Striving towards a 15-20% Ebitda margins.

Expect FY26 exit Ebitda margins to be considerably better.

Believe payment business is profitable even without MDR.

Indirect expenses should not grow "anywhere close" to revenue growth.

Consumer credit business has likely bottomed.

United Breweries Q1 Earnings Key Highlights (Standalone, YoY)

Revenue rises 15.7% to Rs 2,862.42 crore versus Rs 2,472.95 crore.

Net Profit up 6% to Rs 183.71 crore versus Rs 173.28 crore.

Ebitda up 9% to Rs 310.52 crore versus Rs 284.74 crore.

Margin at 10.8% versus 11.5%.

Madhur Deora (President & Group CFO):

AI to be embedded in every customer product and internal process.

Low-hanging cost optimisations already done; further efficiency levers remain.

Indirect expenses to grow well below revenue pace.

Disciplined approach on expense management going forward.

No specific margin guidance, but expects “significant” Ebitda margin improvement by FY26-end.

Source: Con call

Vijay Shekhar Sharma (Founder & CEO):

GMV growth driven by UPI and new merchant additions.

Actively expanding merchant base; strong focus on deepening relationships.

Sees 4–5x growth potential in digital payments ahead.

No business dependence on possible MDR implementation.

No comment on MDR for large or small merchants.

Madhur Deora (President & Group CFO):

Card payments present a large growth opportunity.

Priority is to expand card machine footprint across markets.

Merchant payments remain the core business and key to Ebitda focus.

Source: Con call

Madhur Deora (President & Group CFO):

Other costs rose quarter-on-quarter, leading to higher DLG impact.

Collection costs declined year-on-year and quarter-on-quarter, as personal loan partnerships fell.

Contribution margin expected to stay in the 50s range.

Financial services may see some impact as focus shifts away from DLG.

Emphasises pushing new business initiatives over board responsibilities.

Source: Con call

ndian Railway Finance Corporation Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 2.2% to Rs 6,918.24 crore versus Rs 6,766.03 crore.

Net Profit up 11% to Rs 1,745.69 crore versus Rs 1,576.83 crore.

Dalmia Bharat Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 0.4% to Rs 3,636.00 crore versus Rs 3,621.00 crore.

Net Profit up 179% to Rs 393.00 crore versus Rs 141.00 crore.

Ebitda up 32% to Rs 883.00 crore versus Rs 669.00 crore.

Margin at 24.3% versus 18.5%.

Payments is a profitable, standalone bottom-line driver, says Vijay Shekhar Sharma Founder and CEO of Paytm

Net payment margin to rise, driven by credit cards and EMI products he added.

POS network has grown to ~1 million devices; gained market share in the past year.

Will continue investments in the POS business, said Shekhar Sharma.

Rise in merchant loans is a “needle mover”; DLG is not.

BNPL was discontinued due to unsecured nature, not performance.

Personal credit and BNPL expected to return.

Currently disbursing 30–40% of available partner loan capacity.

Company aims to build a healthy order book

Subcontracting costs expected to normalise going forward

Growth recorded in 11 of the last 12 quarters

Wage hike of $3 million to impact second quarter margins

Bullish on Europe with aggressive fiscal 26 targets

Confident about getting on track in Europe market

Vijay Shekhar Sharma Founder and CEO of Paytm said there is always room to cut costs, but not material in impact

Stayed with the same set of lenders in first quarter, he added.

From next quarter, no more ESOP line disclosures.

Adjusted Ebitda metric to be discontinued.

Source: Con call

Paytm expects contribution margin to be in the high 50s.

Striving towards 15-20% Ebitda in the next few years.

Contribution margin to aid Ebitda.

Growth in contribution should help Ebitda margin.

Source: Con call

Huhtamaki Q1 Earnings Key Highlights (YoY)

Net profit falls 35.3% to Rs 24.9 crore versus Rs 38.5 crore.

Revenue drops 4.3% to Rs 612 crore versus Rs 639 crore.

Ebitda rises 33.3% to Rs 42.6 crore versus Rs 32 crore.

Margin at 7% versus 5%.

Zensar Technologies TMT segment saw recovery, but uncertainty persists.

Company cautious about consistent growth in TMT ahead.

“Worst is behind us” for TMT, says management.

Source: Con call

CreditAccess Grameen Q1 Earnings Key Highlights (YoY)

Net Profit falls 84.9% to 60.2 crore versus Rs 398 crore.

Total Income falls 3.2% at Rs 1,464 crore versus Rs 1,513 crore.

