With Hindalco Industries Ltd.'s subsidiary Novelis Inc.'s results for the three months ended March largely in line with analyst estimates, brokerage firms Citi and BofA see no near-term guidance on account of tariff implications but remain constructive on the long-term story.

BofA has maintained its 'buy' rating on Hindalco, with a target price of Rs 745. The brokerage noted Novelis' earnings were in line with expectations and said profitability improved on the back of a better mix and pricing.

However, BofA acknowledged that near-term uncertainty stemming from macro and tariff issues restricts margin guidance visibility. Even so, it has a positive outlook on a long-term basis, with Novelis' $600 per tonne Ebitda guidance intact, supported by scale, cost efficiency and recycling initiatives.

Citi too is positive, with a 'buy' call and a target price of Rs 720. It highlighted that Novelis' adjusted Ebitda of $494 per tonne was slightly below street expectations but above the firm's estimate of $475 per tonne. Citi expects volumes to improve further from the current quarter with the Bay Minette ramp-up.

On the India front, Citi sees strong profitability potential in the copper segment, with guidance of 500-kiloton volume and Ebitda per tonne of Rs 11,000–12,000. However, Citi flagged muted aluminium pricing and higher alumina costs as headwinds.

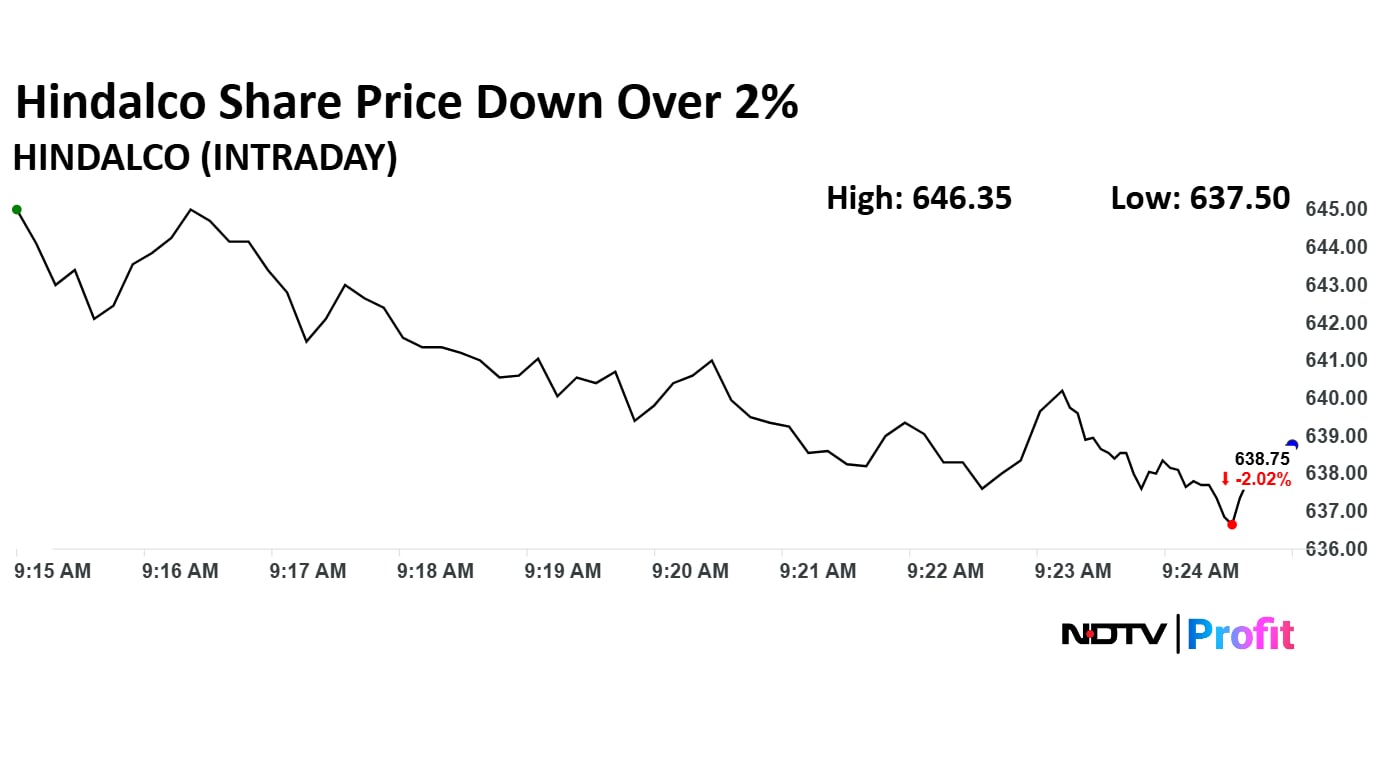

Hindalco Share Price Today

The scrip fell as much as 2.22% to Rs 637.50 apiece. It pared losses to trade 1.88% lower at Rs 639.70 apiece, as of 09:25 a.m. This compares to a 0.48% decline in the NSE Nifty 50 Index.

It has risen 5.98% on a year-to-date basis and 0.78% in the last 12 months. The relative strength index was at 52.14.

Out of 30 analysts tracking the company, 27 maintain a 'buy' rating, and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 14.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.