Net Profit up 2% at Rs 51.5 crore versus Rs 50.5 crore (Cons, YoY)

Revenue up 3.4% at Rs 3,832 crore versus Rs 3,705 crore (Cons, YoY)

Ebitda up 10.9% at Rs 76.7 crore versus Rs 69.2 crore (Cons, YoY)

Margin At 2% versus 1.9% (Cons, YoY)

Net Profit down 60.7% At Rs 11 crore versus Rs 28 crore (Cons, YoY)

Revenue down 9.3% at Rs 700 crore versus Rs 771 crore (Cons, YoY)

Ebitda down 50.4% at Rs 37 crore versus Rs 74.6 crore (Cons, YoY)

Margin At 5.3% versus 9.7% (Cons, YoY)

Net Profit at Rs 236 crore versus Rs 96.9 crore (Cons, YoY)

Calculated NII up 57.5% at Rs 480 crore versus Rs 305 crore (Cons, YoY)

Net Profit up 1.6% at Rs 1,349 crore versus Rs 1,328 crore (Cons, YoY)

Calculated NII up 3.3% at Rs 2,048 crore versus Rs 1,981 crore (Cons, YoY)

Net Profit down 64.8% at Rs 46.5 crore versus Rs 132 crore (Cons, YoY)

Revenue down 3% at Rs 2,053 crore versus Rs 2,117 crore (Cons, YoY)

Ebitda down 43% At Rs 130 crore versus Rs 227 crore (Cons, YoY)

Margin At 6.3% versus 10.7% (Cons, YoY)

Net Profit up 4.7% At Rs 76.1 crore versus Rs 72.6 crore (YoY)

Revenue up 12.8% At Rs 951 crore versus Rs 843 Cr (YoY)

EBITDA up 19.5% At Rs 154 crore versus Rs 129 crore (YoY)

Margin At 16.2% versus 15.3% (YoY)

To Pay Interim Dividend Of Rs 1/Share

NTPC Green Highlights (Cons, YoY)

Net Profit at Rs 87.5 crore versus Rs 38 crore (Cons, YoY)

Revenue up 21.5% At Rs 612 crore versus Rs 504 crore (Cons, YoY)

Ebitda up 26.1% At Rs 529 crore versus Rs 420 crore (Cons, YoY)

Margin At 86.5% Vs 83.3% (Cons, YoY)

Net Loss At Rs 3.1 crore versus profit of Rs 13 crore (Cons, YoY)

Revenue up 37% at Rs 283 crore versus Rs 206 crore (Cons, YoY)

Ebitda loss At Rs 3.7 crore versus profit of Rs 17.9 crore (Cons, YoY)

Brigade Enterprises Highlights (Cons, YoY)

Net Profit up 36.7% at Rs 163 crore Rs 119 crore

Revenue up 29% at Rs 1,383 crore versus Rs 1,072 crore

Ebitda up 12.3% at Rs 328 crore versus Rs 292 crore

Margin at 23.7% versus 27.2%

SAIL Q2 Highlights (Consolidated, QoQ)

Revenue up 3% At Rs 26,704 crore versus Rs 2,5922 crore

Net Profit down 43.8% At Rs 419 Cr versus Rs 745 crore

Ebitda down 8.7% at Rs 2,528 crore versus Rs 2,769 crore

Margin At 9.5% Vs 10.7%

HPCL Q2 Highlights (Consolidated, QoQ)

Net Profit down 12.4% at Rs 3,830 crore versus Rs 4,371 crore

Revenue down 9% at Rs 1.01 lakh crore versus Rs 1.11 lakh crore

Ebitda down 9.3% at Rs 6,891 crore versus Rs 7,602 crore

Margin at 6.8% versus 6.9%

Net Profit down 27.4% At Rs 15.4 crore versus Rs 21.2 crore (YoY)

NII up 43.1% At Rs 32.5 crore versus Rs 22.7 crore

Operating Profit down 18.2% At Rs 21.2 crore versus Rs 25.9 crore (YoY)

Satin Creditcare Highlights (Cons, YoY)

Net Profit up 18.9% at Rs 53.2 crore versus Rs 44.7 crore

Revenue up 19.9% at Rs 788 crore verus Rs 657 crore

Ebitda up 24.3% at Rs 415 crore versus Rs 334 crore

Margin At 52.7% versus 50.8%

Mahanagar Gas Q2 Highlights (Consolidated, QoQ)

Net Profit down 40% at Rs 191 crore versus Rs 318 crore (Cons, QoQ)

Revenue down 1.1% At Rs 2,050 crore versus Rs 2,083 crore (Cons, QoQ)

Ebitda down 32.5% At Rs 338 crore versus Rs 501 crore (Cons, QoQ)

Margin At 16.5% versus 24% (Cons, QoQ)

