Apple Inc. reported its fastest quarterly revenue growth in more than three years, easily topping Wall Street estimates, after demand picked up for the iPhone and products in China.

Revenue rose 9.6% to $94 billion in the fiscal third quarter, which ended June 28, the company said in a statement Thursday. Analysts estimated $89.3 billion on average, according to data compiled by Bloomberg. Apple also predicted that fourth-quarter revenue would be up by a percentage in the mid- to high-single digits — better than the 3% that analysts had forecast.

“We saw an acceleration of growth around the world in the vast majority of markets we track, including Greater China and many emerging markets,” Chief Executive Officer Tim Cook said on a conference call with analysts.

Though US tariffs have increased Apple's cost of doing business, they provided a sales benefit last quarter — with consumers rushing to stores to get out ahead of expected price increases. Still, this effect only amounted to 1 percentage point of the 10-point sales gain, Cook said.

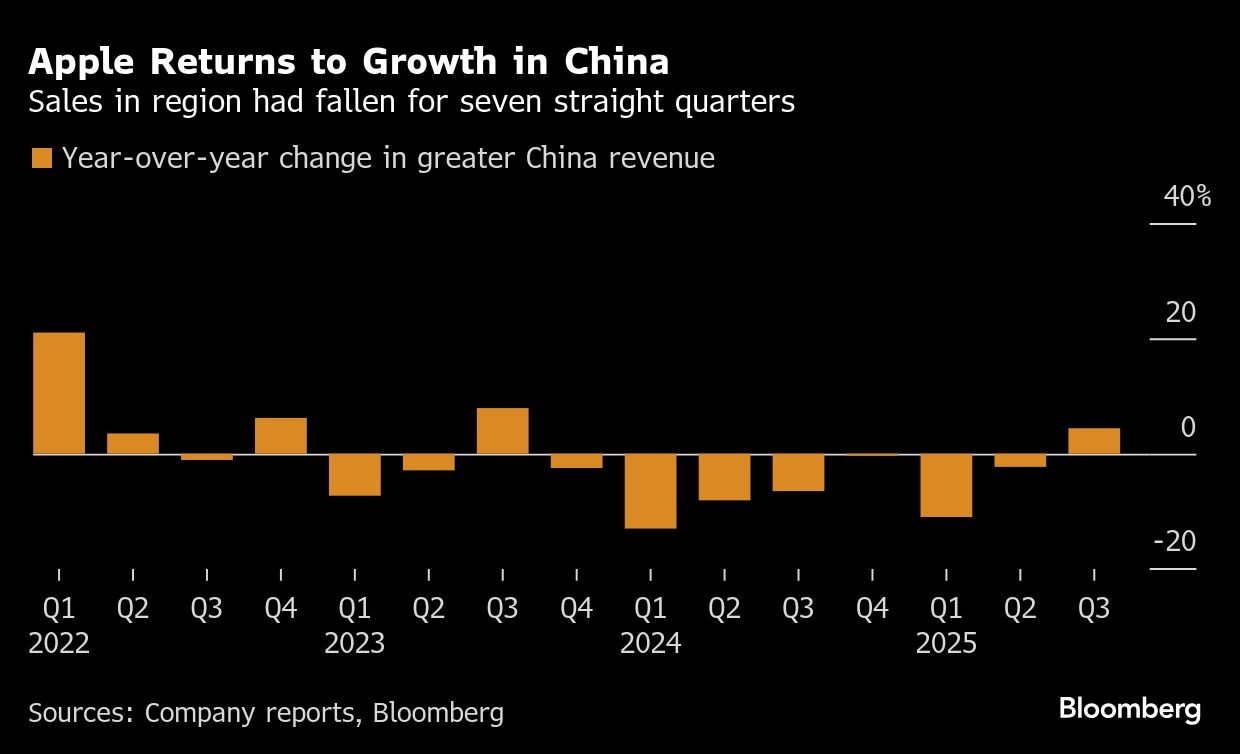

The company also has been staging a comeback in China, a market where local phone brands have made inroads with consumers. Services were another bright spot, topping Wall Street projections.

Read More: Apple's 10 Biggest Challenges, From AI to Tariffs

Apple shares rose about 2% in late trading following the announcement. They had been down 17% this year, putting the company well below Nvidia Corp. and Microsoft Corp. among the world's most valuable businesses.

Apple had projected a $900 million headwind from tariffs during the third quarter, saying that revenue would grow in the low- to mid-single digits. Ultimately, the levies cost the company $800 million, Apple said Thursday. It sees tariffs adding $1.1 billion in expenses during the current period.

