IndiGo beat Nuvama, Citi and Emkay's estimates due to strong demand and higher yields in the third quarter. The stock has received revised target price and earnings per share numbers from Citi and Emkay.

There are concerns that remain given the depreciating Indian currency on forex loss from the brokerage firms as well. The management's fourth quarter growth guidance stands at a strong 20%.

Nuvama Retains 'Hold'

IndiGo beat Nuvama's estimates by 8%. The third-quarter beat estimates mainly based on better yield which was 4% higher, along with a 2% higher revenue passenger kilometers as well.

The RPKM rose 13% year-on-year as capacity expanded by 12%. With healthy demand, cost per available seat kilometer increased 7% on a general inflationary environment. The forex losses due to a sharp currency depreciation was partly offset by lower fuel costs, according to the brokerage.

IndiGo is targeting a strong 20% year-on-year capacity addition in the fourth quarter this year on fleet expansion and low base, while expecting yields to fall by low single-digit year on year, according to the brokerage.

The aircraft on ground situation is likely to improve with grounded fleet falling to the forties by March 2025 with a gradual decrease, according to Nuvama as well.

Citi Lowers Target Price

IndiGo's third-quarter results were much ahead of Citi's estimates, and the brokerage retains the 'buy' rating. Despite this, the brokerage has lowered the target price of the stock.

Strong demand in the last two months of the year had boosted traffic as well as yield. Demand outlook on the stock is robust with the management's fourth-quarter growth guidance at 20% with a low-single digit decline in yield year-on-year.

The addition of grounded aircraft back to the fleet and rapid expansion of network across domestic and international fronts should further support revenue growth, according to the brokerage.

It also notes that the sharp depreciation of the Indian Rupee is likely to result in some losses. This has caused the brokerage to cut earnings estimates, despite the slight increase in revenue estimates.

Citi retains 'Buy' rating, citing strong demand and market share trends. It lowered the target price to Rs 5,100 from Rs 5,300.

Emkay Cuts Earnings Per Share

IndiGo posted robust results in the third quarter, according to Emkay and this was driven by a 3% beat each on RASK and yields. The fuel cost and rentals were also lower.

The cost per available seat kilometer ex-fuel and forex was only 1% above the estimate, though net forex loss was high. The available seat kilometers grew by 12% year-on-year. The load factor was lower at 86.9%, while revenue passenger kilometers rose 13% year-on-year.

The management guided to a healthy demand outlook and IndiGo beating sector estimates with fourth quarter ASK growth of 20%. Aircraft on ground currently in the 60s, are expected to fall to the 40s, supporting spreads.

Optically, the earnings per share is cut 25% to 11% due to forex losses while core earnings and valuation remain unchanged. The brokerage maintains its 'buy' rating with the target price of Rs 5,300.

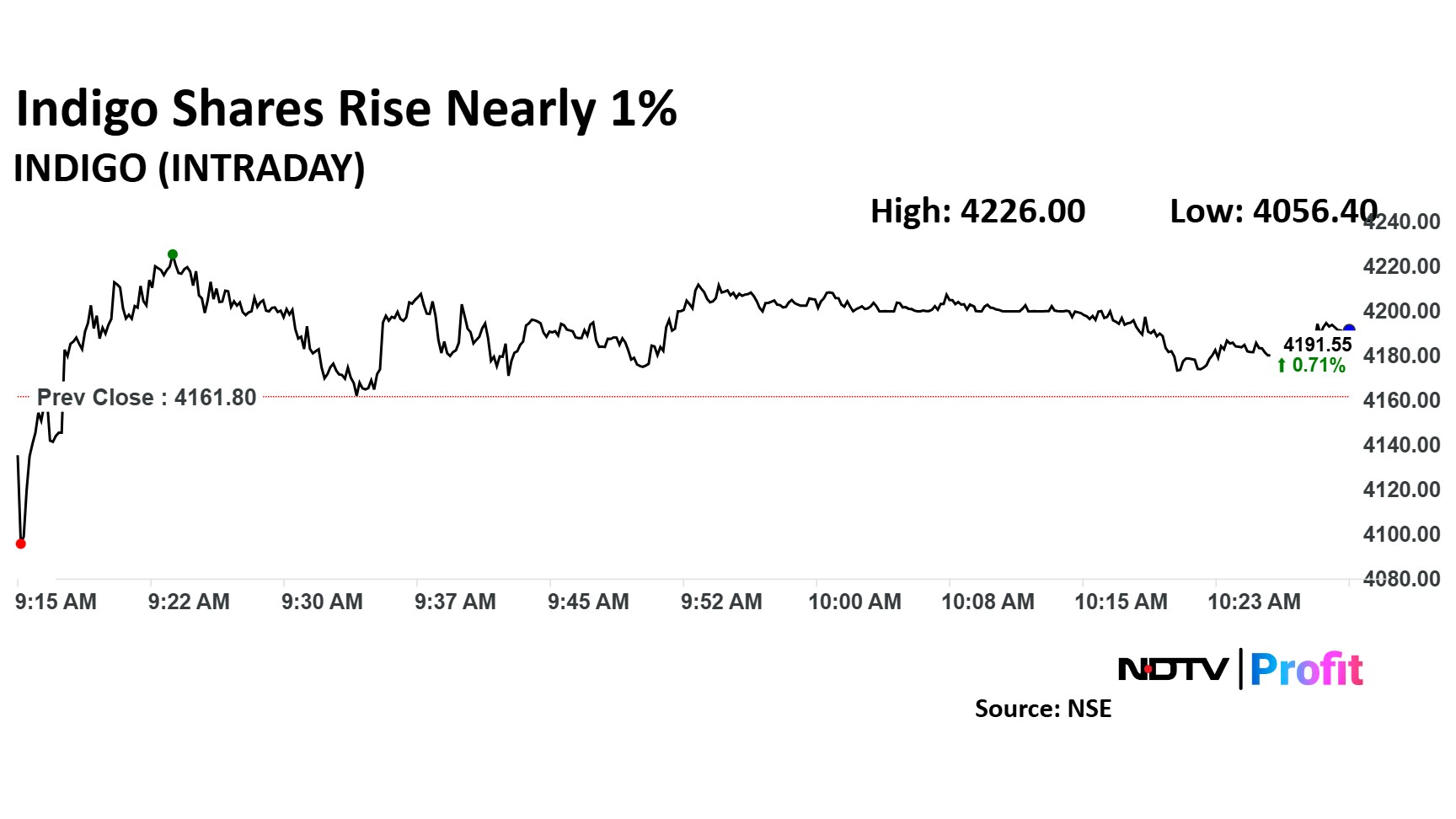

Indigo Share Price

InterGlobe Aviation's stock fell as much as 2.54% during the day. However, the stock later recovered, trading 0.81% higher at Rs 4,195 apiece.

It has risen 44.38% in the last 12 months. The total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 47.4.

Seventeen out of the 22 analysts tracking the company have a 'buy' rating on the stock, three recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 4,914.5, implying an upside of 17%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.