- Bharat Forge's Q2 profit rose 23% to Rs 299.20 crore from Rs 243.59 crore

- Revenue increased 9.3% YoY to Rs 4,031.93 crore for the quarter ended September

- EBITDA grew 12% YoY to Rs 725.66 crore with margin expanding to 18% from 17.5%

Bharat Forge Ltd.'s profit rises 23% to Rs 299.20 crore in the second quarter of this financial year. This is in comparison to profit of Rs 243.59 crore in the previous quarter of this fiscal, according to its stock exchange notification on Tuesday.

Revenue advanced by 9.3% year-on-year for the three months ended September, reaching Rs 4,031.93 crore. Operating income, or earnings before interest, taxes, depreciation, and amortization rose 12% year-on-year to Rs 725.66 crore. The Ebitda margin expanded to 18%.

Bharat Forge Q2 Highlights (Cons, YoY)

Revenue up 9.3% to Rs 4,031.93 crore versus Rs 3,688.51 crore.

Net Profit up 23% to Rs 299.20 crore versus Rs 243.59 crore.

Ebitda up 12% to Rs 725.66 crore versus Rs 647.28 crore.

Margin at 18.0% versus 17.5%.

The company received in-principal approval for raising funds not exceeding Rs. 2,000 crore through term loan, non-convertible debentures or any other debt instruments.

Bharat Forge's CV exports to North America declined by 48% sequentially and 63% on a year-on-year basis. The balance sheet remains robust with cash of Rs 2,309 crores and ROCE (net) of 15.5%.

Indian manufacturing, a key focus area and growth driver for the company registered revenues of Rs 2,746 crore and Ebitda of RS 676 crore.

The company secured new orders worth Rs 1,582 crore including Rs 559 crores in Defence in first half of this financial year. As of the first half of this fiscal, the defence order book stood at Rs 9,467 crores.

Despite demand challenges in the US, passenger car exports registered a flattish performance driven in part by our diversification efforts across geographies and products. However, an extended period of demand uncertainty could impact discretionary spending and thereby Passenger car offtake.

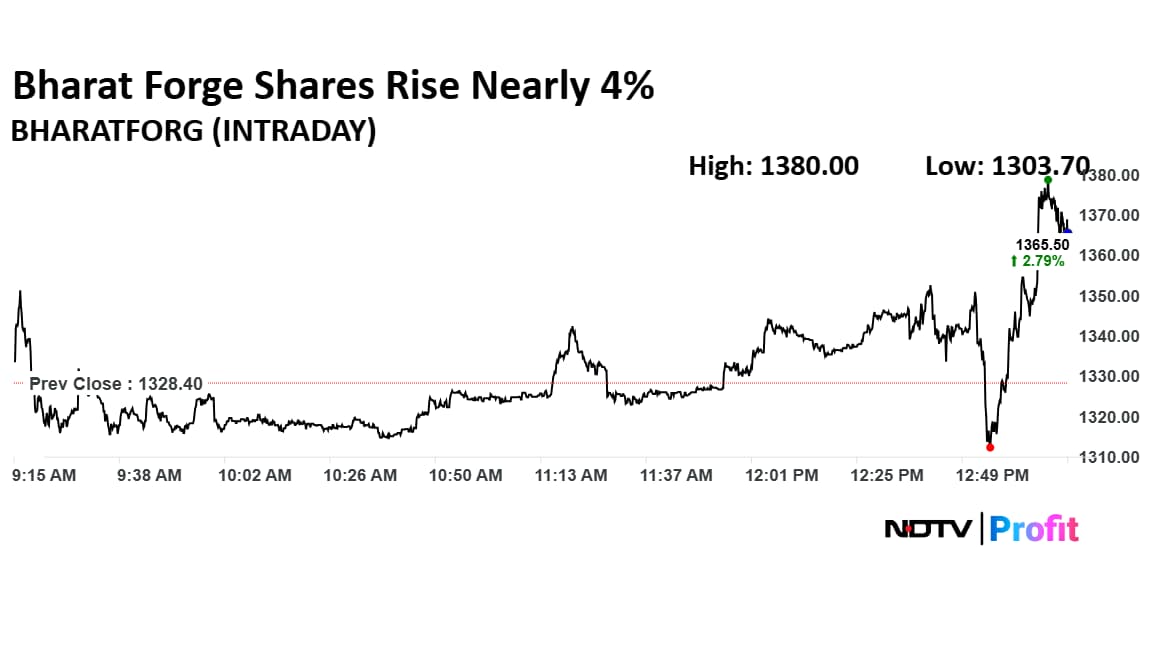

Bharat Forge Share Price Today

The scrip rose as much as 3.88% to Rs 1,380 apiece on Tuesday. It pared gains to trade 3.09% higher at Rs 1,367.60 apiece, as of 1:11 p.m. This compares to a 0.02% advance in the NSE Nifty 50 Index.

It has fallen 2.44% in the last 12 months and risen 5.12% year-to-date. Total traded volume so far in the day stood at 1.07 times its 30-day average. The relative strength index was at 67.49.

Out of 28 analysts tracking the company, nine maintain a 'buy' rating, eight recommend a 'hold,' and 11 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target of Rs 1,171.57 implies a downside of 13%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.