What The RBI Hopes To Achieve By Extending Forex Trading Hours

What The RBI Hopes To Achieve By Extending Forex Trading Hours

An internal working group of the Reserve Bank of India has proposed longer trading hours for the foreign exchange markets, as a way to counter the growing influence of offshore markets.

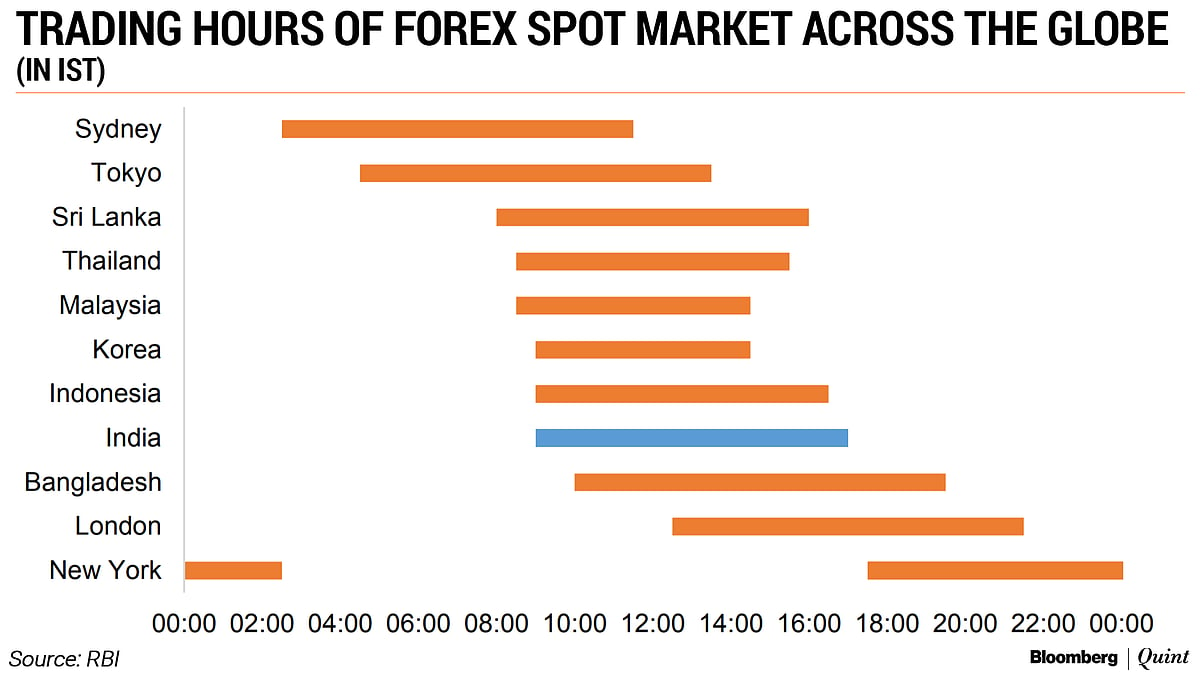

The draft report, released on Wednesday, suggested that timings for both the over-the-counter and exchange traded currency derivative markets be extended. These markets should function from 9 a.m. to 9 p.m. instead of the current 9 a.m. to 5 p.m., the committee suggested.