Revenue down 5.9% at Rs 236 crore versus Rs 250 crore

Ebitda 18.7% down at Rs 15.8 crore versus Rs 19.4 crore

Margin at 6.7% versus 7.7%

Net Profit down 61.2% at Rs 1.6 crore versus Rs 4.2 crore

Astec Lifesciences (Cons, YoY)

Net Loss at Rs 24.4 crore versus loss of Rs 38.6 crore

Revenue down 25.2% at Rs 73.7 crore versus Rs 98.5 crore

Ebitda Loss At Rs 6.7 crore versus loss Of Rs 19.7 crore

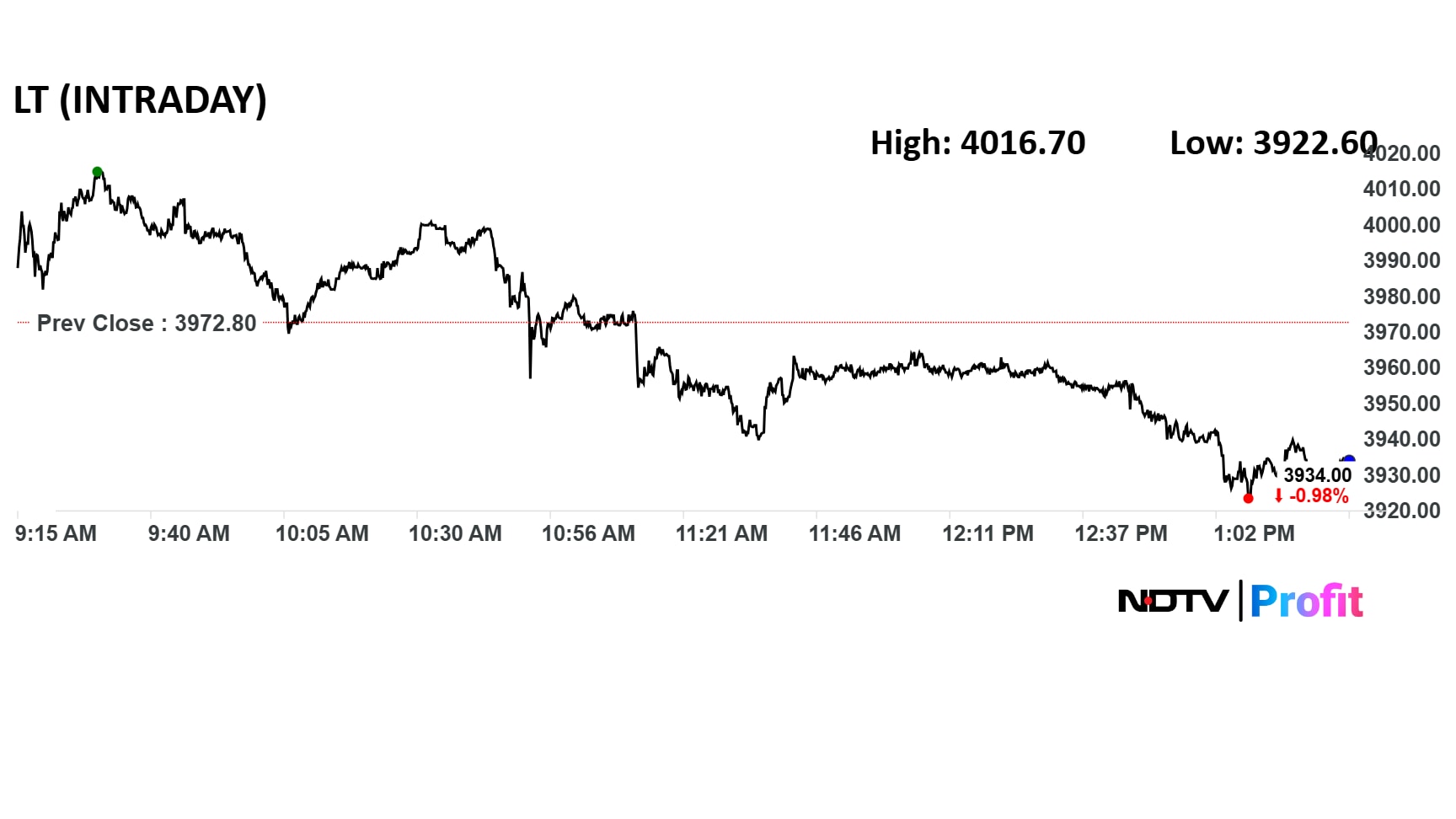

Order inflow of Rs 52,686 crore, up 6% YoY

Order book stood at Rs 3,94,706 crore

Revenue down 1% YoY at Rs 31,759 crore due to slower progress in water related projects

Ebitda margin stood at 6.3% vs 6.0%

L&T Q2 Highlights (Cons, YoY)

Revenue up 10.44% at Rs 69367.81 crore versus Rs 61554.58 crore

Ebitda 6.98% up at Rs 6806.41 versus Rs 6362.04

Margin at 10.01% versus 10.33%

Net Profit up 15.63% at Rs 3926.09 versus Rs 3395.29

BHEL Q2 Highlights ( Cons, YoY)

