.png?downsize=773:435)

Ramkrishna Forgings Ltd.'s consolidated net profit jumped more than twofold in the second quarter of the current financial year, according to an exchange filing on Thursday.

The company posted a profit of Rs 190 crore as compared to Rs 82.2 crore in the year-ago period. The spike was driven by a one-time gain of Rs 95 crore on account of a sale of subsidiary Globe All India Services Ltd. to Yatra Online Ltd. during the September quarter.

Ramkrishna Forgings' revenue during the period under review climbed 17% to Rs 1,054 crore, compared to Rs 899 crore in the corresponding quarter of the previous fiscal.

The earnings before interest, taxes, depreciation and amortisation grew 16% to Rs 233 crore from Rs 200 crore in the year-ago quarter. The Ebitda margin slipped to 22.1% from 22.3%.

During the September quarter, Ramkrishna Forgings received a significant order inflow, amounting to Rs 1,522 crore, which will be executed over a period of four years across various geographies and segments, Managing Director Naresh Jalan said.

"In addition to sustained momentum in order wins, we are engaging more deeply with our existing and prospective customers to offer comprehensive solutions," Jalan said. "The addition of capacity and capabilities will ensure that we are well positioned to enhance wallet share across our customer set even as we build out several new offerings and further diversify the industries we serve."

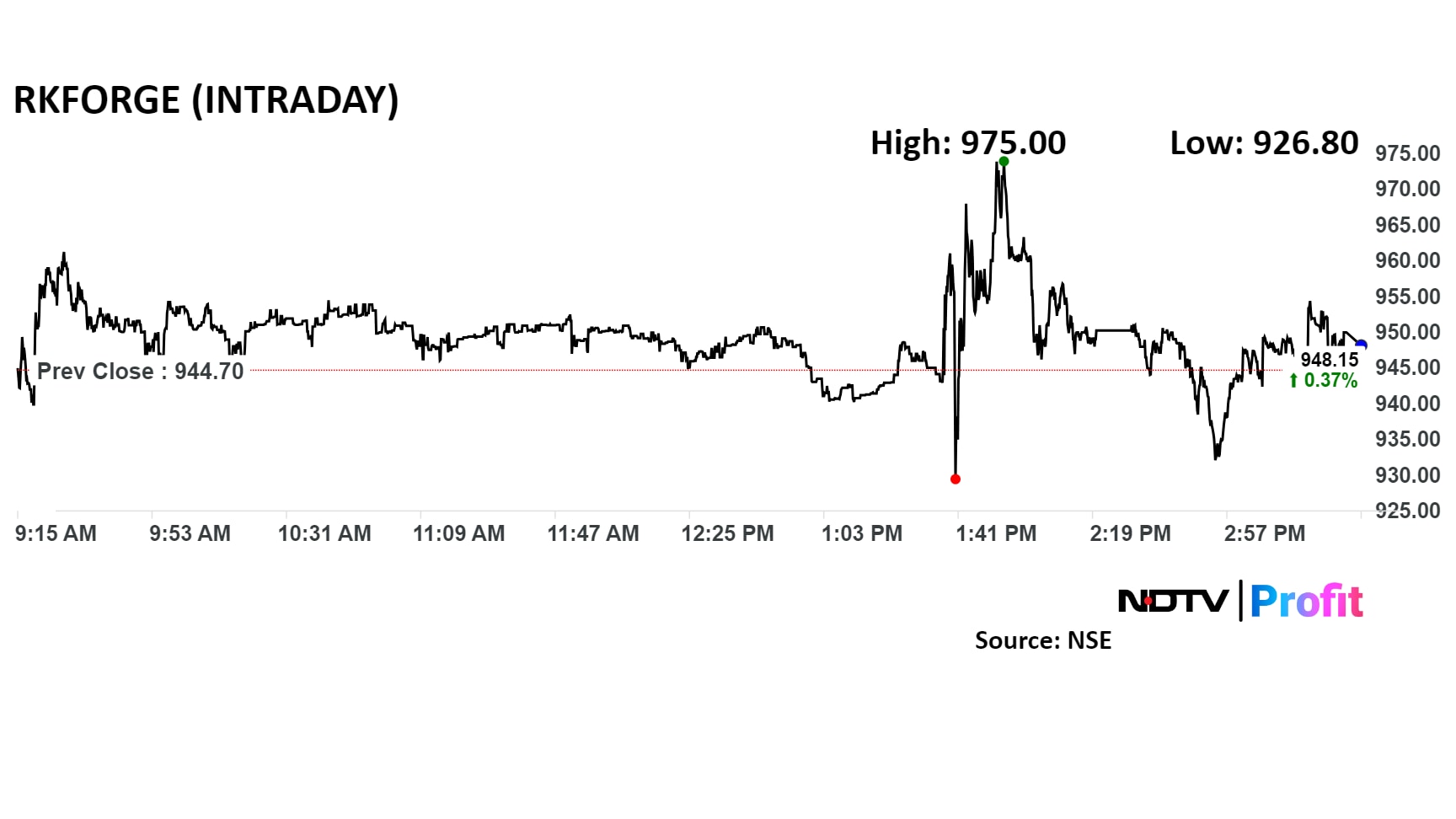

Ramkrishna Forgings' shares traded mixed after the Q2 results were out.

Shares of Ramkrishna Forgings settled 0.56% higher at Rs 950 apiece on the NSE at the closing bell. In comparison, the benchmark Nifty 50 settled 0.15% lower.

The company's stock has risen 30.9% on a year-to-date basis and 50.4% over the past 12 months.

Five out of the eight analysts tracking the stock have a 'buy' rating, and three suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' price targets implies a potential upside of 11%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.