It doesn't help the cause when the leader of a flock goes astray, especially when the herd itself is lost in the mist.

Accenture Plc., the bellwether of India's $245-billion IT services industry, has revised lower its revenue growth guidance for the fiscal ending Aug. 31. The development comes at a time when the sector itself is staring at a washout for the full year.

Revenue of the world's biggest IT company by market capitalisation rose 3% year-on-year to $16.6 billion in the three months ended May 31, according to a statement on Thursday. That compares with the $16.5-billion consensus estimate of analysts tracked by Bloomberg.

Accenture Q3 Results FY23: Key Highlights (YoY)

Revenue up 3% at $16.6 billion (Bloomberg estimate: $16.5 billion)

Operating income down 9% to $2.36 billion, or 14.2% of revenues.

Adjusted earnings per share up 14% to $3.19/share (Bloomberg estimate: $2.99)

The Ireland-based firm now expects to grow at 8–9% in the financial year 2023 as against 9–10% estimated earlier. In comparison:

Infosys Ltd. forecasted its revenue growth at 4–7% in constant-currency terms in the fiscal ending March 31, 2024.

HCL Technologies Ltd. pegged its FY24 revenue growth at 6–8%, with peak growth arriving in October–December.

Wipro Ltd. expected its revenue to decline 1–3% in constant-currency terms in the first quarter of FY24.

Tata Consultancy Services Ltd., the biggest of the lot, does not provide guidance, while Tech Mahindra Ltd. expected a positive upswing in the second half of FY24.

This was at the end of the fourth quarter. Things have changed a lot since then.

India's IT services industry is staring at a longer-than-expected slowdown, even a complete washout, in fiscal 2024 as deal-making deteriorates, according to a June 14 report by JPMorgan Chase and Co.

Project deferrals and cancellations likely persisted in April–June without clear signs of a bottom. Increased competition for a shrinking deal-making pie is likely to trigger falling win and rates, pricing and deteriorating deal terms, it said.

"We reiterate our negative view across the IT services universe, with our last neutral rating downgraded to underweight," JPMorgan had said. "We expect every IT services firm to disappoint in Q1 and current H2 FY24 growth expectations."

Accenture's earnings have simply made matters worse.