Welspun Specilalty Q1 Earnings Key Highlights (Consolidated, YoY)

Net loss at Rs 8 lakh versus profit of Rs 2 crore.

Revenue rises 24.2% at Rs 201 crore versus Rs 162 crore.

Ebitda falls 60.4% to Rs 4.3 crore versus Rs 10.9 crore.

Margin contracts to 2.1% versus 6.7%.

KEI Industries Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 25.4% to Rs 2,590.32 crore versus Rs 2,065.02 crore.

Net Profit up 30% to Rs 195.75 crore versus Rs 150.25 crore.

Ebitda up 18% to Rs 258.01 crore versus Rs 219.08 crore.

Margin at 10% versus 10.6%.

20% of new order bookings now AI-infused

Over 50% of employees trained in AI tools and solutions

Wage hikes effective from 1 July

Macro environment remains under pressure

Introduces ‘Zens AI’ to boost internal productivity

Here Is What Added To Paytm's Profitability

Marketing expenses down 65% year-on-year at Rs 62 crore.

ESOP cost down 88% at Rs 30 crore.

ESOP cost lower on account of new appraisal grants given late in the quarter.

Expect full impact of new appraisal grants in second quarter.

Non-sale employee cost down 28% from a year ago.

JSW Infrastructure Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 21.2% to Rs 1,223.85 crore versus Rs 1,009.77 crore.

Net Profit up 32% to Rs 384.68 crore versus Rs 292.44 crore.

Ebitda up 32% to Rs 581.16 crore versus Rs 440.12 crore.

Margin at 47.5% versus 43.6%.

Cyient DLM Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 8.0% to Rs 278.43 crore versus Rs 257.89 crore.

Net Profit down 30% to Rs 7.46 crore versus Rs 10.60 crore.

Ebitda up 25% to Rs 25.07 crore versus Rs 19.99 crore.

Margin at 9% versus 7.8%

Dixon Technologies Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 95.1% to Rs 12,835.66 crore versus Rs 6,579.80 crore.

Net Profit up 68% to Rs 224.97 crore versus Rs 133.68 crore.

Ebitda up 95% to Rs 482.37 crore versus Rs 247.90 crore.

Margin at 3.8% versus 3.8%.

Oberoi Realty Gearing up for upcoming project launches expected in the years.

Gurgaon project- design work is complete and approval process is also done.

Adarsh Nagar is work in progress in terms of approvals.

360 West revenue booking expected to flow through in September quarter.

Expect 100% occupancy for both Commerce III and Borivali project.

Ebitda and Profit turned profitable due to AI-led operational leverage, better cost structure and higher other income.

Revenue from distribution of financial services up 100% to Rs 561 crore.

This was driven by increase in merchant loans, trail revenue from Default Loss Guarantee portfolio and better collections.

Paytm Q1 Earnings Key Highlights (Consolidated, QoQ)

Revenue up 0.3% to Rs 1,917.50 crore versus Rs 1,911.50 crore.

Net Profit at Rs 122.50 crore versus loss of Rs 539.80 crore.

Ebitda at Rs 71.50 crore versus loss of Rs 88.60 crore.

Margin at 3.7%.

Zensar Technologies Q1 Earnings Key Highlights (Consolidated, QoQ)

Revenue up 1.9% to Rs 1,385.00 crore versus Rs 1,358.90 crore.

Net Profit up 3% to Rs 182.00 crore versus Rs 176.40 crore.

EBIT down 1% to Rs 187.50 crore versus Rs 188.70 crore.

Margin at 13.5% versus 13.9%

Jana Small Finance Bank Q1 Earnings Key Highlights (Standalone, YoY)

Net profit falls 40.2% at Rs 101.9 crore versus Rs 170.5 crore.

Gross NPA at 2.91% versus 2.71% (QoQ).

Net NPA flat at 0.94% (QoQ).

Net interest income falls 2.4% at Rs 595 crore versus Rs 609 crore.

The board has approved a fundraise of Rs 7,500 crore. This includes Rs Rs 4,500 crore via equity and debt and Rs 3,000 crore via bonds.

Shyam Metalics and Energy Q1 FY26 Highlights (Consolidated, QoQ)

Revenue up 6.8% at Rs 4,419 crore versus Rs 4,139 crore.

Ebitda up 12.5% at Rs 580 crore versus Rs 515 crore.

Margin at 13.1% versus 12.4%.

Net Profit up 33.6% at Rs 292 crore versus Rs 219 crore.