Revenue up 14.1% At Rs 7,512 crore versus Rs 6,584 crore(Cons, YoY)

Net Profit at Rs 375 crore versus Rs 106 crore (Cons, YoY)

Ebitda at Rs 581 crore versus Rs 275 crore (Cons, YoY)

Margin at 7.7% versus 4.2% (Cons, YoY)

PB Fintech Q2 Highlights (YoY)

Net Profit at Rs 135 crore versus Rs 50.7 crore (Cons, YoY)

Revenue up 38.2% at Rs 1,614 Cr Vs Rs 1,167 Cr (Cons, YoY)

Ebitda At Rs 97.8 crore Vs Loss Of Rs 7.8 crore(Cons, YoY)

Margin At 6.1%

Revenue down 7.5% to Rs 1,205 crore versus Rs 1,121 crore.

Ebitda up 8.2% to Rs 127 crore versus Rs 117 crore.

Margin at 10.5% versus 10.4%.

Net profit up 24.5% to Rs 59.2 crore versus Rs 47.6 crore.

Revenue down 6.7% to Rs 336 crore versus Rs 360 crore.

Ebitda up 16.3% to Rs 78.6 crore versus Rs 67.6 crore.

Margin at 23.4% versus 18.8%.

Net profit up 24.5% to Rs 59.2 crore versus Rs 47.6 crore.

NMDC Steel Q2 Highlights (Consolidated, QoQ)

Revenue up 0.7% to Rs 3,390 crore versus Rs 3,365 crore.

Ebitda down 50.4% to Rs 207 crore versus Rs 417 crore.

Margin at 6.1% versus 12.4%.

Net loss of Rs 115 crore versus net profit of Rs 25.6 crore.

Mold-Tek Pckaging Q2 Highlights (Consolidated, YoY)

Revenue up 9.6% to Rs 210 crore versus Rs 191 crore.

Ebitda up 16.5% to Rs 39.1 crore versus Rs 33.6 crore.

Margin at 18.6% versus 17.5%.

Net profit up 9.7% to Rs 15.5 crore versus Rs 14.1 crore.

CG Power Q2 Highlights (Consolidated, YoY)

Revenue up 21.1% to Rs 2,923 crore versus Rs 2,413 crore.

Ebitda up 27.8% to Rs 377 crore versus Rs 295 crore.

Margin at 12.9% versus 12.2%.

Net profit up 29.8% to Rs 287 crore versus Rs 221 crore.

To set up greenfield switchgear plant in Western India.

Estimated project cost for switchgear plant at Rs 748 crore.

Heidelberg Cement Q2 Highlights (YoY)

Revenue up 10.9% to Rs 512 crore versus Rs 461 crore.

Ebitda up 53.5% to Rs 57.4 crore versus Rs 37.4 crore.

Margin at 11.2% versus 8.1%.

Net profit up 122.3% to Rs 24.9 crore versus Rs 11.2 crore.

CG Power Q2 Highlights (Consolidated, YoY)

Revenue up 21.1% to Rs 2,923 crore versus Rs 2,413 crore.

Ebitda up 27.8% to Rs 377 crore versus Rs 295 crore.

Margin at 12.9% versus 12.2%.

Net profit up 29.8% to Rs 287 crore versus Rs 221 crore.To set up greenfield switchgear plant in Western India.

Estimated project cost for switchgear plant at Rs 748 crore.

APL Apollo Tubes Q2 Highlights (Consolidated, QoQ)

Revenue up 0.7% to Rs 5,206 crore versus Rs 5,170 crore.

Ebitda up 20.2% to Rs 447 crore versus Rs 372 crore.

Margin at 8.6% versus 7.2%.

Net profit up 27.1% to Rs 302 crore versus Rs 237 crore.

Delivered steady performance in the quarters.

Saw healthy traction in international market.

Indian operations impacted owing to rainfall.

On base business, competition is good and healthy.

In next 5 years, expect the market to double or triple.

On Rs 10 price point, believe this is an aggressive price point.

V-Guard Industries Q2 Highlights (Consolidated, YoY)

Revenue up 3.6% to Rs 1,341 crore versus Rs 1,294 crore.

Ebitda down 0.8% to Rs 109 crore versus Rs 110 crore.

Margin at 8.2% versus 8.5%.

Net profit up 3% to Rs 65.3 crore versus Rs 63.4 crore.

Sanofi India Q2 Highlights (YoY)

Revenue down 9.3% to Rs 475 crore versus Rs 524 crore.

Ebitda up 12% to Rs 134 crore versus Rs 120 crore.

Margin at 28.2% versus 22.8%.

Net profit down 7.5% to Rs 76 crore versus Rs 82.2 crore.

To pay interim dividend of Rs 75 per share.