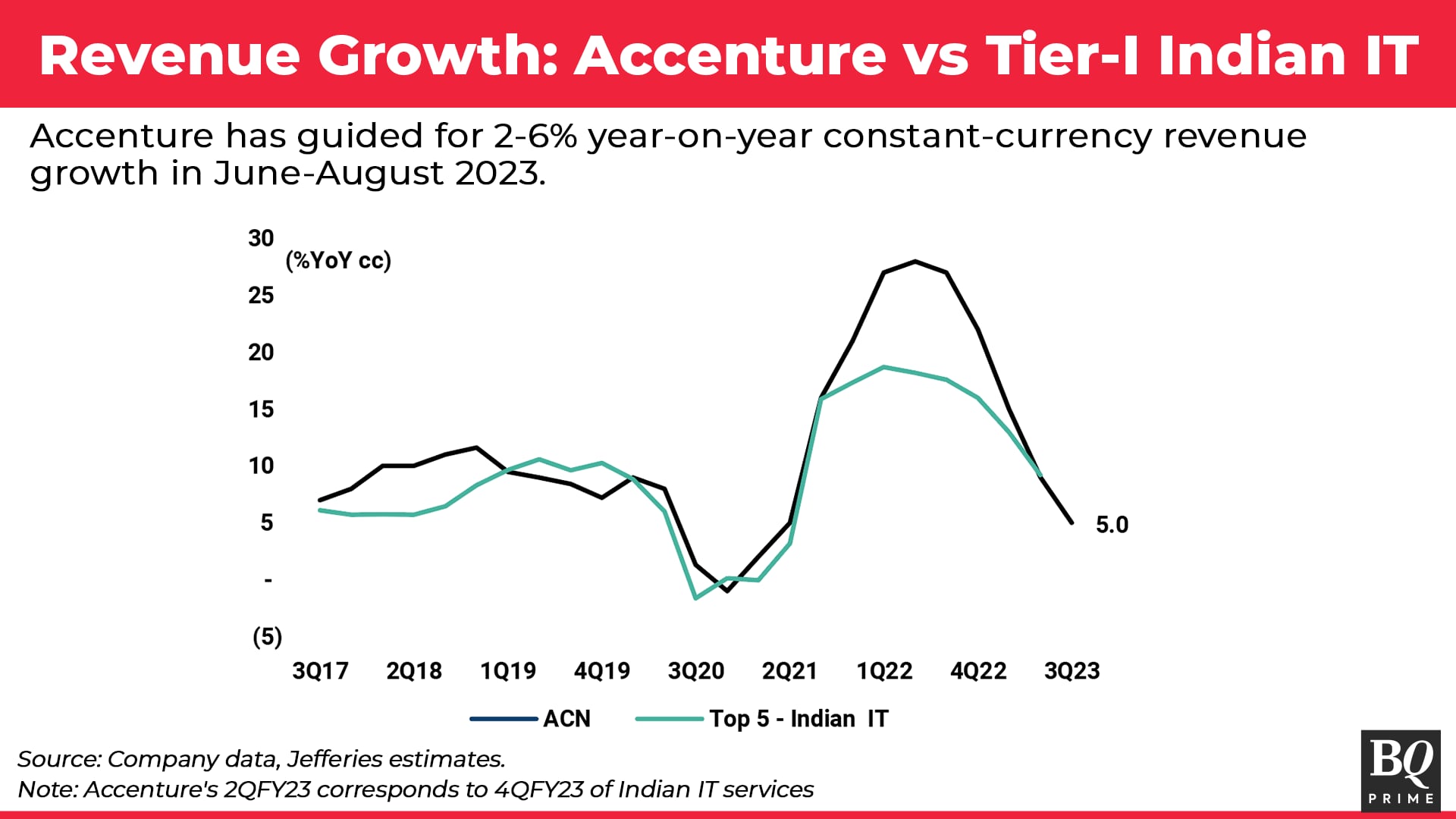

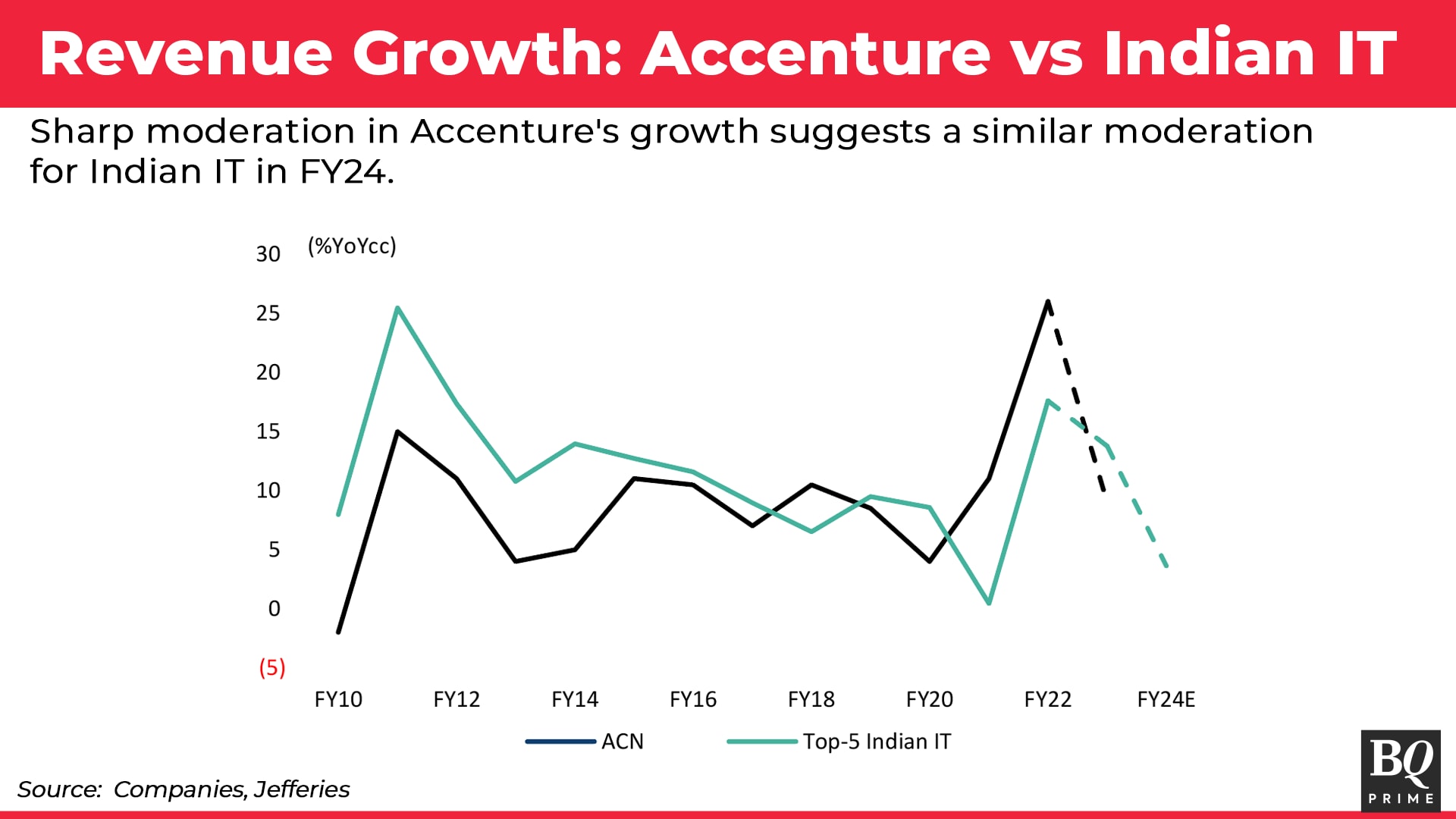

"A sharp moderation in Accenture's bookings—not only in consulting but also in outsourcing —suggests that clients are extremely watchful of their IT spends," analysts Akshat Agarwal and Ankur Pant at Jefferies Financial Group Inc. said in a research report on Thursday.

The lower contract profitability suggests pricing pressure due to rising competition for fewer deals, That, in turn, could impact margins, according to Jefferies.

Accenture's muted outlook for the North American market and the communications vertical offers negative read-through for LTIMindtree Ltd., HCL Tech, Infosys and Tech Mahindra, it said.

Accenture's revenue from the North American market rose a mere 1% over the year ago to $7.72 billion in the quarter ended May 31. Revenue from its communications, media and technology vertical shrank 11% to $2.88 billion.

"With the sector still trading at 21 times its one-year forward price-to-earnings ratio (10% premium to 10-year average price to earnings) amidst a worsening demand outlook, we maintain our cautious stance on the sector," Jefferies said.

Nirmal Bang Securities Pvt. weighed in with a starker outlook for Indian IT, questioning the fiscal 2025 performance as well, especially after Accenture guided for a flat growth in June–August.

"A weak exit from Q4 FY23, possibly zero percent constant-currency organic growth, will set up Accenture for a weak FY24," the brokerage firm said in a note on Friday. "While consensus estimates for revenue and earnings for FY24 have been brought down for Indian IT services companies, we suspect there are risks to the strong rebound expected in FY25."

That Accenture has hinted at pricing pressure for the first time in many quarters calls for a "dekko"—something that the Street hasn't done so far. Even Coforge Ltd., EPAM Systems Inc., HCL Tech and Cognizant Technology Solutions Corp. have warned of irrational pricing in the past, it said.

"In our models, we have assumed modest pricing pressure, but we believe this could be a bigger issue as we go into H2 FY24," Nirmal Bang said. "We remain underweight on the Indian IT services sector, especially for the Tier-II set, whose dependence on 'small deals' is quite significant."

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.