Hindustan Unilever Ltd.'s fourth-quarter profit rose, meeting analysts' estimates. The country's largest consumer goods maker also saw a sequential improvement in volumes during the quarter, even as margins contracted due to raw material inflation.

The standalone net profit of the owner of Surf Excel and Dove soaps increased 4% over the preceding year to Rs 2,493 crore in the quarter ended March, according to an exchange filing. That is compared with the Rs 2,482 crore consensus estimate of analysts tracked by Bloomberg.

Hindustan Unilever Q4 Highlights (Standalone, YoY)

Revenue rose 2.4% to Rs 15,214 crore versus Rs 14,857 crore. (Bloomberg estimate: Rs 15,200 crore).

Ebitda up 1% to Rs 3,466 crore versus Rs 3,435 crore. (Bloomberg estimate: Rs 3,409 crore).

Ebitda margins contracted to 22.8% versus 23.1%. (Bloomberg estimate: 22.4%).

Net profit up 4% to Rs 2,493 crore versus Rs 2,406 crore. (Bloomberg estimate: Rs 2,482 crore).

Final dividend of Rs 24 per share for financial year 2025.

The company reported an underlying volume growth of 2% during the January-March period compared with a flat growth in the preceding quarter.

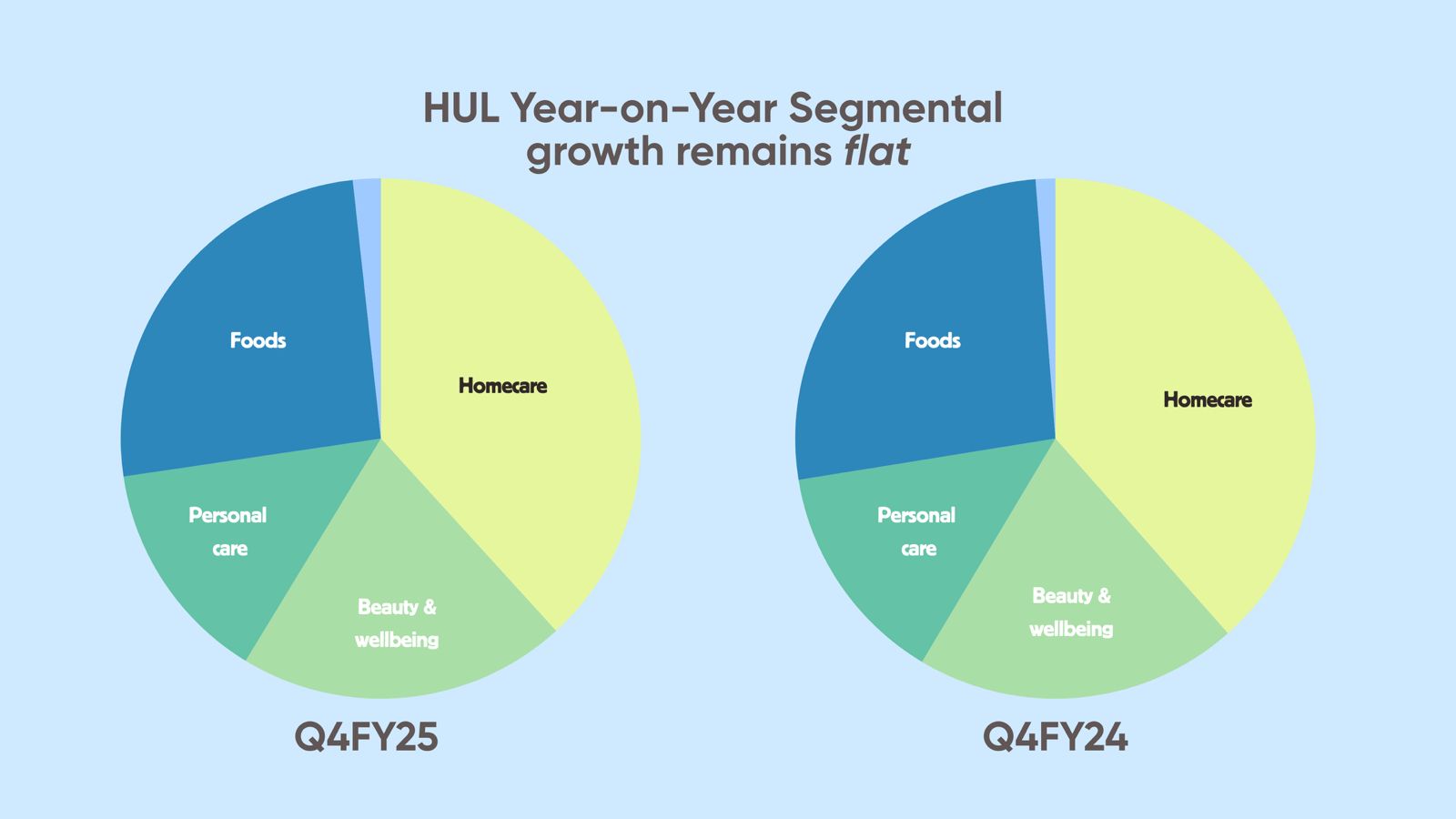

Segment Wise Growth

Homecare grew 1.8% to Rs 5,818 crore, with mid-single volume growth.

Beauty and Wellbeing up 4.2% to Rs 3,113 crore, with volumes growing in low single-digit

Personal care up 2.9% to Rs 2,124 crore, volumes saw low-single digit decline.

Foods fell 0.3% to Rs 3,896 crore, volumes saw mid-single digit decline.

Others (includes exports, consignment, etc.) up 45.3% to Rs 263 crore.

Within foods, the HUL management said that tea delivered low-single-digit growth driven by pricing, while nutrition drinks' turnover was impacted by continued category headwinds and the transitionary impact of pack-price architecture change. Ice creams delivered double-digit volume-led growth.

The home care segment witnessed negative price growth on account of pricing actions taken to pass on commodity-led benefits to consumers. The liquids portfolio in fabric wash and household care continued to grow in double digits, driven by expansion into new formats and segments. Other segments like skin cleansing and oral care were hurt due to price hikes.

HUL's turnover surpassed Rs 60,000 crore for the full fiscal year ending 2025, with underlying volume growth of 2%.

"We delivered a competitive performance, further strengthening our market leadership during the year," said CEO and MD Rohit Jawa, adding that the company will continue to drive volume-led competitive growth.

"This year marked a step up in our portfolio transformation with increased innovation in high-growth spaces, amplified investments in channels of the future, acquisition of Minimalist, divestment of Pureit, and the decision to demerge the ice-cream business," the CEO said.

The company anticipates demand conditions to gradually improve over the next fiscal year. The second half of FY26 is expected to be better than the first, led by portfolio transformation and improving macroconditions.

In the near- to medium-term, the HUL management expects price growth to be in the low-single-digit range if commodities remain where they are.

The company, however, has lowered its operating margin guidance to 22-23% compared with previous guidance of 23-34%. This comes on the back of higher investments in the high-growth demand spaces, according to the management. Furthermore, HUL's gross margin is also expected to moderate as it continues to deliver the right price-value proposition.

Shares of HUL erased gains and fell as much as 4.12% during the day to Rs 2,324 apiece on the NSE. It was trading 3.6% lower at Rs 2,337 apiece, compared to an 0.27% decline in the benchmark Nifty 50 and 0.8% decline in Nifty FMCG as of 11:55 a.m.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.