.png?downsize=773:435)

DB Corp Ltd. reported a challenging first quarter of the current financial year, with its consolidated net profit declining significantly. The newspaper group's revenue also declined, impacting its profitability metrics.

For the quarter ended June 30, DB Corp's consolidated revenue fell by 5.2% year-on-year, coming in at Rs 559 crore compared to Rs 590 crore in the corresponding period of the previous fiscal.

The Ebitda also experienced a substantial contraction to 32.8%, reaching Rs 111 crore against Rs 164 crore in the prior year. Further, the Ebitda margin contracted sharply by 810 basis points, settling at 19.8% from 27.9% in the same quarter last year.

The company's consolidated net profit for the first quarter stood at Rs 80.8 crore, marking a 31.4% decrease from the Rs 118 crore recorded in the year-ago period.

DB Corp Q1 Highlights (Consolidated, YoY)

Revenue down 5.2% to Rs 559 crore versus Rs 590 crore.

Ebitda down 32.8% to Rs 111 crore versus Rs 164 crore.

Margin at 19.8% versus 27.9%.

Net Profit down 31.4% to Rs 80.8 crore versus Rs 118 crore.

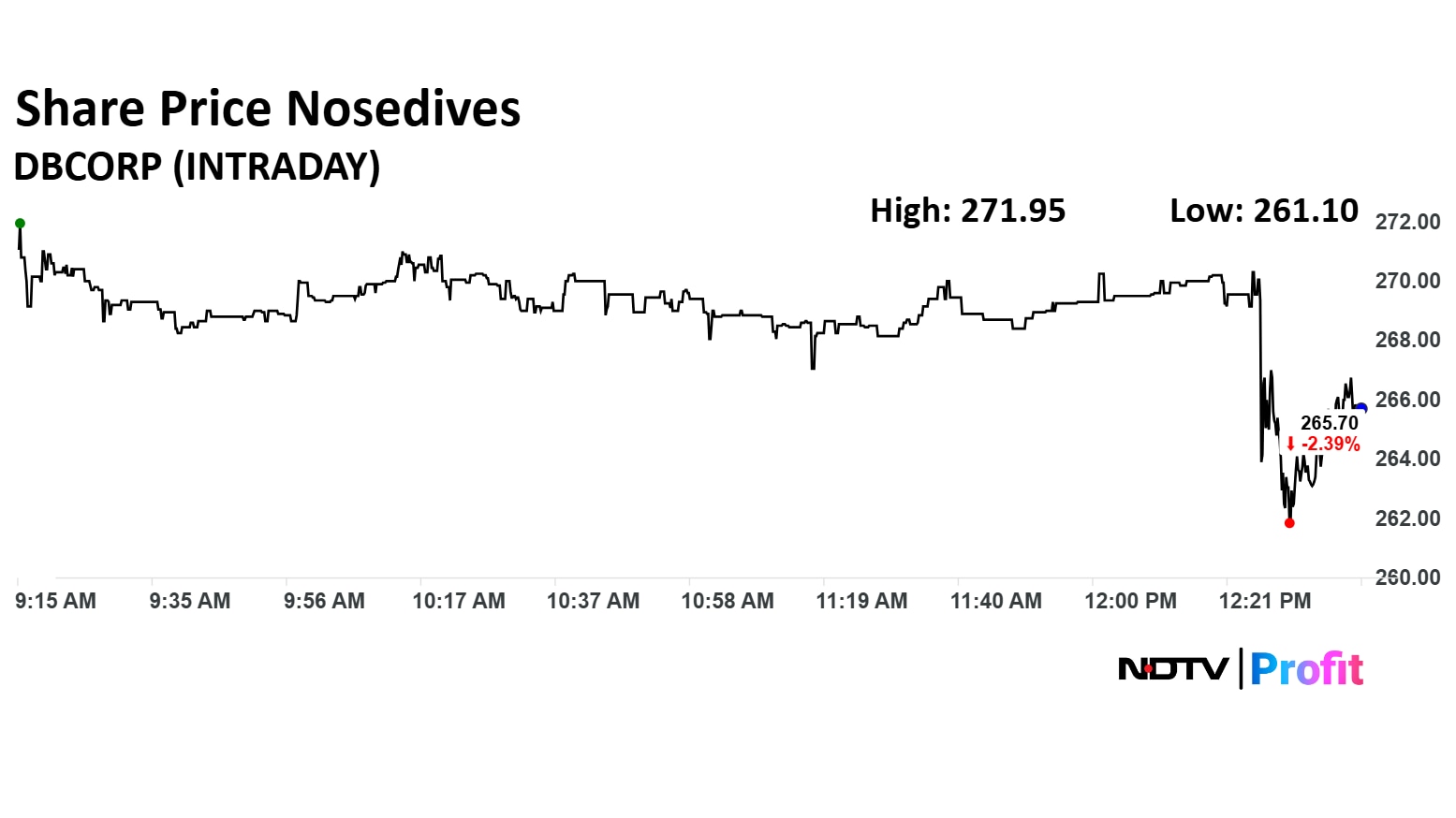

DB Corp Share Price

DB Corp stock fell as much as 4.08% during the day to Rs 261 apiece on the NSE. It was trading 2.48% lower at Rs 265 apiece, compared to an 0.05% advance in the benchmark Nifty 50 as of 12:50 p.m.

It has declined 27.71% in the last 12 months and 11.90% on a year-to-date basis. The total traded volume so far in the day stood at 3.3 times its 30-day average. The relative strength index was at 46.26.

Two out of the three analysts tracking the company have a 'buy' rating on the stock, and one recommends a 'hold', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 272, implying a upside of 2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.