That's a wrap on the all the corporate earnings for the day. Thanks for following the blog through this day buzzing with big names and results.

Big names across sectors like Hero Motor, Eicher Motors, Voltas along others are schedued to post their second quarter earnings tomorrow. Don't forget to follow NDTV Profit's live coverage of all the latest earnings!

Thank you and good night!

Lemon Tree Hotels Q2 Highlights (Consolidated, YoY)

Net Profit increased by 16.7% at Rs 34.6 crore versus Rs 29.6 crore.

Revenue grew by 7.7% at Rs 306 crore versus Rs 284 crore.

Ebitda remained flat at Rs 131 crore, signaling challenges in operating expense management.

Margin compressed to 42.7% versus 46%.

General Insurance Corp Q2 Highlights (Consolidated, YoY)

Net Premium Earned was nearly flat, increasing only 0.4% at Rs 8,925 crore versus Rs 8,887 crore.

Net Profit surged by 54.8% at Rs 2,874 crore versus Rs 1,856 crore.

Galaxy Surfactants Q2 Highlights (Consolidated, YoY)

Revenue saw strong growth of 24.8% at Rs 1,326 crore versus Rs 1,063 crore.

Ebitda decreased by 13.4% at Rs 111 crore versus Rs 128 crore.

Margin compressed significantly to 8.3% versus 12%.

Net Profit declined by 21.5%, reaching Rs 66.5 crore versus Rs 84.7 crore.

Prestige Estates Q2 Highlights (Consolidated, YoY)

Revenue was up 5.5% at Rs 2,432 crore versus Rs 2,304 crore.

Ebitda jumped by 44.1% at Rs 910 crore versus Rs 631 crore.

Margin expanded sharply to 37.4% versus 27.4%.

Net Profit more than doubled, hitting Rs 430 crore versus Rs 192 crore.

Senco Gold Q2 Highlights (Consolidated, YoY)

Revenue showed moderate growth of 2.4% at Rs 1,536 crore versus Rs 1,500 crore.

Ebitda soared over 100%, nearly doubling at Rs 106 crore versus Rs 51.8 crore.

Margin nearly doubled to 6.9% versus 3.5%.

Net Profit quadrupled, reaching Rs 48.7 crore versus Rs 12 crore.

Cochin Shipyard Q2 Highlights (Consolidated, YoY)

Revenue was largely flat, showing a marginal decline of 2.2% at Rs 1,119 crore versus Rs 1,143 crore.

Ebitda was down 62.7% at Rs 73.6 crore versus Rs 197 crore.

Margin narrowed sharply to 6.6% versus 17.3%.

Net Profit was down by 43.1% at Rs 108 crore versus Rs 189 crore.

Techno Electric Q2 Highlights (Consolidated, YoY)

Revenue saw explosive growth of 91.1% at Rs 843 crore versus Rs 441 crore.

Ebitda grew significantly by 58.5% at Rs 111 crore versus Rs 70.2 crore.

Margin narrowed to 13.2% versus 15.9%.

Net Profit increased by a strong 10.3% at Rs 104 crore versus Rs 94.2 crore.

Travel Food Services Q2 Highlights (Consolidated, YoY)

Revenue showed a significant decline of 28.9% at Rs 356 crore versus Rs 500 crore.

Ebitda decreased by 15.5% at Rs 135 crore versus Rs 160 crore.

Margin saw a sharp improvement to 38.0% versus 32.0%.

Net Profit decreased by 10.6% at Rs 95.7 crore versus Rs 107 crore.

IRCTC Q2 Highlights (Consolidated, YoY)

Revenue recorded a stable increase of 7.7% at Rs 1,146 crore versus Rs 1,064 crore.

Ebitda grew by 8.4% at Rs 404 crore versus Rs 373 crore.

Margin saw a marginal improvement to 35.3% versus 35.0%, indicating continued strong operational control.

Net Profit increased by 11% at Rs 342 crore versus Rs 308 crore.

Corporate Action

IRCTC announced an Interim Dividend of Rs 5 per share.

The company has fixed November 21 as the Record Date for the payment of the Interim Dividend.

Nazara Tech Q2 Highlights (Consolidated, YoY)

Revenue showed phenomenal growth, surging by 65.1% at Rs 526 crore versus Rs 319 crore.

Ebitda saw an increase at Rs 59.8 crore versus Rs 25.1 crore.

Margin expanded to 11.4% versus 7.9%.

Net Loss of Rs 29.4 crore, swinging from a Net Profit of Rs 23.8 crore in the year-ago quarter.

Sansera Engineering Q2 Highlights (Consolidated, YoY)

Revenue saw steady growth of 8.1% at Rs 825 crore versus Rs 763 crore.

EBITDA increased by 7.5% at Rs 143 crore versus Rs 133 crore.

Margin remained largely flat with a marginal contraction to 17.3% versus 17.4%.

