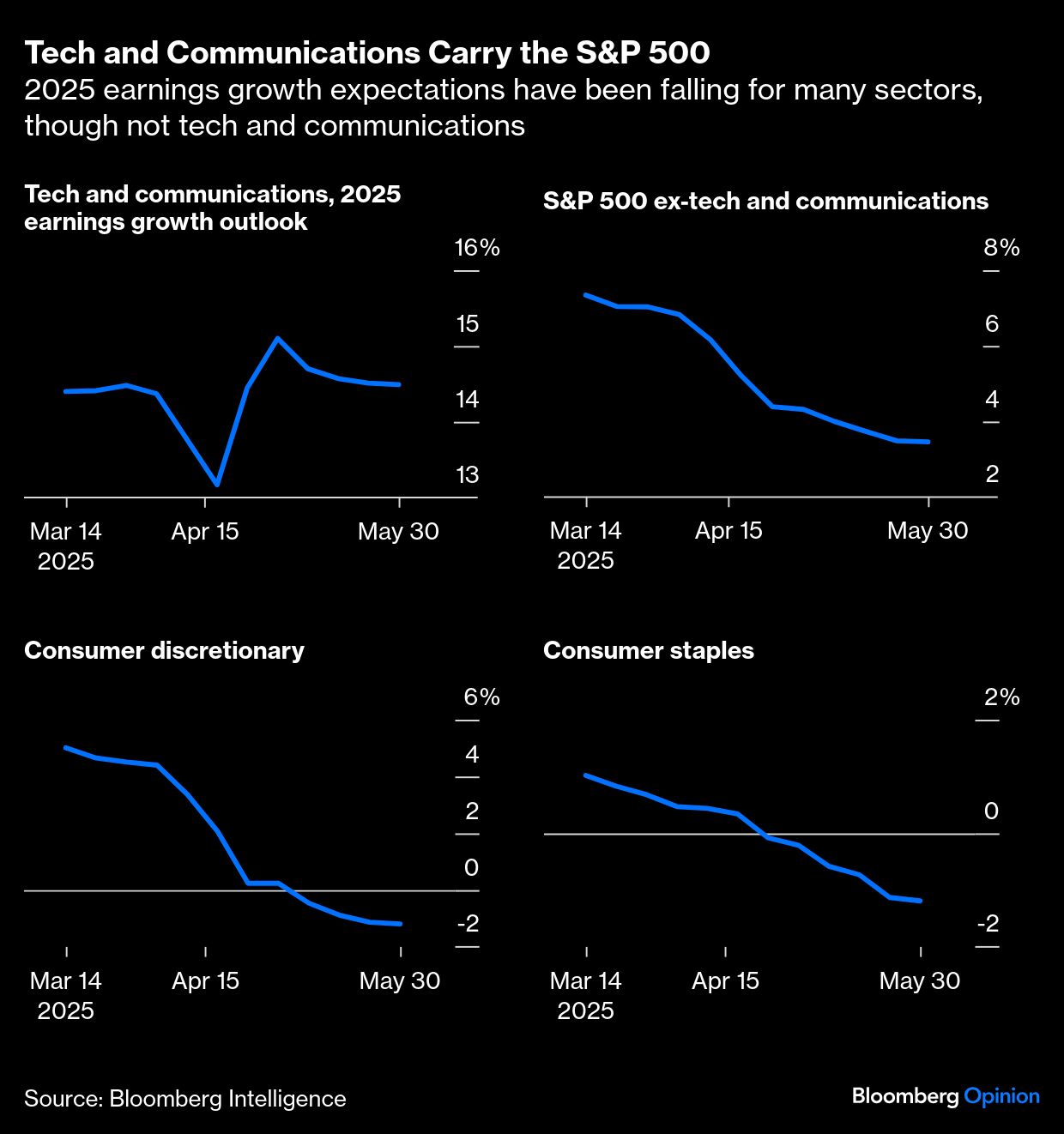

If you are wondering why the S&P 500 Index has held up so well in the past two months, look no further than the technology and communications sectors, which collectively account for nearly half of the index by weighting. For all the wild and headline-grabbing swings in trade policy since early April, analysts have continued to project more than 14% earnings growth in those combined sectors this year — an outlook that really hasn't budged. Wall Street isn't ignoring the potential risks from tariffs and a consumer slowdown, analysts just think that America's innovation superstars will partially offset any damage.

