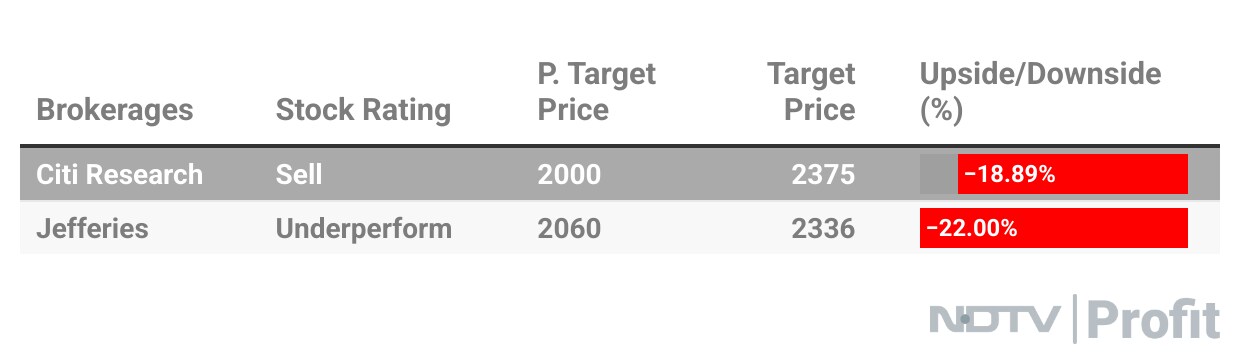

Jefferies and Citi Research hiked SRF Ltd.'s target price after the company posted better-than-expected results in the fourth quarter. Growth in specialty chemicals and domestic demand in refining and gas prices supported this unexpected growth, according to brokerages.

SRF's management guided for 20% growth in specialty chemicals in the financial year 2026. However, visibility of such growth is clouded in the first half. Exports declined sharply in April on the month, suggesting a softness. Specialty chemicals witnessed a year-end recovery in FY25 volumes from seasonality and an increase in exports to US innovators, Jefferies said.

Low crop prices and elevated Chinese exports weigh on pricing in financial year 2026. Jefferies expects 18% growth for SRF. Jefferies raised the Ebitda estimates to 8% and 5%, respectively, for FY26 and FY27.

SRF Q4FY25 Result Highlights (Consolidated, YoY)

Revenue up 21% at Rs 4,313 crore versus Rs 3,570 crore (Bloomberg estimate: Rs 4,059 crore).

Ebitda up 37.6% at Rs 957 crore versus Rs 696 crore (Estimate: Rs 877. 7 crore)

Ebitda margin at 22.2% versus 19.5% (Estimate: 21.6%)

Net profit up 24.6% at Rs 526 crore versus Rs 422 crore (Estimate: Rs 467.7 crore)

SRF sees price pressure from Chinese competitors, which may result in price adjustments for various products, Citi Research said. Its valuations are at 27 times one-year forward EV/Ebitda at the higher end of its past five-year range of 15–27 times, which will likely maintain upside for the stock.

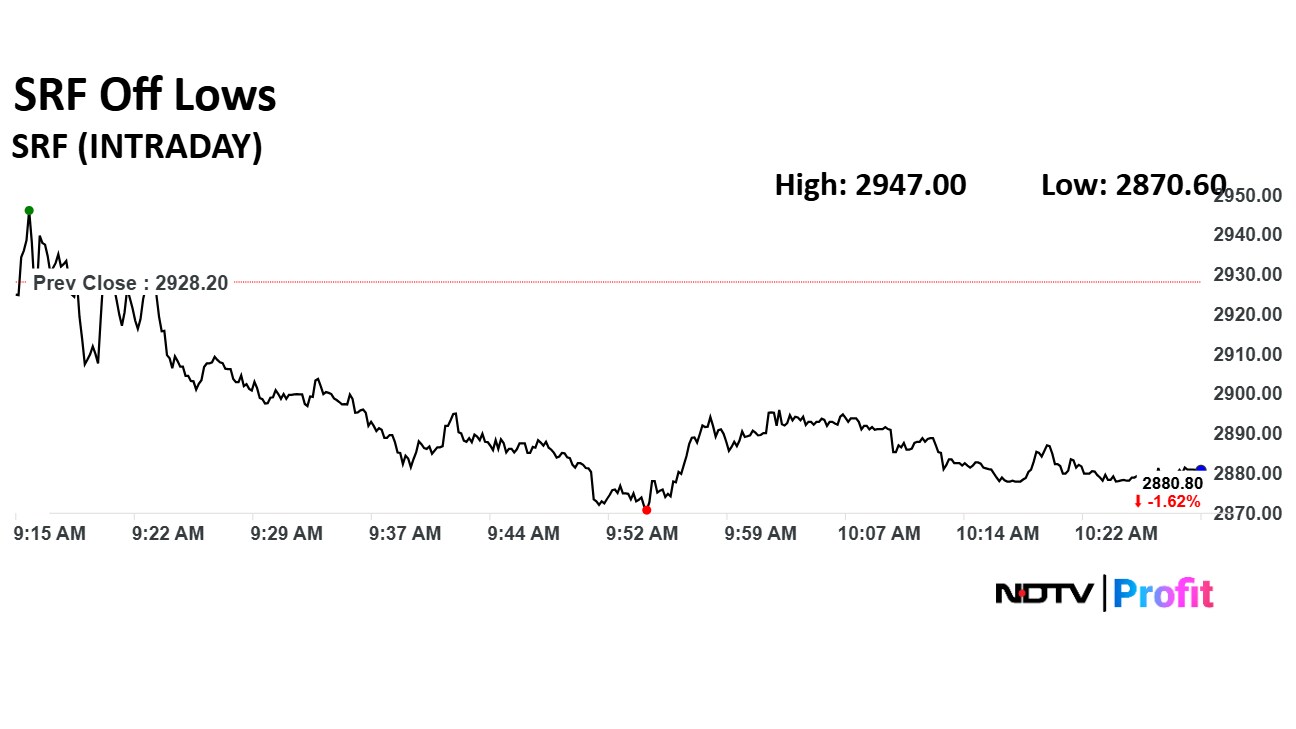

SRF share price fell 1.97% to Rs 2,870.60 apiece. It was trading 1.51% lower at Rs 2,883.90 apiece as of 10:34 a.m., as compared to 0.58% advance in the NSE Nifty 50 index.

The scrip rose 26.28% in 12 months, and 28.9% on year-to-date basis. Total traded volume so far in the day stood at 2.3 times its 30-day average. Relative strength index was at 45.03.

Out of 33 analysts tracking the company, 15 maintain a 'buy' rating, eight recommend a 'hold,' and 10 suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 0.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.