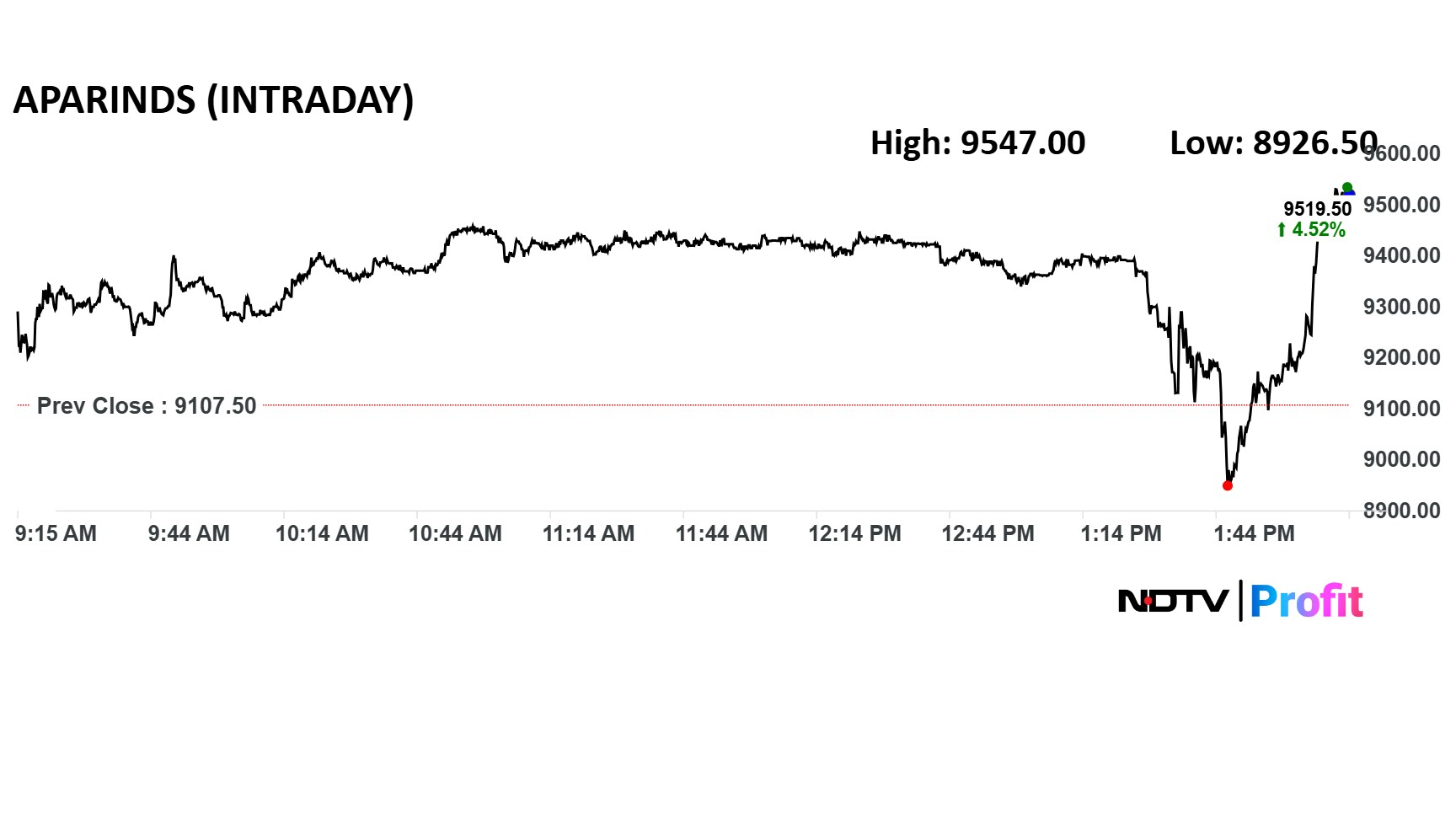

Apar Industries Q2FY26 Results (Consolidated, YoY)

Revenue up 23% at Rs 5,715 crore versus Rs 4,645 crore

EBITDA up 29.3% at Rs 461 crore versus Rs 357 crore

Margin at 8.1% versus 7.8%

Net Profit up 30% at Rs 252 crore versus Rs 194 crore

Apar Industries Q2FY26 Results (Consolidated, YoY)

