Nvidia, AMD Reach Deal To Give US A Cut Of China AI Chip Sales

Trump said he’d originally told Nvidia that he wanted a 20% cut for the US if he cleared H20 sales to China but eventually settled for a 15% share. The two negotiated “a little deal,” he said.

Nvidia Corp. and Advanced Micro Devices Inc. have agreed to pay 15% of their revenues from Chinese AI chip sales to the US government in an unusual, legally questionable deal that reflects the Trump administration’s willingness to soften export controls in exchange for financial payouts.

Nvidia plans to share 15% of the revenue from sales of its H20 AI accelerator in China, US President Donald Trump said in a briefing with reporters on Monday. AMD will deliver the same share from MI308 revenues, a person familiar with the situation said, asking not to be identified discussing internal deliberations.

Trump said he’d originally told Nvidia that he wanted a 20% cut for the US if he cleared H20 sales to China but eventually settled for a 15% share. The two negotiated “a little deal,” he said.

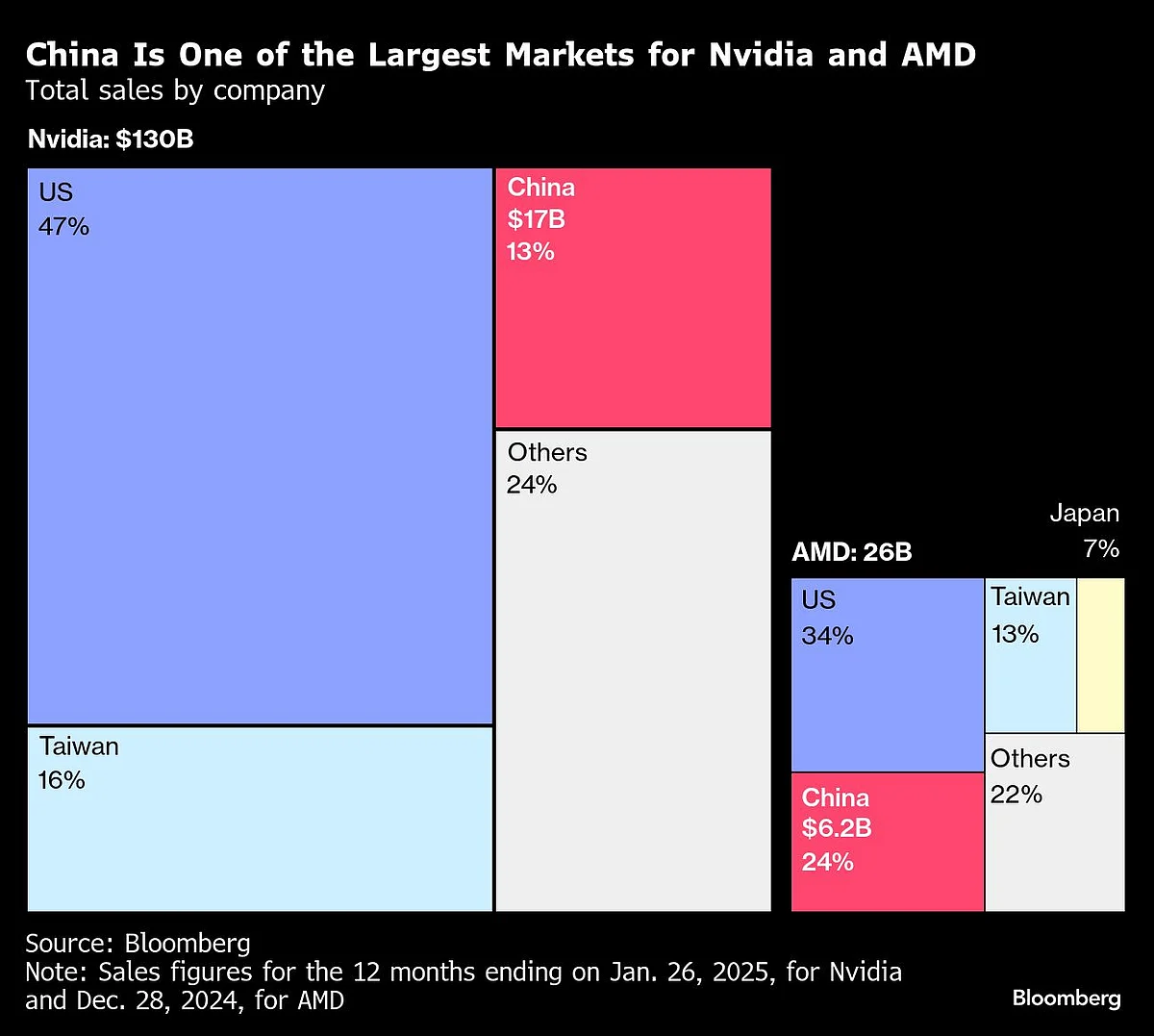

The chip companies’ consent to cede part of chip sales underscores the urgency of their desire to cater to customers in the world’s second-largest economy. The US government has cut off sales of the most capable AI chips, arguing that China might use them for military purposes, instead allowing shipment of only pared-back products. But the Trump administration has consistently relented on trade conditions in exchange for financial concessions — and in this case officials said the chips are not the most advanced, playing down their national security implications.