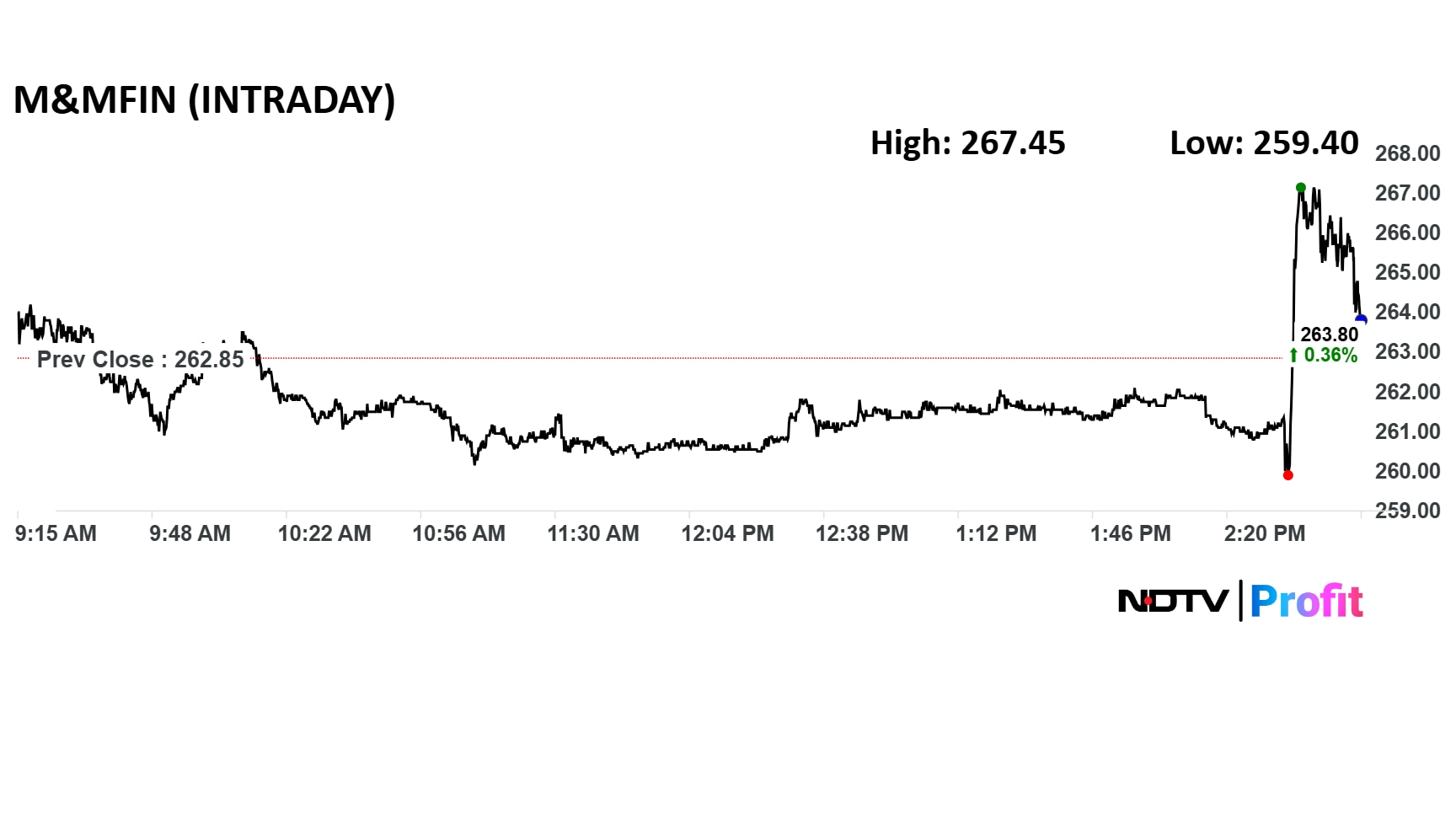

M&M Finance shares rose after Q1 results.

M&M Finance shares rose after Q1 results.