Revenue up 23% at Rs 5,715 crore versus Rs 4,645 crore

EBITDA up 29.3% at Rs 461 crore versus Rs 357 crore

Margin at 8.1% versus 7.8%

Net Profit up 30% at Rs 252 crore versus Rs 194 crore

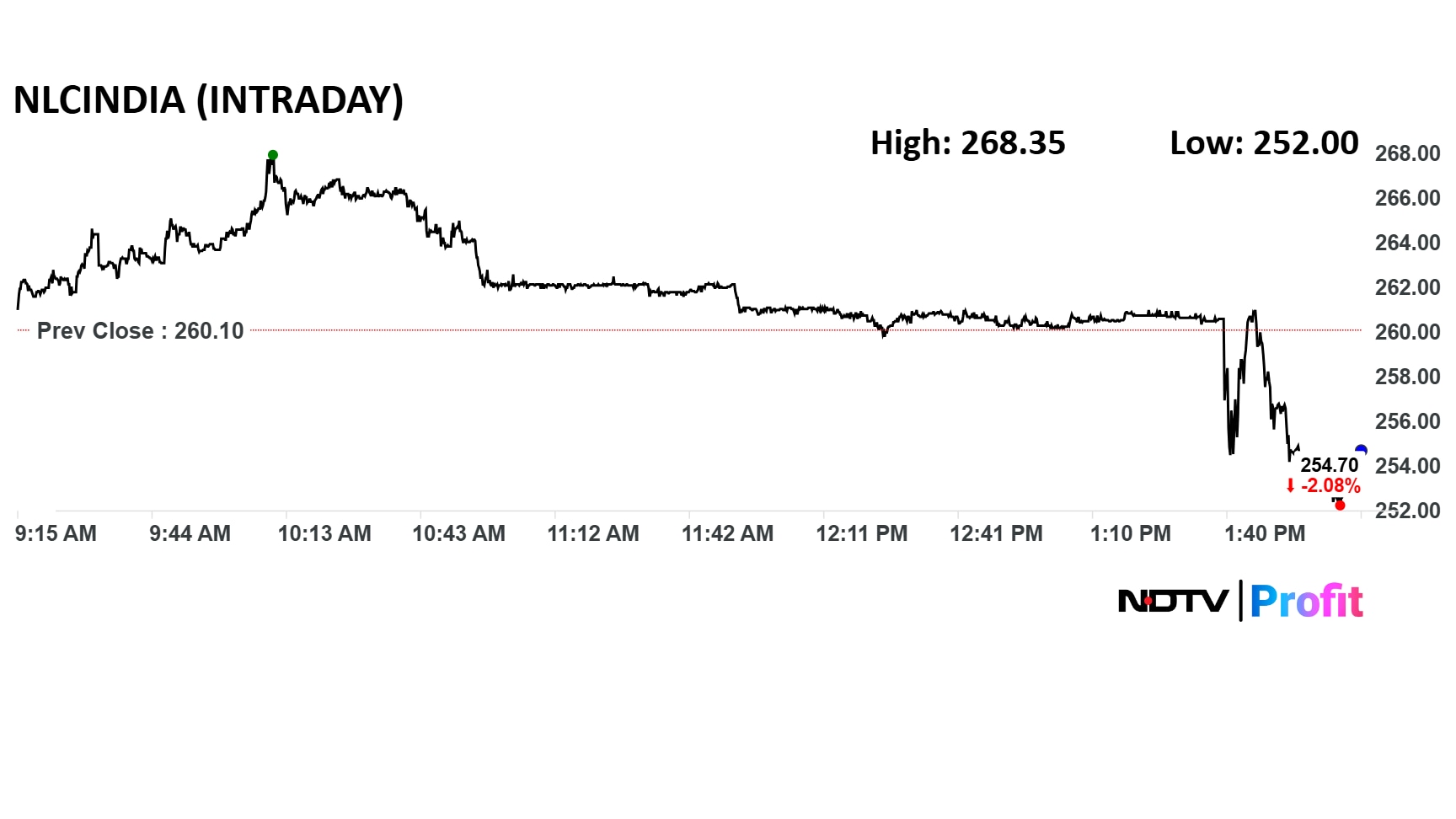

NLC India to invest Rs 666 crore in NLC India Renewables.

NLC India Q2FY26 Results (Consolidated, YoY)

Revenue up 14.2% at Rs 4,178 crore versus Rs 3,657 crore

EBITDA up 30.5% at Rs 1,400 crore versus Rs 1,073 crore

Margin At 33.5% Vs 29.3%

Net Profit down 27% at Rs 665 crore versus Rs 912 crore

NLC India Q2FY26 Results (Consolidated, YoY)