Net Profit delivered the standout performance, surging by 38.4% at Rs 71.4 crore versus Rs 51.6 crore.

Endurance Tech Q2 Highlights (Consolidated, YoY)

Revenue was up by 16.5% at Rs 2,678 crore versus Rs 2,300 crore.

Ebitda grew modestly by 7.9% at Rs 322 crore versus Rs 299 crore.

Margin saw a slight contraction to 12% versus 13%.

Net Profit growth was at 1.5% at Rs 188 crore versus Rs 185 crore.

Cupid Q2 Highlights (Consolidated, YoY)

Revenue showed massive growth, jumping to Rs 84.4 crore versus Rs 41.6 crore.

Ebitda saw dramatic growth, climbing to Rs 28.4 crore versus Rs 10.4 crore.

Margin expanded significantly to 33.7% versus 24.9%.

Net Profit soared to Rs 24.1 crore versus Rs 10 crore.

Entro Healthcare Q2 Highlights (Consolidated, YoY)

Revenue surged by 20.8% at Rs 1,571 crore versus Rs 1,301 crore.

Ebitda increasing by 46.3% at Rs 61.9 crore versus Rs 42.3 crore.

Margin expanded to 3.9% versus 3.3%, indicating increased operational efficiency.

Net Profit grew by 34% at Rs 31.6 crore versus Rs 23.6 crore.

Elgi Equipment Q2 Highlights (Consolidated, YoY)

Revenue grew by 11.4% at Rs 968 crore versus Rs 869 crore.

Net Profit surged by 28.2% at Rs 121 crore versus Rs 94.7 crore.

Ebitda saw a marginal decline of 1.2% at Rs 140 crore versus Rs 142 crore.

Margin compressed to 14.5% versus 16.3%, indicating a slight increase in operating costs relative to revenue.

HG Infra Q2 Highlights (Consolidated, YoY)

Revenue remained virtually flat, increasing by only 0.2% at Rs 905 crore versus Rs 902 crore.

Ebitda declined by 6.1% at Rs 206 crore versus Rs 220 crore.

Margin fell to 22.8% versus 24.3%, indicating cost or execution pressure.

Net Profit dropped sharply by 35.4% at Rs 52.1 crore versus Rs 80.7 crore.

Deepak Nitrite Q2 Highlights (Consolidated, YoY)

Revenue saw a decline of 6.4% at Rs 1,902 crore versus Rs 2,032 crore.

Ebitda fell by 31.4% at Rs 204 crore versus Rs 298 crore.

Margin stood at 10.7% versus 14.6%.

Net Profit dropped significantly by 38.9% at Rs 119 crore versus Rs 194 crore.

Cohance Life Q2 Highlights (Consolidated, YoY)

Revenue declined by 8% to Rs 556 crore versus Rs 604 crore.

Ebitda fell by 41.1% at Rs 121 crore versus Rs 205 crore.

Margin stood at 21.8% versus 34%.

Net Profit dropped by 46.5% at Rs 74.1 crore versus Rs 139 crore.

Data Patters Q2 Highlights (Consolidated, YoY)

Revenue surged to Rs 308 crore compared to Rs 91 crore.

Ebitda soared by 99.6% at Rs 68.5 crore versus Rs 34.3 crore.

Margin stood at 22.3% versus 37.7%

Net Profit grew by 62.4% at Rs 49.2 crore versus Rs 30.3 crore.

Thomas Cook Q2 Highlights (Consolidated, YoY)

Revenue up 3.5% to Rs 2,074 crore versus Rs 2,004 crore.

Ebitda down 13.3% to Rs 108 crore versus Rs 125 crore.

Margin to 5.2% versus 6.2%.

Net profit up 2.5% to Rs 66.4 crore versus Rs 64.8 crore.