M&M Financial Services Q1 FY26 Highlights (Standalone, YoY)

Net Profit up 3.2% at Rs 530 crore versus Rs 513 crore

Total Income 18% at Rs 4,438 crore versus Rs 3,760 crore

Net Profit rose 21.7% to Rs 144 crore versus Rs 118 crore

Revenue fell 14.3% to Rs 1,825 crore versus Rs 2,130 crore

Ebitda fell 11.7% at Rs 239 crore versus Rs 271 crore

Margin at 13.1% versus 12.7%

Net Profit rose 21.3% to Rs 109 crore versus Rs 89.8 crore

Revenue rose 0.6% to Rs 1,103 crore versus Rs 1,096 crore

EBITDA rose 9.3% to Rs 187 crore versus Rs 171 crore

Margin at 16.9% vs 15.6%

Net Profit rose 21.3% to Rs 109 crore versus Rs 89.8 crore

Revenue rose 0.6% to Rs 1,103 crore versus Rs 1,096 crore

EBITDA rose 9.3% to Rs 187 crore versus Rs 171 crore

Margin at 16.9% vs 15.6%

Revenue fell 2.3% to Rs 298 crore versus Rs 321 crore

Ebitda rose 5% to Rs 77 crore versus Rs 73.3 crore

Net Profit rose 4.8% at Rs 56 crore versus Rs 53.6 crore

Margin at 25.8% Vs 22.8%

Revenue fell 2.3% to Rs 298 crore versus Rs 321 crore

Ebitda rose 5% to Rs 77 crore versus Rs 73.3 crore

Net Profit rose 4.8% at Rs 56 crore versus Rs 53.6 crore

Margin at 25.8% Vs 22.8%

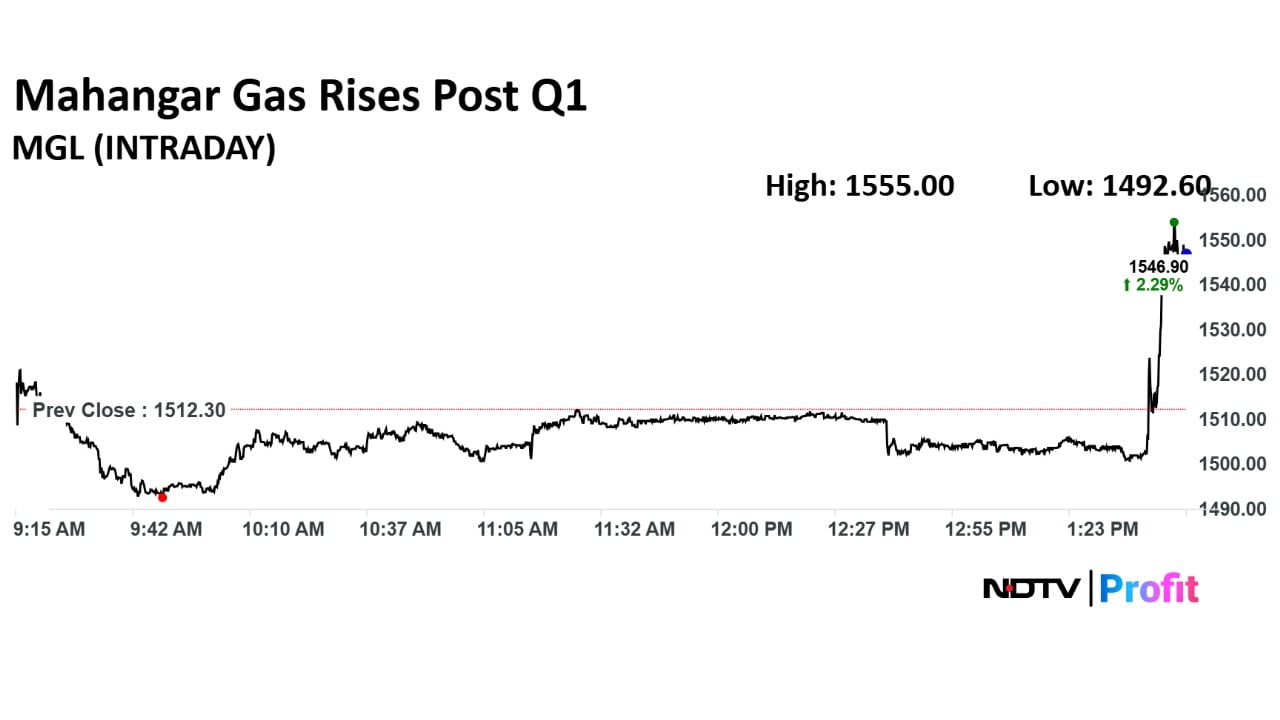

Mahangar Gas Q1 Key Highlights (QoQ)

Margin at 24.6% versus 20.3%

EBITDA rose 28.3% to Rs 485 crore versus Rs 378 crore

Revenue rose 6% to Rs 1,980 crore versus Rs 1,865 crore

Net Profit rose 28.6% to Rs 324 crore versus Rs 252 crore

Mahangar Gas Q1 Key Highlights (QoQ)

Margin at 24.6% versus 20.3%

EBITDA rose 28.3% to Rs 485 crore versus Rs 378 crore

Revenue rose 6% to Rs 1,980 crore versus Rs 1,865 crore

Net Profit rose 28.6% to Rs 324 crore versus Rs 252 crore

Mahanagar Gas Q1 FY26 Highlights (Standalone, QoQ)

Revenue up 6% at Rs 1,976 crore versus Rs 1,865 crore.

