- Alibaba's cloud business grew 34%, boosting quarterly revenue to 247.8 billion yuan

- Chinese e-commerce revenue rose 16%, indicating strong competition with JD.com and Meituan

- Net income fell to 20.99 billion yuan due to increased subsidies and AI development costs

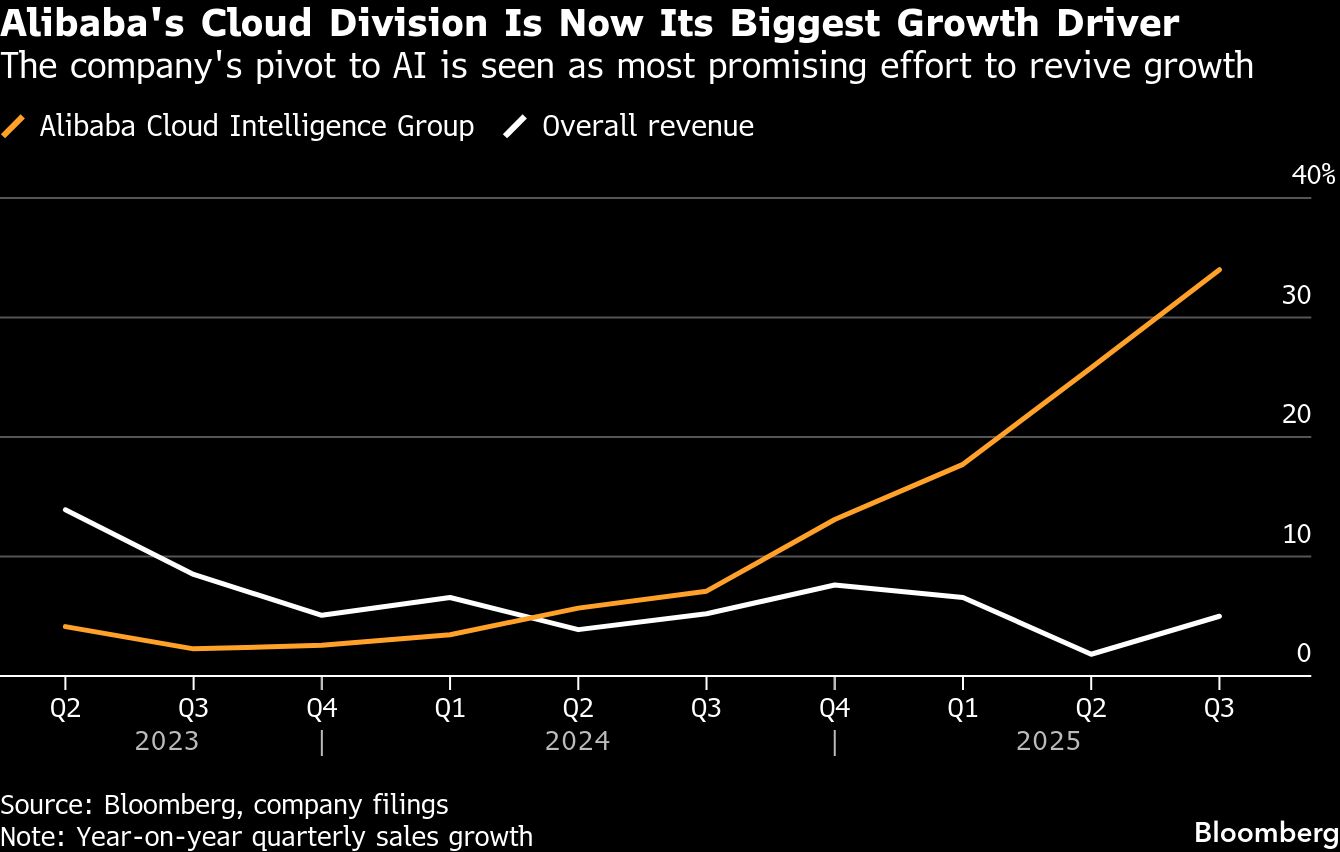

Alibaba Group Holding Ltd. posted better-than-projected 34% growth in its cloud business, offsetting a plunge in profit after the company unleashed spending on consumer subsidies and data centers to ride an AI boom.