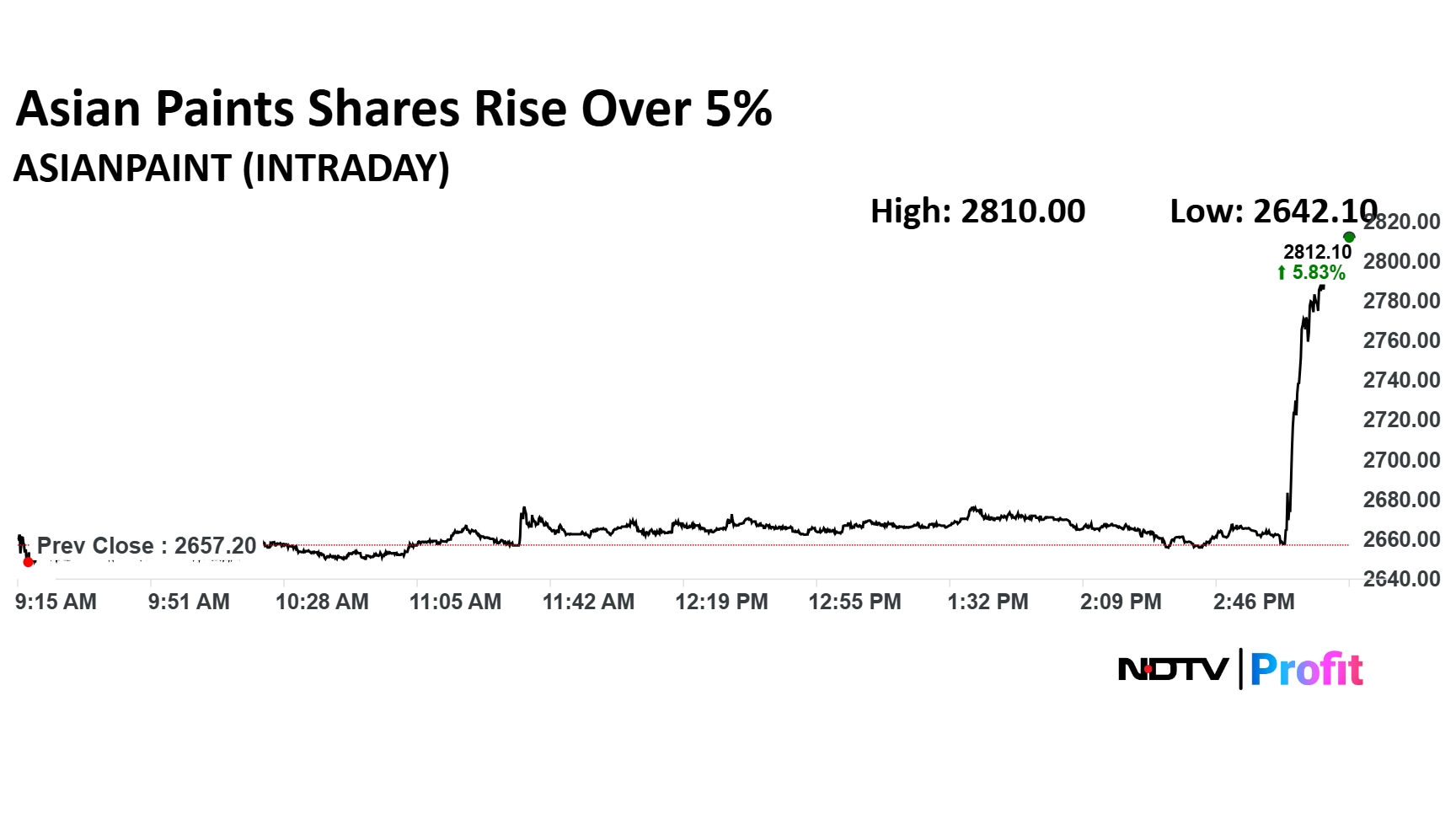

Input Costs and Raw Materials

Raw material prices are generally expected to remain stable.

Management cautioned that geopolitical uncertainty may weigh on input costs in the future.

Demand and Market Environment

The overall demand environment for the paints industry is currently characterized as "not great."

Competitive intensity remains high in the market.

Potential demand boosters include a good monsoon and the upcoming wedding season.

Growth & Strategy Outlook

The company expects mid-single-digit value growth moving forward.

The gap between value growth and volume growth is anticipated to be around 4-5%.

Management will focus more on premium and luxury emulsion segments to specifically drive higher value growth.

Q2 volume growth was primarily driven by focused marketing initiatives.

Ircon International Q2 Highlights (Consolidated, YoY)

Revenue down 19.2% to Rs 1,977 crore versus Rs 2,448 crore.

Ebitda down 29.7% to Rs 141 crore versus Rs 201 crore.

Margin to 7.1% versus 8.2%.

Net profit down 32.7% to Rs 139 crore versus Rs 206 crore.

LLoyds Metals Q2 Highlights (Consolidated, QoQ)

Revenue up 53.2% to Rs 3,651 crore versus Rs 2,384 crore.

Ebitda up 31.3% to Rs 1,043 crore versus Rs 794 crore.

Margin to 28.6% versus 33.3%.

Net profit down 10.8% to Rs 572 crore versus Rs 642 crore.

DCX Systems Q2 Highlights (Consolidated, YoY)

Revenue down 1.4% to Rs 193 crore versus Rs 196 crore.

Ebitda Loss to Rs 13 crore versus Loss of Rs 5.8 crore.

Net Loss to Rs 9 crore versus Profit of Rs 5.2 crore.

Hindustan Foods Q2 Highlights (Consolidated, YoY)

Revenue grew by a strong 17.6% at Rs 1,039 crore versus Rs 883 crore.

Ebitda increased by 22.8% at Rs 85.8 crore versus Rs 69.9 crore.

Ebitda Margin improved to 8.3% versus 7.9%.