Ebitda up 28.3% at Rs 485 crore versus Rs 378 crore.

Margin at 24.6% versus 20.3%.

Net Profit up 28.6% at Rs 324 crore versus Rs 252 crore.

Kirloskar Pneumatic Q1 FY26 Highlights (YoY)

Revenue up 2.3% at Rs 282 crore versus Rs 275 crore.

Ebitda down 15.1% at Rs 33.3 crore versus Rs 39.2 crore.

Margin at 11.8% versus 14.2%.

Net profit down 5.9% at Rs 25.3 crore versus Rs 26.9 crore.

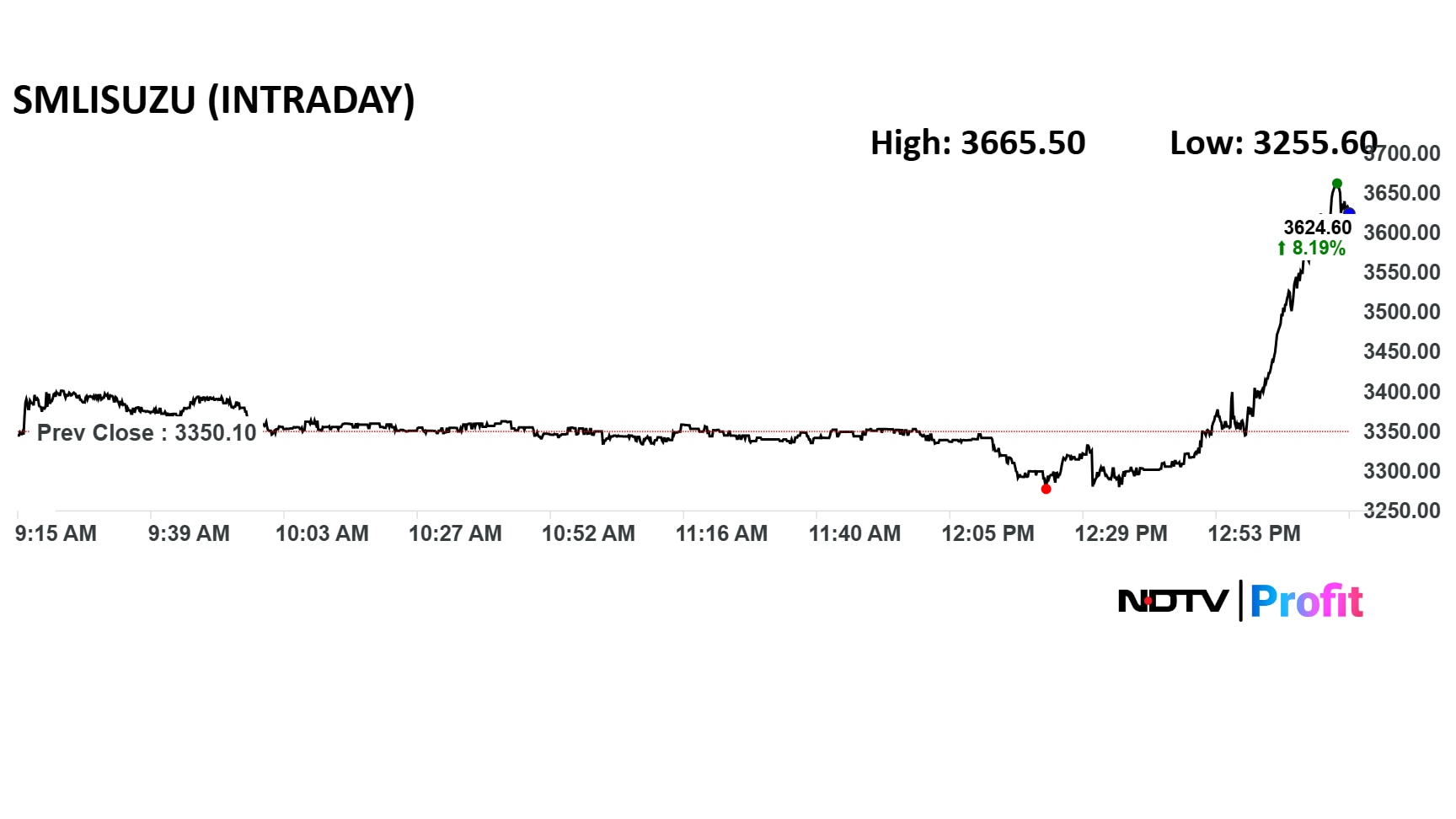

SML Isuzu shares hit record high of Rs 3,665.5, rising over 9% after the Q1 results.

SML Isuzu shares hit record high of Rs 3,665.5, rising over 9% after the Q1 results.

SML Isuzu Q1 FY26 Highlights (YoY)

Revenue up 13.4% to Rs 845.89 crore versus Rs 746.01 crore

Ebitda up 29.8% to Rs 105 crore versus Rs 80.9 crore

Margin at 12.4% versus 10.8%

Net profit up 44.3% to Rs 66.96 crore versus Rs 46.39 crore

"Our Q1 results reflect persistent headwinds from tough operating conditions on account of subdued urban demand and elevated competition intensity. The current quarter performance is also influenced by cycling a high base from the previous year," said CEO Prabha Narasimhan.

"We have made good strides in category premiumization, with our premium portfolio delivering strong revenue growth. We expect to navigate the current challenges and anticipate a gradual recovery in the back half of the year," he further added.

Colgate Palmolive India Q1 FY26 Highlights (YoY)

Revenue down 4.3% to Rs 1,433 crore versus Rs 1,497 crore (Bloomberg estimate: Rs 1,478.7 crore)

Ebitda down 11% at Rs 453 crore versus Rs 508 crore (Bloomberg estimate: Rs 484 crore)