The cloud division, which houses the flagship Qwen platform, propelled overall revenue 5% higher to 247.8 billion yuan ($35 billion) in the September quarter, just outstripping expectations.It posted a 16% rise in Chinese e-commerce revenue, suggesting it was faring well in a three-way battle with JD.com Inc. and Meituan. The company's US shares gained more than 2% in pre-market trading.

The strong results are likely to encourage investors betting on Alibaba as a leader in artificial intelligence development. The company has accelerated the release of AI models, culminating in the relaunch of its Qwen mobile app — an effort to replicate the success of OpenAI's ChatGPT — that got off to a fast start this month.

Alibaba's report emerges against a backdrop of growing doubt about the sustainability of investment in AI infrastructure — without a clear path to profitability. On Tuesday, Chief Executive Officer Eddie Wu dismissed concerns about an AI investment bubble — stoked in part by the circular nature of data center financing. In fact, the Chinese company plans to explore “aggressive” investment to keep pace with surging market demand and ferocious competition in a fast-changing environment.

“Looking ahead to the next three years, we don't really see much of an issue in terms of a so-called AI bubble,” Wu said.

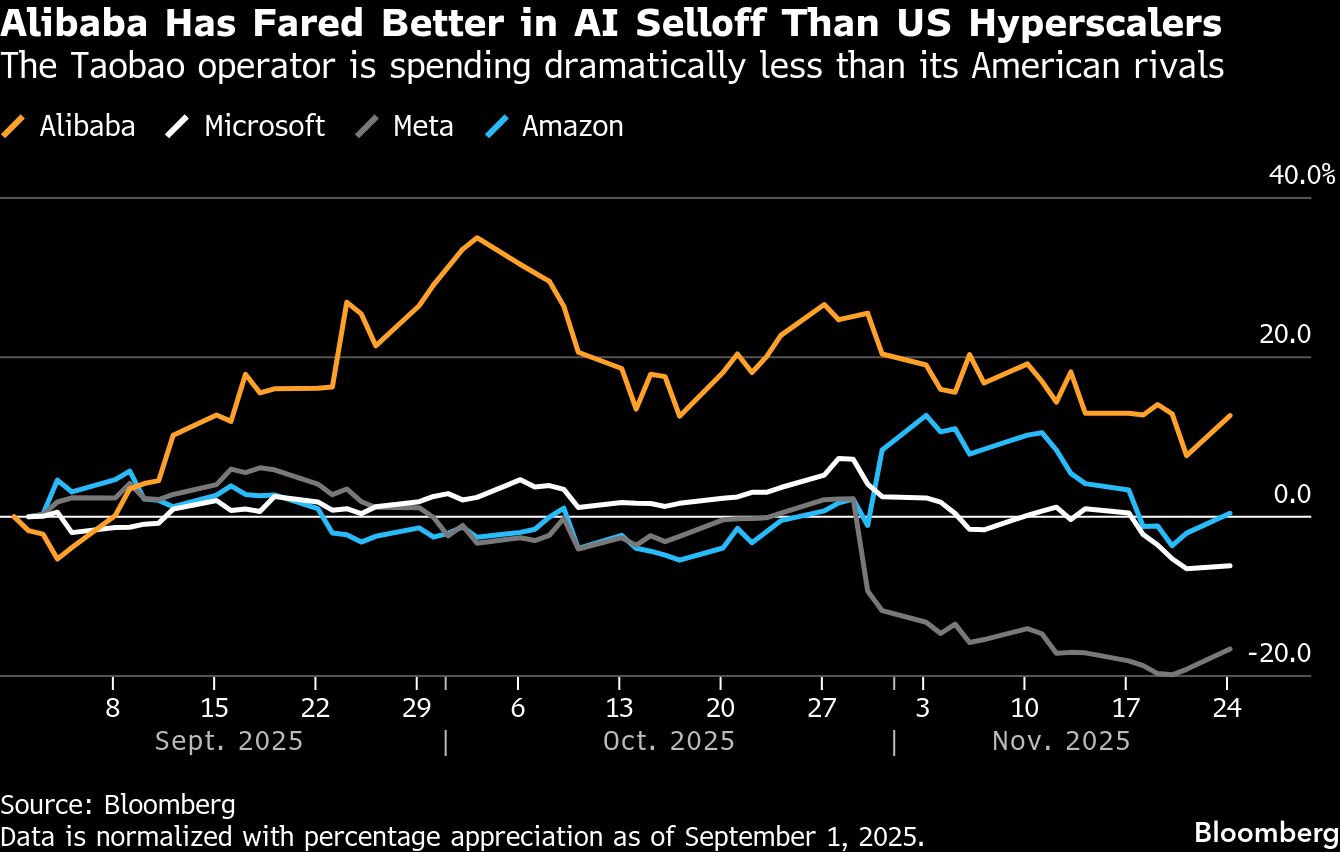

Wu's comments stand in contrast to warnings from Chairman Joe Tsai just in March, when he flagged over-investment from the likes of Amazon.com Inc., Microsoft Corp. and Meta Platforms Inc. Their shares have sagged over the past month as concerns mount about whether data center construction may be outpacing demand over time.

Alibaba joins JD.com and PDD Holdings Inc. in reporting better-than-anticipated results, boosted by Beijing's stimulus measures and billions of dollars in subsidies as they vie for shoppers and diners.

But that cut into profitability: Net income dived to 20.99 billion yuan during the period — reflecting not just the discounting but also the mounting costs of AI development. Sales and marketing expenses more than doubled in the quarter.

What Bloomberg Intelligence Says

Alibaba's China e-commerce profit slump likely offset the lift from narrower international e-commerce losses and higher cloud earnings. Along with steeper other losses, including the contribution from Cainiao, this is set to hurt operating profit for the second straight quarter.

Alibaba Spends Big to Fuel AI and Quick Commerce Growth: TOPLive

Chinese AI firms have weathered a global AI stock selloff better, in part because their spending plans are still comparatively modest. Yet Alibaba's — at 380 billion yuan over three years — sets it apart from much of the domestic competition. Tencent Holdings Ltd. committed roughly $1.8 billion toward capital expenditure in the most recent quarter.