Net Profit surged by 53.7% at Rs 35.2 crore versus Rs 22.9 crore.

Ashina Housing Q2 Highlights (Consolidated, YoY)

Revenue to Rs 166 crore versus Rs 54.4 crore.

Ebitda to Rs 29.4 crore versus Loss of Rs 11.8 crore.

Margin at 17.7%.

Net profit to Rs 27.6 crore versus Loss of Rs 7.5 crore.

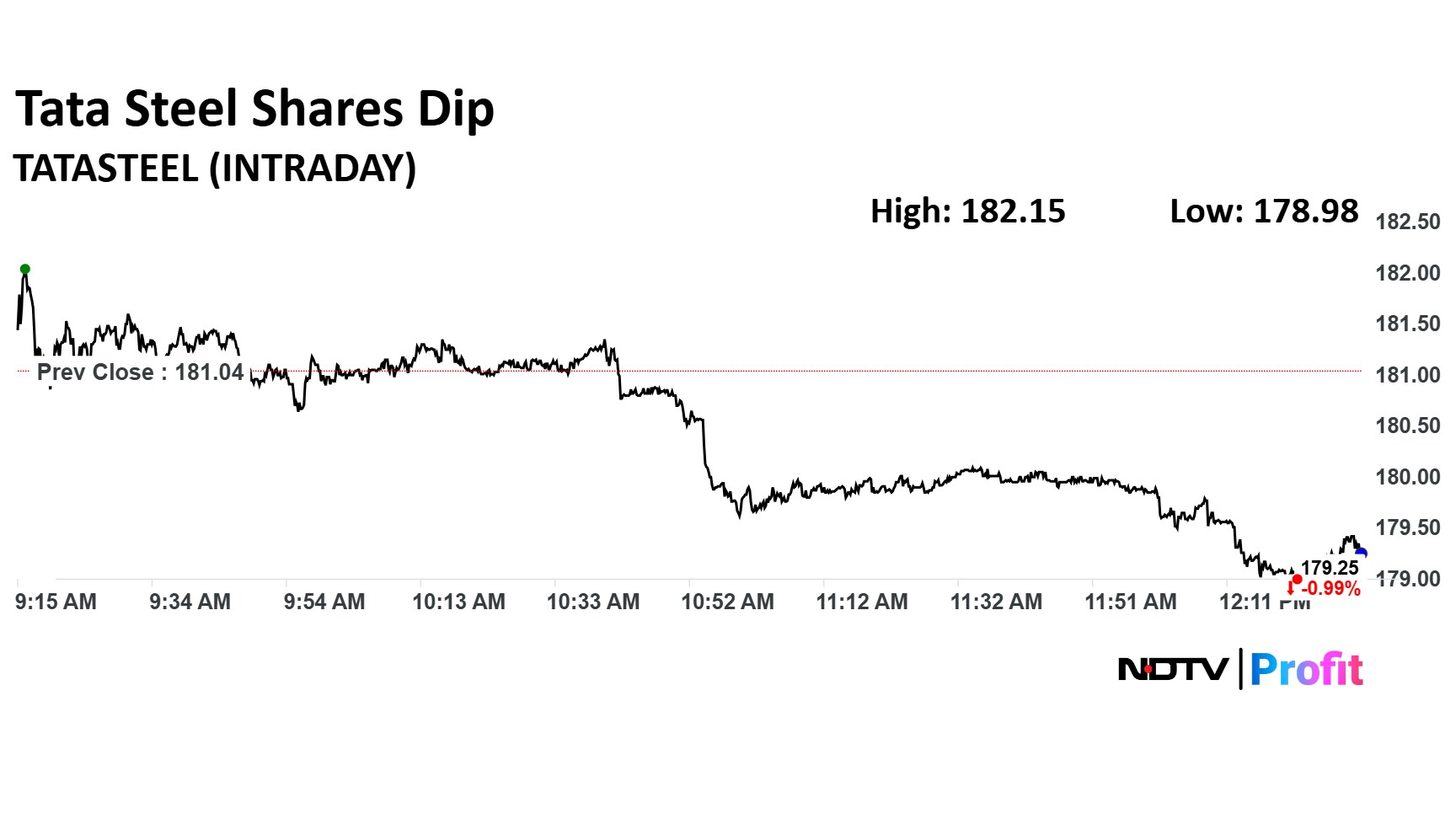

Tata Steel Q2 Highlights (Consolidated, QoQ)

Revenue up 10.4% at Rs 58,689 crore versus Rs 53,178 crore.

Ebitda up 19.8% at Rs 8,897 crore versus Rs 7,427 crore.

Margin at 15.2% versus 14.0%.

Net Profit up 49.3% at Rs 3,102 crore versus Rs 2,078 crore.

Ramkrishna Forgings Q2 Highlights (Consolidated, YoY)

Revenue down 13.9% to Rs 908 crore versus Rs 1,054 crore.