Margin at 31.6% versus 34% (Bloomberg estimate: 32.7%)

Net profit down 12% to Rs 320.6 crore versus Rs 364 crore (Bloomberg estimate: Rs 346.2 crore)

Blue Jet Health Q1 FY26 Highlights (Consolidated, YoY)

Revenue at Rs 355 crore compared to Rs 163 crore.

Ebitda at Rs 121 crore versus Rs 44.1 crore.

Margin at 34.1% compared to 27.1%.

Net Profit at Rs 91.2 crore versus Rs 37.7 crore.

The Board approved the payment of Second Interim dividend of Rs 9, per equity share of face value of Re 1 each, for the financial year ending Dec. 31, 2025, which will be paid on Aug. 8, 2025.

Crisil Q2 FY26 Highlights (Consolidated, YoY)

Total Income up 6.3% at Rs 867 crore versus Rs 815 crore.

Net Profit was up 14.3% at Rs 172 crore versus Rs 150 crore.

Crisil follows a January-December financial year.

Vardhaman Textiles Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 3.3% at Rs 2,386 crore versus Rs 2,309 crore.

Ebitda down 6.4% at Rs 326 crore versus Rs 348 crore.

Margin at 13.6% versus 15%.

Net Profit down 13% at Rs 207 crore versus Rs 239 crore.

As per analysts' concencus estimates compiled by Bloomberg, Paytm is expected to narrow its net loss from Rs 540 crore in the March quarter to Rs 126 crore for the June quarter.

The Vijay Shekhar Sharma-founded company's net interest income is expected to come in at Rs 1,968 crore while margin is seen at 13.4%

Analysts are looking at Paytm's margin picture on loans and merchant loan growth as key monitorables ahead of the first quarter earnings.

