Ordinary investors have won the battle of fees. The challenge will be holding on to that victory as Wall Street mounts a counteroffensive.

Investing today is as easy as opening a free brokerage account and buying a low-cost, commission-free index fund that tracks the broad market, then sitting and marveling as it blossoms. Since I started my first professional job in the mid-1990s, an investment in a cheap S&P 500 Index fund would have grown more than 17-fold, beating virtually every professional investor over that time.

For Wall Street, this has meant decades of falling fees, a trend that the industry now sees an opportunity to reverse. Financial firms are leveraging the hype around cryptocurrencies, artificial intelligence and private markets to lure investors back into high-priced funds. The campaign will be hard to resist. The Street is skilled at selling speculative, conveniently high-fee investments that promise — but rarely deliver — bigger payoffs than index funds can achieve. And with crypto, AI and private assets, there's plenty of sizzle.

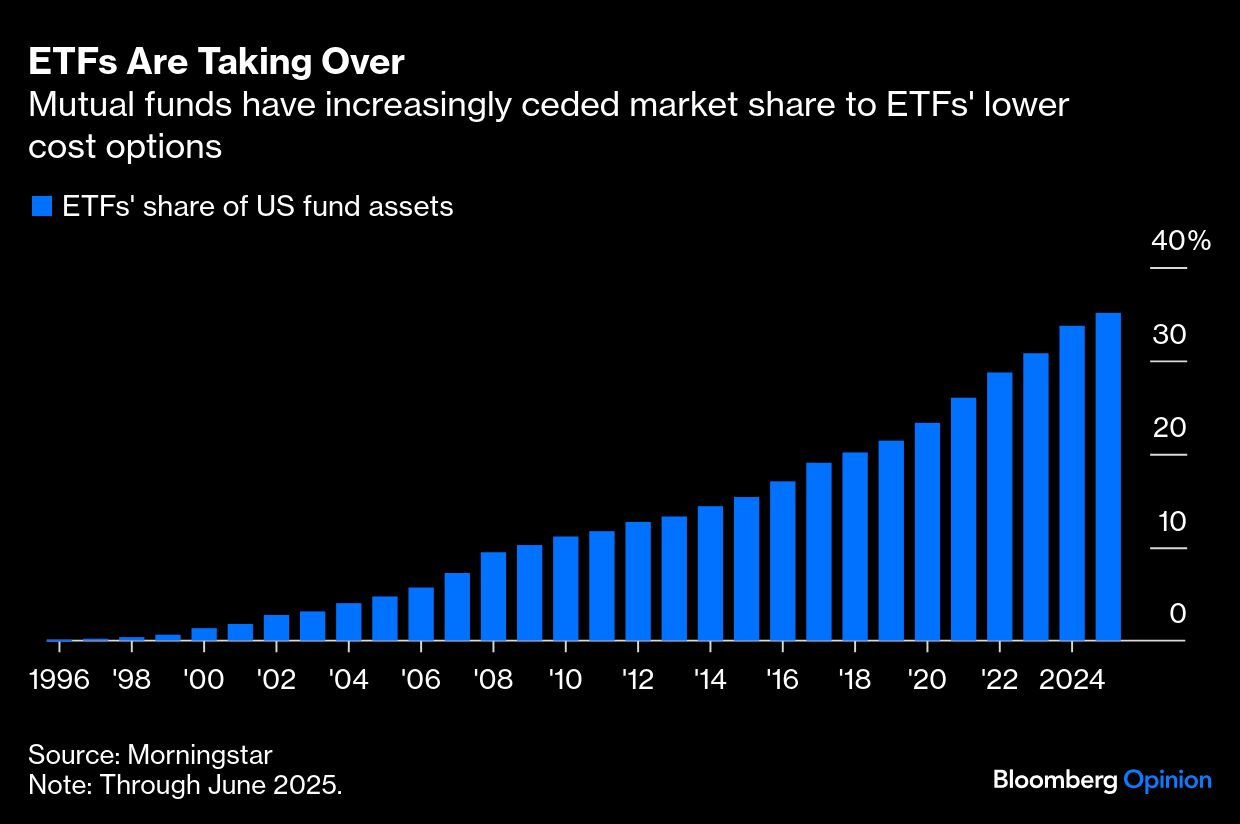

Consider the patterns emerging in exchange-traded funds, an innovation that accelerated the low-cost revolution Vanguard Group Inc. sparked with the launch of the first index fund in the 1970s.

The first ETF, State Street Corp.'s SPDR S&P 500 ETF Trust, launched in 1993 and is still among the most popular. In fact, the three biggest ETFs are S&P 500 funds with a combined $2 trillion in assets. The draw is an average expense ratio of just 0.05% a year and zero commissions to trade. The ETF revolution was built on a barrage of such low-cost market trackers. ETFs now have a 35% market share of combined US assets in ETFs and open-end mutual funds as of June from less than 1% through the 1990s, according to Morningstar. If the trend continues, there's little doubt that ETFs will soon be the bigger player.

But the products are in danger of losing their edge.

The roughly 670 funds that launched in the 1990s and 2000s and are still around today have an asset-weighted average expense ratio of 0.13%, and nearly all of them are index funds. Since then, Wall Street has gradually encroached, turning what was a low-cost index haven into a high-priced casino. The average expense ratio of the 1,200 funds that launched in the 2010s crept up to 0.21%, and the percentage of index funds dipped to 75%. That was just a hint of the coming onslaught. Of the more than 2,500 ETFs that have launched so far this decade, only 25% are index funds. The group's average expense ratio jumped to 0.39%, nearly matching that of mutual funds, which have been scrambling to lower fees.

The direction is unmistakable — and unfavorable for investors. When the 2000s ended, there were only 25 ETFs with an expense ratio of 1% or more. In the 2010s, 73 more appeared. And so far this decade, I count an additional 272 that have already gathered $40 billion in assets. They are almost exclusively the kind of speculative funds you would expect — digital assets, inverse and leveraged, derivatives-based and emerging technologies (read AI). The only ones likely to get rich from these ETFs are the fund companies.

More enticements are coming. The White House is reportedly readying an executive order that will open 401(k)s to private assets and cryptocurrencies. The mutual funds in retirement plans are already more expensive than comparable ETFs. Imagine how much more private assets and crypto funds will siphon from workers' retirement savings.

Financial firms that genuinely believe in the investment merit of crypto, AI and private assets should charge fees that are comparable to stock and bond index funds. They'll still make plenty of money given the popularity of those investments. BlackRock Inc.'s recently launched iShares Bitcoin Trust ETF charges 0.25% a year and is already the firm's most profitable ETF. There's no reason why Vanguard's highly anticipated private asset fund can't conform to the firm's low-cost ethos.

Whatever happens, investors will still be able to build wealth steadily and reliably with low-cost index funds that track broad markets. They have already served generations of savers faithfully and will continue to — if investors can just overlook Wall Street's high-priced temptations.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.