Ebitda down 26% to Rs 123 crore versus Rs 166 crore.

Margin to 13.5% versus 15.7%.

Net Loss of Rs 9.5 crore versus a Profit of Rs 140 crore.

Afcons Infra Q2 Highlights (Consolidated, YoY)

Revenue up 1% to Rs 2,988 crore versus Rs 2,960 crore.

Ebitda down 4.6% to Rs 328 crore versus Rs 344 crore.

Margin to 11% versus 11.6%.

Net Profit down 22.2% to Rs 105 crore versus Rs 135 crore.

Gabriel India Q2 Highlights (Consolidated, YoY)

Revenue up 14.9% to Rs 1,180 crore versus Rs 1,027 crore.

Ebitda up 14.5% to Rs 113 crore versus Rs 98.5 crore.

Margin Flat At 9.6%.

Net Profit up 9.7% to Rs 69 crore versus Rs 62.9 crore.

Additional Update

To Pay interim dividend of Rs 1.9 per share.

Man Infra Q2 Highlights (Consolidated, YoY)

Revenue down 35.4% to Rs 149 crore versus Rs 230 crore.

Ebitda up 32.7% to Rs 36.6 crore versus Rs 27.6 crore.

Margin to 24.6% versus 12%.

Net Profit up 27% to Rs 60 crore versus Rs 47.3 crore.

Supriya Life Q2 Highlights (YoY)

Revenue up 20.3% to Rs 200 crore versus Rs 166 crore (YoY).

Ebitda up 12.3% to Rs 72.7 crore versus Rs 64.7 crore (YoY).

Margin to 36.4% versus 39% (YoY).

Net Profit up 9.3% to Rs 50.4 crore versus Rs 46.2 crore (YoY).

FIEM Industries Q2 Highlights (Consolidated, YoY)

Revenue up 16.8% to Rs 715 crore versus Rs 612 crore.

Ebitda up 22.7% to Rs 99 crore versus Rs 80.7 crore.

Margin to 13.8% versus 13.2%.

Net Profit up 26.8% to Rs 63.7 crore versus Rs 50.2 crore.

Honasa Consumer Q2 Highlights (Consolidated, YoY)

Revenue showed strong growth, rising 16.5% to Rs 538 crore versus Rs 462 crore.

EBITDA turned positive at Rs 47.6 crore versus a loss of Rs 30.8 crore YoY.

Ebitda Margin stood at 8.8%.

Massive swing to a profit of Rs 39.2 crore compared to a loss of Rs 18.5 crore in the same quarter last year.

Pfizer Q2 Highlights (YoY)

Revenue rose 9.1% to Rs 642 crore versus Rs 589 crore.

Ebitda increased 21.5% to Rs 230 crore versus Rs 189 crore.

Ebitda Margin improved to 35.8% from 32.2%.

Net Profit was up 19.4% to Rs 189 crore versus Rs 158 crore.

SpiceJet Q2 Highlights (Consolidated, YoY)

Revenue down 13.4% to Rs 792 crore versus Rs 915 crore.

Ebitda Loss widens 15.7% to Rs 435 crore versus Loss of Rs 376 crore.

EBITDAR Loss widens 70.5% to Rs 416 crore versus Loss of Rs 244 crore.

Net Loss widens 35.6% to Rs 621 crore versus Loss of Rs 458 crore.

Dredging Corp Q2 Highlights (YoY)

Revenue up 3.6% to Rs 212 crore versus Rs 205 crore.

Ebitda to Rs 25 crore versus Ebitda Loss of Rs 1.5 crore.

Ebitda Margin to 11.8%.

Net Loss widens 2.1% to Rs 34.2 crore versus Loss of Rs 33.5 crore.

PN Gadgil Q2 Highlights (Consolidated, YoY)

Revenue up 8.8% to Rs 2,178 crore versus Rs 2,001 crore.

Ebitda up 97.8% to Rs 107 crore versus Rs 54.1 crore.

Margin at 4.9% versus 2.7%.

Net Profit up 127.2% to Rs 79.3 crore versus Rs 34.9 crore.

Varroc Engineering Q2 Highlights (Consolidated, YoY)

Revenue up 6.1% to Rs 2,207 crore versus Rs 2,081 crore.

Ebitda up 0.4% to Rs 208 crore versus Rs 201 crore.

Margin at 9.1% versus 9.7%.

Net Profit up 9.5% to Rs 60.9 crore versus Rs 55.6 crore.

Shivalik Bimetal Q2 Highlights (Consolidated, QoQ)

Revenue up 0.6% to Rs 137 crore versus Rs 137 crore.

Ebitda down 2.8% to Rs 31.1 crore versus Rs 32 crore.

Margin at 22.6% versus 23.4%.

Net Profit up 9.1% to Rs 24.9 crore versus Rs 22.8 crore.