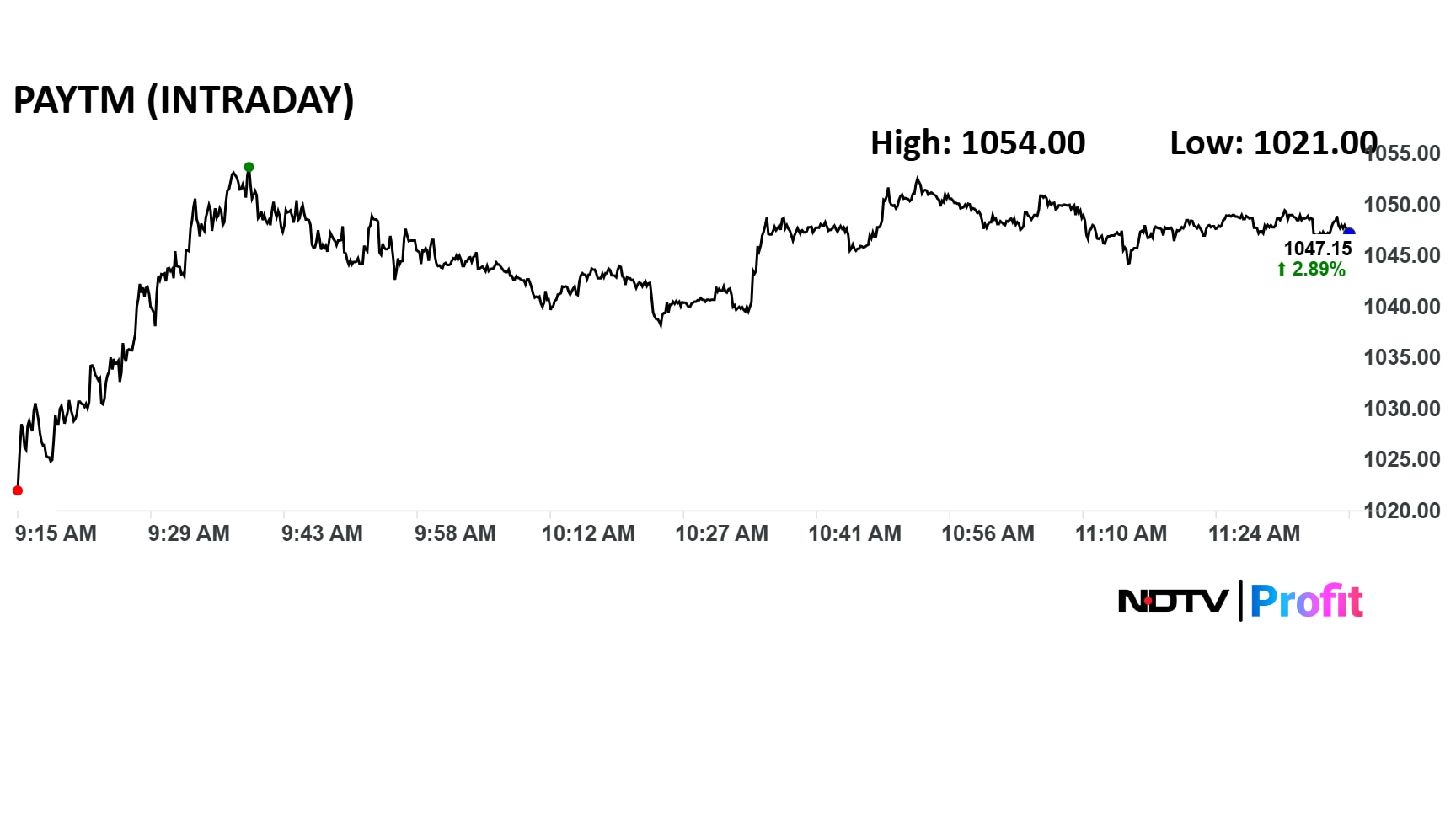

Shares of Paytm parent One97 Communications Ltd. surged over 2.5% on Tuesday, ahead of the company's June quarter earnings.

Paytm stock surged to an intraday high of Rs 1054, which amounted to a surge of more than 2.5%. The benchmark NSE Nifty 50, in contrast, remains flat, trading at marginal gains of 0.06%.

Shares of Paytm parent One97 Communications Ltd. surged over 2.5% on Tuesday, ahead of the company's June quarter earnings.

Paytm stock surged to an intraday high of Rs 1054, which amounted to a surge of more than 2.5%. The benchmark NSE Nifty 50, in contrast, remains flat, trading at marginal gains of 0.06%.

At least 53 companies are set to announce their Q1FY26 results of the April-June quarter on July 22. The list includes prominent names such as Dixon Technologies (India), Paytm operator One 97 Communications, Colgate-Palmolive (India), Ideaforge Technology, and Indian Railway Finance Corporation, among others.

