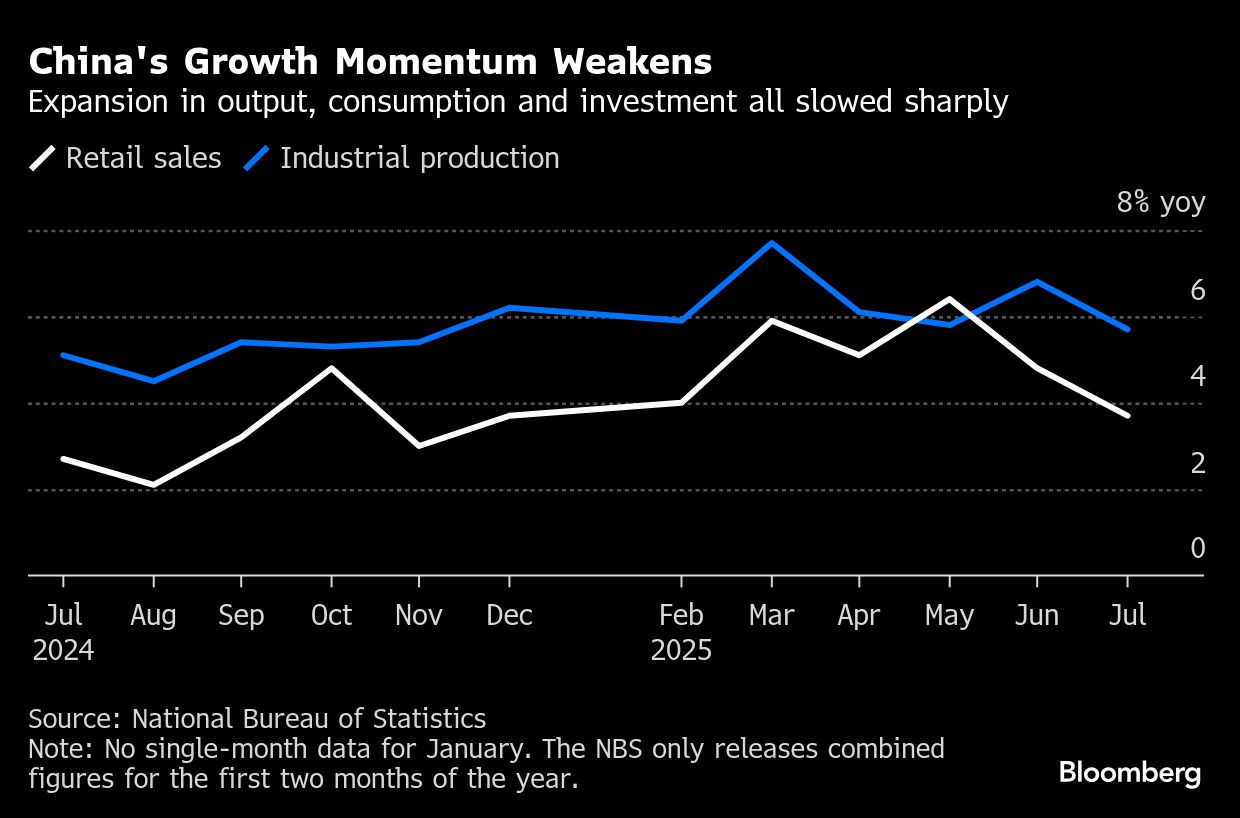

- Factory output growth slowed to 5.7% in July, the weakest since November

- Retail sales rose 3.7% year-on-year, the lowest growth this year

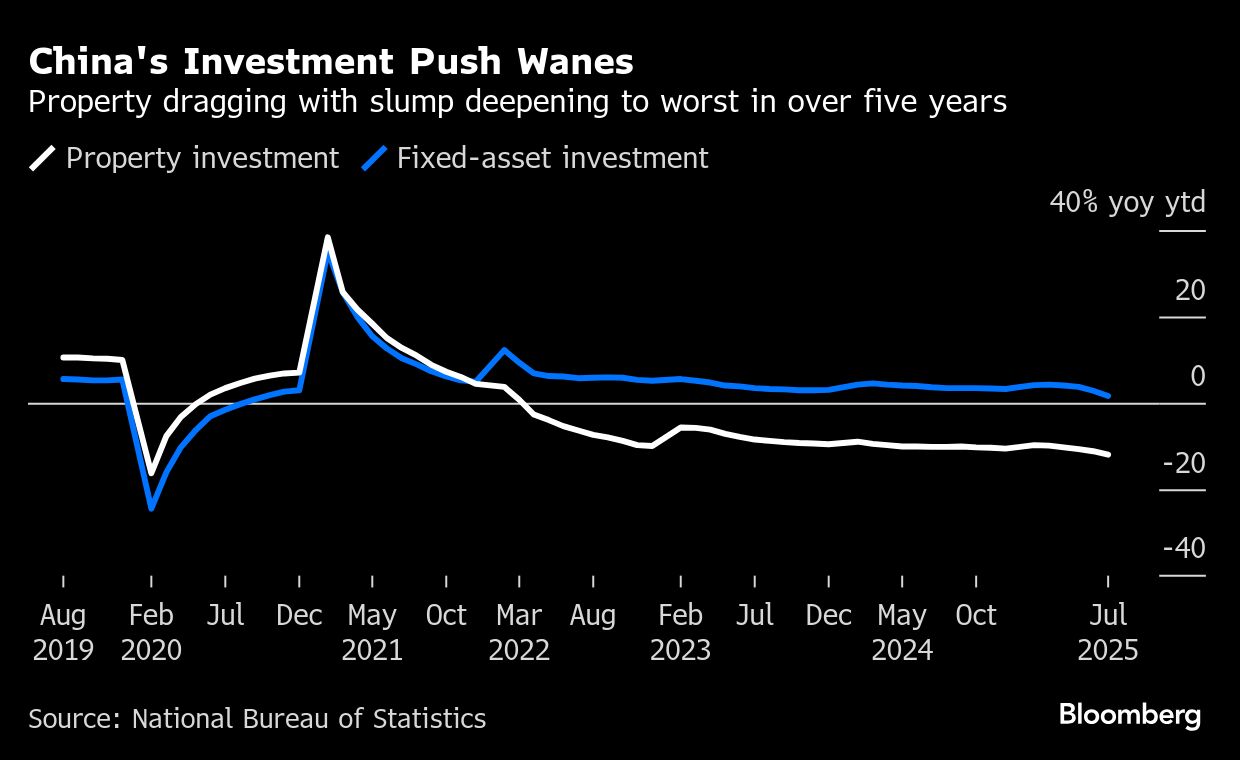

- Fixed-asset investment growth decelerated to 1.6% amid real estate contraction

China's economy slowed across the board in July with factory activity, investment and retail sales disappointing, suggesting Beijing's crackdown on destructive price wars and spillovers from Donald Trump's tariffs are casting a pall over the world's No. 2 economy.

Production at Chinese factories and mines rose at the slowest rate since November and expanded a worse-than-forecast 5.7% last month from a year earlier, according to data released by the National Bureau of Statistics on Friday, compared with June's gain of 6.8%.

Retail sales grew 3.7% on year in July, the least this year and down from 4.8% in the previous month. Expansion in fixed-asset investment in the first seven months of the year decelerated to 1.6%, as a contraction in the real estate sector deepened. The urban unemployment rate climbed more than expected to 5.2%.

“July's main economic indicators suggest that the country's tariff-related swoon has begun,” said Homin Lee, a senior macro strategist at Lombard Odier in Singapore. “The loss of momentum evident in both demand and supply indicators calls for the mid-year fiscal policy tweak.”

The offshore yuan held steady after the data release and the yield on China's 10-year government bonds edged slightly lower. The Hang Seng China Enterprises Index retreated as much as 1.5%, while the onshore CSI 300 Index ended the morning session 0.5% higher after swinging between small gains and losses.

The latest snapshot of the economy indicated China's growth lost steam after a show of strength earlier in the year allowed Beijing to take a wait-and-see approach to further stimulus.

Top leaders have signaled they will stick with supportive measures already planned while promising to pump more aid when needed, a strategy analysts expect to be fine-tuned pending economic figures in the coming months.

“China's economy overcame negative factors including a complex and fast-changing external environment and extreme weather at home, and maintained progress amid stability,” the NBS said in a statement. “The economy still faces numerous risks and challenges.”

Although uncertainty abounds over the outlook for global trade, industrial activity and construction also suffered from extreme weather. The disruptions in July, caused by high temperatures, unusually heavy rain and flooding in large swathes of China, added to what's traditionally a slow season for the economy.

Growth in yuan-denominated new loans contracted for the first time in 20 years in the month, highlighting subdued willingness for borrowing and spending.