Asian Paints Q2 Segment Highlights

International business sales up 9.9% to Rs 846.0 crore.

Bath Fittings business (Home Décor) sales down 4.7% to Rs 79.3 crore.

Kitchen business (Home Décor) sales down 7.2% to Rs 97.7 crore versus Rs 105.3 crore.

White Teak sales down 15.2% to Rs 26.4 crore.

Asian Paints Q2 Highlights (Consolidated, Year-over-Year)

Revenue up 6.3% to Rs 8,531 crore versus Rs 8,028 crore.

Ebitda up 21.3% to Rs 1,503 crore versus Rs 1,240 crore.

Margin to 17.6% versus 15.4%.

Net Profit up 43% to Rs 994 crore versus Rs 695 crore.

Announced interim dividend of Rs 4.5 per share.

Sudarshan Chemical Industries Q2 Highlights (Cons, YoY)

Net Profit down 60.9% to Rs 11.7 crore versus Rs 29.9 crore.

Revenue rises to Rs 2,387 crore versus Rs 696 crore.

Ebitda up 31.5% at Rs 132 crore versus Rs 101 crore.

Margin at 5.5% versus 14.4%.

Vadilal Industries Q2 Highlights (Cons, YoY)

Net Profit declines 14.3% to Rs 33.4 crore versus Rs 39 crore.

Revenue rises 15.5% to Rs 341 crore versus Rs 296 crore.

Ebitda falls 15.3% at Rs 51.3 crore versus Rs 60.6 crore.

Margin at 15% versus 20.5%.

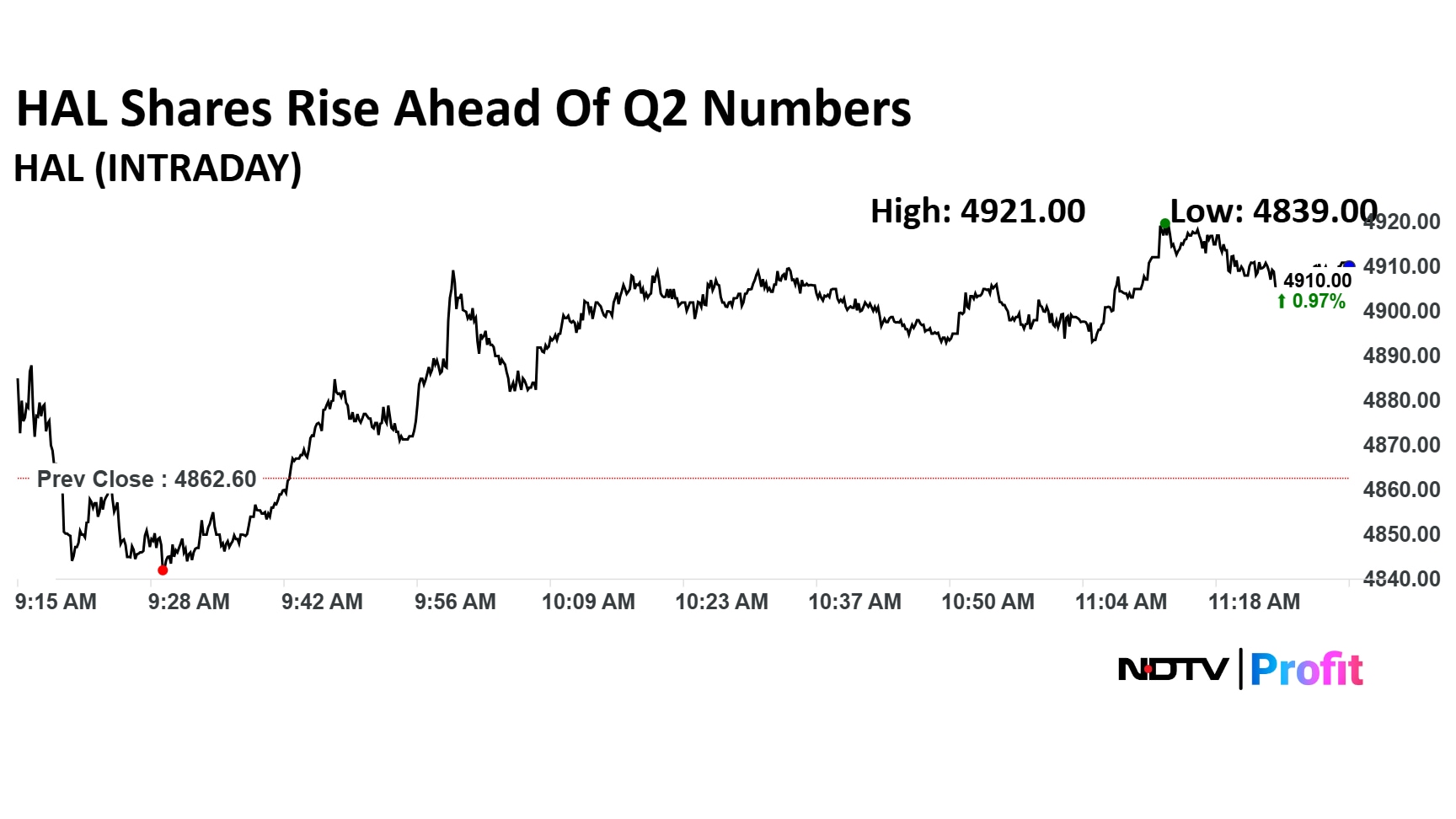

HAL Q2 Highlights (Cons, YoY)

