.png?downsize=773:435)

Hindalco Industries Ltd.'s profitability will likely remain healthy in next two-three years, as downstream projects ramp up and captive coal mining starts, according to analysts.

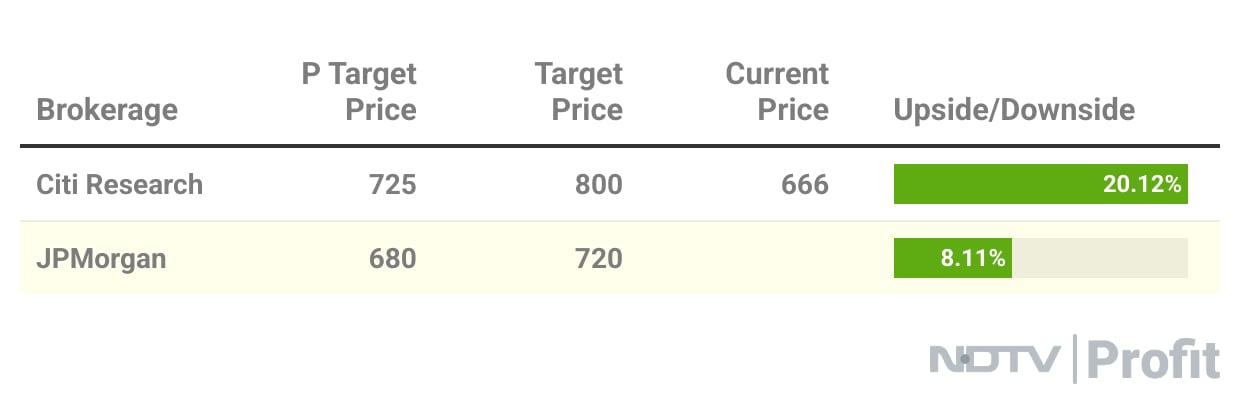

JPMorgan and Citi hiked their target prices on the stock after the company reported a 41% year-on-year rise in net profit for the fourth quarter of financial year 2025, beating analysts' estimates.

Hindalco Industries Q4 Highlights (Consolidated, QoQ)

Revenue up 11.1% to Rs 64,890.00 crore versus Rs 58,390.00 crore.

Net profit up 41% to Rs 5,283.00 crore versus Rs 3,735.00 crore.

Ebitda up 17% to Rs 8,836.00 crore versus Rs 7,583.00 crore.

Margin at 13.6% versus 13.0%.

To pay dividend of Rs 5 per share.

Hindalco Industries acquired EMMRL which holds the lease for Bandha Coal Block. The company will do an additional Rs 4,000 crore capital expenditure upon its acquisition cost. JPMorgan expects pricing will be better than what Hindalco Industries' current purchase rate is from NCVL.

Captive coal mines comprised 2% of volumes in financial year 2025, and management is expecting a significant contribution by financial year 2028 after Chakla and Bandha coal mines start ramping up, JPMorgan said.

Citi Research is bullish on Hindalco Industries' aluminum business' medium term outlook. From 2026, there'll be certainty on US and China policies, which will improve manufacturing, structural metal supply constraints, and lower visible inventories will drive renewed investor inflows.

Within aluminum downstream, the management has guided to add 60–70 kilotonnes volumes in financial year 2026, JPMorgan said. From the ongoing expansion, Hindalco Industries aspired to reach Ebitda of $300 per tonnes in the medium term.

JPMorgan raised Hindalco Industries' Ebitda estimates for aluminum business slightly and lowered net debt assumptions.

Hindalco Industries' consolidated net debt improved to 1.1 times versus 1.3 times as of December 2024, which hints at the company's improved leverage, Citi Research said.

India business should benefit from lower costs. Management expects India's aluminum costs to remain stable in the first quarter of financial year 2026. Its downstream Ebitda will improve slowly, Citi Research said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.