And reasonably so. Artificial intelligence posterchild Nvidia Corp. said Wednesday that it had $44.1 billion in revenue in the latest quarter, up an extraordinary 69% from a year earlier. Microsoft Corp., the index's biggest company by weighting, posted a 20% increase in cloud revenue last quarter, showing why its software-heavy model leaves it relatively insulated from tariffs. And Netflix Inc., which successfully hiked subscription prices recently, said revenue jumped 12.5%, reaffirming the resilience of its business model.

None of this is to say that all is fine and dandy in the economy, but there's clearly a compositional element to the perceived strength of the main equity index. In addition to the sector weightings issue, my Bloomberg Opinion colleague Nir Kaissar has pointed out that the companies with the heaviest weights also tend to enjoy extraordinary pricing power that will serve them well in the face of a trade war. That partially explains why the S&P 500 is back within spitting distance of its all-time highs, even as small-caps and mid-caps are still down about 17% and 11%, respectively.

But even for large cap stocks, the index outlook can be somewhat deceiving. Consumer discretionary earnings forecasts haven't held up quite so well since President Donald Trump left markets in a tizzy with his April 2 “Liberation Day” tariffs on countries around the world. According to data compiled by Bloomberg Intelligence, Wall Street analysts now expect the S&P 500's consumer discretionary sector to post a 1.2% earnings drop this year. Prior to April 2, analysts expected discretionary growth of 4.5%. The outlook for the consumer staples sector has also been revised sharply lower. The revisions reflect a weaker revenue environment and — for discretionary in particular — narrower profit margins.

The question now is what comes next. On the positive side, the US Court of International Trade ruled Wednesday that many of President Trump's tariffs are illegal. But as Goldman Sachs Group Inc. wrote, the ruling “might not change the final outcome for most major US trading partners.” A federal appeals court Thursday paused the Court of International Trade's ruling, and the White House plans to appeal to the Supreme Court.

Even if it fails in its appeal, Goldman's Alec Phillips said the White House could still reinstate many of the other tariffs through other legal means. A number of market participants think that Trump has experienced buyers' remorse over some of the tariffs (or “chickens out” whenever market volatility rears its head). But if Trump were really looking for a chance to walk away from the policy entirely while still saving face politically, this ruling would be precisely that off-ramp. All indications suggest that he isn't going to take it.

On the macroeconomic front, the outlook is equally foggy. Revisions to first-quarter gross domestic product published Thursday showed that consumer spending advanced at its weakest pace in two years, and higher-frequency data from Bank of America Institute suggest that the consumer slowdown extended into April and the first part of May. The traditional labor market indicators have been decent, yet hiring remains extremely sluggish and continuing jobless claims are now at their highest since 2021.

At the corporate level, even some of the superstar stocks are flashing warning signs, with tariff-exposed Apple Inc. expected to post just “low- to mid-single digit” revenue growth in its next quarterly report (though that depends on the outcome of tariff policy). Investors are also rightfully on alert for further headwinds to ad-driven businesses including Alphabet Inc. and Meta Platforms Inc. As for the quintessential AI stocks including Nvidia and Microsoft, investors may one day find themselves on the wrong side of extraordinarily high expectations. But evidently that day isn't today.

There's a common bearish take that the market is ignoring the macroeconomic headwinds, and I don't think that's quite right. Yes, the S&P 500 is probably at the richer end of its fair value band, but it's not untethered from it. Mr. Market seems to have the story generally right: a handful of innovation superstars continue to deliver otherworldly results. Another handful of consumer-based sectors are starting to struggle due to the softening consumer and nonsensical trade policy that's apparently on the ropes. And beyond that, nobody has the faintest idea of what's going to happen next.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.