UPL Ltd. share price declined in Monday's session as Jefferies cut earnings per share estimates for the ongoing and the next financial year after the company missed the brokerage's estimates for fourth quarter earnings. According to Jefferies, UPL's net profit was dragged down because of a one-off loss of $2.75 billion.

"Factoring in Q4 miss, we make minor 1-3% cuts in FY26-27e EPS,"Jefferies

Jefferies also tweaked UPL's sales and Ebitda growth estimates to 7% and 19% for the ongoing financial year. UPL trades at 13 times FY26 price-to-earnings, which is still 8% below the historical average.

However, UPL posted a whopping 2,140% on the year growth in its net profit for the fourth quarter. The company was able to post a surge in its profit because of operational profitability, Jefferies said. Volume growth, better product mix, and rebate normalisation drove UPL's Ebitda growth during the fourth quarter.

UPL Q4 Earnings Key Highlights (Consolidated, YoY)

Revenue rose 10.6% to Rs 15,573 crore versus Rs 14,078 crore

Ebitda rose 67.5% to Rs 3,237 crore versus Rs 1,932 crore

Margin at 20.8% versus 13.7%

Net Profit at Rs 896 crore versus Rs 40 crore

Board to pay dividend of Rs 6 per share.

For UPL, FY25 was a good year, Jefferies said. UPL saw its Ebitda rising 47% on the year during FY25, and volume growth rose 13%. Deleveraging of $1.1 billion happened during the previous financial year.

Jefferies believe that recovery will start from second half of FY26. It maintained 'Buy' on UPL and raised the target price to Rs 810 from Rs 710, which implied 19.76% upside from Monday's closing price.

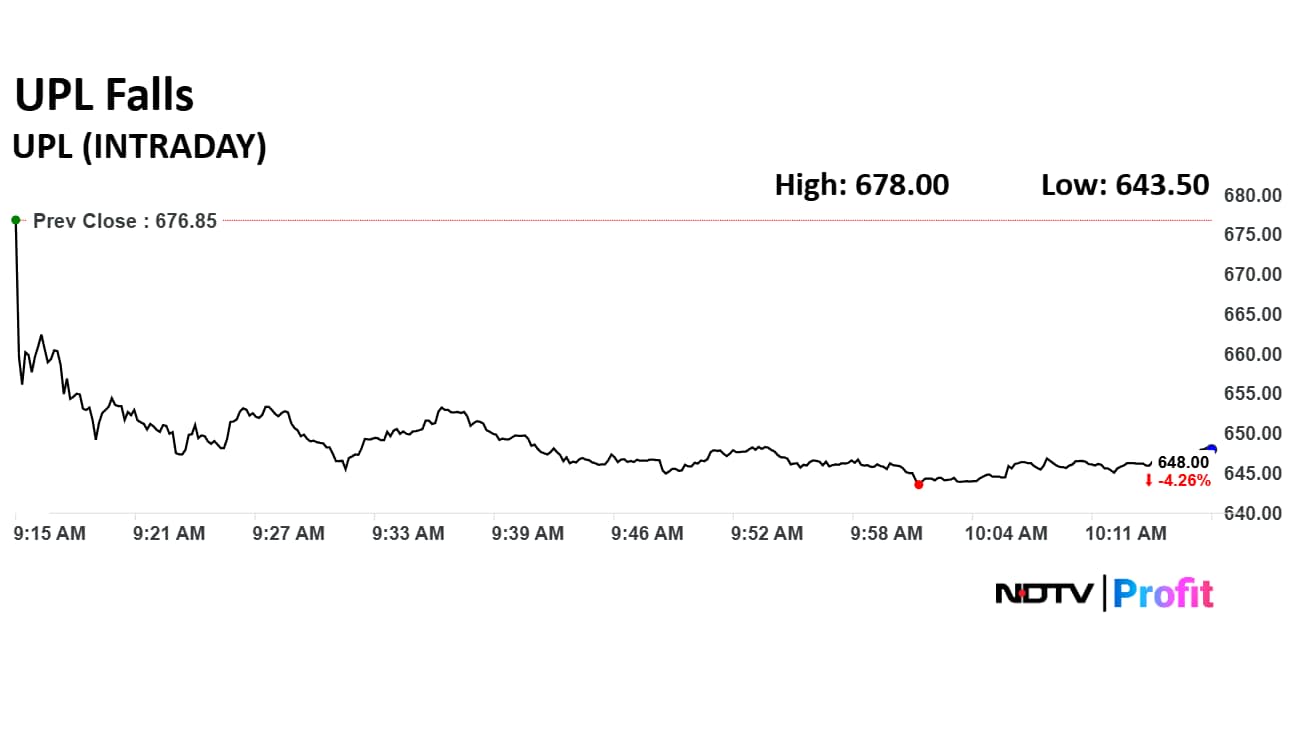

UPL share price declined 4.93% to Rs 643.50 apiece. It was trading 4.29% down at Rs 647.80 apiece as of 10:19 a.m., as compared to 0.66% decline in the NSE Nifty 50 index.

The scrip rose 21.55% in 12 months, and 29.46% on year-to-date basis. Total traded volume so far in the day stood at 5.1 times its 30-day average. The relative strength index was at 45.61.

Out of 25 analysts tracking the company, 17 maintain a 'buy' rating, six recommend a 'hold,' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 14.4%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.