(Bloomberg Opinion) --

Don't get me wrong; high-frequency inputs are important in any assessment of economic conditions and policy responses. They give you a sense of how the economy is functioning. They should inform and influence how officials think but not in the absence of a strategic view of our economic prospects.

One way to think about this problem is to use the analogy of driving a car by looking in the rear-view mirror rather than through the windshield. This type of driving works for straight roads. It is problematic in other situations. Similarly, the threat of policy mistakes is particularly high during economic turning points.

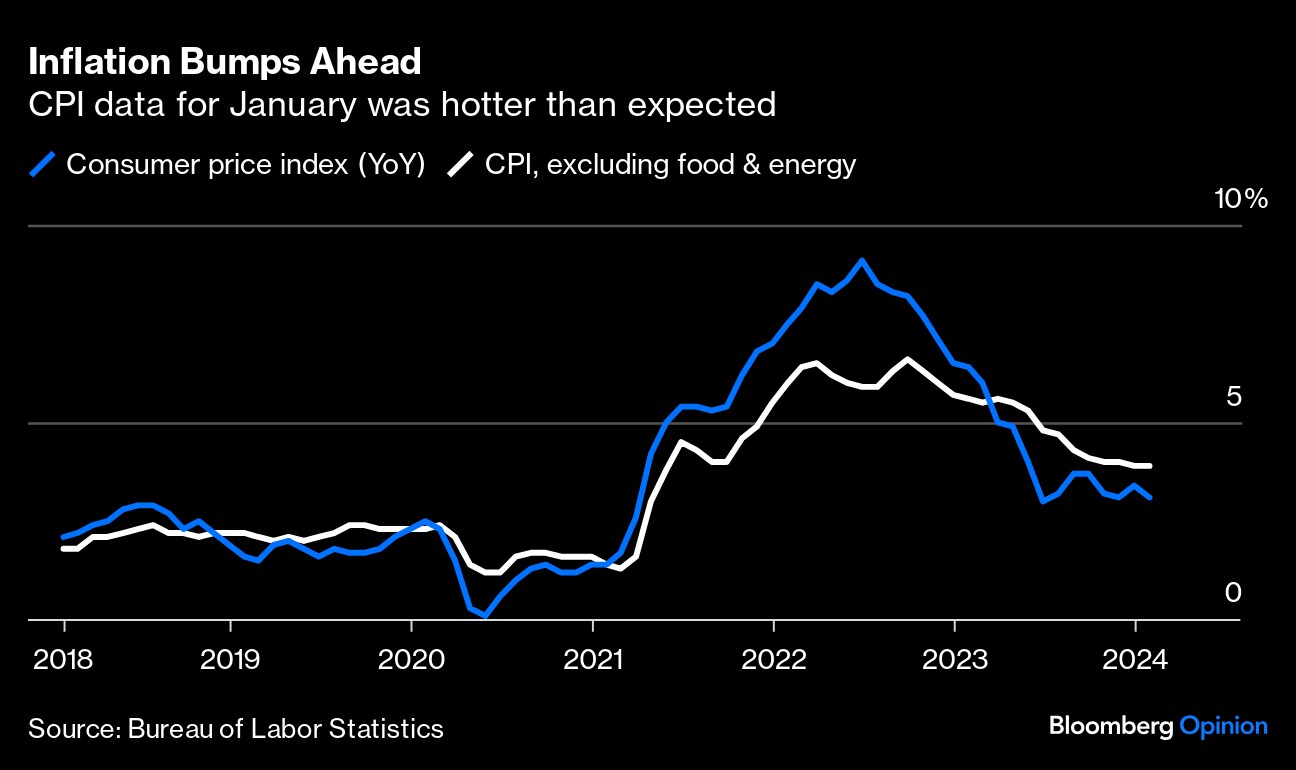

The Fed is highly unlikely to face a straight road from here given the current dynamics of inflation, including the time-variant tug of war between some outright goods deflation and high services inflation. There are also complications with defining some important determinants of its terminal fed funds rate, be they questions about the neutral rate, or r-star, or the appropriateness of a 2% inflation target for the US when the global economy, at the moment, is characterized by changing and insufficiently flexible supply.

The time has come to discard the excessive data dependency that risks making the Fed too backward looking in its thinking, overly reactive in policy implementation and too narrow in its discussions of economic and financial issues. Historic data should not be the sole determinant of policy making. This ongoing obsession with the numbers should give way to an approach that also incorporates strategic vision and forward-looking insights on where the economy is heading.

The extent to which the world's most powerful central bank succeeds at this may well be the difference between the much-desired soft landing for the US economy and yet another Fed policy mistake that undermines economic well-being.More From Bloomberg Opinion:

- Federal Reserve Flight 2024 Hasn't Landed Yet: Bill Dudley

- Inflation Selloff Is Wake-Up Call to Market: Mohamed A. El-Erian

- The Fed Is Not Political. Well, Not Exactly: Claudia Sahm

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Mohamed A. El-Erian is a Bloomberg Opinion columnist. A former chief executive officer of Pimco, he is president of Queens' College, Cambridge; chief economic adviser at Allianz SE; and chair of Gramercy Fund Management. He is author of “The Only Game in Town.”

More stories like this are available on bloomberg.com/opinion

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.