Instead of announcing massive new measures to juice growth, Beijing in recent weeks ramped up efforts to curb cutthroat competition among businesses. The campaign has attracted intense attention from investors given the stakes involved in reflating the economy and the potential impact on corporate profitability in industries from steel to solar energy and electric cars.

Investment in manufacturing, property and infrastructure fell across the board in July, which was “extremely rare,” according to Jacqueline Rong, chief China economist at BNP Paribas SA.

The effort to curb so-called involution drove local governments to “strictly control” new investment in industries suffering from intense competition or having overcapacity concerns, holding back spending in manufacturing, she said.

“If August's economic data continue to be weaker than expectations, policymakers may feel compelled to introduce additional supportive measures in late September or early October to prop up growth in the fourth quarter,” she said.

The size of any potential stimulus package might be smaller than what was provided for the same period last year, however, given the risk of missing the around 5% annual growth target is lower and the stock market is in much better shape, Rong added.

There are signs the government's consumer subsidies are also having less impact on boosting demand, as retail sales of household electronics, office supplies and furniture slowed in July from a month ago. Car purchases fell 1.5% from a year earlier, the first drop since the January-February period.

Some local governments ran into a funding shortage for the subsidy program starting from June, before the country's top economic planning agency allocated more money to them around late July.

Officials may consider broadening the trade-in program to cover more goods and even services as part of its response to the broader slowdown, according to Standard Chartered Plc analyst Ding Shuang, who expects the government to prepare contingency plans to prevent any further downturn.

“The data should sound the alarm to the policymakers, but they may not shift policies abruptly based on a one-month data point,” Ding said. “Investment is the main drag.”

Private capital expenditure declined 1.5% in the first seven months from a year ago, the worst reading for the cumulative gauge since September 2020.

Authorities are also looking for ways to boost domestic consumption to reduce reliance on foreign demand in the long run amid rising rivalry with the US.

The government this week unveiled a plan to subsidize part of the interest payments on some consumer loans, after announcing earlier it will gradually waive preschool fees to ease education costs and offer childcare subsidies for families across the nation.

“Looking ahead, economic activity data will likely show more signs of growth slowdown, perhaps even at a faster pace in the coming months,” said Xiaojia Zhi, chief China economist at Credit Agricole CIB in Hong Kong.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.

:max_bytes(150000):strip_icc():focal(722x523:724x525):format(webp)/Savannah-Guthrie-mother-Nancy-Guthrie-020226-02-0368cb6ddb864bf09919fd100fe546b0.jpg?im=FeatureCrop,algorithm)