- IREDA's Q2 revenue increased 26.2% to Rs 2,057 crore from Rs 1,630 crore last year

- Net profit rose 41.6% to Rs 549 crore compared to Rs 388 crore in the previous year

- Net interest income grew 49.4% to Rs 817 crore versus Rs 547 crore in prior year quarter

The Indian Renewable Energy Developement Agency reported its second quarter earnings early Tuesday. The company saw a 26.2% uptick in revenue rising to Rs 2,057 crore. This compares to Rs 1,630 crore that was reported during the previous year.

The company's bottom-line rose over 41.6% to Rs 549 crore, during this quarter. This compared to Rs 388 crore reported during the same quarter in the previous year.

The net interest income or NII was up 49.4% to Rs 817 crore. The NII during the same quarter in the previous year stood at Rs 547 crores.

IREDA Q2 Highlights

Revenue up 26.2% at Rs 2,057 crore versus Rs 1,630 crore.

Net Interest Income up 49.4% at Rs 817 crore versus Rs 547 crore.

Net Profit up 42% at Rs 549.33 crore versus Rs 387.75 crore.

IREDA is a 'Navratna' public sector enterprise and comes under the Ministry of New and Renewable Energy (MNRE). Founded in 1987, it functions as a Non-Banking Financial Institution (NBFI) dedicated to advancing and financing ventures in renewable energy and energy efficiency. Guided by its vision of 'Energy for Ever', the organisation plays a key role in supporting sustainable energy initiatives across the country.

IREDA holds official recognition as a Public Financial Institution under Section 4A of the Companies Act, 1956, and is registered with the Reserve Bank of India (RBI) as a Non-Banking Financial Company (NBFC).

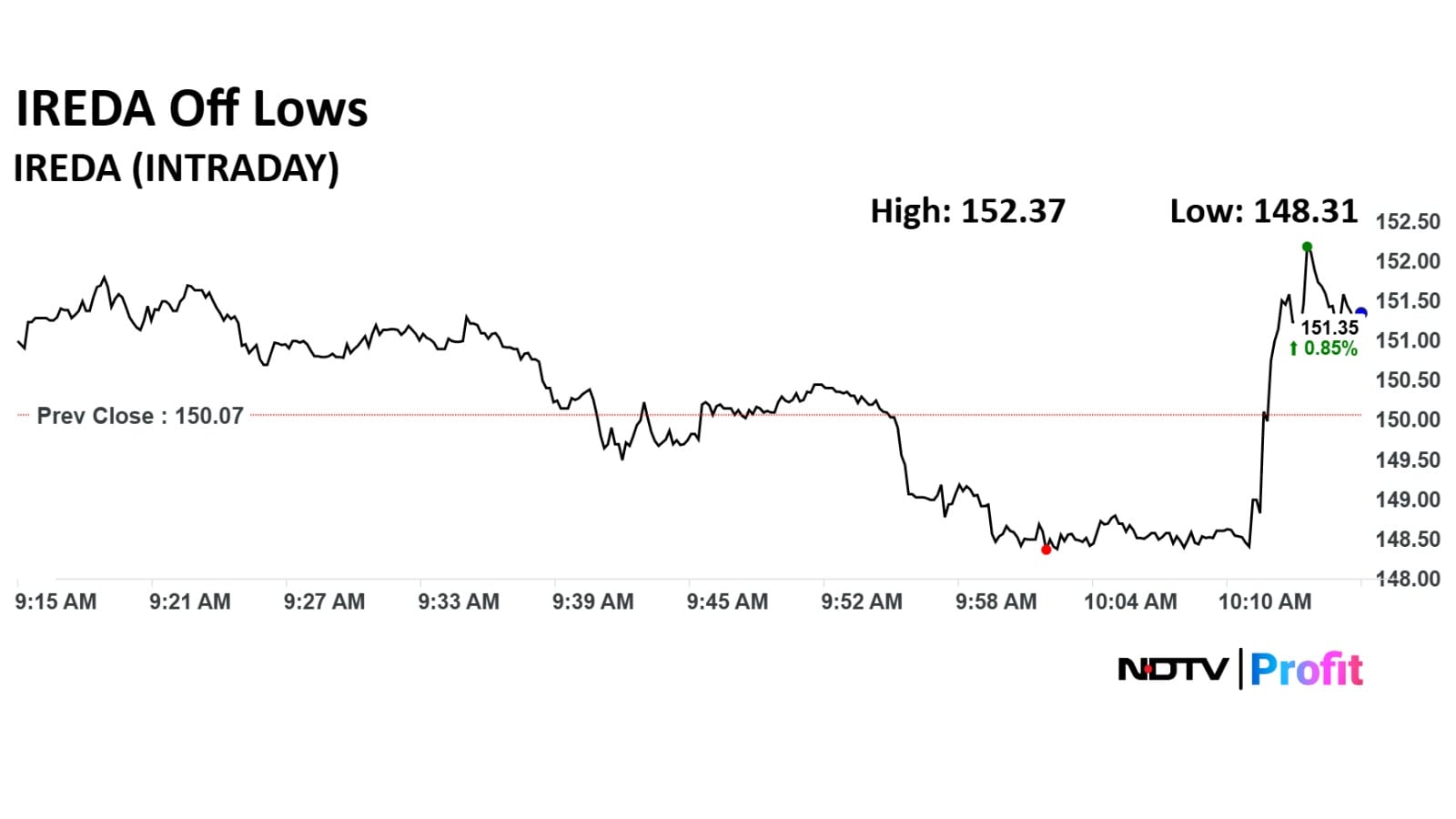

IREDA Share Price

IREDA stock rose as much as 3.68% during the day to Rs 155.59 apiece on the NSE. It was trading 2.33% higher at Rs 153.50 apiece, compared to an 0.08% decline in the benchmark Nifty 50 as of 10:58 a.m.

It had declined 30.67% in the last 12 months and declined 28.60% on a year-to-date basis. The total traded volume so far in the day stood at 4.9 times its 30-day average. The relative strength index was at 42.79.

One out of the two analysts tracking the company has a 'buy' rating on the stock, and the other recommends a 'hold', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 151.79.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.