Revenue up 14.2% at Rs 4,178 crore versus Rs 3,657 crore

EBITDA up 30.5% at Rs 1,400 crore versus Rs 1,073 crore

Margin At 33.5% Vs 29.3%

Net Profit down 27% at Rs 665 crore versus Rs 912 crore

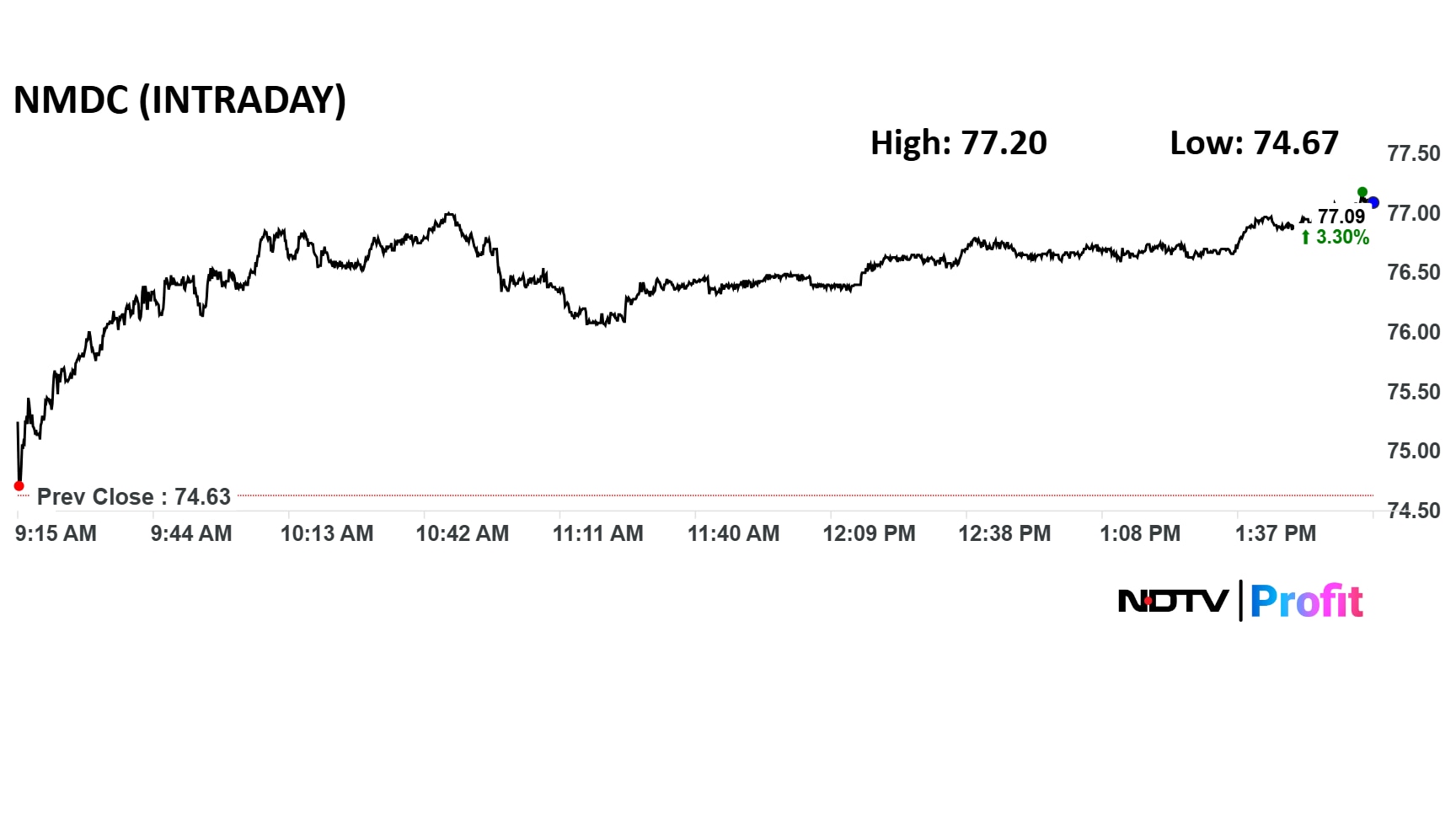

NMDC Q2FY26 Results (Consolidated, QoQ)

Revenue down 5.4% at Rs 6,378 crore versus Rs 6,739 crore

EBITDA down 19.6% at Rs 1,993 crore versus Rs 2,478 crore

Margin at 31.3% versus 36.8%

Net Profit down 14.5% at Rs 1,683 crore versus Rs 1,967 crore

NMDC Q2FY26 Results (Consolidated, QoQ)

