AI Boom Seen Driving Next Decade Of Emerging Markets Performance

Emerging-market stocks that are highly exposed to AI have even outperformed the so-called Magnificent Seven megacap tech firms.

Emerging-market funds are pivoting to capture the artificial intelligence craze, with some investors predicting that booming technology spending will drive returns for years to come.

Encouraged by the success of Chinese AI developer DeepSeek and Asia’s powerhouse semiconductor firms, asset managers like AllSpring Global Investments and GIB Asset Management are concentrating more of their portfolio in AI stocks. That’s been a winning trade, with AI companies being the six biggest contributors to the rally in Bloomberg’s EM stocks index this year.

“This trend could last for the next 10 to 20 years,” said Alison Shimada, head of total emerging markets equity at AllSpring, which oversees $611 billion. “The impact on local populations within EM will be transformational.”

While much of the AI investment frenzy has focused on a handful of Silicon Valley firms, EM companies that can harness the technology or supply crucial components are benefitting. AI servers, for example, have become the main growth driver for Taiwan’s Hon Hai Precision Industry Co., which is known as Foxconn.

The top contributors to Bloomberg’s EM stock index this year are Taiwan Semiconductor Manufacturing Co., Tencent Holdings Ltd., Alibaba Group Holding Ltd., Samsung Electronics Co., SK Hynix Inc. and Xiaomi Corporation, together accounting for 37% of the index’s rally.

Emerging-market stocks that are highly exposed to AI have even outperformed the so-called Magnificent Seven megacap tech firms so far this year, according to equities strategists at Citigroup Inc.

“You cannot invest in emerging markets without having a sanguine and optimistic view of what this AI story can evolve into from a corporate earnings perspective,” said Kunal Desai, London-based co-portfolio manager for global emerging markets equities at GIB Asset Management.

Desai said that Taiwan and South Korea will be “central drivers” of the EM market story over the next two to three years, with Malaysia, China, India, parts of Latin America and the Middle East seeing “disproportionate gains” due to their exposure to AI data and applications. His fund has invested in AI stocks during recent market dips, predicting that a third of emerging market returns will come from AI-related stocks in the coming years.

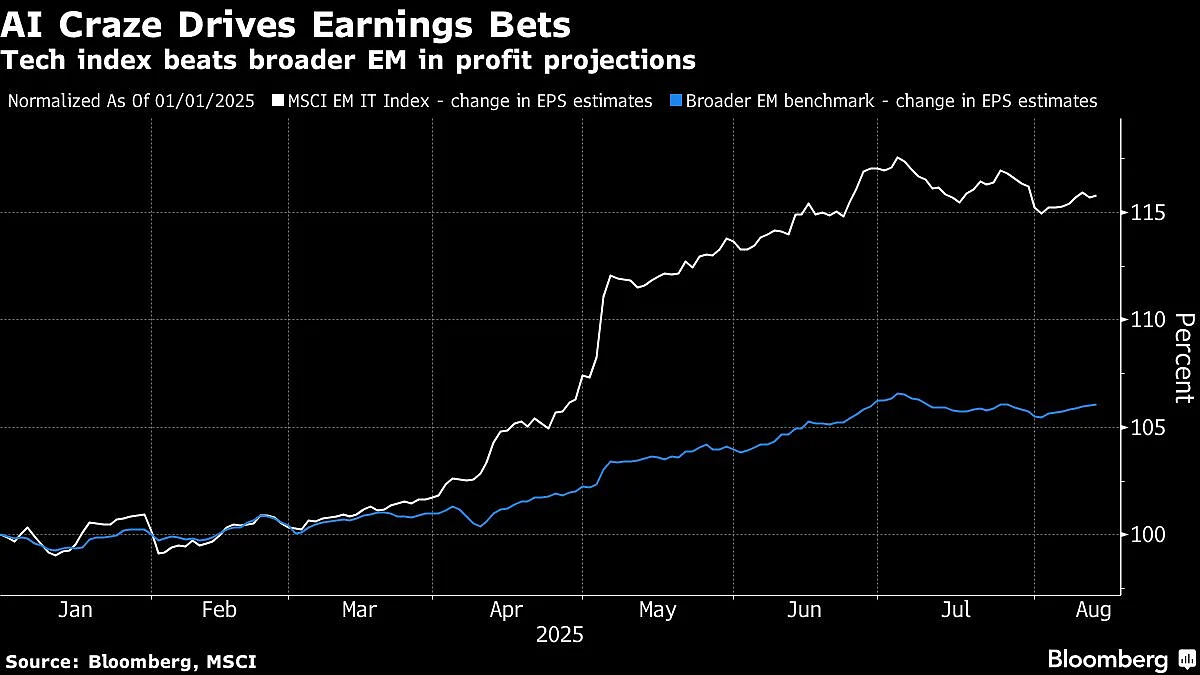

There are signs that the momentum will continue as AI adoption accelerates across segments including cloud computing and electrical vehicles. The average estimate of forward 12-month earnings for EM tech stocks has increased 15% since the start of the year, compared to 6% for EM stocks overall.

“The share of AI contribution from the performance standpoint will only grow from here,” said Xingchen Yu, an emerging markets strategist at UBS Global Wealth Management. “The rise of AI and tech is creating a new layer of secular growth, especially in North Asia.”

The AI revolution could help EM stocks overcome a key obstacle: earnings performance. Company results have lagged forecasts every quarter since early 2022, with MSCI EM Index companies collectively missing profit expectations by more than 12%, according to data compiled by Bloomberg.

But firms in the AI-heavy information-technology sector have consistently met earnings projections since the fourth quarter of last year, boosting investor confidence.

"This sector has been expected to grow explosively and will continue to do so in the future,” said Young Jae Lee, senior investment manager at Pictet Asset Management Ltd. “AI will continue to be a key sector within emerging markets."