Current market pricing implies that the Federal Reserve will begin to cut short-term interest rates at the mid-June monetary policy meeting. Futures imply that by the end of the year, the central bank will have reduced its target for the federal funds rate target by 75 basis points to 100 basis points.

Last week, Chair Jerome Powell pushed back on these expectations. He noted that because the Trump's administration's tariff policies will pressure prices higher and depress growth, likely pushing the Fed away from its objectives for full employment and stable inflation. “I do think we'll be moving away from these goals, probably for the balance of this year,” he said.

The Fed will be patient for four reasons. First, the economic outlook is unusually cloudy. There is no precedent for the rapid increase in US tariffs that have been far larger than Fed officials anticipated. Knowing how to respond to an unprecedented change in trade policies is difficult on its own but even more so when those policies are in flux. Moreover, the imposition of higher tariffs may temporarily boost economic growth as households and businesses front-load their purchases in anticipation of higher prices later. The 5.3% surge in motor vehicle and parts sales in March was the biggest in two years and is, perhaps, the most compelling example.

Second, the growth potential of the US has fallen abruptly and sharply. The shift in trade policy will undermine productivity growth. In the short run, productivity will be hurt by the rise in import prices, which will provoke US manufacturers to readjust their supply chains to find lower cost alternatives. In the longer run, productivity will be hurt because the tariffs will skew activity toward more production in protected markets, where the US has less comparative advantage, and away from exports to countries such as China that have enacted retaliatory tariffs.

The large decline in labor force growth will also constrain economic activity. The collapse in border apprehensions implies a near cessation of immigration into the US. Labor supply will also be restrained by much higher rates of deportations. Deportations, in turn, will also hurt productivity growth by causing shortages of workers in areas such as construction and farming where immigrants play a major role.

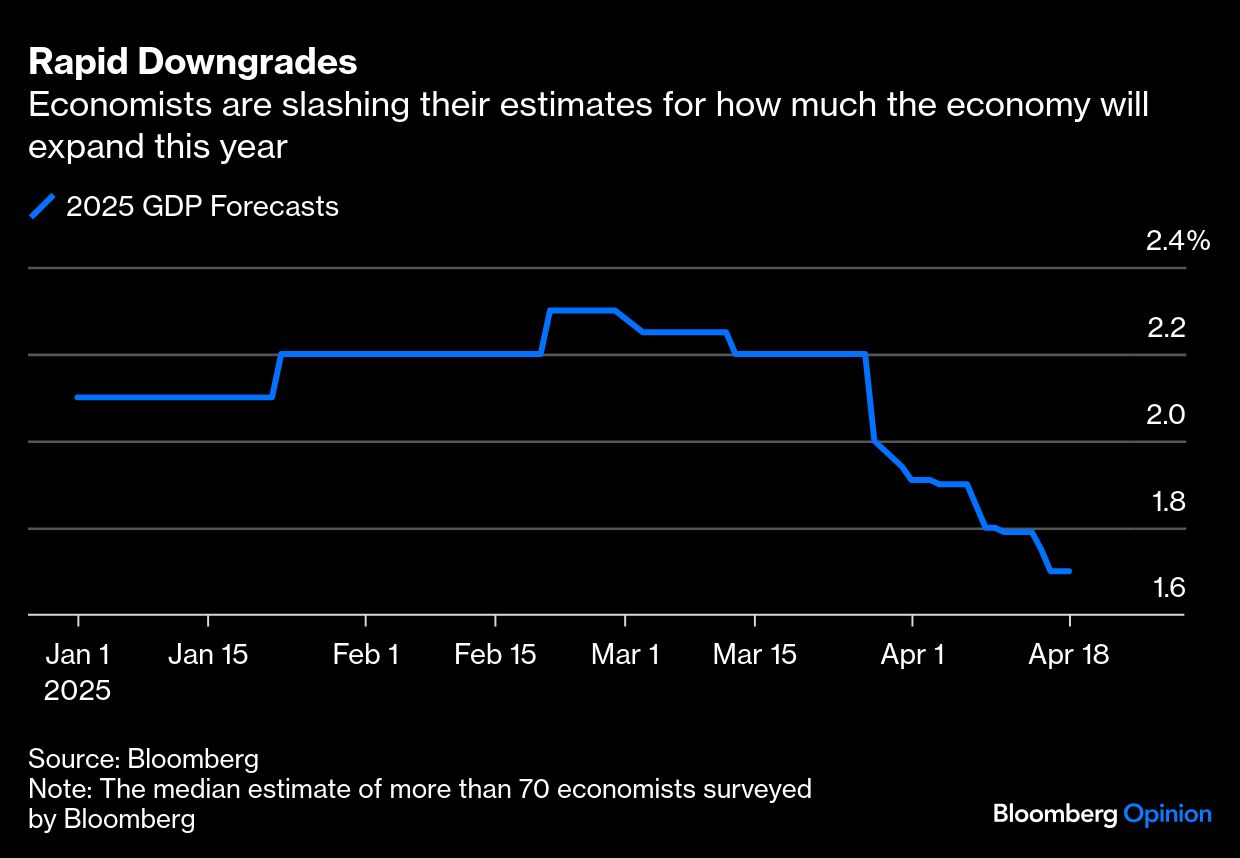

The drop in the US growth potential is important because it means that slower growth may not lead to sufficient slack in the labor market to provoke more monetary policy support. Although real gross domestic product growth is anticipated to slow sharply this quarter, the current unemployment rate of 4.2% is little changed from where it was last summer.