Revenue down 5.4% at Rs 6,378 crore versus Rs 6,739 crore

EBITDA down 19.6% at Rs 1,993 crore versus Rs 2,478 crore

Margin at 31.3% versus 36.8%

Net Profit down 14.5% at Rs 1,683 crore versus Rs 1,967 crore

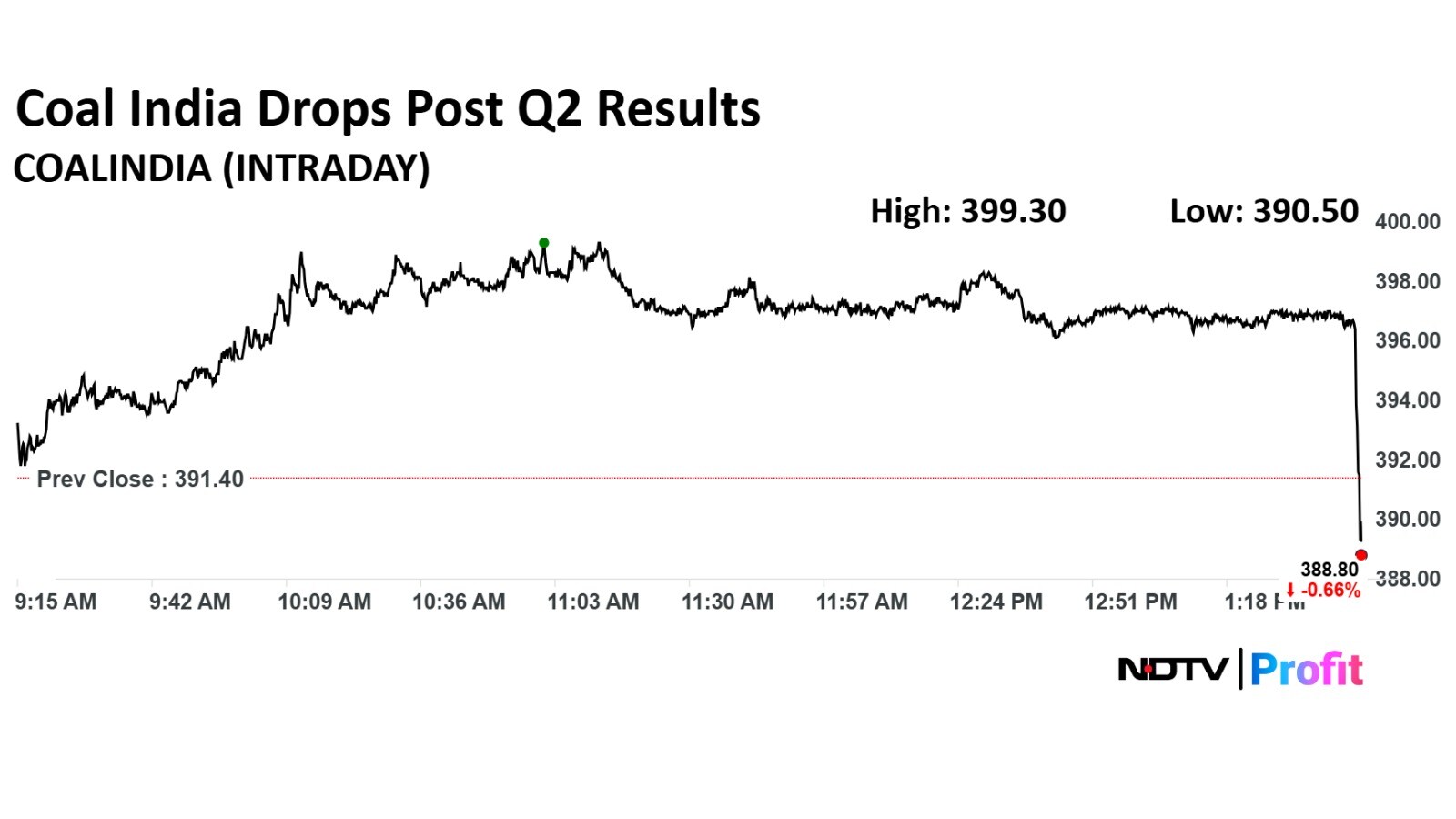

Coal India declared a second interim dividend for the FY26 at Rs 10.25 per equity share. The company has fixed Tuesday, Nov. 4 as the record date for the purpose of determining the eligibility of shareholders. The payment will be made by Nov. 28.

Coal India Q2FY26 Results (Consolidated, QoQ)

Revenue down 16% at Rs 30,187 crore versus Rs 30,394 crore (Bloomberg estimate: Rs 30,394.36 crore)

Ebitda down 46% at Rs 6,716 crore versus Rs 12,521 crore (Bloomberg estimate: Rs 8,409 crore)

Margin at 22.2% versus 34.9% (Bloomberg Estimate 27.7%)

Net profit down 50% at Rs 4,263 versus Rs 8,743 crore (Bloomberg estimate: Rs 5,692 crore)

Coal India Q2FY26 Results (Consolidated, QoQ)

Revenue down 16% at Rs 30,187 crore versus Rs 30,394 crore (Bloomberg estimate: Rs 30,394.36 crore)

Ebitda down 46% at Rs 6,716 crore versus Rs 12,521 crore (Bloomberg estimate: Rs 8,409 crore)

Margin at 22.2% versus 34.9% (Bloomberg Estimate 27.7%)

Net profit down 50% at Rs 4,263 versus Rs 8,743 crore (Bloomberg estimate: Rs 5,692 crore)

Varun Beverages Q3 Highlights (Consolidated, YoY)

Revenue up 2% to Rs 4,897 crore versus Rs 4,805 crore.

Ebitda down 0.3% to Rs 1,147 crore versus Rs 1,151 crore.

Margin at 23.4% versus 24%.

Net profit up 19.5% to Rs 741 crore versus Rs 620 crore.