Revenue up 10.9% to Rs 6,628.61 crore versus Rs 5,976.29 crore.

Net Profit up 10% to Rs 1,669.07 crore versus Rs 1,510.48 crore.

Ebitda down 5% to Rs 1,557.89 crore versus Rs 1,639.96 crore.

Margin at 23.5% versus 27.4%.

Info Edge Q2 Highlights (Cons, QoQ)

Net Profit rises 6.9% at Rs 316 crore versus Rs 296 crore.

Revenue rises 1.8% at Rs 805 crore versus Rs 791 crore.

EBIT rises 6.6% at Rs 249 crore versus Rs 234 crore.

Margin at 30.9% versus 29.5%.

Mrs Bector Q2 Highlights (Cons, YoY)

Net Profit falls 6.2% at Rs 36.5 crore versus Rs 38.9 crore.

Revenue rises 11.1% at Rs 551 crore versus Rs 496 crore.

Ebitda declines 1.4% at Rs 69.3 crore versus Rs 70.3 crore.

Margin at 12.6% versus 14.2%.

Hi-Tech Q2 Highlights (Cons, YoY)

Net Profit rises 11.9% at Rs 20.3 crore versus Rs 18.1 crore.

Revenue up 21.7% at Rs 859 crore versus Rs 706 crore.

Ebitda up 5.1% at Rs 44.3 crore versus Rs 42.2 crore.

Margin at 5.2% versus 6%.

Ashok Leyland Q2 Highlights (YoY)

Revenue up 9.3% to Rs 9,588.18 crore versus Rs 8,768.83 crore.

Net Profit flat at Rs 771.06 crore versus Rs 770.10 crore.

Ebitda up 14% to Rs 1,162.16 crore versus Rs 1,017.30 crore.

Margin at 12.1% versus 11.6%

Goldiam International Q2 Highlights (Cons, YoY)

Revenue up 40.8% at Rs 193 crore versus Rs 137 crore

Net Profit up 41.8% at Rs 31.4 crore versus Rs 22.1 crore

Ebitda up 25.6% at Rs 38.3 crore versus Rs 30.5 crore

Margin at 20% versus 22.3%

Welspun Living Q2 Highlights (Cons, YoY)

Revenue down 15% at Rs 2,441 crore versus Rs 2,873 crore

Net Profit down 93.5% at Rs 13 crore versus Rs 201 crore

Ebitda down 57% at Rs 153 crore versus Rs 358 crore

Margin at 6.3% versus 12.4%

Century Plyboards Q2 Highlights (Cons, YoY)

Revenue up 17.1% at Rs 1,386 crore versus Rs 1,184 crore

Net Profit up 72.4% at Rs 68.9 crore versus Rs 40 crore

Ebitda up 56.9% at Rs 175 crore versus Rs 111 crore

Margin at 12.6% versus 9.4%

Eris Lifesciences Q2 Highlights (Cons, YoY)

Revenue up 6.9% at Rs 792 crore versus Rs 741 crore

Net Profit up 31.1% at Rs 120 crore versus Rs 91.7 crore

Ebitda up 9% at Rs 288 crore versus Rs 265 crore

Margin at 36.4% versus 35.7%

Globus Spirits Q2 Highlights (Cons, YoY)

Revenue down 3.6% at Rs 661 crore versus Rs 638 crore

Net Profit at Rs 22 crore versus Rs 1.4 crore

Ebitda up 93% at Rs 59.4 crore versus Rs 30.8 crore

Margin at 9% versus 4.8%

Shriram Properties Q2 Highlights (Cons, YoY)

Revenue up 46% at Rs 205 crore versus Rs 141 crore

Net Profit at Rs 8.6 crore versus loss of Rs 80 lakh

Ebitda loss at Rs 5.1 crore versus loss of Rs 1.2 crore

IRB Infra Q2 Highlights (Cons, YoY)

Revenue up 10.4% at Rs 1,751 crore versus Rs 1,586 crore

Net Profit up 41.1% at Rs 141 crore versus Rs 99.8 crore

Ebitda up 20.6% at Rs 925 crore versus Rs 767 crore

Margin at 52.8% versus 48.3%

Insecticides India Q2 Highlights (Cons, YoY)

