Canara Bank reported on Friday a 12.3% growth in standalone net profit in the October-December quarter, while its asset quality improved.

The bottom line increased to Rs 4,104 crore compared to Rs 3,656 crore in the year-ago period, according to an exchange filing.

Net interest income of the public sector lender fell 3% on year to Rs 9,149 crore from Rs 9,417 crore. Consequently, the net interest margin was 2.83% as compared to 2.88% a quarter ago.

"NIMs are under stress. Initially, the bank had guided a NIM target of 2.9% for 2024-25 but due to pressure on liquidity and deposits, we have revised down our guidance target," the management said in the post-earnings call. The bank expects the NIMs to stabilise at 2.8% in the current financial year.

Asset quality improved, with gross non-performing assets declining to 3.34% from 3.73% in the previous quarter. The Net NPA reduced to 0.89% from 0.99%.

Gross advances of the bank rose 9.55% at Rs 9.87 lakh crore. Retail, agriculture and micro, small and medium enterprises loan book grew 12% YoY to Rs 5.95 lakh crore, followed by an 8.08% growth in corporate and others to Rs 4.53 lakh crore.

The bank's management sees demand for corporate loans from, infrastructure, manufacturing, data centre, and other infrastructure-related sectors such as energy and steel.

The bank's domestic deposit stood at Rs 12.57 lakh crore as of December 2024 with a growth of 7.76%.

On the proposed liquidity-coverage-ratio guidelines by the Reserve Bank of India, the management said that its LCR may take hit of 11-12% on these norms.

Answering a query on the bank's subsidiaries' initial public offering, the management said that so far, three merchant bankers have been selected for Canara Rebeco Mutual Fund IPO and that its insurance subsidiary's IPO will take place in 2026-27.

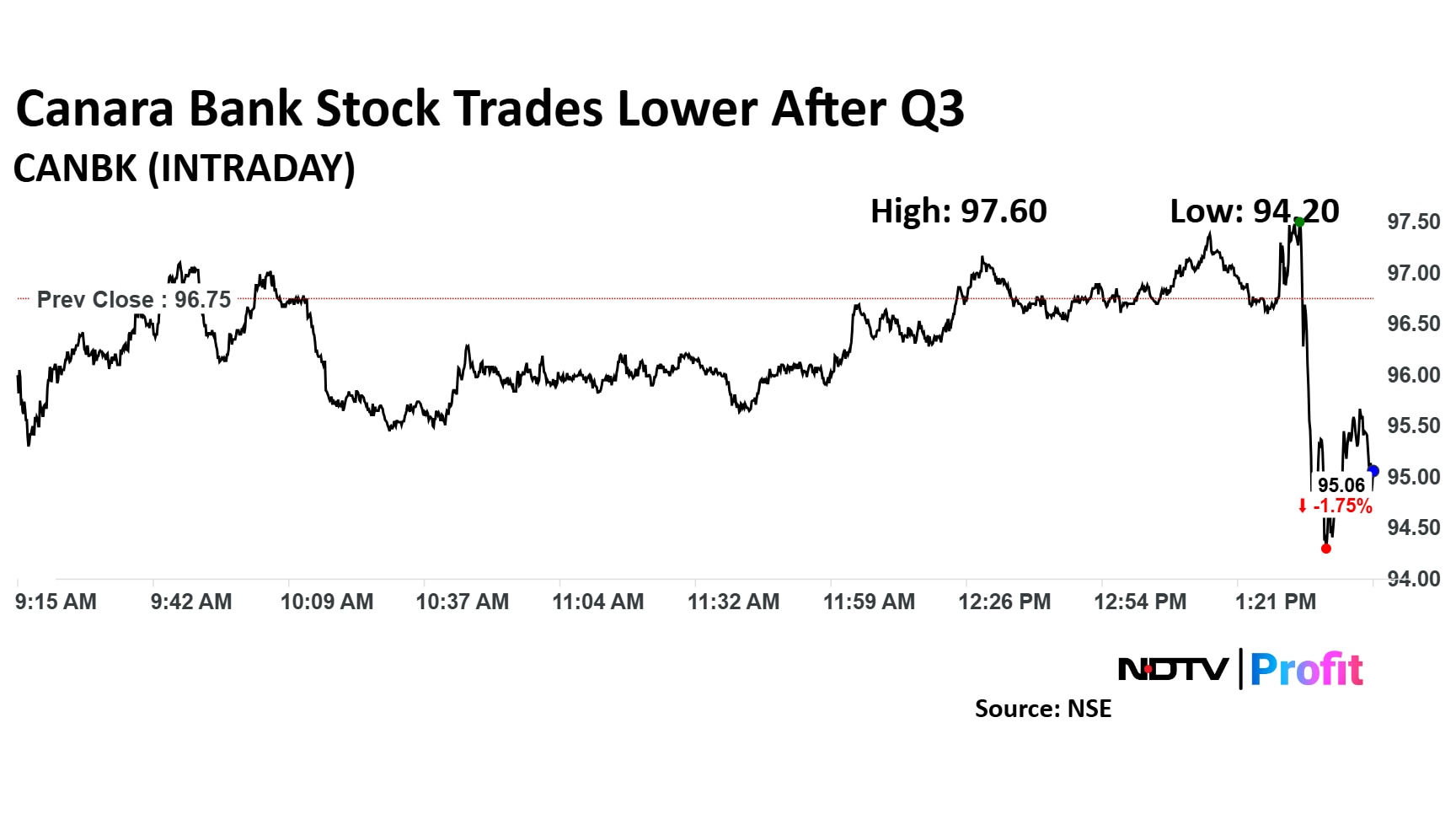

Canara Bank's shares fell as much as 2.6% intraday to Rs 94.2 apiece after the results were annnounced. The scrip was trading 1.75% lower by 1:50 p.m. The benchmark NSE Nifty 50 was down 1%.

The stock has risen 0.78% in the last 12 months. The relative strength index was 48.

Eleven out of the 18 analysts tracking Canara Bank have a 'buy' rating on the stock, four recommend a 'hold' and three suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price target of Rs 118.6 implies a potential upside of 24%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.