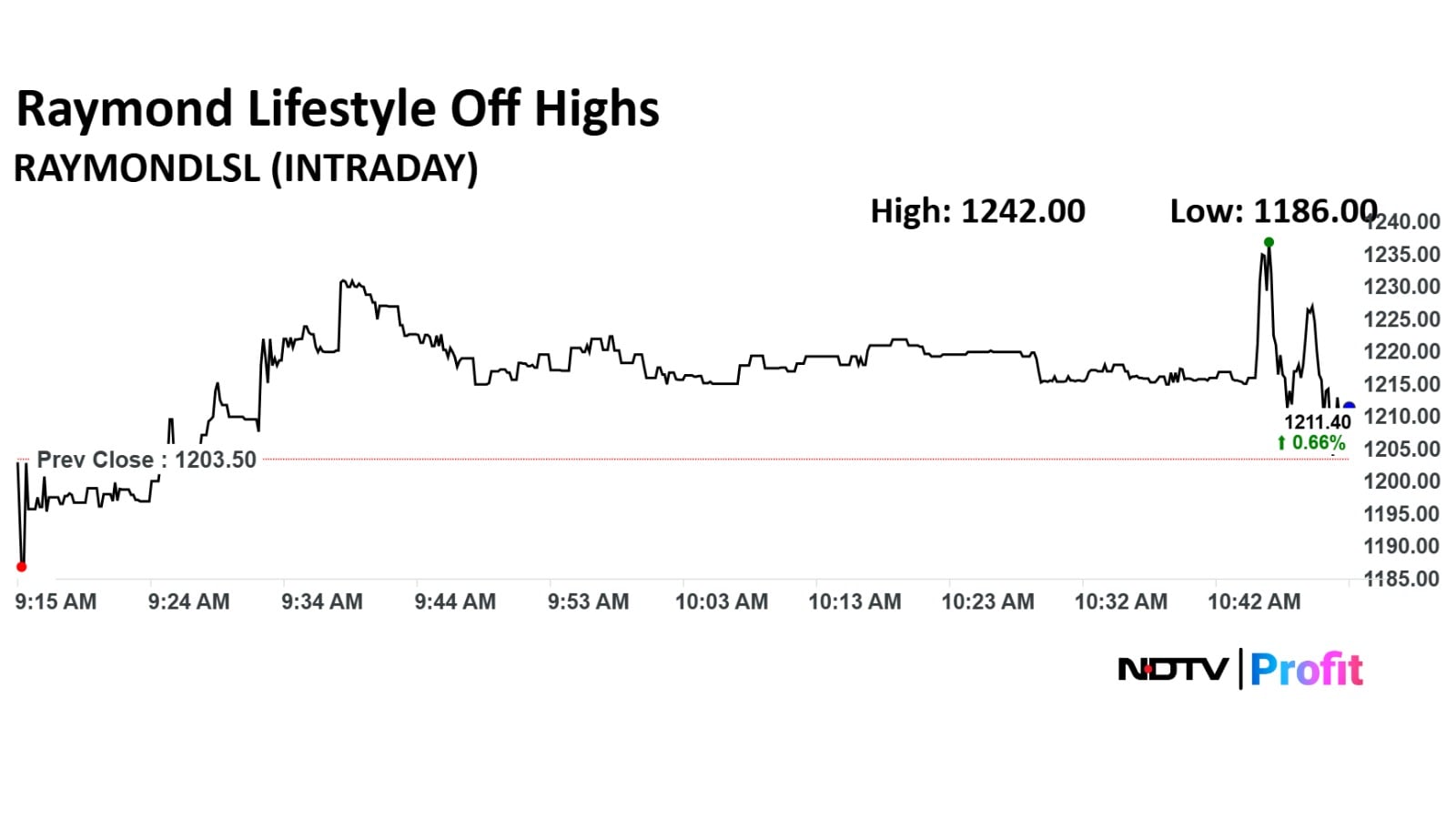

Raymond Lifestyle Q2 Highlights (Consolidated, YoY)

Revenue up 7.3% to Rs 1,832 crore versus Rs 1,708 crore.

Ebitda up 5.2% to Rs 226 crore versus Rs 215 crore.

Margin at 12.3% versus 12.6%.

Net profit up 78.3% to Rs 75.2 crore versus Rs 42.2 crore.

Hello and welcome to NDTV Profit's live coverage of the second-quarter earnings season. Various players are set to announce their performance for the second quarter.

Today is the most packed day for heavyweights from the Infrastructure and Capital Goods segments. The market will keenly watch the performance of EPC giant Larsen & Toubro Ltd (L&T) and the country's dominant coal miner, Coal India Ltd. Oil Marketing Company (OMC) Hindustan Petroleum Corporation Ltd (HPCL) also reports.

Other notable companies include Bharat Heavy Electricals Ltd and beverage majors United Breweries Ltd and Varun Beverages Ltd.

This is your front-row seat to the earnings action, so stay with us for real-time updates, analysis of the numbers, and all the key details that companies will be putting out through the day!

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.