Revenue up 1.8% at Rs 638 crore versus Rs 627 crore

Net Profit down 3.7% at Rs 59.1 crore versus Rs 61.4 crore

Ebitda down 0.2% at Rs 89.5 crore versus Rs 89.7 crore

Margin at 14% versus 14.3%

West Coast Paper Q2 Highlights (Cons, YoY)

Revenue down 0.2% at Rs 1,043 crore versus Rs 1,045 crore

Net Profit down 80.4% at Rs 17.5 crore versus Rs 89.1 crore

Ebitda down 52% at Rs 68 crore versus Rs 142 crore

Margin at 6.5% versus 13.6%

Precision Wires Q2 Highlights (Cons, YoY)

Revenue up 18% at Rs 1,226 crore versus Rs 1,038 crore

Net Profit up 84.8% at Rs 35.6 crore versus Rs 19.3 crore

Ebitda up 63% at Rs 59 crore versus Rs 36.2 crore

Margin at 4.8% versus 3.5%

Jtekt India Q2 Highlights (Cons, YoY)

Revenue up 5.6% at Rs 639 crore versus Rs 605 crore

Net Profit down 6.4% at Rs 18.2 crore versus Rs 19.5 crore

Ebitda down 2.1% at Rs 46.3 crore versus Rs 47.3 crore

Margin at 7.2% versus 7.8%

Campus Activewear Q2 Highlights (Cons, YoY)

Revenue up 16% at Rs 387 crore versus Rs 333 crore

Net Profit up 40% at Rs 20 crore versus Rs 14.3 crore

Ebitda up 30.7% at Rs 49.9 crore versus Rs 38.2 crore

Margin at 12.9% versus 11.5%

Tarsons Products Q2 Highlights (Cons, YoY)

Revenue up 3% at Rs 102 crore versus Rs 99.2 crore

Net Profit down 68% at Rs 3.3 crore versus Rs 10.3 crore

Ebitda up 9% at Rs 27.5 crore versus Rs 25.2 crore

Margin at 26.9% versus 25.4%

Jyothy Labs Q2 Highlights (Cons, YoY)

Revenue up 0.4% at Rs 736 crore versus Rs 733 crore

Net Profit down 16.4% at Rs 87.8 crore versus Rs 105 crore

Ebitda down 14.5% at Rs 118 crore versus Rs 138 crore

Margin at 16.1% versus 18.9%

Tata Steel is estimated to generate revenue of Rs 55,898 crore and an Ebitda of Rs 8,185 crore, resulting in a margin of 14.6%, while net profit is pegged at Rs 2,740 crore.

Shares of Tata Steel are trading marginally lower, ahead of the company's earnings announcement.

Tata Steel is estimated to generate revenue of Rs 55,898 crore and an Ebitda of Rs 8,185 crore, resulting in a margin of 14.6%, while net profit is pegged at Rs 2,740 crore.

Shares of Tata Steel are trading marginally lower, ahead of the company's earnings announcement.

Ashok Leyland expected to post a standalone revenue of Rs 9,564 crore and an Ebitda of Rs 1,129 crore, implying a margin of 11.8% with net profit estimated at Rs 724 crore.

The company reported a 13% year-on-year growth in net profit for the first quarter. Standalone net profit rose to Rs 593.70 crore versus Rs 525.50 crore year-on-year, while revenue was up 1.5% to Rs 8,724.50 crore.

Shares of defence-major Hindustan Aeronautics were trading marginally higher ahead of the company's Q2 results announcement on Wednesday. HAL's shares were up nearly 1% at Rs 4,910.90 apiece, as of 11:30 a.m.

Shares of defence-major Hindustan Aeronautics were trading marginally higher ahead of the company's Q2 results announcement on Wednesday. HAL's shares were up nearly 1% at Rs 4,910.90 apiece, as of 11:30 a.m.

According to Bloomberg consensus estimates, Asian Paints is projected to report a revenue of Rs 8,157 crore with an Ebitda of Rs 1,341 crore, reflecting a margin of 16.4% and a net profit of Rs 887 crore.

Advanced Enzyme Technologies Q2 Highlights (Cons, YoY)

Revenue up 26.3% at Rs 185 crore versus Rs 146 crore

Net Profit up 32% at Rs 43.3 crore versus Rs 32.8 crore

Ebitda up 41.5% at Rs 60 crore versus Rs 42.4 crore

Margin at 32.5% versus 29%

Hello and welcome to NDTV Profit's live coverage of the second-quarter earnings season. Various players are set to announce their performance for the second quarter today. These include key names such as Hindustan Aeronautics, Tata Steel, Asian Paints and Ashok Leyland among others.

This is your front-row seat to the earnings action, so stay with us for real-time updates, analysis of the numbers, and all the key details that companies will be putting out through the day!

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.