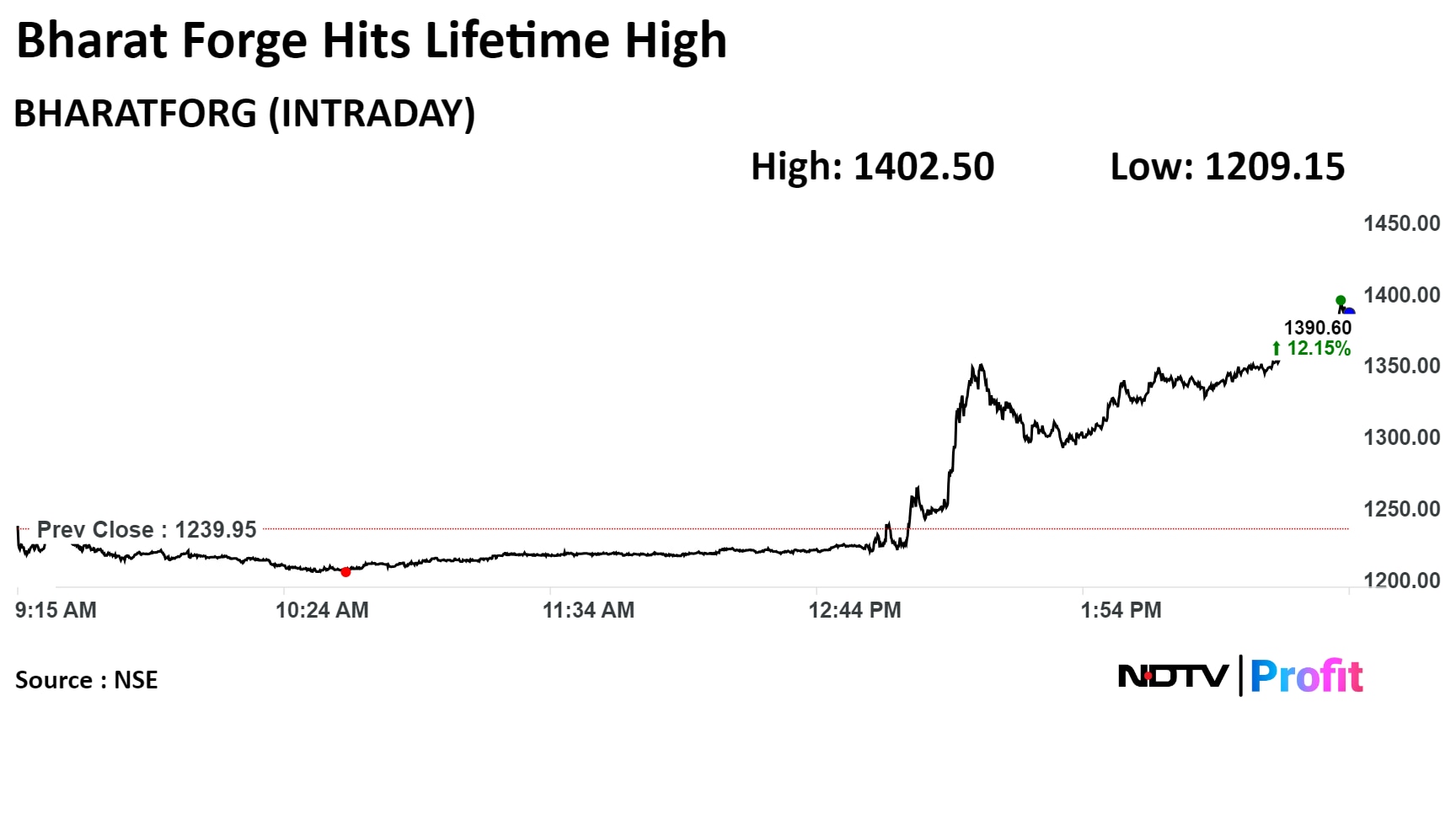

Bharat Forge Ltd.'s consolidated net profit surged 78% in the fourth quarter of financial year 2024, following which its shares jumped nearly 15% on Wednesday to an all-time high.

The bottom line of the company rose to Rs 227 crore in the quarter ended March in comparison to Rs 128 crore in the year-ago period, according to an exchange filing.

Bharat Forge Q4 Earnings Highlights (Consolidated, YoY)

Revenue up 15% to Rs 4,164 crore versus Rs 3,629 crore.

Net profit up 78% to Rs 227 crore versus Rs 128 crore.

Ebitda up 47% to Rs 643 crore versus Rs 439 crore.

Margin expands to 15.4% versus 12.1%.

In its conference call, Deputy Managing Director Amit Kalyani pointed out several factors that led to a change in the company's bearish view last quarter.

These include a tremendous order flow from businesses moving to India from China and Europe, a stronger outlook from its customers and winning market share in existing products as well as new products.

On the NSE, the stock rose as much as 14.75% during the day to Rs 1,442.90 apiece. It was trading 14.2% higher at Rs 1,420 per share, compared to a flat benchmark Nifty 50 at 3:15 p.m.

The share price has risen 15.15% on a year-to-date basis and 80.2% in the last 12 months. The total traded volume so far in the day stood at 8.75 times its 30-day average. The relative strength index was at 77.70, indicating that the stock may be overbought.

Nineteen out of the 29 analysts tracking the company have a 'buy' rating on the stock, two recommend 'hold' and eight suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 14.9%.

Watch The Video Here

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.