Third-quarter earnings rose to $1.57 a share, beating the average estimate of $1.43. In China, Apple reported revenue of $15.4 billion, up 4.4% from a year earlier. Wall Street had been looking for sales of $15.2 billion from that crucial market.

The Cupertino, California-based company generated $44.6 billion from iPhone sales during the June quarter, topping estimates of $40.1 billion. Beyond the tariff-spurred spending, the iPhone business got a boost in February from a new low-end model dubbed the 16e.

That device costs $599, far exceeding the price of the model it replaced, the $429 iPhone SE. Apple will announce its next iPhones in September, and the next-generation devices typically go on sale in the final weeks of the fiscal fourth quarter.

Services continue to be the company's biggest growth driver, with sales rising 13% to $27.4 billion in the third quarter. Apple didn't provide guidance for the segment when the company discussed its March results, citing uncertainty from “several factors,” but Wall Street had been looking for about $26.8 billion.

Though it's been a bright spot for Apple, the services business faces a variety of threats. Regulators around the world are proposing changes to its App Store policies, potentially reducing revenue from software and subscriptions. Separately, the US Justice Department is likely to upend an agreement with Google that makes the search engine Apple's default option. That arrangement generates roughly $20 billion a year for the iPhone maker.

Apple also is struggling to keep up with rivals in artificial intelligence. The company is even considering outsourcing its large language models, or LLMs, the technology underpinning generative AI, Bloomberg has reported.

On the conference call, Cook was upbeat about Apple's progress in AI, saying the company is upping its investment in the technology. He declined to comment on whether he believes LLMs will become commoditized, saying it would give away some of Apple's strategy. That suggests a shift toward outside technology may be in the cards.

Cook also said he was open to acquisitions if they can accelerate Apple's road map. The company has already acquired seven small companies this year, he said, while signaling that bigger deals may be possible. “We are are not stuck on a certain size company,” Cook said.

Apple's Mac lineup was a highlight last quarter. The product chalked up sales of $8.05 billion, beating Wall Street expectations of $7.3 billion. The company released new MacBook Air and Mac Studio models with faster processors in early March, bolstering the division.

The iPad generated $6.58 billion in revenue, down 8.1% from a year earlier. That missed Wall Street estimates of $7.1 billion. The year-earlier period included the launch of a revamped, pricey iPad Pro, making the comparison more difficult. Apple hasn't yet released a new iPad Pro this year, but does plan to launch one with an M5 chip and camera changes, Bloomberg News has reported.

The company's Wearables, Home and Accessories segment — which includes AirPods, smartwatches, TV set-top boxes, Vision Pro headsets and HomePod speakers — remains in a downward spiral. Its sales fell 8.6% to $7.4 billion in the quarter. Wall Street had been looking for $7.8 billion.

The business was once seen as a way to decrease Apple's reliance on iPhone sales, which account for roughly half its revenue. But the division peaked in 2021, when it had almost $15 billion during the holiday quarter. Apple blamed the decline on it launching major new iPad accessories in the year-ago quarter.

A lack of compelling new products, however, is likely a bigger factor. The Apple Watch Ultra in 2022 was the last major change to the company's smartwatch lineup. The company also hasn't rolled out a new version of the AirPods Pro since 2022, and the low-end models from last year haven't been as big a hit as anticipated.

The biggest snag for the category might be the Vision Pro, which costs $3,499 and took nearly a decade and several billion dollars to develop. Despite its high price, the device hasn't moved the needle for wearables revenue and has been a commercial flop. The company is planning a refreshed model later this year with a new chip — but meaningful changes to the product aren't planned until 2027.

Still, the category may get a boost in the coming years when Apple rolls out smart glasses, rivaling a popular product from Meta Platforms Inc. Apple is also planning a new Ultra watch this year with satellite connectivity, a feature aimed at hikers looking to stay in contact when away from cellular networks. And it's developing new AirPods, an updated Apple TV box and a smart home device with a screen and fresh operating system, Bloomberg News has reported.

On the call, Cook was asked whether consumers might eventually switch to some kind of screen-free AI device — posing a threat to the iPhone. He said that the company's flagship product will be tough to replace.

“It's difficult to see a world where iPhone's not living in it,” he said. “And that doesn't mean that we are not thinking about other things as well, but I think that the devices are likely to be complementary devices, not substitution.”

(Updates with more from conference call starting in 14th paragraph.)

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.