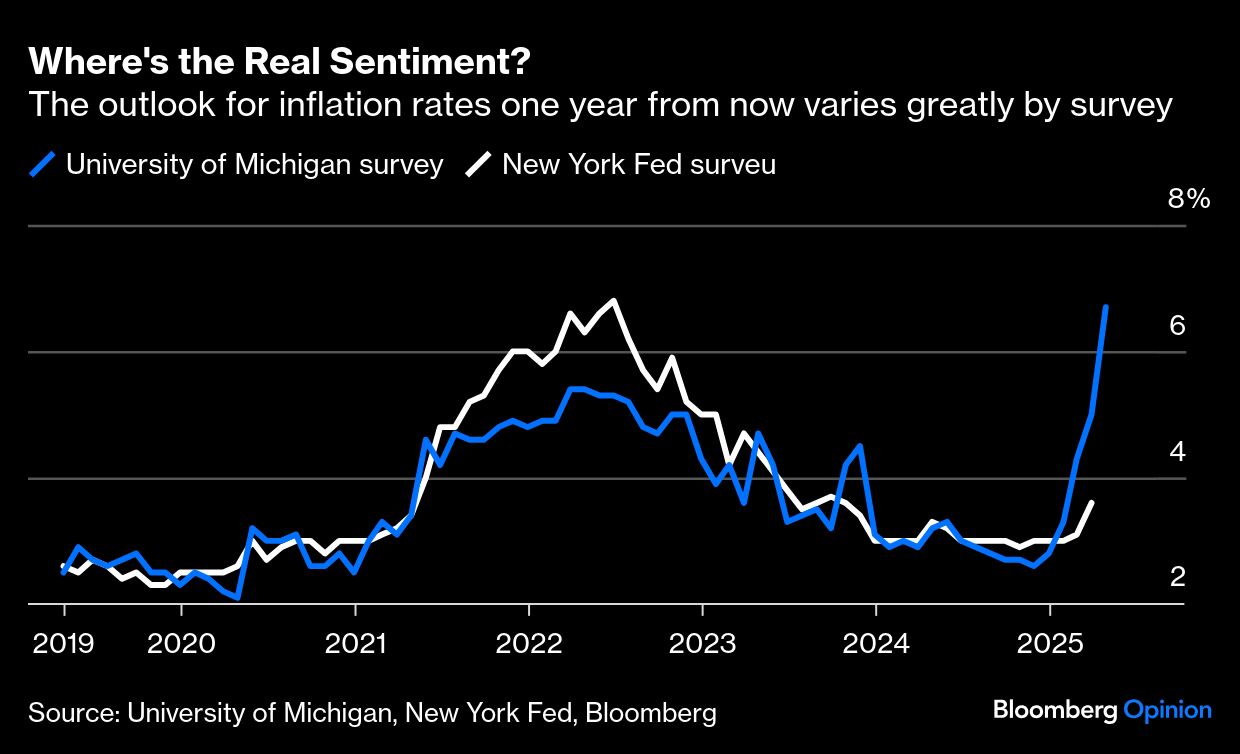

Third, with inflation on track to exceed the Fed's 2% objective for the fifth consecutive year, policymakers need to be careful to avoid making a mistake that could cause inflation expectations to become unanchored. If that were to occur, the costs of pushing inflation down would skyrocket, as was evident during the 1970s. So far, the evidence on inflation expectations remains mostly favorable. While near-term expectations have jumped and the University of Michigan's monthly consumer sentiment survey shows a large spike in long-run expectations, this has not been validated by either the survey conducted by the Federal Reserve Bank of New York or by the inflation rate implied by Treasury Inflation-Protected Securities. But inflation is sensitive to the Fed's own actions and this limits the scope for a Fed response to economic weakness.

Fourth, the need for patience is also higher given President Donald Trump's attacks on the Fed's independence. If Fed officials were to cut rates and this was interpreted as caving to the White House pressure, confidence in the Fed's ability to contain inflation would diminish, pushing up inflation expectations. Because of this, Trump's pressure on the Fed is counterproductive. Not only does it increase the motivation for the Fed to wait, but it also makes households and businesses more concerned about the inflation consequences should the Fed's independence come to an end. A central bank under attack creates more uncertainty about the central bank's motivations. If the Fed were to cut rates later this year, market participants might wonder whether that was warranted by changes in the economic outlook or undertaken under duress in response to pressure from the administration.

What will the Fed do this year and how does that compare with market expectations? Expect the Fed to be slower to move than anticipated. The high level of uncertainty will make it difficult to assess whether the Fed needs to put more weight on constraining inflation versus supporting employment. It will take time for that uncertainty to dissipate especially given that tariff policy is far from settled. An inconclusive outlook could cause Fed officials to sit on their hands for many months.

However, If the employment side of its mandate were to deteriorate sharply, then the Fed would likely move aggressively, meaning 25 basis-point rate cuts wouldn't cut it (no pun intended). Here the unemployment rate rather than payroll employment growth is the key metric. If the unemployment rate were to move above 4.5%, the Sahm Rule threshold of a 0.5 percentage point increase would be triggered, indicating a likely recession.

Although skeptics of the rule will point out that the trigger was hit last year and there was no recession, circumstances now are very different. The rule sent a false signal last year because the rise in the unemployment rate was caused by rapid labor force growth, not by a slowdown in the hiring rate. This year the signal from a rising unemployment rate will be more reliable because, with negligible labor force growth, it would be driven by a drop in hiring and an increase in layoffs.

The uncertainty of the outlook translated to monetary policy: Nothing or a lot of easing much later this year. That seems considerably more likely than a modest series of rate cuts beginning in June.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.