On the surface, Alibaba's ambitions also appear more aggressive. Its revamped Qwen mobile app attracted 10 million users within four days — one of the fastest rollouts of any Chinese AI service — and Alibaba said the plan is to build it into a full-fledged AI agent that can handle tasks like shopping on Taobao. Qwen is set to gradually incorporate features like mapping, shopping, travel booking and education, with the goal of building a broader ecosystem.

Investors have so far cheered that ambition. The Hangzhou-based company's shares have nearly doubled in value since the start of the year — though in the long run it'll have to sustain rapid cloud revenue growth and fight off just about China's entire internet sector, spanning startups such as DeepSeek to tech giants like ByteDance Ltd.

While US players like OpenAI or Alphabet Inc.'s Google remain shut out of China, Qwen has to contend with local rivals.

ByteDance's Doubao chatbot already has over 172 million monthly active users, according to QuestMobile data. Tencent is leveraging WeChat to promote its own Yuanbao, while laying out plans to build the ubiquitous WeChat into an agentic AI-capable service. And consumer-facing apps have yet to show a clear path to revenue generation in China, where users have shown little appetite to pay for subscriptions.

Still, the country's biggest tech companies are hampered by US restrictions on the most advanced Nvidia Corp. chips. Supply of domestic alternatives is limited. That hinders AI development to an extent, though Alibaba and local firms like Huawei Technologies Co. are seeking to develop homegrown accelerators.

Wu again set out plans to build a “full-stack” suite for AI development, from advanced models to the infrastructure — such as semiconductors — required to build them. The company's chip unit, T-Head, has gained headway in efforts to compete with Huawei.

More broadly, executives flagged signs of recovery in Chinese consumption through quick commerce — fast-delivery of goods and meals — which in turn drives traffic to its other platforms. They reaffirmed a target of expanding gross merchandise value from quick-commerce to 1 trillion yuan in about three years.

Alibaba's ability to control costs around consumer services while investing in cloud operations is something investors will monitor over the longer term.

“Our Alibaba Cloud server infrastructure is seriously lagging behind the growth rate of customer orders. Our backlog of orders continues to expand,” Wu said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.