There’s no guarantee the arrangement with Nvidia and AMD will succeed. Trade experts said it’s vulnerable to legal challenges because it could be construed as an export tax, something that’s not allowed under the Constitution. The chipmakers themselves said it will take months to revive production of the parts — assuming Chinese customers even opt for dated components.

China’s government, meanwhile, has grown increasingly hostile to the idea of Chinese firms deploying the H20 and is unlikely to warm to the idea of a chip tax. Yuyuantantian, a social media account affiliated with state-run China Central Television that regularly signals Beijing’s thinking about trade, on Sunday slammed what it described as security vulnerabilities and inefficiencies of Nvidia’s chip.

AMD shares gained less than 1% to $173.05 at 3:25 p.m. in New York on Monday. Nvidia shares were little changed.

“Both Nvidia and AMD already said they would start shipping to China, so that market reaction already happened,” said Jay Goldberg, an analyst at Seaport Global Securities. The big question is exactly when they’re going to start delivering to China again, especially now that there are strings attached, Goldberg said.

The deal also threatens to undermine the US argument that some trade controls are necessary to safeguard national security, said Jacob Feldgoise, a researcher at the DC-based Center for Security and Emerging Technology. “This seeming quid pro quo is unprecedented from an export-control perspective,” he said. “The arrangement risks invalidating the national security rationale for US export controls.”

When the Trump administration first decided to grant export licenses to Nvidia and AMD last month, Treasury Secretary Scott Bessent said exports of H20 chips were part of trade talks with China and were used as “a negotiating chip.” White House AI adviser David Sacks emphasized at the time that the product wasn’t “the latest and greatest.”

Trump reiterated these points at the briefing on Monday, calling Nvidia’s H20 “an old chip” and hailing the company’s latest Blackwell chip as the “super duper advanced” one. He signaled though that he’d be open to negotiate another deal with Nvidia Chief Executive Officer Jensen Huang to sell a scaled-back version of the most advanced Blackwell chip to China, too. “I think he’s coming to see me again about that,” Trump said.

An Nvidia spokesperson said the company follows US export rules, adding that while it hasn’t shipped H20 chips to China for months, it hopes the regulations will allow US companies to compete in China. AMD similarly said in a statement Monday that it’s adhering to all US export-control laws.

The US government has meanwhile begun approving export licenses for the chips. AMD’s initial license applications have been cleared, the company said Monday. The Financial Times earlier reported on the revenue-sharing deal.

Trump has targeted chipmakers in the past week with a series of declarations that were light on specifics and rattled companies from Silicon Valley to Asia. On Wednesday, Trump threatened 100% tariffs on imported chips, unless companies also made investments on US soil. On examination, though, those new tariffs would apply to almost no one since most major chipmakers appear to be covered by existing investments or separate trade deals.

On Thursday, Trump called on Intel Corp. Chief Executive Officer Lip-Bu Tan to resign, describing the Malaysia-born entrepreneur as “highly conflicted” without giving details. Tan, who sent a letter to employees assuring them that he had engaged with the administration, is expected to meet with Trump on Monday, a person familiar with the situation said. The Wall Street Journal was first to report on the meeting.

Tan has been targeted by Republican Senator Tom Cotton over historical business ties to China.

Huang has lobbied long and hard for the lifting of restrictions, arguing that walling China off will only slow the spread of American technology and encourage local rivals such as Huawei Technologies Co. In yet another sign that his message is getting through to the White House, Trump described Huang on Monday as a “great,” “very brilliant guy.”

The tax is expected to funnel some capital to the US — but not an enormous amount in relative terms. Both Nvidia and AMD have said it’ll take time to ramp back up production of their China-specific products — even if order levels return to previous levels, which is uncertain.

Nvidia raked in $4.6 billion of revenue from the H20 in the fiscal quarter ended April 27 — days after new restrictions on shipping the AI accelerator to China were imposed.

It also said it had been unable to ship $2.5 billion of H20 China revenue in that period because of the new rules. That implies it would have got more than $7 billion in H20 sales to China during the period. If it can return to that level, the US government will stand to get about a billion dollars a quarter from its deal.

AMD could generate $3 billion to $5 billion of 2025 revenue if restrictions were lifted, Morgan Stanley estimates. Chinese alternatives such as Huawei’s Ascend chips now account for 20% to 30% of domestic demand, it reckoned.

“The US government clearly needs the money given its deficits and eagerness to collect tariffs,” said Vey-Sern Ling, managing director at Union Bancaire Privee in Singapore. “But the complication is China’s accusations about H20 chips containing back doors, which could be a negotiation tactic to highlight that the country is not ‘hard up’ for US chips.”

For its part, Nvidia emphasized that its H20 chip is “not a military product or for government infrastructure.” China has “ample supply of domestic chips,” the company said in an emailed statement. “It won’t and never has relied on Americans chips for government operations, just like the US government would not rely on chips from China.”