Here's the full list:

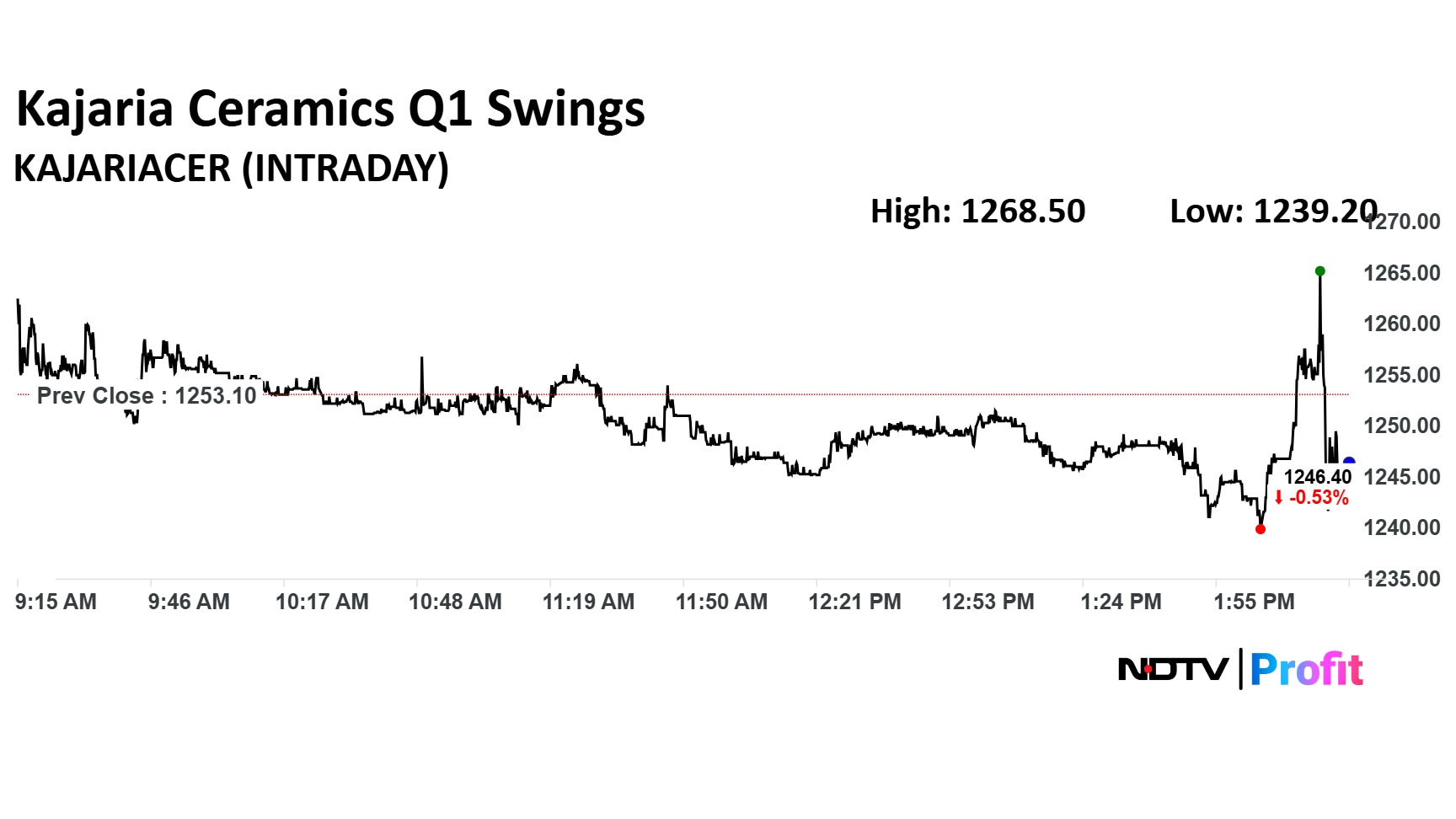

Ideaforge Technology Ltd., Infobeans Technologies Ltd., JSW Infrastructure Ltd., Dalmia Bharat Ltd., Indian Railway Finance Corporation Ltd., Jindal Hotels Ltd., MRP Agro Ltd., One 97 Communications Ltd., Shricon Industries Ltd., Aurionpro Solutions Ltd., Blue Jet Healthcare Ltd., Mahindra & Mahindra Financial Services Ltd., United Breweries Ltd., Hawa Engineers Ltd., Alexander Stamps And Coin Ltd., Welspun Specialty Solutions Ltd., WSFx Global Pay Ltd, Zensar Technologies Ltd., CreditAccess Grameen Ltd., Kajaria Ceramics Ltd., Artson Ltd., Bhagyanagar India Ltd., Colgate Palmolive (India) Ltd., Adroit Infotech Ltd., Dixon Technologies (India) Ltd. and Eco Hotels And Resorts Ltd.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.