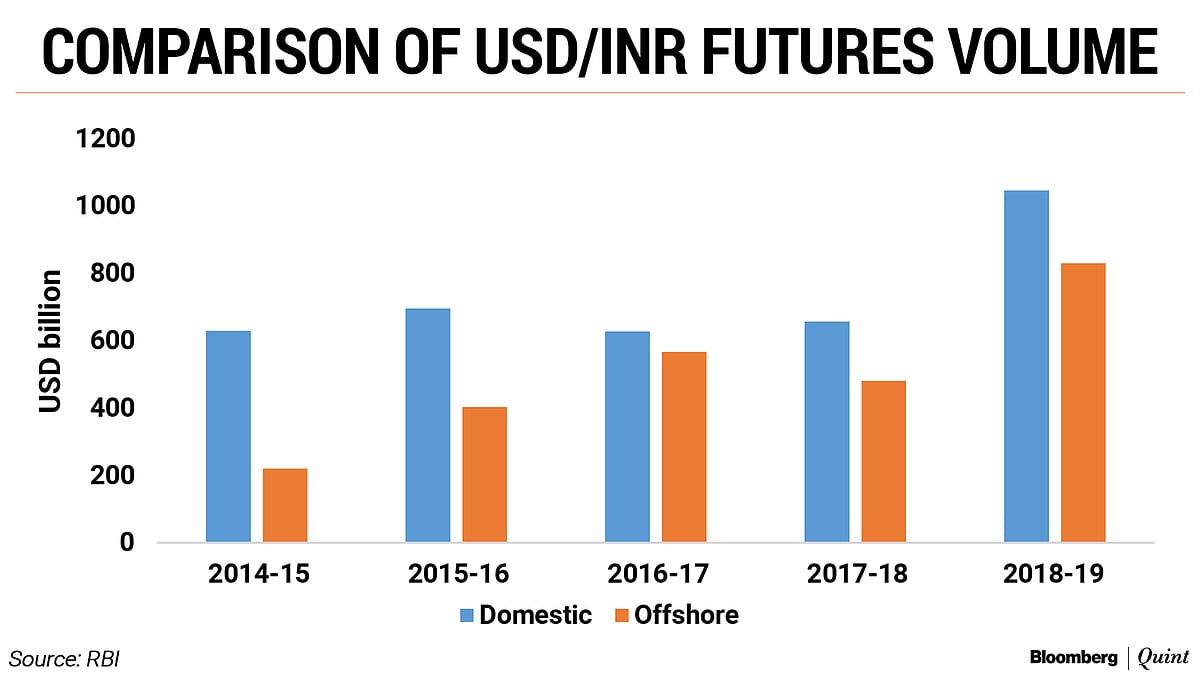

A key reason behind the recommendation, the committee said, was the increasing volume of transactions in the offshore markets. The market share of domestic exchanges in U.S. Dollar/Indian Rupee futures has fallen from about 74 percent in 2014-15 to 56 percent in 2018- 19. Offshore markets for non-deliverable forwards have also seen sizeable growth, stated the report.

Offshore markets provide several advantages such as ease of capital flows, a conducive tax environment, convenience, enabling regulatory environment and longer trading windows, noted the report.

While a separate committee, headed by former Deputy Governor Usha Thorat, is looking into broader aspects of the increasing dominance of the offshore forex markets, the RBI’s internal group suggested that timings for domestic trade could be extended as a start.

The extended trading hours would make it easier for clients to respond to international developments, which may take place before or after Indian trading hours.

Current market hours overlap with trading hours of Asian markets and half of a European trading day. However, Asian markets open before India opens and the US markets open after the close of Indian markets. Further, internationally, forex markets are quite active when New York and London times overlap, but the domestic Rupee market is closed during these hours, the report said.

Volume Boost With Higher Costs

The extension in market hours was a long standing demand of the industry, said Sajal Gupta, head of forex and rates at Edelweiss Securities.

Gupta agreed with the committee’s view that ending trading at 5 pm Indian Standard Time makes it difficult for clients to respond to news coming out of an important market like the U.S. This prompts more people to hedge their forex risks overseas as compared to in India.

About 40 to 50 percent of the volumes traded on forex derivatives is on overseas markets. A lot of offshore volume may shift back to India after the extension of market hours.Sajal Gupta, Associate Director, Forex & Rates, Edelweiss Securities.

Should forex derivative volumes start moving back onshore, the RBI’s ability to monitor and control the foreign exchange markets would improve, Gupta said.

To be sure, payment and settlement systems would need to gear up for the extended trading timings and manpower requirements across treasury departments of banks and brokerages would rise, Gupta added.

Bhaskar Panda, senior vice president in the treasury advisory group at HDFC Bank, said the move was more likely to help traders such as those in dealing in commodities as they are exposed to the overnight fluctuations in the dollar/rupee market. He agreed that the extended trading hours will help align India’s foreign exchange markets more closely with global markets.

Not everyone agrees that a timing change will make a substantial dent in offshore trading volumes.

If offshore markets have become large enough to challenge local markets, increasing trading timings alone may not work, said Kamal Mahajan, head of treasury and global markets at Bank of Baroda. Those markets are thriving for various other reasons, he said.

If a step is taken along with a move towards (fuller) capital account convertibility then it may be useful. By changing timing alone, a 5-10 percent rise in (domestic trading) volume wont justify the cost.Kamal Mahajan, Head - Treasury and Global Markets, Bank of Baroda.

Better Price Discovery

The committee report also showed that extension of trade timings could help make the domestic markets less prone to sharp price fluctuations. This, in turn, would help in better foreign exchange management.

Liberalisation of the Indian market has increased the rupee exposure of non-residents over time, noted the paper. As a result, it is found that the onshore exchange rate, especially in times of volatility, is guided by the price movements in offshore markets. Extended market hours could make domestic markets less prone to external price fluctuations, the report said.

To be sure, longer hours may also mean lower liquidity and fewer market participants, which could lead to price swings in off-peak trading hours, the report added.

According to Mahajan, extending trading timings only in the inter-bank market will mean poor liquidity but an extension across the board, including for retail clients, will be a costly affair.

“If we increase trading time purely for exchange traded derivatives, the cost is bearable. But if we are extending timings even for the OTC market, the cost is huge, he said.

The RBI’s internal working group has recommended a trading time extension across OTC and exchange traded derivatives to ensure parity.

The central bank has sought views on its draft report by July 31 before finalising its recommendations.