if they don't go down, the negative impact will be even greater.”

Saito added that even if the across-the-board levy comes down from the level imposed from April, US tariffs would still be more than 10% higher than they were at the beginning of the year, so the impact will continue to reverberate.

Beyond the US, exports to China fell 3.5%, led by a drop in shipments of vehicles, auto parts and nonferrous metals. Goods going to Europe declined by 3.4% as steel shipments fell 53.1%. The yen averaged 145.56 per the dollar in July, 8.9% stronger than a year earlier, according to the Finance Ministry.

Looking ahead, economists largely expect Japanese exports to stagnate as firms adjust to the new trade environment. The Japanese government earlier this month slashed its economic outlook, citing the rising toll from US trade measures.

Mounting profit pressures may also limit companies' ability to continue raising wages — potentially threatening Japan's fragile virtuous cycle of wage and price growth.

“The economy will likely contract in the third quarter due to a decline in exports,” Saito said. “As for the tariff-related uncertainty that Governor Ueda mentioned, I think it will take quite a while before the fog clears.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.